Environmental, social, and governance (ESG) impact is a theme that has already gained momentum across the globe. The term “ESG” is believed to have been first coined in 2005 in a study titled “Who Cares Wins.” However, eighteen years have passed since then, and ESG has now become a vital corporate discipline and a significant agenda across various global discussions, encompassing politics, business, and climate change.

Responsible investing, in simple terms, entails integrating environmental, social, and governance factors into investment processes and decision-making. Green Deposits are a way to mobilize money from public and institutions to specifically invest that money towards sustainability project.

According to a report published by Forbes, “ESG factors cover a wide spectrum of issues that traditionally are not part of financial analysis, yet they may have financial relevance. This could include evaluating how corporations respond to climate change, their proficiency in water management, the effectiveness of their health and safety policies in preventing accidents, supply chain management practices, the treatment of workers, and the existence of a corporate culture that fosters trust and innovation.”

RBI’s Initiatives for Green Finance and Banks’ Role in Sustainability Efforts

As ESG permeates all aspects of business, banks are emerging as driving forces in sustainability efforts. The financial services sector plays a pivotal role in mobilizing national resources and managing their allocation. The banking industry in India, including non-banking financial services companies, has positively impacted the country’s socio-economic progress. However, for India to achieve its net-zero target by 2070, the banking industry needs to take on a more central role in leading the ecosystem towards sustainability.

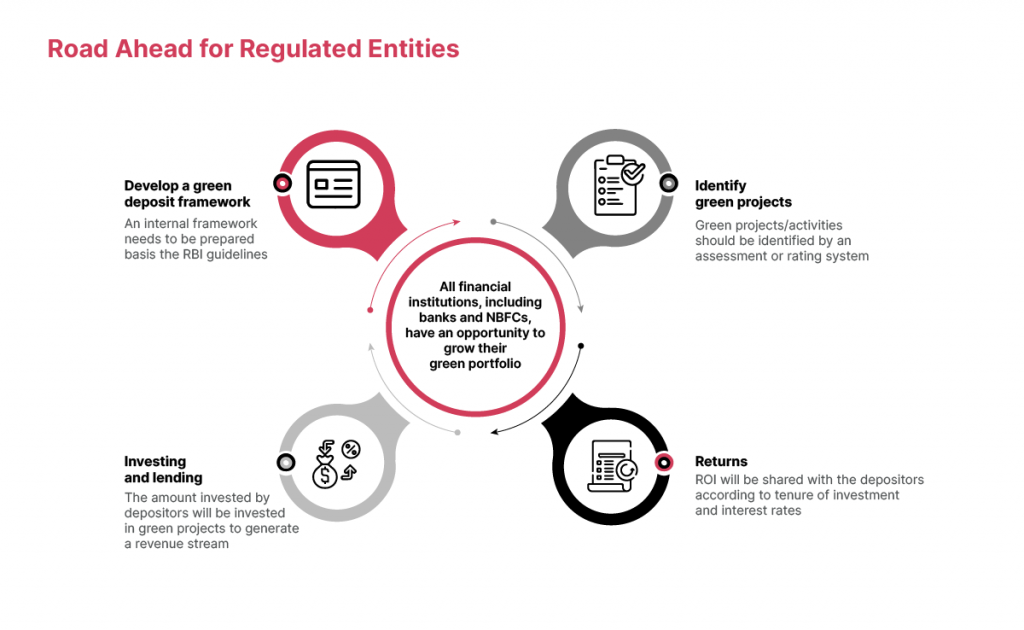

Recognizing the industry’s significance, the Reserve Bank of India (RBI) has established regulatory guardrails and frameworks to promote the raising and deployment of green finance in the domestic market. This move allows banks and other deposit-accepting NBFCs to enhance their fundraising abilities and build a corpus of green funds dedicated to environment-friendly and sustainability-linked products. Consequently, businesses can gain easier access to green loans, ideally at better rates and with more favorable conditions, to finance their journey towards sustainable growth.

Effective June 1, 2023, retail and institutional investors have access to green deposits. As per the RBI, a “green deposit” refers to an interest-bearing deposit received by a Regulated Entity (RE) for a fixed period, with the proceeds earmarked for allocation towards green finance. The RBI mandates regulated entities to establish a comprehensive board-approved policy on green deposits, outlining in detail all aspects related to issuing and allocating such deposits.

Utilization of Green Deposits Funds: Supported Sectors and Projects

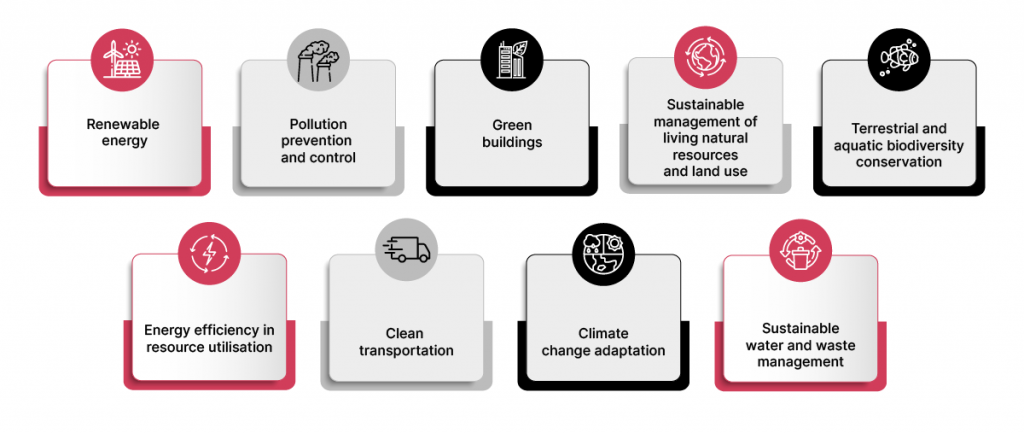

In its circular dated April 11, 2023, the RBI stipulates how regulated entities should use the proceeds from green deposits or green finance. The current provisions within the framework allow the utilization of green deposits funds in the following sectors:

1. Renewable Energy:

1. Renewable Energy:

- Solar, wind, biomass, and hydropower energy projects that integrate energy generation and storage.

- Incentivizing the adoption of renewable energy.

2. Energy Efficiency:

- Design and construction of energy-efficient and energy-saving systems and installations in buildings and properties.

- Supporting lighting improvements.

- Supporting the construction of new low-carbon buildings and energy-efficient retrofits for existing buildings.

- Projects to reduce electricity grid losses.

3. Clean Transportation:

- Green Projects promoting the electrification of transportation.

- Adoption of clean fuels, such as electric vehicles, including the building of charging infrastructure.

4. Climate Change Adaptation:

- Projects aimed at making infrastructure more resilient to the impacts of climate change.

5. Sustainable Water and Waste Management:

- Promoting water-efficient irrigation systems.

- Installation and upgrading of wastewater infrastructure, including transport, treatment, and disposal systems.

- Flood defense systems.

6. Pollution Prevention and Control:

- Green projects targeting the reduction of air emissions, greenhouse gas control, soil remediation, waste management, waste prevention, waste recycling, and energy/emission-efficient waste-to-energy.

7. Green Buildings:

- Projects related to buildings that meet regional, national, or internationally recognized standards or certifications for environmental performance.

8. Sustainable Management of Living Natural Resources and Land Use:

- Environmentally sustainable management of agriculture, animal husbandry, fisheries, and aquaculture.

- Sustainable forestry management, including afforestation/reforestation.

- Support for certified organic farming.

- Research on living resources and biodiversity protection.

9. Terrestrial and Aquatic Biodiversity Conservation:

- Projects related to coastal and marine environments.

- Projects related to biodiversity preservation, including the conservation of endangered species, habitats, and ecosystems.

The Green Finance Ecosystem (GFS)

With a view to drive a green finance ecosystem (GFS), the RBI framework aims to supports and enable investments in environmentally sustainable projects and initiatives. The GFS aims to create a financial system that supports the transition to a low-carbon, resource-efficient, and sustainable economy, while also addressing the risks and opportunities associated with environmental issues such as climate change, pollution, and biodiversity loss. As per RBI’s circular, the purpose or rationale behind the green deposits framework is, “To encourage regulated entities (REs) to offer green deposits to customers, protect interest of the depositor, aid customers to achieve their sustainability agenda, address greenwashing concerns and help augment the flow of credit to green activities or projects.”

This new framework may seem extremely opportune given India’s strong narrative around the ‘Make in India’ campaign and its commitment to be net zero by 2070. This move lends tremendous credibility to India’s aspiration to be seen as a responsible, sustainable and a global economic power. It reflects India’s commitment, at a policy level, to address the growing global issues concerning ESG impact. Commitment with a follow up action like this will go a long way in positioning India is a global partner of choice across manufacturing, research, and bilateral trade. Considering the possibilities that it opens; the RBI’s green deposits framework has clearly given India another ‘India Shining’ moment after the Unified Payments Interface (UPI) and Central Bank Digital Currency (CBDC) initiatives.