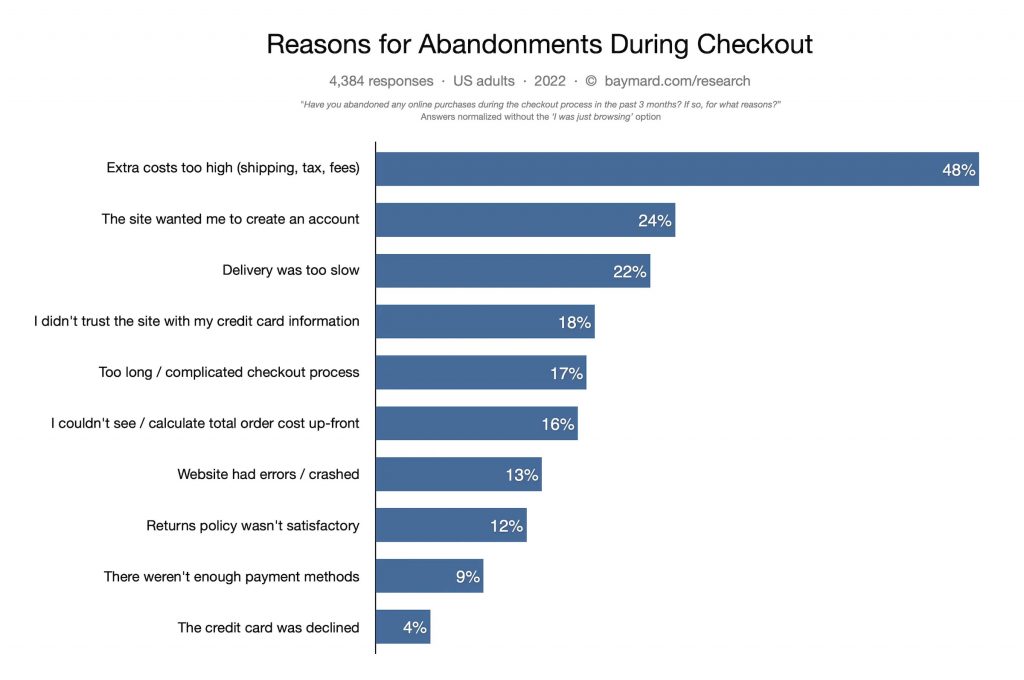

When shopping online, reaching the checkout page or app screen is not a guarantee of a sale. Consumers give up on the purchase intent for various reasons. According to a report, in 2022, only 3 out of 10 customers who add items to their cart complete the purchase. A well-designed checkout page and seamless payment method can lead to satisfied customers, while a poorly executed process can result in frustration and a loss of revenue. This highlights the importance of optimizing the checkout experience to ensure customer satisfaction and boost business outcomes.

What is checkout abandonment and what are the reasons for it?

Crafting an ideal eCommerce checkout experience is a critical element in enhancing customer satisfaction and driving sales conversion rates. Checkout abandonment occurs when customers exit the payment process before completing the transaction, and the reasons for this behavior can vary depending on the industry, target audience, and individual customer preferences.

Every abandoned checkout represents lost revenue for the business, as resources have been allocated toward marketing, operations, and development efforts to bring the customer to this stage of the purchasing process. To optimize outcomes, it is recommended to prioritize minimizing checkout abandonment rates, as it can have a significant impact on the overall financial performance of the business.

Source: Baymard Institue: Cart & Checkout Usability Research

Best practices for streamlining the checkout process in eCommerce platforms

#1 Keep the checkout process simple

Although it may seem obvious, it is crucial to avoid causing frustration for visitors during checkout as it could deter them from completing their purchase.

To minimize distractions during checkout, removing the header and footer may be a helpful consideration as they may draw the user’s attention away from important buttons and options. It is imperative to eliminate any possible obstacles such as lengthy forms with excess fields and mandatory account creation or sign-up during the checkout process to ensure a smooth and user-friendly experience. Some ways to ensure a simple and seamless user experience are:

a. Single-page checkout

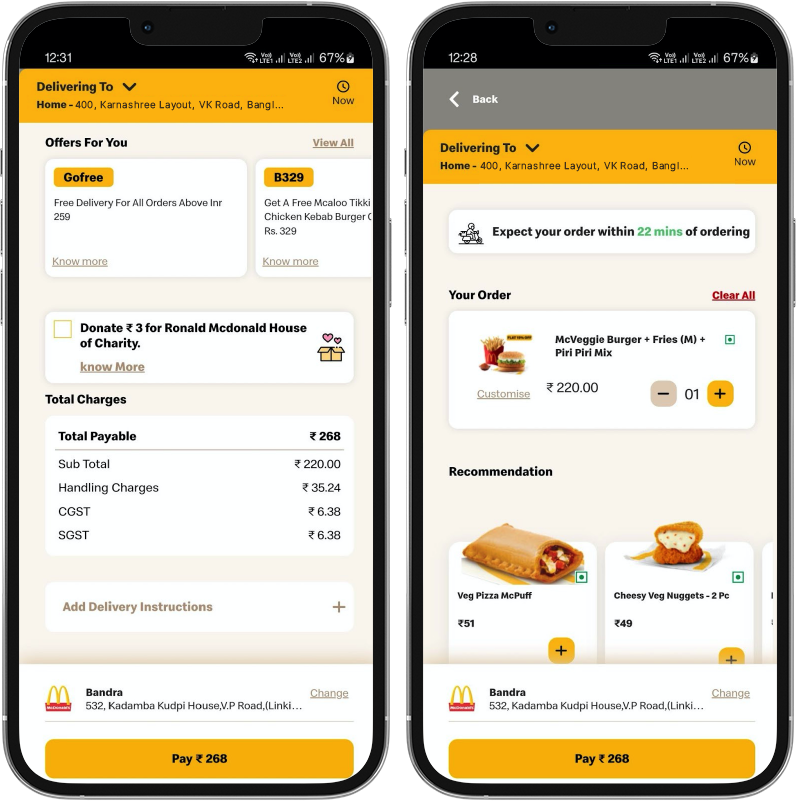

With all the necessary steps displayed on a single page, users can complete the checkout process with minimal navigation. Furthermore, a single-page checkout can provide users with the ability to select custom delivery options and shipping methods. This helps to enhance the user experience by giving them more control over the delivery process. Incorporating a progress indicator in the checkout process will help users to track their progress and understand the mini-milestones they have accomplished, which can help to simplify the process and reduce confusion.

b. Smart form filling

This can be achieved through the use of various tools such as shipping address predictors, autofill options like Google Autofill, and form field validation with error notifications. To streamline the process further, consider adding a radio button or small checkbox that allows users to select the same billing address as the shipping address. These tools make form-filling quick, efficient, and error-free.

c. Guest Checkout

Many customers prefer to make a purchase quickly without the hassle of signing up or creating an account. Forcing them to do so can become a source of friction and lead to abandoned carts. By allowing users to checkout as a guest and enter only the minimum required information, they can proceed directly to payment and complete their purchase without delay.

#2 Localized checkout experience

When running an eCommerce website that caters to customers across various nations, it is essential to consider implementing a localized checkout experience. This approach increases the likelihood of converting potential customers by eliminating any barriers that they might encounter while navigating the checkout process. Here’s how you can do so:

a. Support for multiple currencies and payment gateways

To provide a seamless and personalized checkout experience for users of an eCommerce website operating across multiple countries, it is essential to consider implementing features such as support for multiple currencies and payment gateways. Instead of relying on currency conversion options, users should be allowed to select their preferred currency to avoid additional costs and potential friction.

b. Adhere to global tax guidelines

It is important to adhere to global tax guidelines, as tax requirements vary depending on the user’s location. By dynamically calculating international taxes based on the user’s location, the checkout process can be made more streamlined and frictionless.

c. Multi-language support

Supporting multiple languages can also greatly enhance the localized experience of the checkout process. Multilingual checkout options can remove the language barrier for online shoppers who may not be comfortable with English, contributing to a more seamless and pleasant overall experience.

#3 Entice a leaving customer to proceed to checkout

To improve online conversion rates, it’s important to take all possible steps to guide customers toward the checkout process.

a. Upsell your bestsellers

Upsells are a good way to incentivize customers to buy more items, but it’s important to strike a balance and avoid overwhelming users with too many options. Limited-time offers and checkbox buttons can make it easy for customers to add additional items to their cart. Suggested items should include a mix of subscription-based and one-time purchase options.

b. Offer discounts and personalized recommendations

Exit intent pop-ups can be used to offer discounts, provide compelling copy, and present limited-time promo codes to entice customers back to the checkout process. If customers still choose to leave, offering an option to sign up for updates or newsletters can help maintain a connection and encourage future purchases.

#4 Build trust and assurance

Building trust and assuring customers is essential for any business to succeed. During the checkout process, customers may have concerns about the product, support, or transaction security. To address these concerns, businesses can take several steps to assure customers.

a. Provide social proof

One effective approach is to incorporate customer testimonials or case studies with positive reviews on the website. This can help reassure customers about the quality of the product and reduce the risk of abandoned carts. By showcasing the real-life experiences of other satisfied customers, businesses can instill confidence in their potential buyers.

b. Easy access to customer support

Providing a live chat option or a support phone number during the checkout process can be a great way to offer assistance and address any concerns. Customers can get immediate help with their questions, and this can help to prevent them from abandoning their carts.

#5 Make checkout convenient and flexible

Streamlining the purchase process and providing customers with more options and flexibility are some effective ways to customer retention.

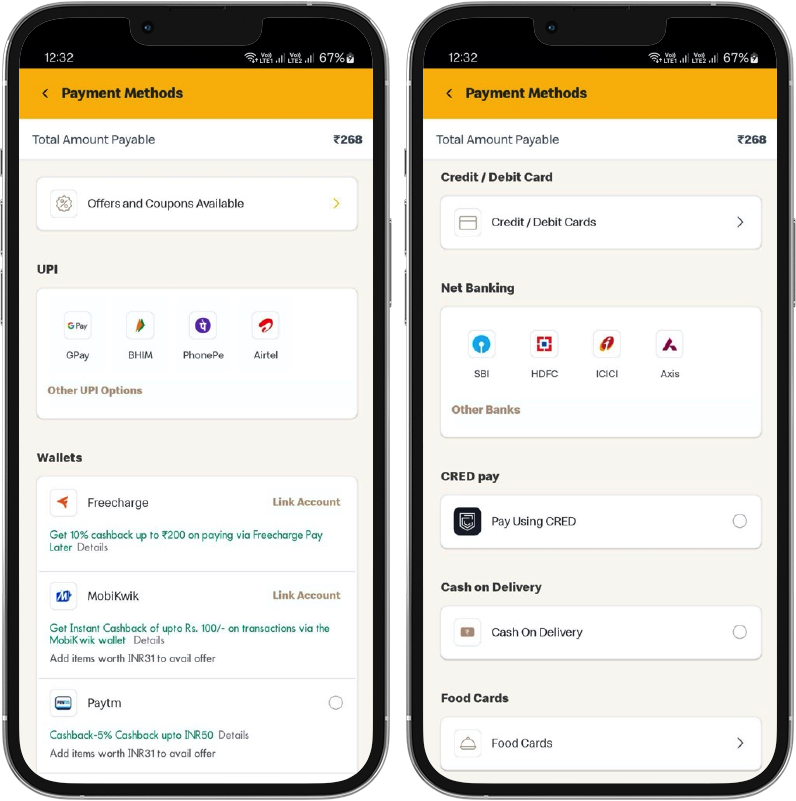

a. Multiple payment options

A common reason for cart abandonment is the unavailability of preferred payment methods, which vary across different countries. In some regions, credit cards are widely used, while in others, consumers may feel more secure using alternative methods such as Digital wallets like Paytm, Amazon Pay, or Apple Pay. By offering multiple payment options, you can enhance the customer experience and encourage them to complete their purchase.

b. Ensure mobile-friendliness

With mobile eCommerce sales on the rise, it is imperative to optimize the checkout process for mobile devices. According to Insider Intelligence, in 2023, mobile eCommerce sales are expected to account for 43.4% of total retail eCommerce sales, up from 41.8% in 2022. Neglecting to optimize your eCommerce checkout for mobile devices could result in missed opportunities for sales. Therefore, it is important to ensure that the mobile checkout process is just as seamless as the desktop and to test the effectiveness of the call-to-action buttons.

c. Providing convenient purchase options

Providing customers with both one-time purchase and subscription checkout options can offer flexibility and cater to different customer preferences. Offering subscriptions can also help to increase customer loyalty and retention. Therefore, it is recommended that eCommerce businesses consider providing both one-time purchase and subscription checkout options to enhance the customer experience.

#6 Be attentive to security and privacy

Ensuring security and privacy in online shopping is a crucial factor that demands attention. Customers often prioritize the perceived security of their transactions while shopping online. Additionally, displaying security certifications and trust seals at checkout instills confidence in concerned customers.

a. Meet security guidelines

It is recommended to obtain a Secure Sockets Layer (SSL) certificate for the eCommerce website, which establishes a secure connection and encrypts credit card information. Adherence to the Payment Card Industry Data Security Standard (PCI DSS) is also vital to safeguard card information and ensure secure payments.

b. Compliance with data privacy regulations

California Consumer Privacy Act (CCPA) and the General Data Privacy Regulation (GDPR) adherence is necessary when storing sensitive information collected from customers, such as phone numbers, credit card information, shipping address, and email address. Additionally, following Multifactor Authentication (MFA) standards provides added security beyond the traditional username and password login.

#7 Keep experimenting to find your fit

As an eCommerce merchant, it’s important to remember that there’s no one-size-fits-all approach to designing the perfect checkout experience for your customers. Prioritizing the design of your checkout and engaging in continuous experimentation is key. Regular testing and analysis can help identify areas that need improvement, ranging from CTA placement to image reorganization within the checkout design.

a. Consider A/B testing to find the fit

This involves creating two versions of a checkout page and testing each version with a group of customers to see which one performs better. By testing different variations of the checkout page, you can identify the elements that work best for your customers and improve the overall checkout experience.

b. Using analytics tools to understand customer behavior at the checkout

This can help identify common pain points and areas that require improvement. For example, if you notice a high cart abandonment rate on a particular page, you can investigate the reasons behind it and make changes to improve the user experience.

Wrapping Up

The process of checking out is undeniably a critical component of the buying journey, and therefore, it is prudent to consistently strive for its optimization, as this effort will yield favorable outcomes in the long term. Enhancing the checkout experience is an extensive and continuous undertaking, and adopting the following best practices can serve as a starting point, allowing room for experimentation to determine what tactics are most effective for your specific circumstances.