Founded in 1472, Banca Monte Dei Paschi di Siena is said to be the oldest surviving bank in the world. Since then, the banking industry has come a long way. It has not only grown in size but also wields huge influence across the world. Several powerful local and global brands have been established and many of them are synonymous with trust and financial safety. But as with every other industry, change is the only constant in banking too.

The onset of the internet, smartphones and better mobile connectivity has given rise to digital banking. For a large set of customers there was no reason to visit a brick & mortar branch office as all transactions could be completed on the web or on the mobile. Over the last few years, the term neobank has been used to describe digital-first or digital-only banking services. Europe, India and the US have been home for several successful neobanks in the recent past. What’s more, as a sign of its popularity, several niche services have already been launched in the domain:

– Launched recently, Lucy is a neobank targeted at women entrepreneurs.

– There’s a neobank exclusively to meet the needs of musicians: Nerve merges user experience and financial technologies to help artists build stronger communities and sustainable careers.

What makes neobanks an attractive proposition for consumers? Let us attempt to answer a few basic questions about neobanks, the reasons for their popularity and the role of digital experiences.

1. What are neobanks? Are there different types of neobanks?

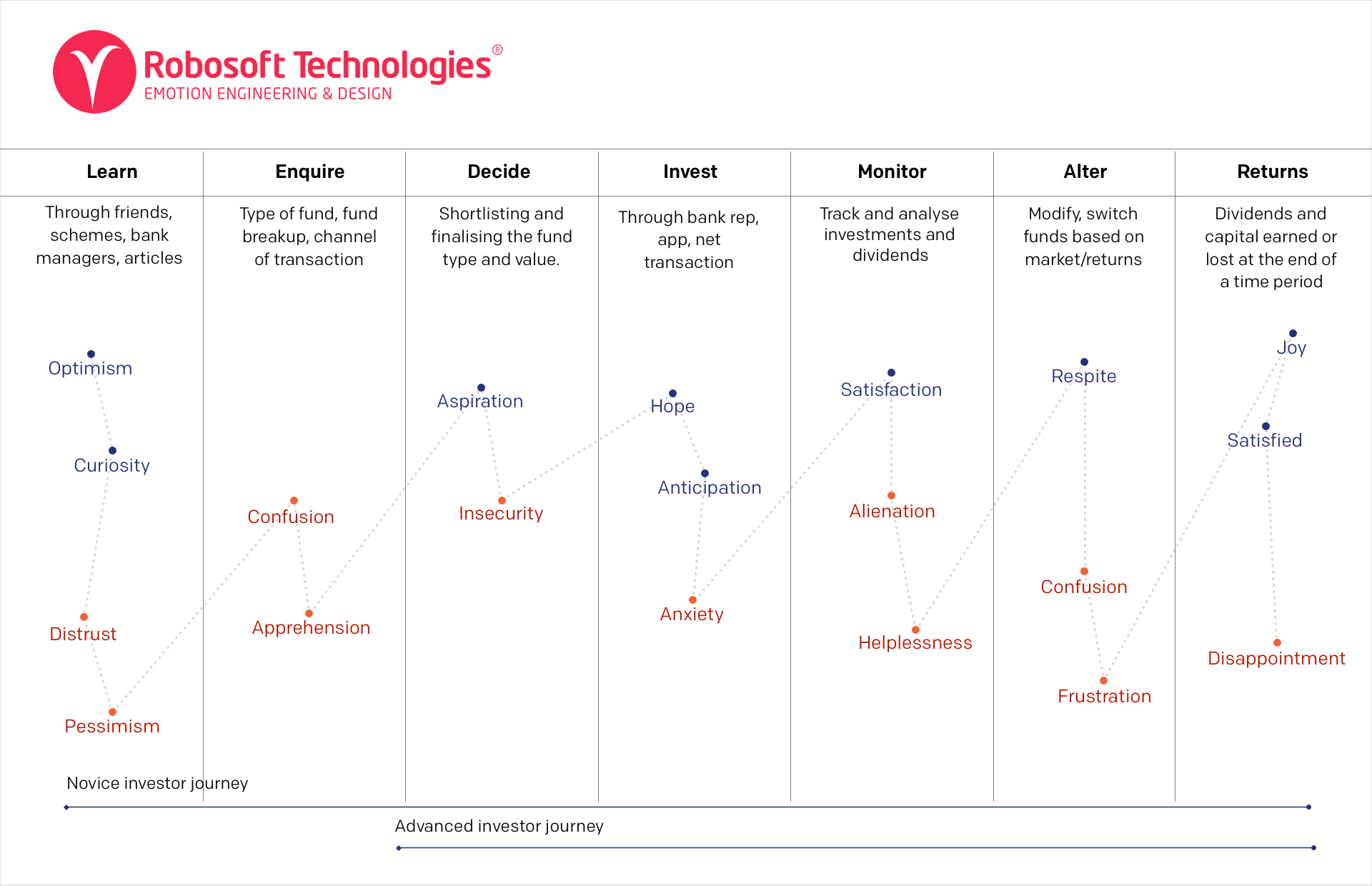

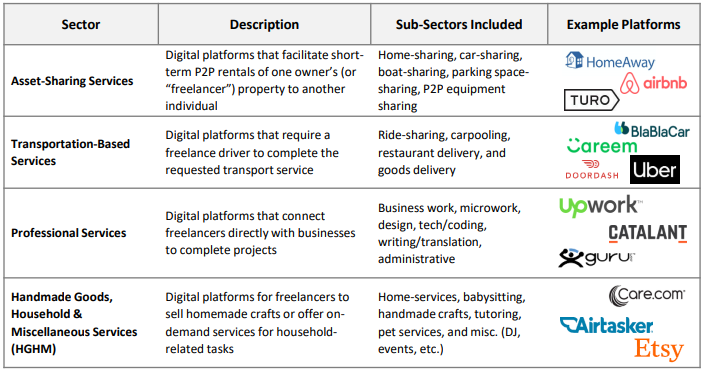

When banking began the digitization journey, the FinTech industry emerged, providing technology to digitize several processes in financial services. This enabled online banking, payments and other services like insurance and wealth management. Customer preferences shifted as they embraced the convenience of online transactions. They prioritized convenience over the traditional approach of trusting a person at the local bank branch or an insurance agent. They preferred digital payments over cash, removing the need for ATMs. Neobanks emerged at the intersection of technology and banking in this industry shift. The concept of neobanks emerged around 2015, and in a very short span of time disrupted the entire banking industry.

“Neobanks are digital first, born in the cloud, completely online banks, with absolutely no physical presence. They provide banking services only via web or mobile a smartphone app.”

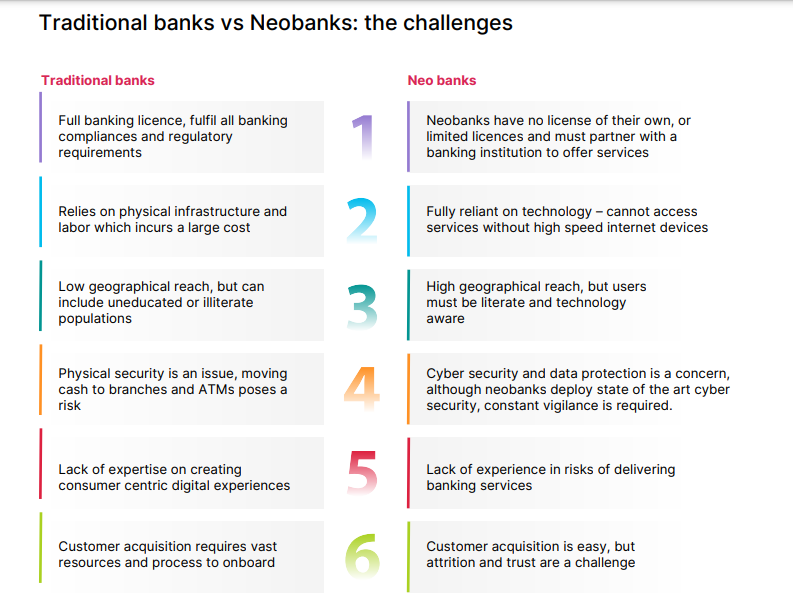

In Europe and the US, neobanks are also referred to as ‘challenger banks’ or ‘open banking’. They all have the following key characteristics:

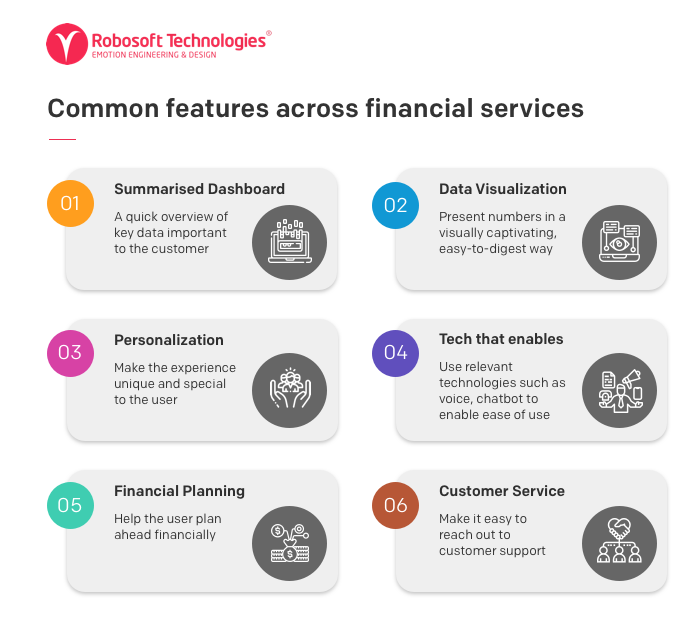

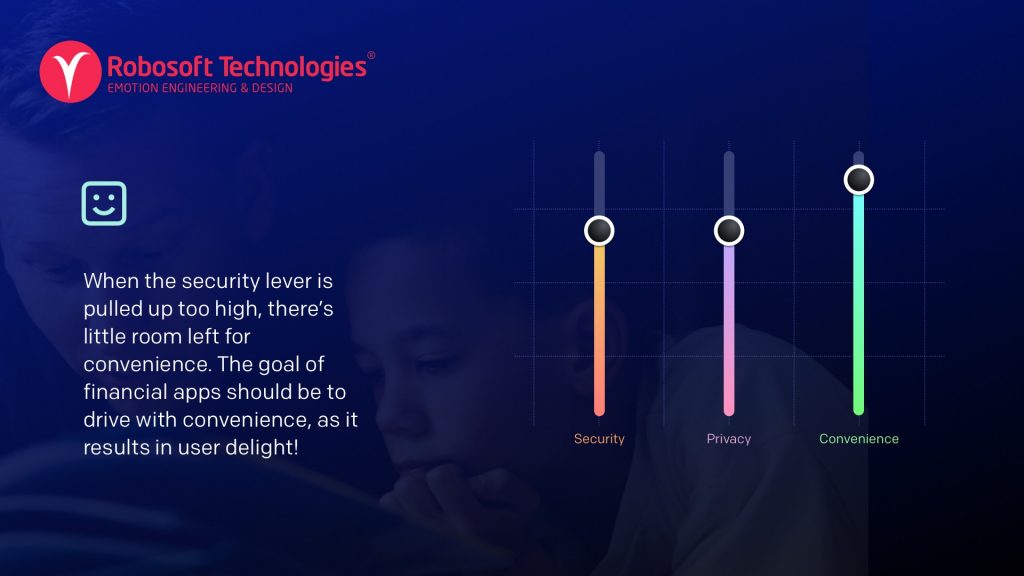

– Customer first: understanding the generation that are digital natives, and rely on their phones for everything, neobanks adopt an entirely digital approach to the customer experience, offering crisp, user friendly and intuitive interfaces.

– Technology powered: Neobanks are entirely technology driven, using technology to acquire customers and deliver services. They deploy artificial intelligence to create personalized, customized offers based on data. Traditional banks rely on in-person or phone customer service, while neobanks may rely on chatbots or Robo-Advisors.

– No physical presence: Neobanks have no physical presence at all; they operate without branches, offices, ATMs or any type of physical infrastructure.

– No banking license: Neobanks typically do not have a banking license and offer services along with a banking partner, although some countries that allow digital banking licenses have seen some licensed neobanks.

In general, a neobank is different from a traditional bank, a mobile wallet or a digital bank, and can fall into these categories.

1. Independent neobanks that work with banking partners: most neobanks follow this model, where a FinTech firm creates a digital experience with a mobile or web platform, and they collaborate with conventional banks to offer services and products. Yolt, Lunarway, and Moven are examples of neobanks that work in this model.

2. Neobanks owned by traditional banks: several traditional banks have realized the value of a digital-only, customer first approach. Aside from their online banking portals, banks set up wholly owned neobanks as part of their digital initiatives such as DigiBank set up by DBS.

3. Licensed neobanks: some countries such as UK, Brazil, Germany, South Africa, and Singapore allow digital banking licenses, and as a result, some neobanks have acquired banking licenses. This allows them to offer more valuable, regulated services. Monzo, N26, MyBank, Starling Bank, and Revolut are some examples.

Additional read: Mobile Fintech vs Traditional Banking products

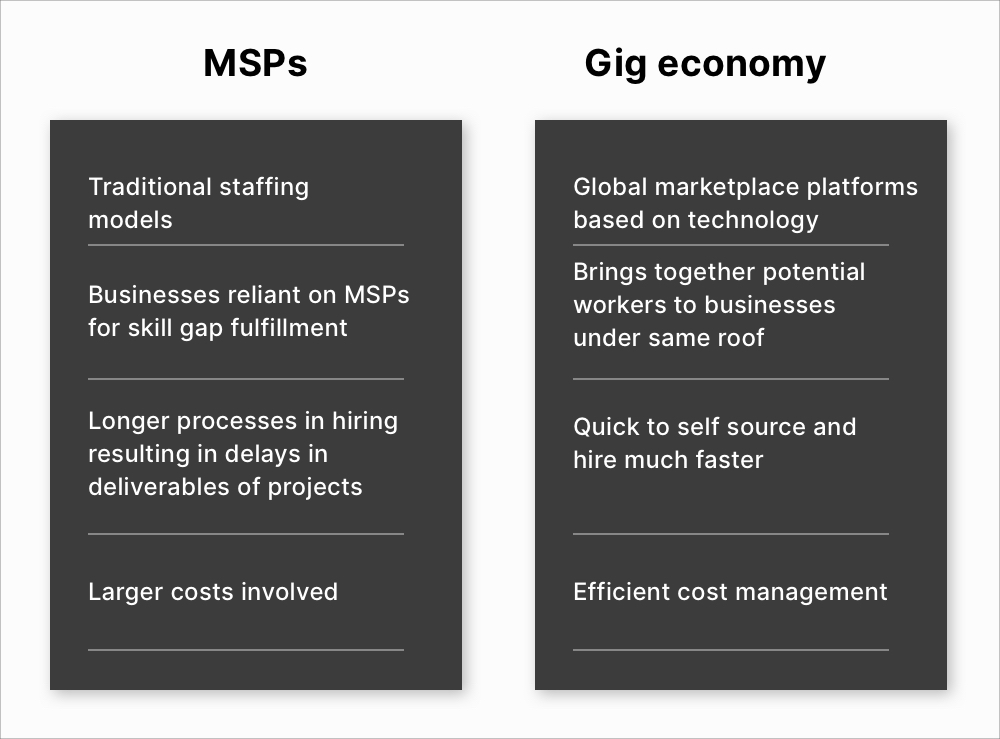

2. Aside from lack of physical outlets, how are neobanks different from traditional banks?

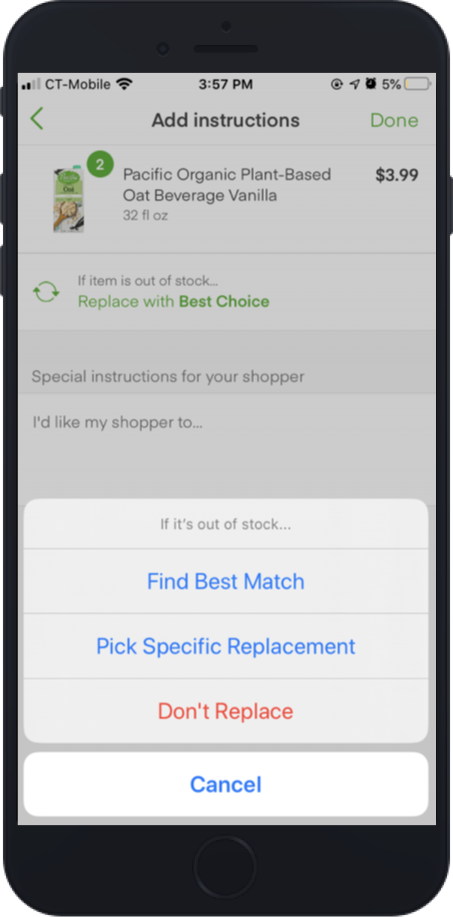

What neobanks did best is understand the new age consumer and use technology to create a user-first banking experience, rather than a regulation and process first banking experience.

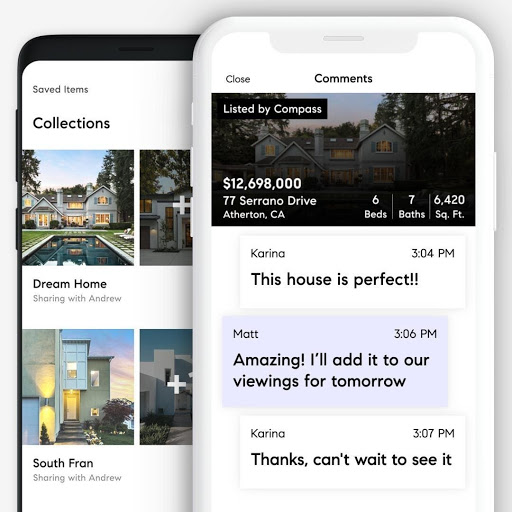

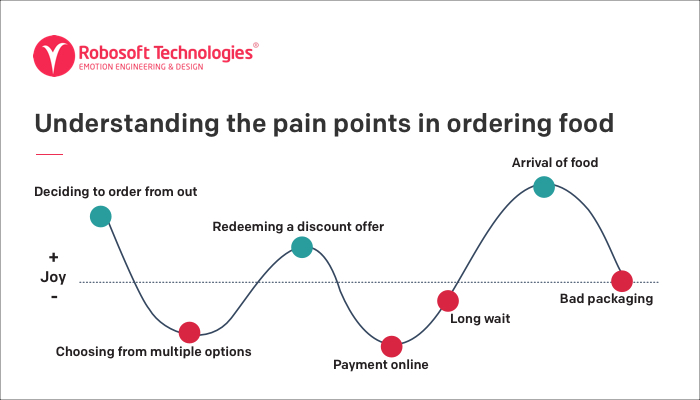

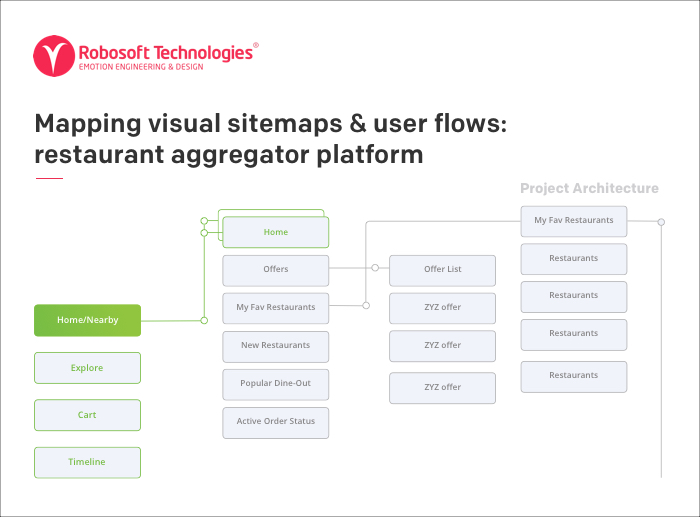

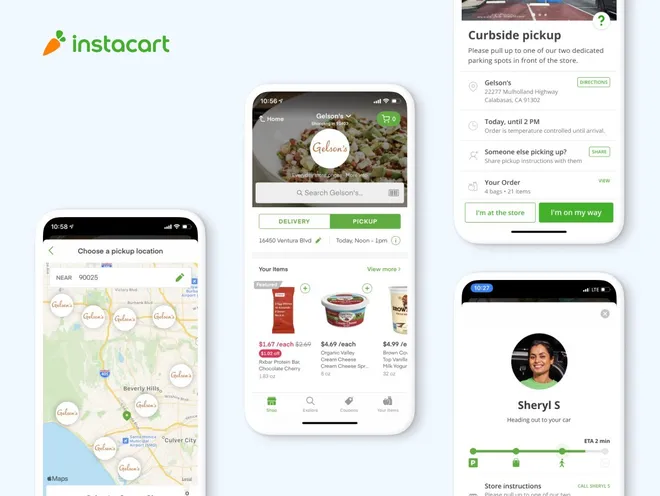

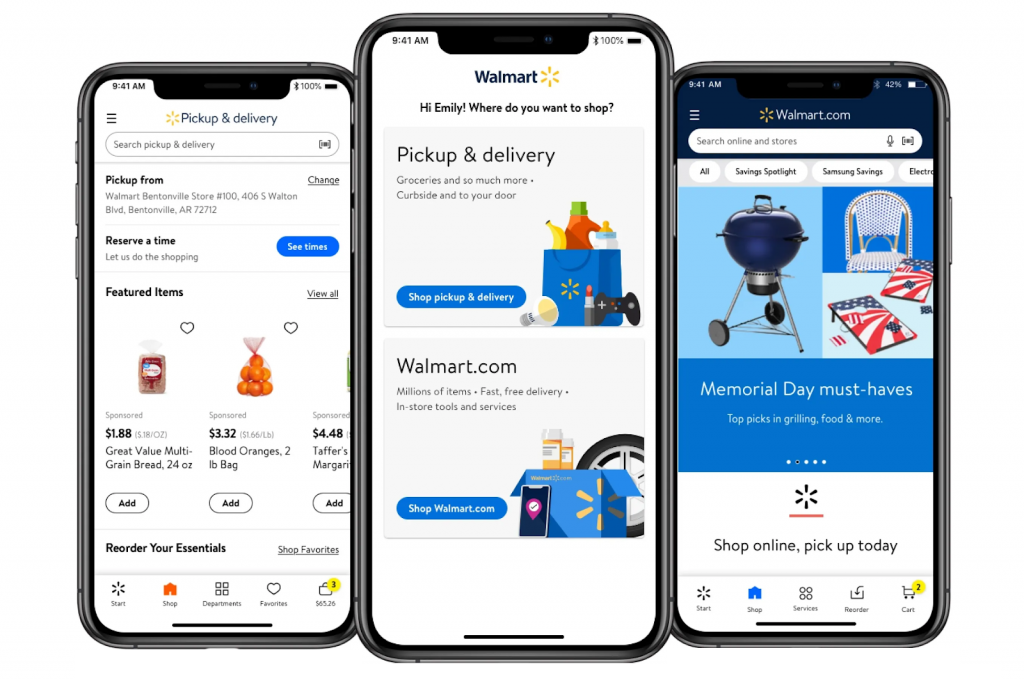

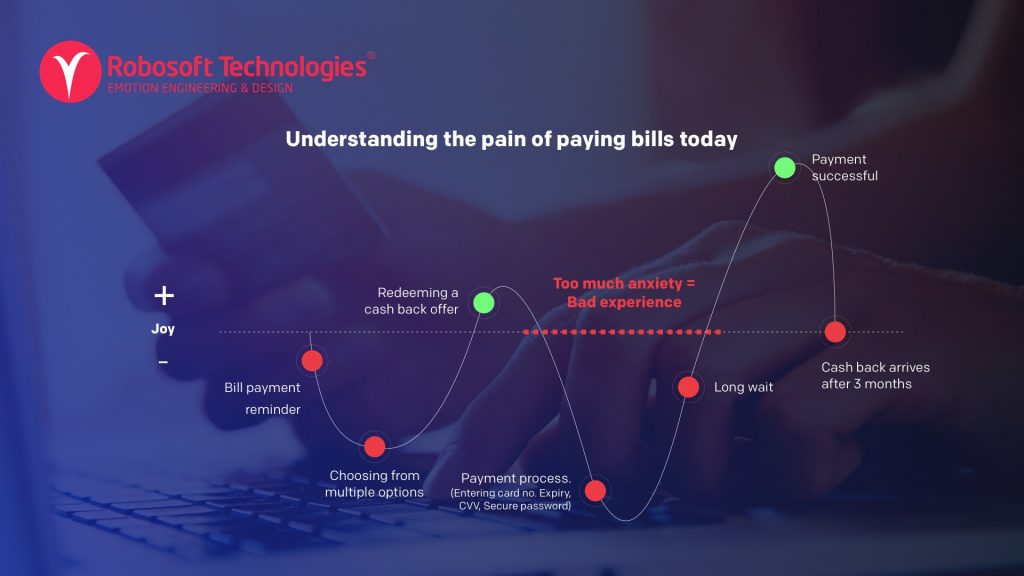

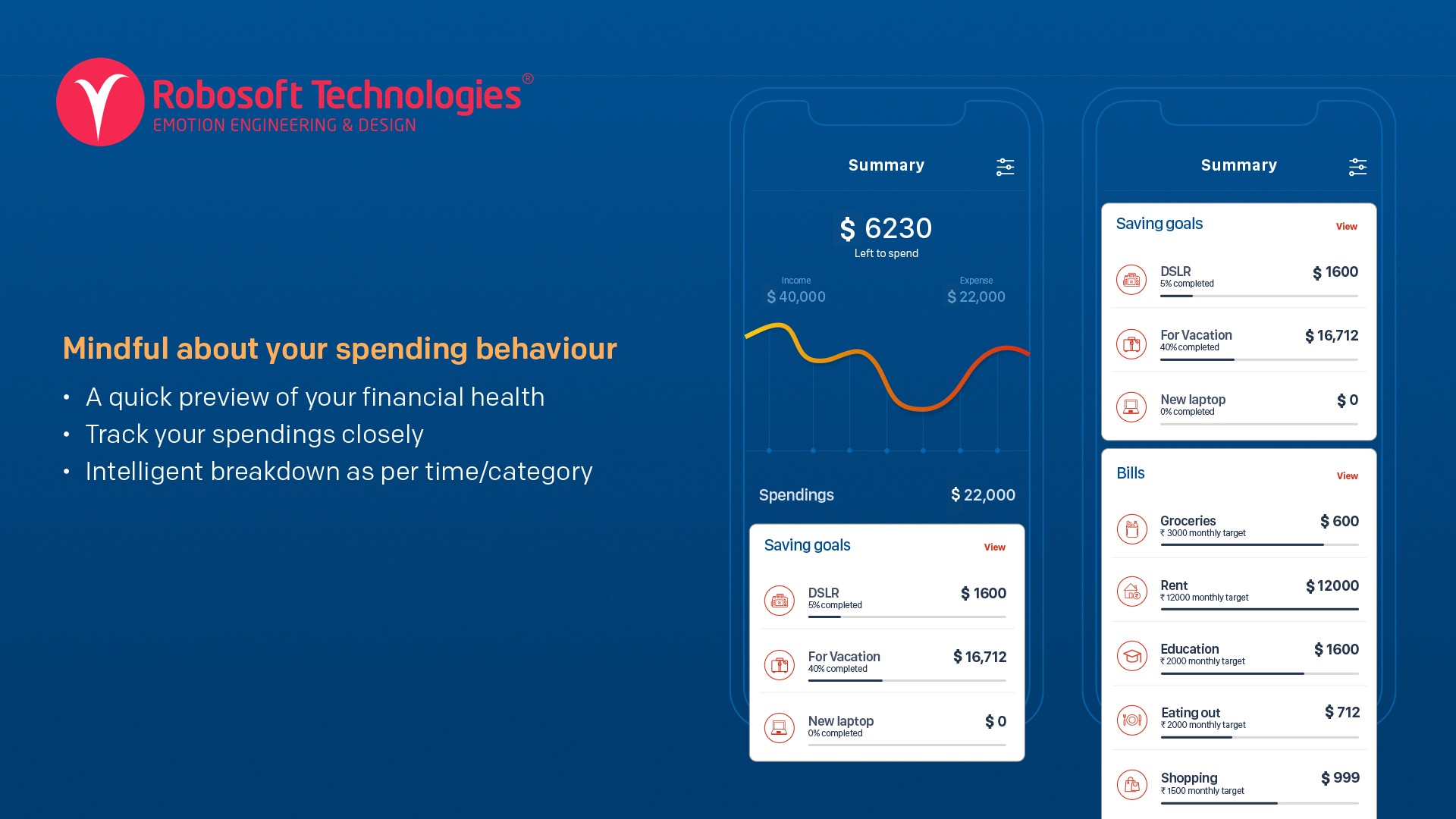

Neobanks create a purely delightful digital journey with easy to use and attractive interfaces. New solutions are built based on a mobile-first experience over a branch-first experience. They use data to create unique solutions and understand the pulse of the customers to create digitally enabled experiences.

3. What aspects of neobanks do customers like?

It is believed that the incredibly easy account opening and smooth, quick on-boarding are hugely attractive to those who have signed up with neobanks (Niyo in India anchors its advertising on the fact that its account opening takes just 100 seconds).

Deloitte surveyed millennials in over 20 countries and found that 68% say that new financial players understand their needs. They expect banks to offer a slick and sophisticated app, with new offers tailored to their needs. 79% of millennials access their mobile banking app multiple times a week. With Gen Z entering the workforce, there will be new expectations of social media integrations and deeply unique experiences.

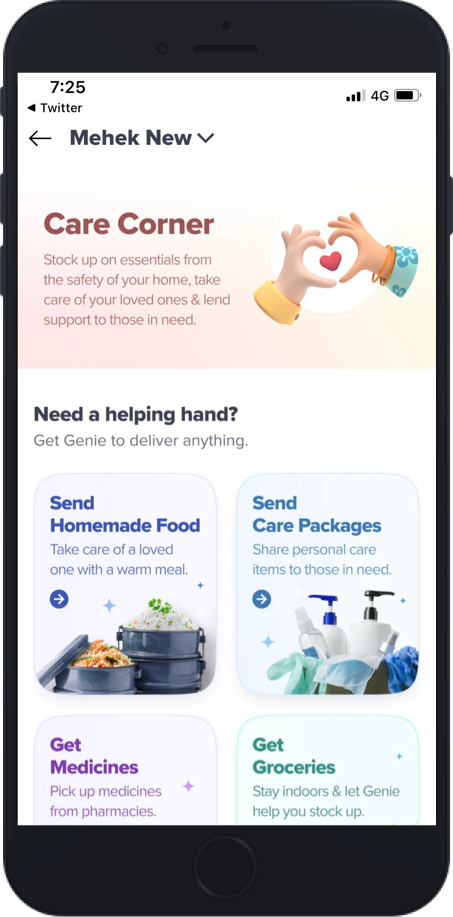

Consumers want fully connected services from neobanks, which means creating products and services that cross over the traditional industry lines.

– Hyper-personalization options such as bundling services like real estate with home loans, peer to peer payments, personal finance planning, and even lifestyle related features are being integrated into the digital experience.

– For small and medium enterprises as well, neobanks are offering integrated services of banking as well as financial management including accounting, invoicing and taxation.

Neobanks have seen widespread adoption and growth as they are agile and easy to set up, and customers find it simple to engage with them.

Easy account creation: customers can easily open an account in a few clicks, without having to visit a bank branch or provide reams of documentation.

Personalization: the user experience is unique and tailor-made with data available on spending patterns and other insights

Range of services at lower fees: not having to bear costs of labor or branches as well as less spend on regulatory compliances allow Neobanks to offer services including banking, debit and credit cards, forex, loans and others free or at very low service rates

4. What’s in it for neobanks?

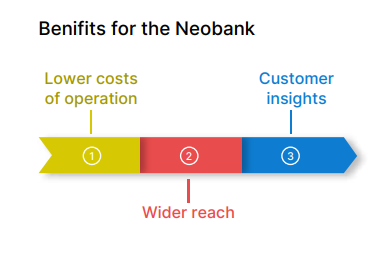

Low cost and agile: Neobanks are 100% online, so they have no investment on physical infrastructure and low operational spends such as customer support, ATMs or bank branches.

Wider reach of customers: the ease of account creation via mobile phones and simple user interfaces, enable neobanks to reach the unbanked populations including small and medium enterprises, blue collar workers and youth.

Data on consumer patterns and trends: being completely digital allows neobanks to collect and analyses consumer data, understand the patterns, and behaviors. Using machine learning allows them to provide a customized experience, and artificial intelligence helps neobanks create personalized services.

5. What is the industry shifts which were favorable to neobanks?

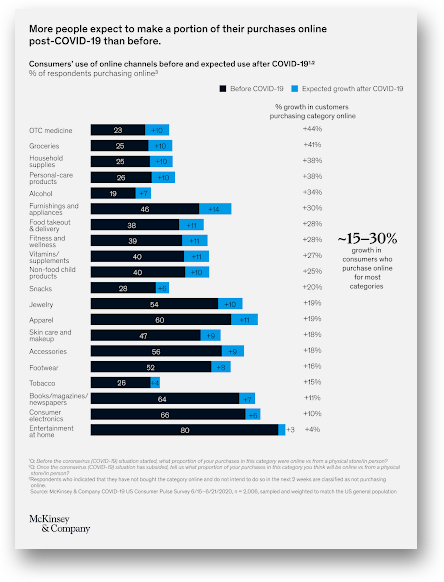

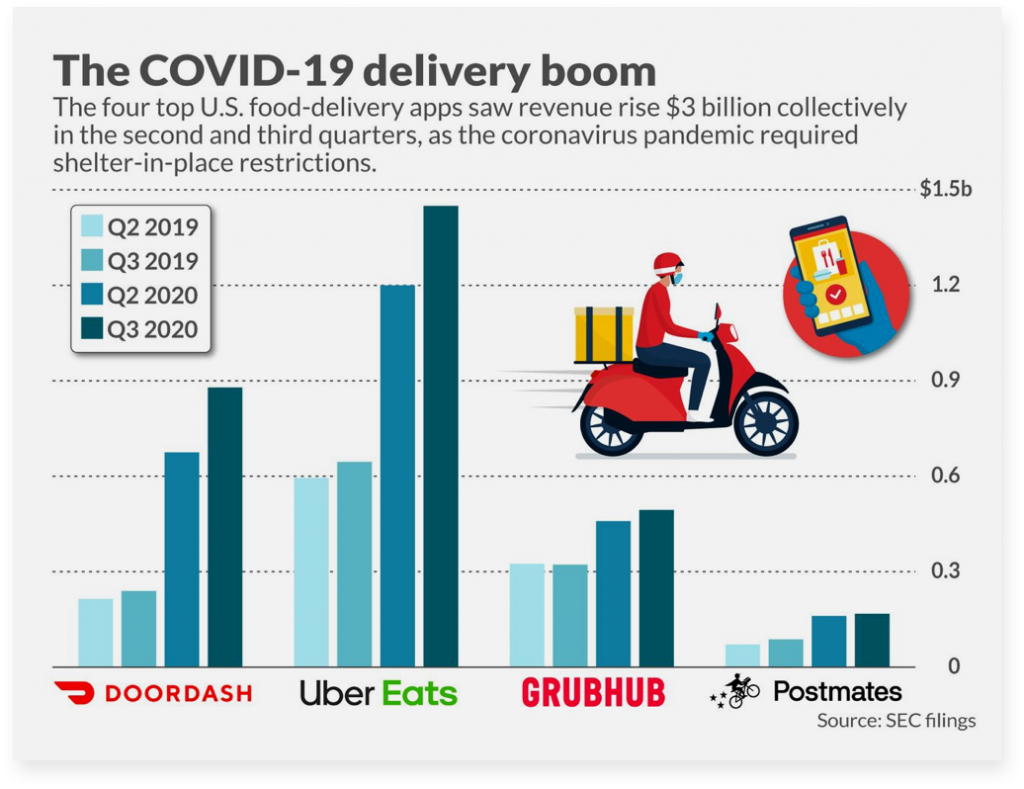

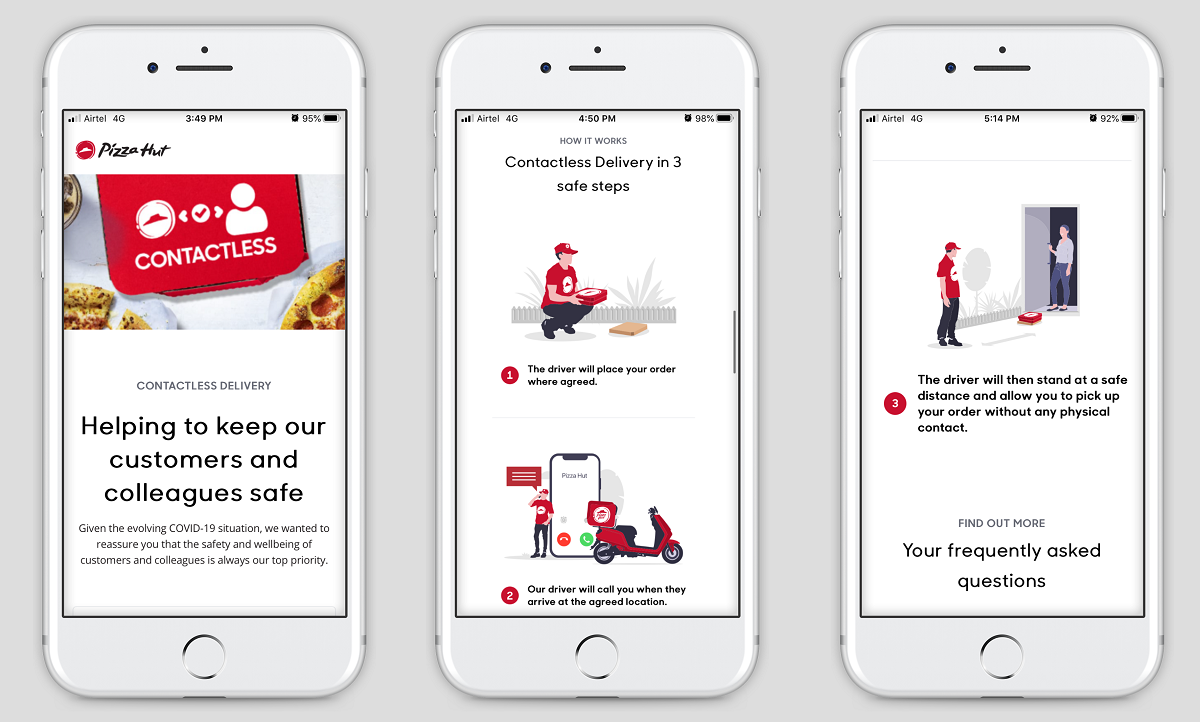

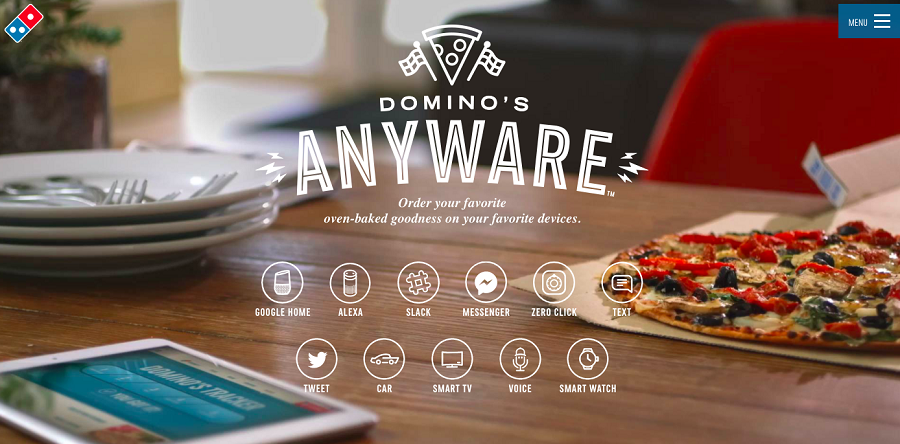

Digital acceleration: The pace of adoption of new technologies and relying on digital solutions for everything (be it ordering food or hailing a cab) increased recently. The pace of this change accelerated after the Covid-19 pandemic and has impacted several industries including media & entertainment and delivery services.

Hyper-personalization: Product or service parity is common across categories. While consumers may see very little difference between brands, the ones which cater to a ‘segment of one’ are bound to have an edge. Consumers expect unique services, ongoing communication and access to relevant information and data.

Change in the notion of trust: An imposing building and presence over decades was equated with solid performance and trust by the older generation. Millennials and Gen Z don’t see such as markers of trust. They expect the digital experience to work and work best for them.

Shifts in technology capabilities: The foundational elements of technology put in place in the first wave of digitization by banks and FinTechs have a lot to do with the success of neobanking. API integrations allow data and information to be shared by various applications, which allows neobanks to offer simplified services, and fast digital experiences. Account aggregator system reforms such as India’s UPI (Unified Payments Interface) have enabled ways to connect, bypass legacy-infrastructure hurdles, and innovate using technology.

Technology-enabled design as brand edge: Both B2C and B2B enterprises have come to accept that design can be a secret weapon in creating brand affinity. While slick user interfaces attract users and simplify the digital journey, machine learning and artificial intelligence are bridging data and user experiences. With these AI / ML applications, neobanks draw from individual data to create a personalized experience, or offer unique services or products by predicting a user’s need.

Additional read: 5 factors set to impact the future of banking

Despite the rise of neobanks, traditional banks which have adapted well to the digital world still have an edge due to brand recognition, positive equity and a huge customer base. All in all, it promises to be a win-win for the end consumers who can get the best of banking facilities, customer service and digital experiences.