In today’s age of remarkable technological progress, artificial intelligence (AI) has become a transformative force in numerous industries, revolutionizing the way they operate. Among the many sectors experiencing its transformative power, the insurance industry stands out as a prime beneficiary.

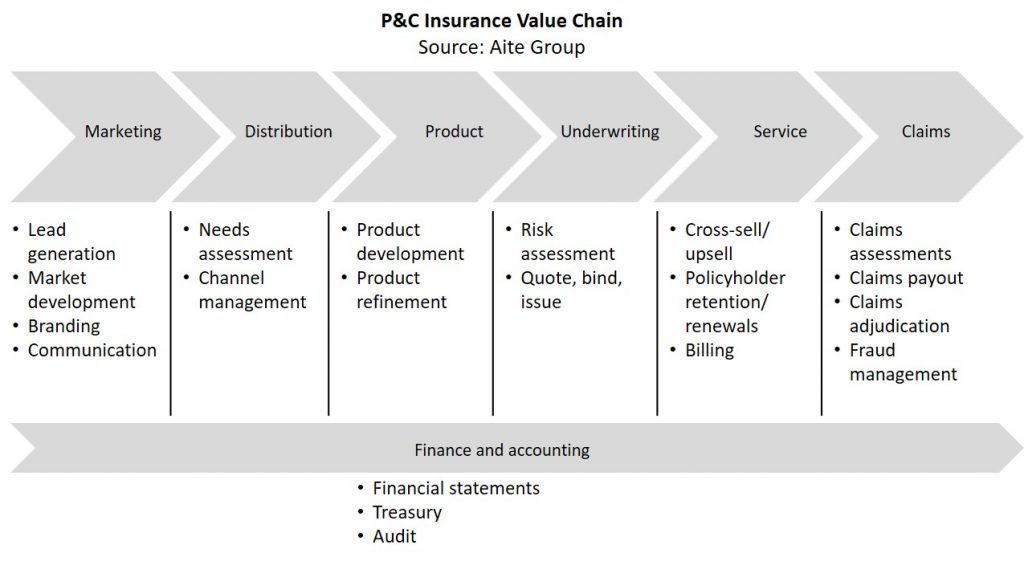

With the ability to enhance efficiency and accuracy in ways previously unimaginable, AI is reshaping the landscape of insurance operations, from underwriting and claims processing to risk assessment and customer service.

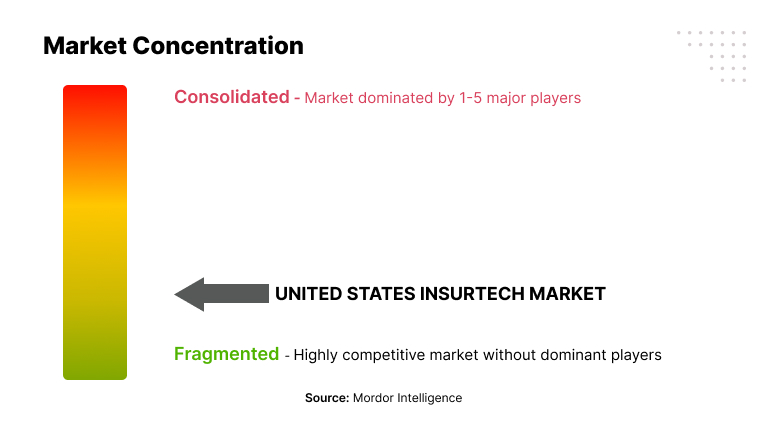

The global AI in insurance market size was valued at USD 6.92 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 24.08% from 2022 to 2028. A recent survey found that 21% of insurance organizations are preparing their workforce for collaborative, interactive, and explainable AI-based systems. It is also predicted that investment in AI insurance will be ranked high on the agenda of decision-makers.

AI is transforming the insurance industry by automating tasks, analyzing data, and enhancing decision-making. This leads to improved efficiency, accuracy, and customer service, which drives customer satisfaction and boosts profitability.

How is AI Changing the Insurance Game

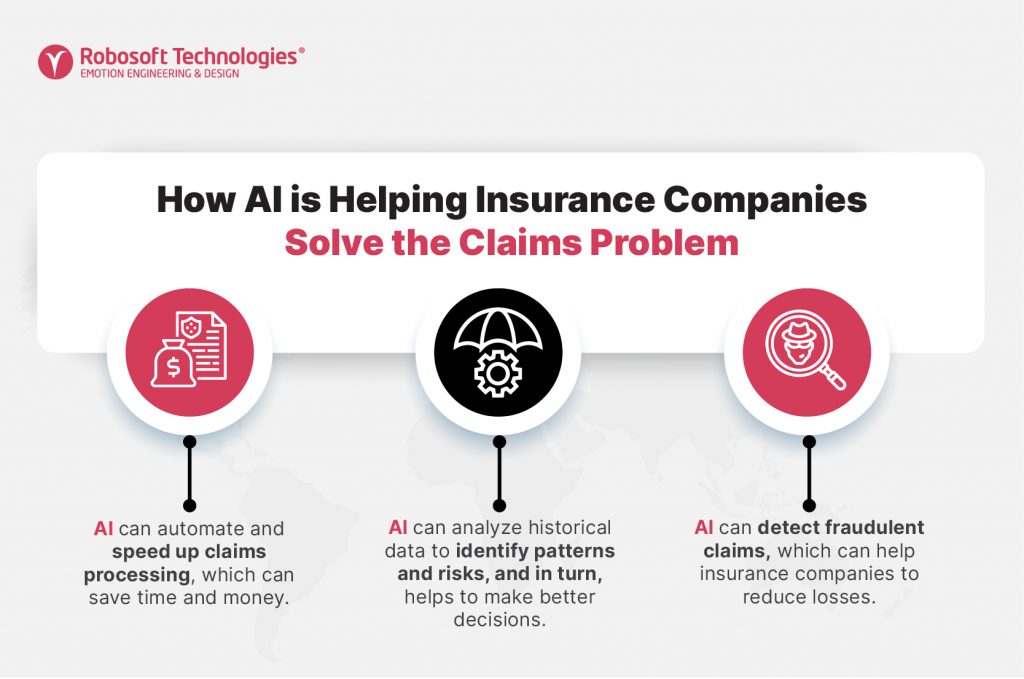

#1 Tackling the claims problem

a) Accelerated claims processing

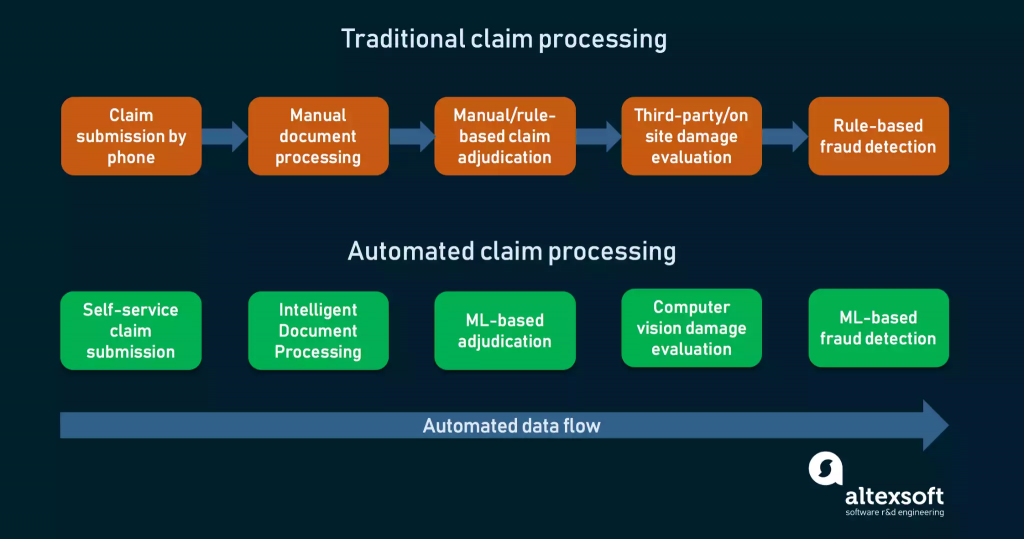

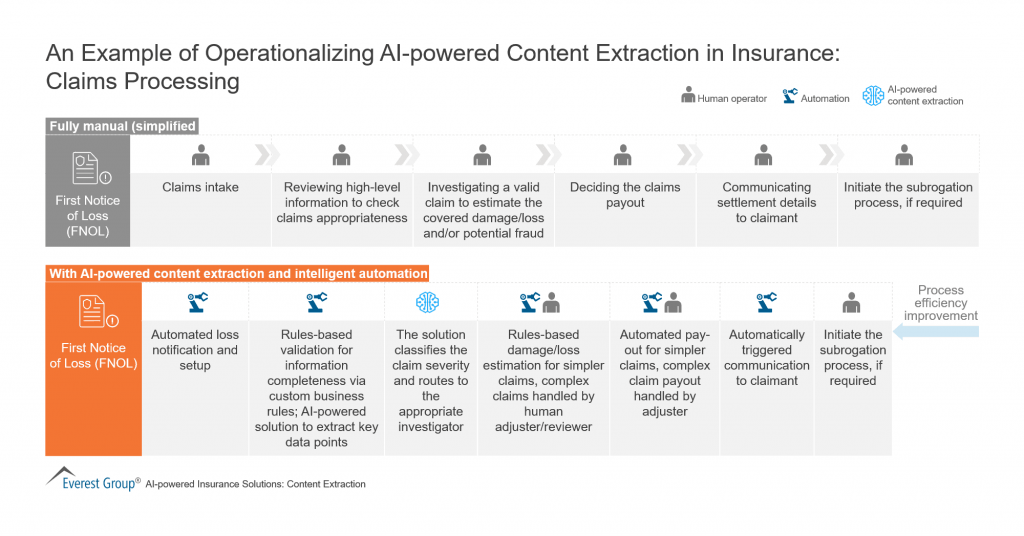

In today’s digital era, insurance companies have streamlined the claims process through convenient methods like smartphones and web portals. AI-powered bots guide customers, verify policy details, detect fraud, and expedite settlement for prompt resolution.

Insurance companies are using new technologies to accelerate claims processing and improve the customer experience:

- AI-powered chatbots can be used to automate and streamline the claims processing process, which can help reduce costs and improve customer satisfaction.

- AI-driven touchless insurance claim processes can automate the entire claims process. This includes reporting the claim, updating the system, and communicating with the customer.

- Document capture technologies and optical character recognition can efficiently extract text from scanned documents.

- AI-based handwriting recognition software can now process handwritten documents at a speed and accuracy that far exceed human capabilities.

- Automated processes are now being used to handle many aspects of claims processing, from routing claims to approving them.

b) Claims reserve optimization

AI plays a pivotal role in the digital trends insurance industry in claims reserve optimization by leveraging data analytics to enhance accuracy, efficiency, and decision-making. It analyzes historical claims data, identifies patterns, and predicts risks, enabling more precise allocation of reserves while reducing errors and administrative burdens.

The benefits of AI-based insurance solutions for claim reserve optimization:

- Real-Time Claims Estimation: AI and ML technology streamlines the process of analyzing claims data, saving significant time that is typically spent on data preparation. This enables insurers to estimate claims more efficiently and accurately.

- Early Fraud Detection: AI-powered solutions can identify fraudulent activities in insurance claims, reducing the need for manual effort and intensive claim processes. By detecting fraud early on, insurers can prevent delayed claims and improve the overall efficiency of claim processing.

- Enhanced Safety in Hazardous Locations: Leveraging AI in insurance helps assess damages in hazardous locations while minimizing safety risks for claims inspectors. This technology aids in identifying potential dangers and ensures that compensation claims are accurate and fair.

c) Claim fraud detection and prevention

AI plays a crucial role in the identification and prevention of fraudulent insurance claims, thereby enabling insurers to establish a streamlined and effective system for managing claims. By swiftly analyzing vast amounts of data, insurance AI algorithms can identify patterns and detect anomalies that deviate from these patterns.

AI in insurance is revolutionizing fraudulent claim detection and prevention through the following methods:

- Big fraud schemes: AI technology allows insurance companies to cross-reference and analyze data points from internal and external databases, simplifying the detection of fraudulent activities.

- Fraud patterns: AI integration in insurance streamlines fraud detection by identifying patterns. For example, when a claim for a stolen smartphone is filed, AI can quickly search databases for prior suspicious activity, raising a red flag for further investigation.

By leveraging AI, insurance companies can improve their ability to detect and prevent fraudulent claims, safeguarding the interests of policyholders and the industry as a whole.

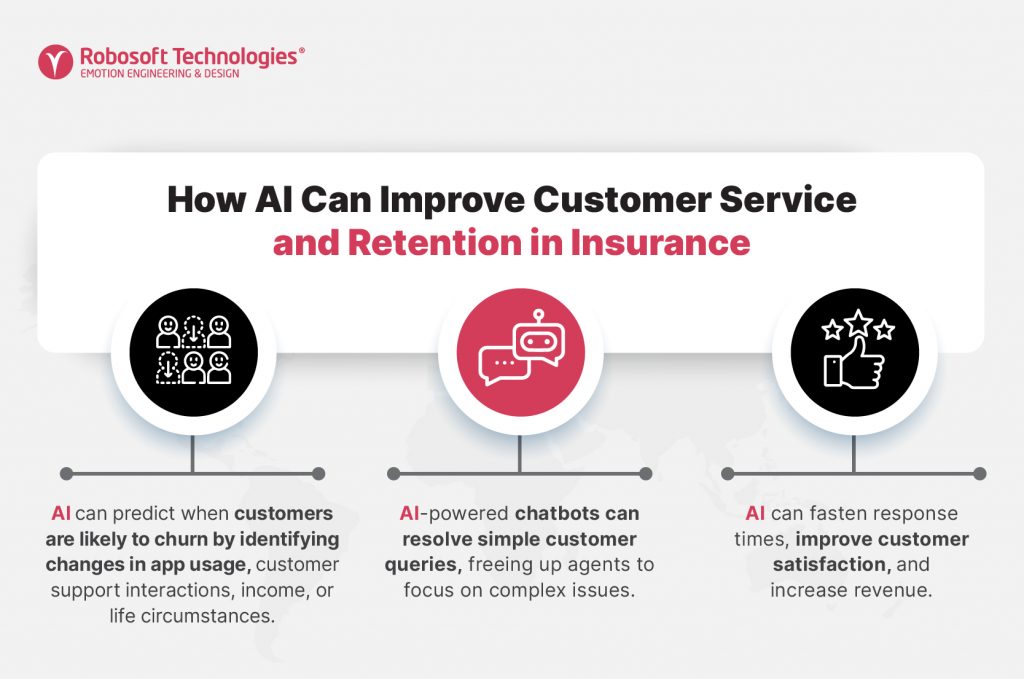

#2 Customer Service and Retention

a) Prediction of customer churn

The insurance industry has higher customer acquisition costs than many other sectors. Retaining existing customers proves to be a more cost-effective approach. Insurance companies are now leveraging AI-based solutions for churn prediction, enabling them to anticipate when customers are likely to churn and proactively implement measures to retain them.

Through the utilization of AI and Machine Learning algorithms, key indicators such as shifts in app usage and rewards program engagement, alterations in the frequency of customer support interactions, fluctuations in income, or changes in life circumstances can be identified. Furthermore, these algorithms can also forecast employee attrition by monitoring changes in work patterns and gauging employee satisfaction.

Consequently, this approach presents a mutually beneficial solution for insurance companies and their customers.

b) Deliver efficient customer support

Insurance companies are increasingly adopting chatbots to improve customer service by reducing response time and thus saving costs. These AI-powered solutions enhance team productivity by quickly resolving simple queries, allowing more focus on complex issues. Implementing virtual agents (chatbots) and personalized interactive videos enables 24/7, multi-channel customer service, positively impacting online experience, loyalty, brand reputation, and revenue generation.

AI in insurance enhances customer service in the following ways:

- Resolving FAQs: AI chatbots address common questions, reducing support tickets and costs. Learning Customer Behavior – AI learns patterns to offer personalized service options based on previous activities.

- Faster Response Times: AI speeds up support by providing agents with relevant information.

- Natural Language Understanding: AI analyzes customer interactions to understand and resolve issues promptly.

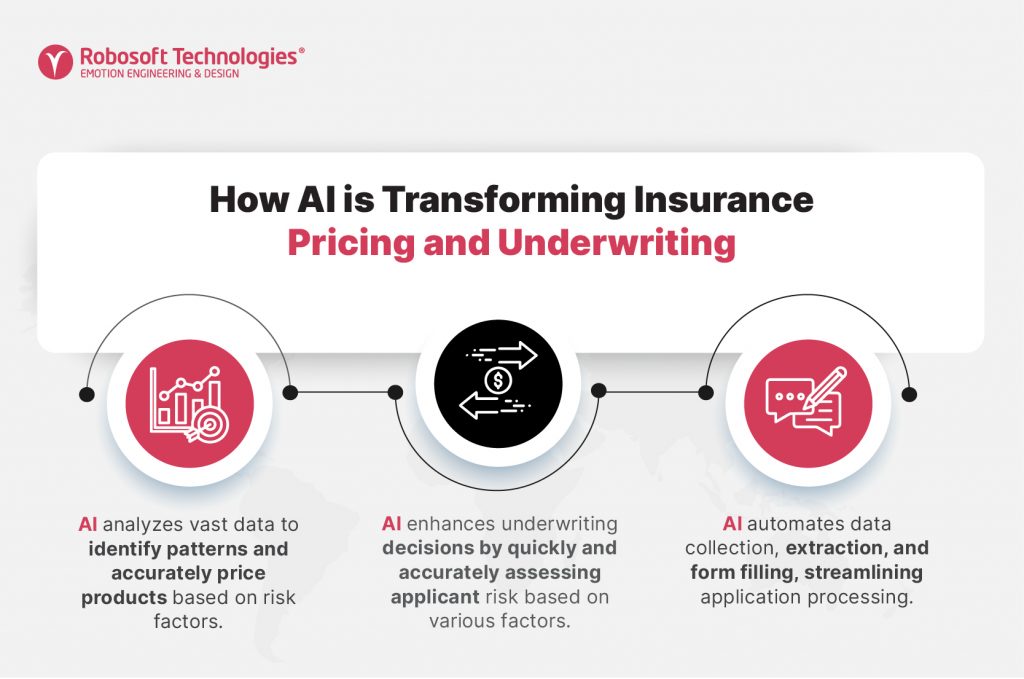

#3 Insurance Pricing and Underwriting

AI is transforming insurance by revolutionizing pricing and underwriting. It analyzes data patterns to price products accurately and identifies risk factors from claims data. AI also enhances underwriting decisions by swiftly analyzing applicant information. This potential for efficiency, accuracy, and profitability makes AI a game-changer in the insurance industry.

AI in insurance improves underwriting in the following ways:

- Pricing: AI analyzes vast data to identify patterns and accurately price products based on risk factors.

- Underwriting: AI enhances underwriting decisions by quickly and accurately assessing applicant risk based on various factors.

- Efficient Application Processing: AI automates data collection, extraction, and form filling, streamlining application processing.

- Better Risk Assessment: AI and ML models deepen understanding of customer risk profiles, enhancing risk assessment accuracy.

- Frictionless Customer Experience: AI shortens underwriting workflows, meeting real-time service expectations and improving customer satisfaction.

- Improved Profitability: AI-based automation improves underwriting profitability by reducing costs, customer churn, and retention expenses.

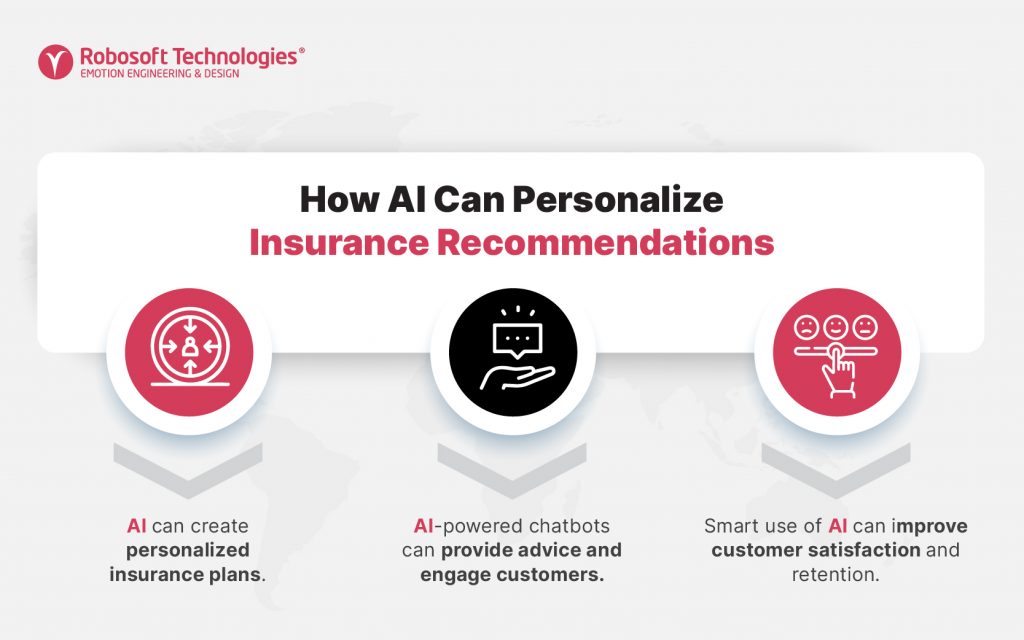

#4 Personalized Recommendations

Meeting the diverse needs, preferences, and lifestyles of customers is crucial in the insurance industry. Personalized policies, loyalty programs, and recommendations tailored to individual attributes and preferences have become essential.

Research shows that engaged and satisfied customers are 80% more likely to renew their policies. To meet this demand, insurers are utilizing advanced technologies like Machine Learning and AI to develop tools for creating personalized insurance plans based on customer data.

By implementing insurance chatbots and virtual assistants, insurers can provide machine-generated insurance advice, ensuring customers receive adequate coverage and a seamless experience. Additionally, chatbots and voice bots can engage customers with personalized offers, preventing customer churn to competitors and offering tailored recommendations and upselling opportunities.

AI Use Cases in Insurance

Insurance companies are increasingly using AI to improve their operations and provide better service to their customers. Here are some examples of insurance companies that have used AI:

- Lemonade: Lemonade is a New York-based insurance company that uses AI to process claims in minutes, while the traditional claims process can take weeks or even months.

- Hippo: Hippo is a home insurance company that uses AI to identify fraudulent claims with 99% accuracy.

State Farm: State Farm is an American insurance company that uses AI to provide customers with 24/7 support through its chatbot, AskJake. - AXA: AXA is a French insurance company that uses AI to develop new products tailored to the needs of individual customers.

A leading non-life insurance company in India offers a wide range of insurance products, including motor insurance. The company’s video chat-based claims survey solution uses the Robosoft Video Chat Solution to enable customers to have video chats with claims adjusters to discuss their claims. The solution also allows claims adjusters to record and capture images of vehicle damage. The solution has been a success for the company and has helped to reduce the time it takes to process claims.

As AI continues to evolve, we can expect to see even more insurance companies using AI to improve their operations and provide better service to their customers.

Wrapping Up

The advent of AI has the potential to revolutionize the insurance industry, bringing about unprecedented changes for insurers and their customers. With AI, insurers can offer their customers a more seamless user experience and potentially more affordable rates.

Moreover, AI enables insurance companies to optimize their processes, resulting in increased efficiency and cost savings. By leveraging AI technologies, insurers can make more accurate risk predictions, leading to safer policy decisions. As AI continues to evolve and be adopted by more companies, we can expect further advancements and improvements in the insurance landscape. Therefore, the future of insurance is indeed being shaped by the transformative power of AI, and this trend is only likely to continue in the years to come.