Today, consumers have greater control over their financial journeys. Therefore, banks must adapt to customers’ evolving needs by providing seamless, end-to-end experiences.

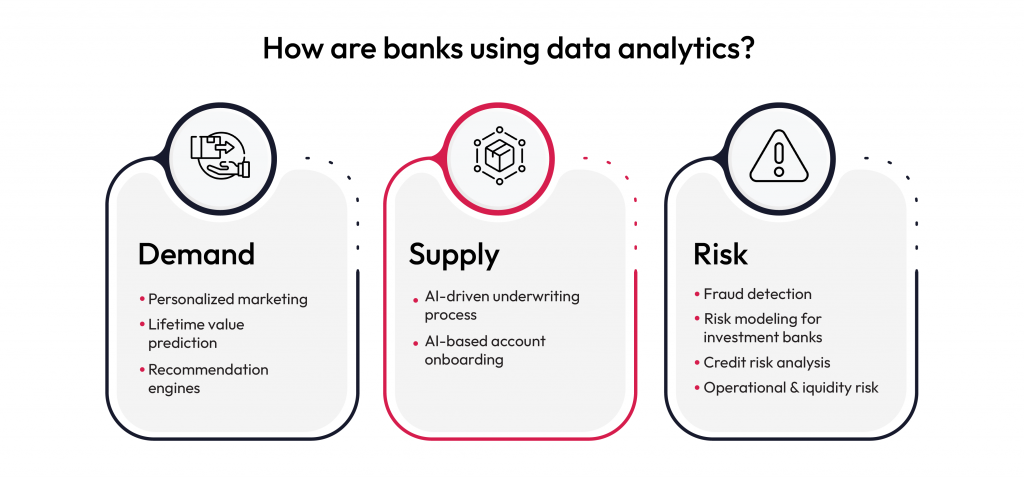

Data plays a critical role in this transformation. Robust data foundations enable banks to efficiently assess transaction details, stakeholder information, payment processing, compliance, and documentation. Given the increasing use of smartphones and the constantly evolving fintech landscape, it is important to focus on addressing three key areas:

- Cost reduction

- Improved decision-making

- Enhanced customer experiences

Now, let’s dive into how predictive analytics can assist in achieving these objectives.

Understanding the role of predictive analytics in modern banking

Prebuilt predictive analytics platforms aim to enhance personalization. But these platforms continuously fall short due to constantly changing customer behavior.

Banks need real-time analytics capabilities which helps them understand spending patterns linked to major life or financial events, enabling banks to predict and implement the next best actions (more on this in the next section).

Creating real-time predictive models allows banks to tailor hyper-personalized offers, recognizing the unique motivations behind each customer’s activities and events. This approach ensures more accurate and relevant customer engagement, ultimately driving better results for the customer and financial institution.

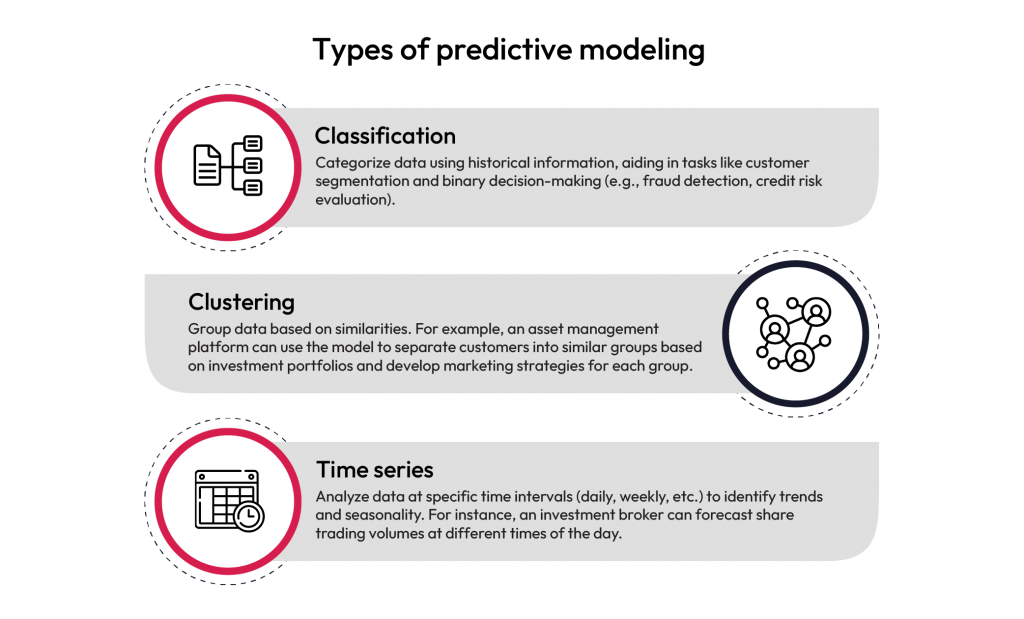

Types of predictive modeling

Predictive modeling automates targeting, minimizing manual data analysis and dependence on human intuition. Here are a few common types of predictive models:

Benefits of predictive analytics

Predictive analytics in BFSI offers significant benefits for leadership aiming to boost profitability and efficiency:

- It reduces costs by preventing fraud, lowering loan defaults, and retaining customers who might otherwise churn.

- Real-time data updates enable better decision-making, accurately representing risks and boosting confidence.

- Hyper-personalization allows targeted customer segmentation and personalized communication, enhancing overall customer experience and satisfaction.

Banks understand the necessity of establishing a top-notch customer experience. However, many still have crucial operational data confined within legacy IT systems.

How are banks adopting experience driven banking?

Banks and NBFCs are embracing experience-led banking by analyzing customer data from digital banking activities, customer interactions, and transaction records. They use transactional, behavioral, and demographic details. Integrating data from both digital and physical channels is crucial for creating a comprehensive customer profile (360-degree view) and omnichannel experience.

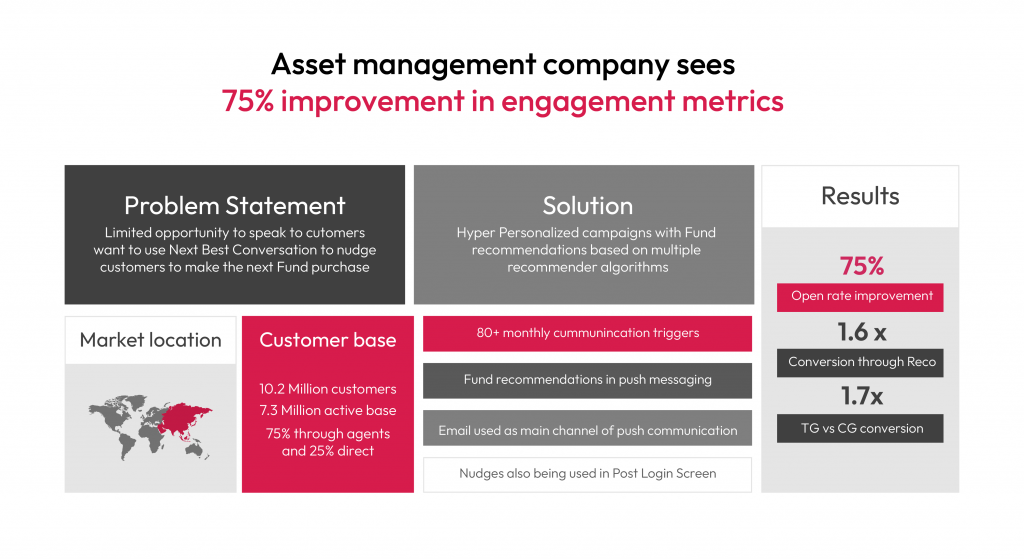

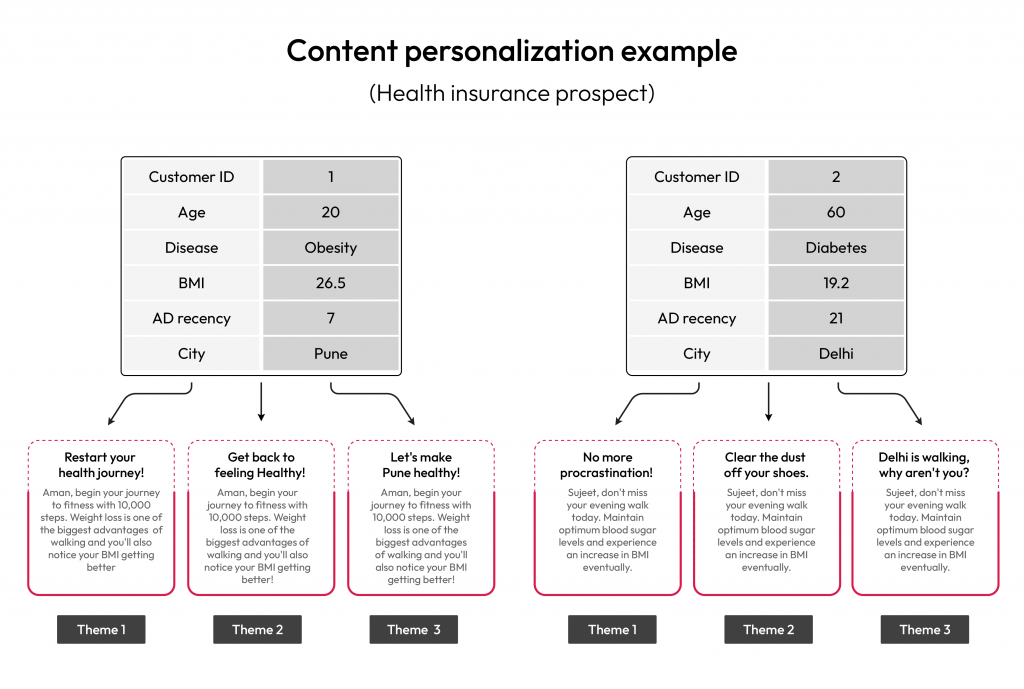

Hyper-personalization is driving a 75% increase in customer engagement in one of our BFSI projects at Robosoft, as shown in the image below.

Next best action model

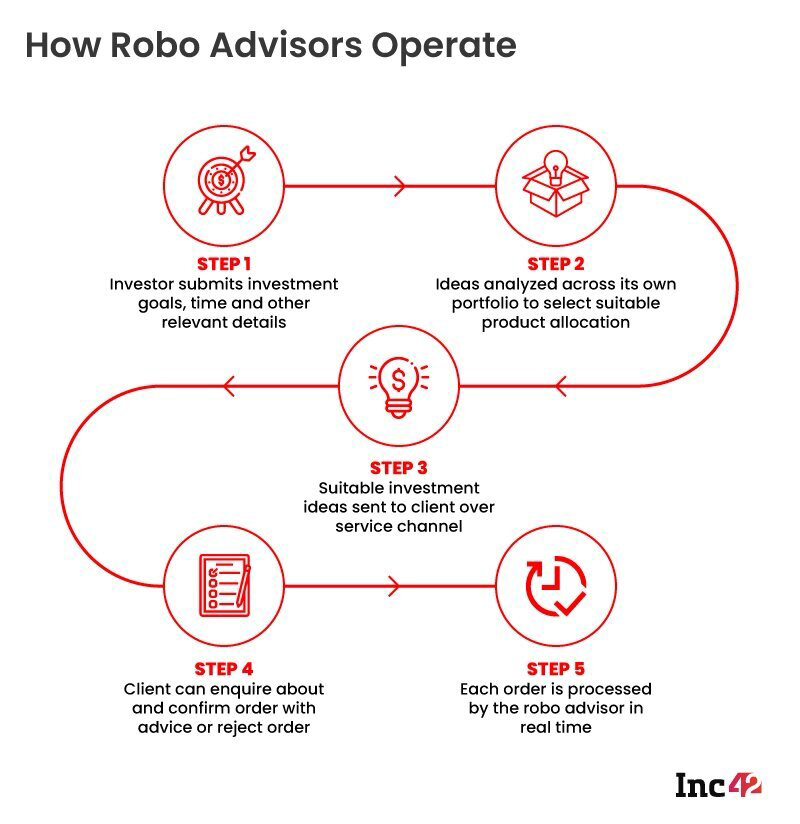

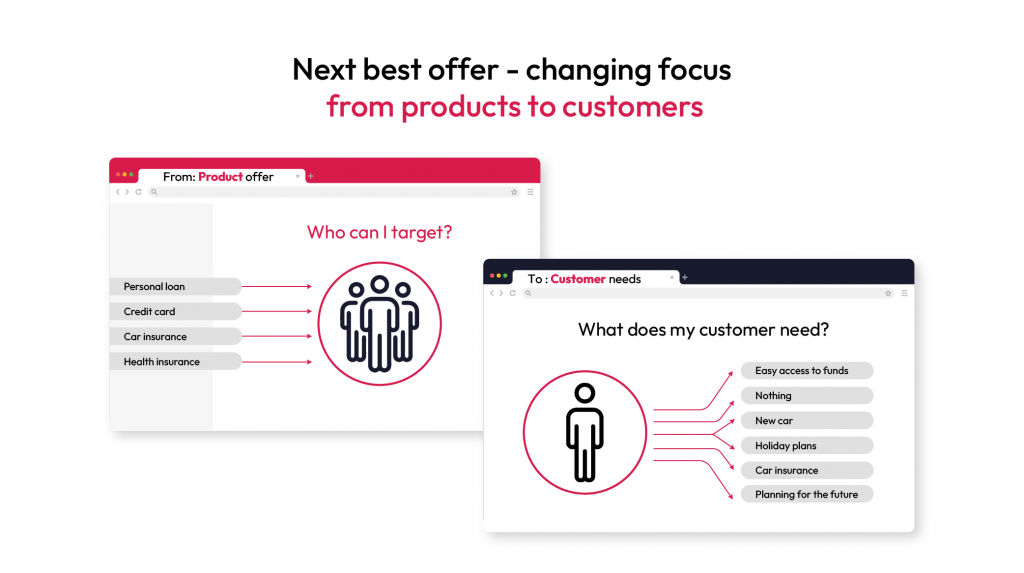

The next best action model (next best offer) uses AI to suggest the most appropriate decision or action for each customer interaction. We have published a detailed blog on building best-in-class recommendation systems – save it for later reading.

In contrast to the past, today’s customer journeys are non-linear and highly dynamic due to frequently changing personal financial situations. Banks can significantly improve results by proactively addressing customer needs with suitable alternatives.

Outcome-driven personalization in BFSI

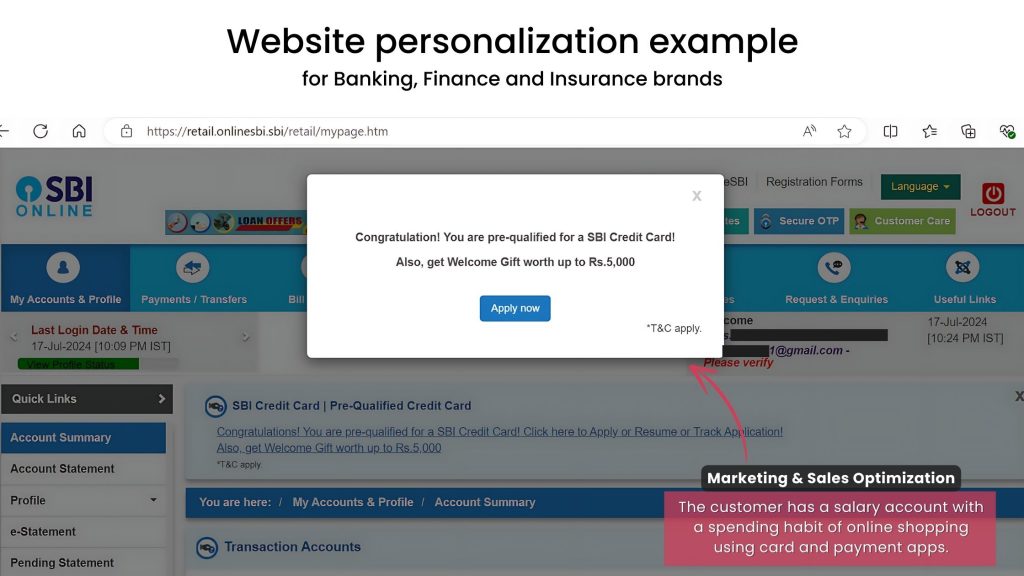

BFSI brands can use predictive analytics to improve website personalization, thereby increasing onboarding completion rates and decreasing drop-offs. Brands can nurture long-term relationships by providing guidance and support during the setup process.

Tailored messages, such as reminders for bill payments, updates on loan qualification, credit card offers, or information about nearby branch locations based on past transactions and browsing history, have the potential to re-engage inactive customers and enhance overall engagement and conversions. Same goes for mobile app personalization.

Use cases of predictive analytics in banking

- Collateral management: Predictive analytics helps banks forecast payment flows and anticipate end-of-day and intra-day positions, identifying potential collateral shortfalls. For example, HSBC uses predictive models to improve collateral management, ensuring accurate and timely forecasts to mitigate risks. It leverages NLP and machine learning within its PayMe app to understand transaction intent quickly. Their platform also offers personalized recommendations to customers to reduce irregular activities.

- Cash management: Predictive analytics enables banks to forecast cash and manage working capital efficiently. For instance, Bank of America compares a company’s working capital and payment efficiency with industry benchmarks. Predictive analytics provides them with deposit balance notifications, dynamic data visualizations, and metrics for assessing payment efficiency, optimizing supplier payments, managing strategic cross-border payment flows, and protecting against account fraud.

- Risk management: Predictive analytics helps take proactive anti-fraud actions, enhance internal audits, and refine credit and liquidity risk evaluations. For example, Wells Fargo bank uses analytics to notify customers about unusually high recurring payments and suggests transferring excess funds by checking savings accounts.

- Marketing and sales optimization: Predictive analytics helps banks optimize their marketing and sales strategies by identifying the most effective channels, messages, and offers for various customer segments. For example, HDFC and many other banking players use predictive analytics to segment customers and tailor marketing campaigns, leading to higher engagement and value-building for top customers.

Conclusion

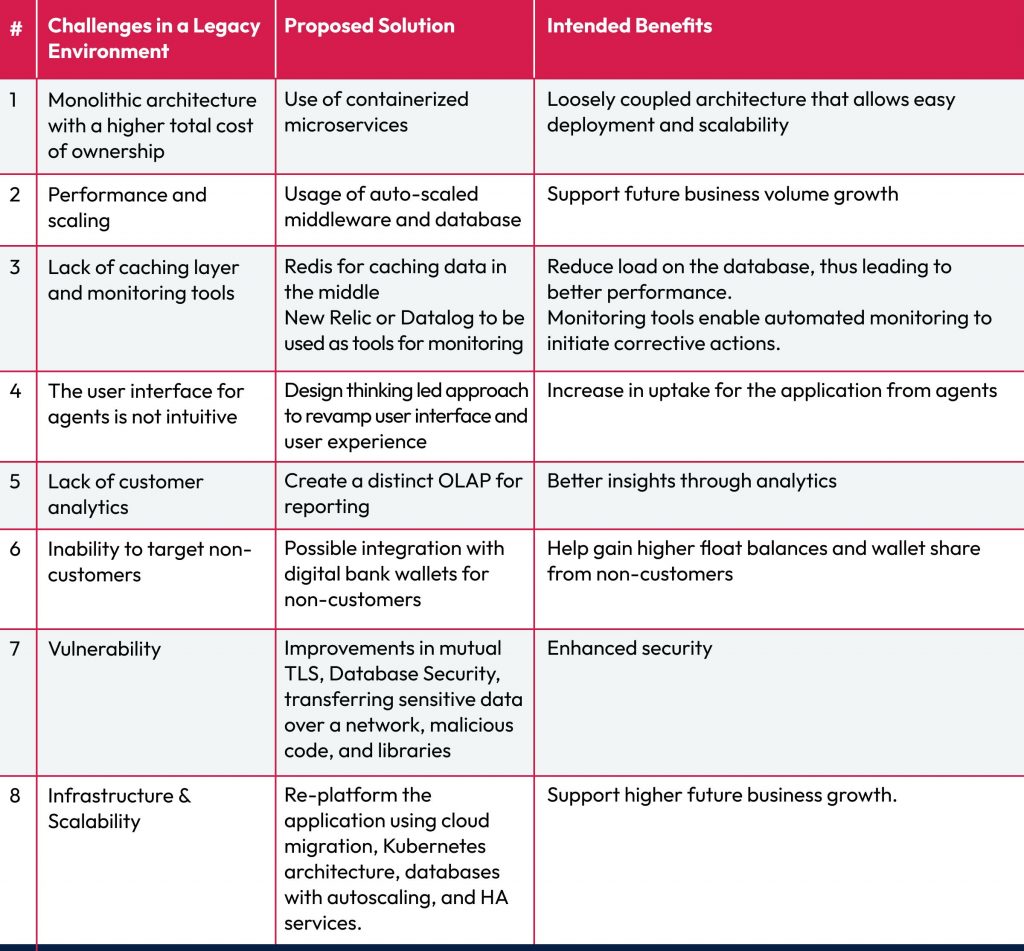

The growing demand for super apps, embedded finance, and personalized services has prompted banks to upgrade their digital banking platforms.

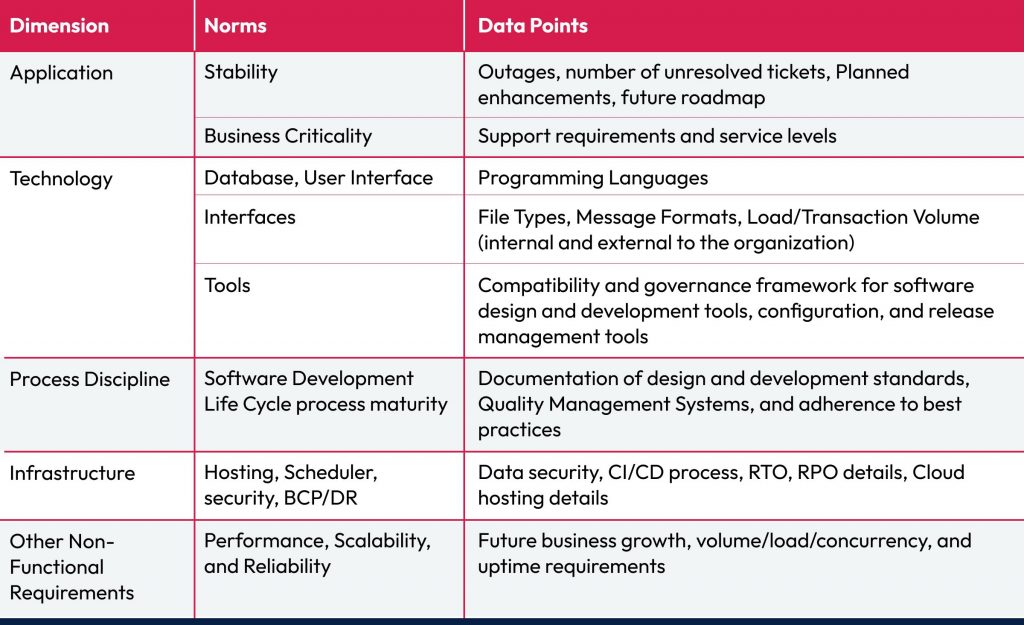

To leverage predictive analytics effectively, banks must update their application environment. Key steps include aligning IT and business initiatives, unlocking core systems, securely integrating data, and optimizing APIs through automation. By following this approach, banks can tap into previously unused capabilities to deliver seamless digital experiences much faster.

Many financial institutions have established AI and machine learning innovation centers to enhance data utilization through predictive analytics. This shift requires building in-house capabilities or collaborating with external tech partner to develop advanced fintech products and tailored digital experiences.

1. Renewable Energy:

1. Renewable Energy: