Wealth management was once the exclusive purview of financial advisors who managed the portfolios of a select, affluent few. Personalized portfolio plans and personal relationships drove such advice. The advent of digital technology has democratized many industries – and wealth management is no exception. As we know, in financial services, digital solutions are at the heart of the consumer experience.

The rise of fintech brands, especially those that help manage investments, is dependent more on technologies than on bespoke human advice, as it is all about scale. This has resulted in redefining wealth management as a service. According to a report by FactSet, investors across the wealth scale—from the mass affluent customer with $100 to invest to the ultra-high net worth (UHNW) client worth $10 million—are already embracing online platforms.

The key to digitalization success is targeting the right business areas, bringing in the right skills, and identifying the key processes to maximize value delivery. A comprehensive hybrid-advisory approach leveraging automation, data analytics, digital, and cloud solutions are the need of the hour.

The key pillars of digital experience in wealth management

Rapid technological advancements, changing investor preferences, and increasing financial awareness are prompting wealth managers to reconsider their customer engagement and business strategies. Digitalization helps modern wealth advisors create and understand their client personas better, moving away from “one size fits all” to a more customized approach. The right technology framework will lower infrastructure costs and improve the efficiency, speed, and scalability of the whole wealth management value chain.

Improving customer prospecting through AI/ML and digital onboarding

Digitalization through AI/ML can help wealth managers identify the right prospects and drive customer acquisitions through data-led personalized marketing. Its ability to combine data from various sources enables it to efficiently classify customer segments based on a variety of criteria, identify prospects using real-time data signals from social media, and generate dynamically personalized content for potential clients, all of which help to increase customer acquisition.

Digital Onboarding: Customer onboarding has traditionally required time-consuming manual documentation. However, many broker-dealers and other wealth management companies are digitizing and automating the process to enhance the client experience and save money.

The foundation for a long-term client relationship is established during the wealth management onboarding process, which includes the first serious interactions between an adviser and a client. Client onboarding processes include

- Prospecting

- Product selection

- Regulatory checks

- New Account Opening (NAO)

As a result, businesses are now able to onboard and serve more clients in less time and with fewer resources, maintaining their competitiveness in a market where investors and regulators are driving down fees. Firms with a robust digital onboarding experience will have a solid competitive advantage in the industry.

Achieving investor centricity through data analytics and management

Wealth managers need accurate and real-time data to assess investor sentiments, understand critical market parameters, and produce insights for quick investor decisions. Data can provide timely, pertinent, and actionable insights that can be used to create new (and enhance existing) product and service propositions, optimize channel management, generate higher returns through informed portfolio choices for the investor, and boost customer engagement, and customer retention.

Wealth managers can make wise decisions and appropriate portfolio modifications by using a quantamental investment technique that leverages sentimental analysis, alternative data, and return analytics. Most wealth managers have advanced their client analytics and advisory capabilities and are in various phases of development.

At present, wealth managers have most of their data locked in product silos and legacy systems. Before using advanced analytics, it is understood that access to precise and complete data is necessary. Wealth management companies need a client-focused, precise master data architecture that combines data from all points along the value chain. By increasing their investment in data management and analytics as part of their digitalization initiatives, wealth managers have a better chance of generating higher returns.

Personalized client experience at the front and center

Personalization is one way that advisors can stay competitive with other firms that may offer lower fees or higher returns on investments. According to a survey, investors are increasingly in need of personalized, goal-based planning and other specialized services. In the next two years, 58% of respondents said they would like personalized financial guidance.

Personalization as its name says is unique to each client. To build solutions that will work with whatever position the clients find themselves in, advisors have for decades always thrived on understanding their clients’ backgrounds and perspectives on risk. For instance, knowing information about a client’s household size, state of residency, and annual income are crucial data points in creating customized options that may be more suited for particular people.

Wealth managers can now offer personalized services at a reasonable cost, enabling them to better compete with firms that offer lower fees or higher returns on investments. Automated rebalancing and custom indexing are two examples.

Advisors can automate trading and rebalancing via automated portfolio allocation. And with the help of automated reporting tools, the adviser can inform a large number of clients about portfolio changes.

Enhancing digital investor management and advisory services

For the wealth management sector, it is crucial to offer a more holistic customer and advisory experience. In addition to the human touch, new-age investors are extremely drawn to digital personalization. Wealth managers may increase client acquisition by creating personalized content for potential investors using AI and data-enabled marketing. By increasing customer engagement, a redesigned digital experience can increase customer retention and give advisers more leverage.

A few of the main touchpoints are-

- Omnichannel engagement experience: Extends “zero-touch” service by using customized solutions built on video conferencing, on-demand virtual meet (with human advisor), and bot-enabled self-service. Portfolio review and building can be performed over user-friendly virtual solutions accessible over multiple channels.

- Data-empowered custom solutions: Includes chatbots and avatars that create a personalized and smoother investor experience, thereby promoting customer retention, upselling, and cross-selling. Many established firms are providing AI/ML-powered offerings to query investor portfolios and their holdings and provide data analytics on the performance of the securities in their portfolio.

- Advisor mobile apps: Enables wealth advisors to organize their activities and handle customer interactions. These apps (for example, MyMerrill) can include functionalities like advisor dashboards and 360-degree visualizations of customers and their risk appetites.

Adopting a cloud architecture to improve scalability and operational efficiency

The Information Technology (IT) landscape within wealth management firms consists of legacy systems that maintain a high volume of financial data, which requires increasing maintenance efforts and costs. An increase in financial data will drive automation processes and solutions as automation and AI/ML become more integrated into wealth management services.

Cloud infrastructure can offer a more reliable alternative to internal legacy systems for handling the increased inflow of data at scale, as well as higher operational efficiency and improved agility/time-to-market. By identifying the migration’s decision paths, which will guide the cloud migration strategy through the assessment, design, build, and migration stages, wealth management firms can optimize their existing application portfolio for cloud adoption.

Robo-advisory: taking the stress out of investing

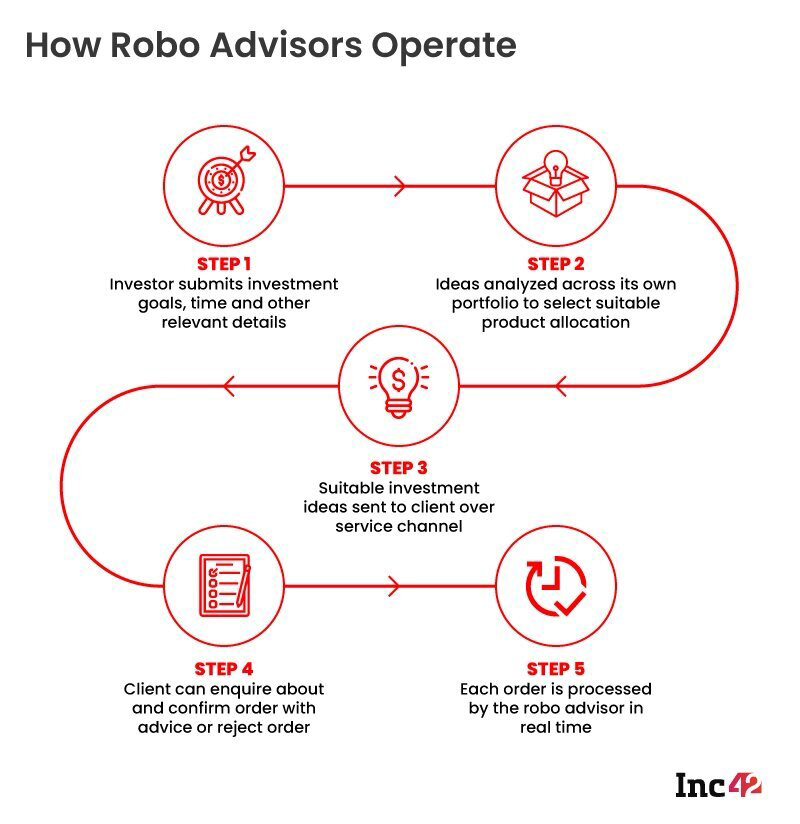

Robo-advisors use automated, algorithm-based systems to provide portfolio management advice. These services are created with customer-centric thinking, and the technology is developed based on their wants and needs.

Customers are drawn to Robo-advice for a variety of reasons. First of all, it entails lower transaction fees and smaller investment requirements. Secondly, it entails more effective investment management. This is because the majority of Robo-offerings offer portfolio management using algorithmically based automated investment solutions that automatically rebalance the customer’s portfolio’s asset allocation without requiring any activity from the user. Thirdly, it provides less experienced investors with more comprehensive advice. Finally, Robo-advice offers more transparency on each investment and how they are likely to perform. The digital interface of many Robo-advisors makes it easy for an investor to analyze their returns versus benchmarks and progress toward goals.

Robo-advice services, whether new-age start-ups or established ones, also have the potential to widen the availability of investment advice from high net-worth individuals to less wealthy investors. Designing robo-advice services for the mass affluent presents a challenge because the customers may have good investment knowledge or little to no investment knowledge, and there is no human advisor there to make sure that the customer has understood the advice they have received.

Robo-advice services that are well-designed assist customers in receiving the best advice for their financial situation and reduce the likelihood that they will purchase the incorrect product. An agile, customer-experience-led, iterative strategy that designs and tests various interaction patterns is the most effective way to do this; whether that be an interactive Web or Mobile App, Chatbot, or combination of multiple technologies, that is right for the persona of a customer using the service.

Enhancing Digital Experience across the Wealth Management Value Chain

Opportunities for digitalization are seen throughout the wealth management value chain. An integrated digital transformation that addresses all the relevant user touchpoints would make it possible for investors and advisers to have a generally improved user experience. Every component of the wealth management value chain can be linked to a digitalization lever (Front office, Middle office, and Back office).

- Customer experience is adversely affected by front-office digitalization. The focus is on seamless engagement and improved digital user experience to reduce the turnaround time, increase process efficiency, and ensure a smoother customer journey by Big Tech and Fintech experience.

- The middle office, which drives the core line of operation in wealth management, is firmly focused on data analytics. However, given the sensitive nature of client data protection concerns and legislation like GDPR and equivalent laws coming into place around the world, a controlled approach to data management and cloudification is the way forward.

- Automation and cloudification are the main digitalization potential in the back office space. The user experience quotient is not very high primarily because the activities are more in-house driven rather than external stakeholder driven.

The Road Ahead

The need to stay digitally connected and have a lasting influence on investors and asset managers have accelerated after the global pandemic. The focus is on creating a digital ecosystem built on tools and measures for a touchless remote experience without compromising on quality, which may have permanently changed how people work.

From a service and product perspective, the focus is steadily moving toward personalization, driven by effective data analysis. The emphasis is now on specialized products, personalized advisory services, and flexible pricing structures for different investment classes. One key factor that unites these shifts is the proactive application of technology and accelerated digitalization, whether inorganically or organically.

Effective use of technology through an omnichannel delivery model is essential for people-centric and relationship-driven industries like wealth management to promote the right level of customer engagement. Firms can look forward to investing in in-house technology and aligning with tech vendors, for the timely implementation of modern investment solutions, keeping relevant to a variety of customer segments, and staying ahead of ever-increasing competition.