Over the years, financial institutions have evolved with and as a result of the current economic, political, and social forces at play. Legal and regulatory reforms matured, and the technology behind the banking world became more sophisticated. According to a recent study by Ernst & Young – “while the recent financial crisis and resulting regulatory reforms continue to play an important role in reshaping the structure and operating models of banks and markets more broadly, technology-driven innovation will lead to much broader, deeper and more rapid transformations in future years.”

Further a Fujitsu survey entitled “Transforming Britain Report” highlighted sentiments from over 2,000 individuals (including roughly 650 business leaders from various industries) that roughly 50% of finance industry leaders are convinced banks won’t be recognizable from their current format in 10 years.

As in most industries in 2018, digital transformation is forever altering the landscape of banking. While blockchain is certainly the most talked-about technology that experts have predicted will reshape this industry, other technologies such as wearables, machine learning and AI, and robo-advisors are creating a new age of digital banking for banks and clients alike.

As of July 2018, 3.2 billion people globally have access to the internet. Researchers estimate that over 50 billion devices will be connected to the internet by 2020.

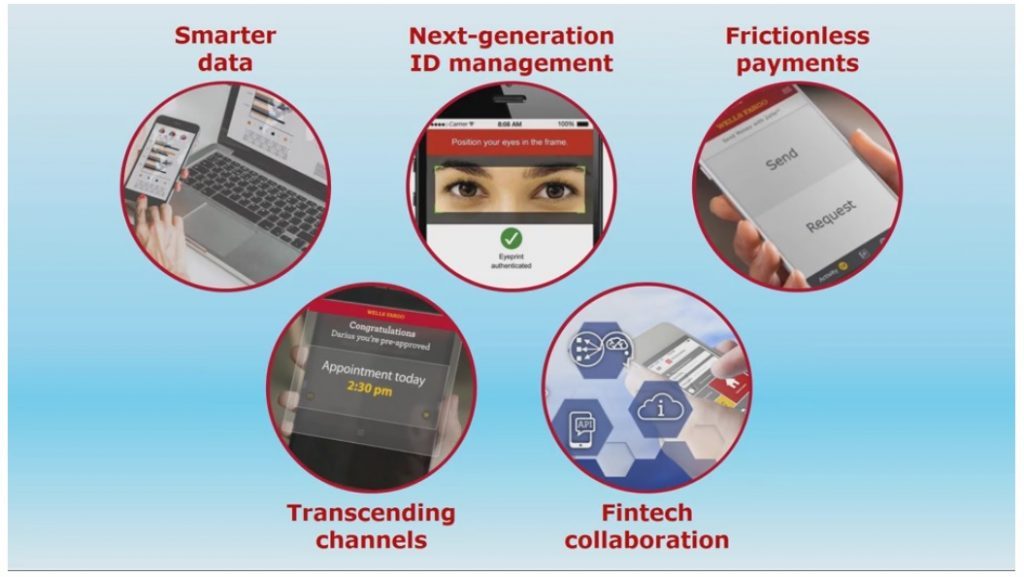

Disruption is occurring at every level in the banking industry, from faster, more transparent customer service to back-end operations and inventory management. From new technology to new competition to heightened customer expectations, incumbent banks have become increasingly vulnerable to outside pressures. Prudent banks are spearheading digital ecosystems for more nuanced customer engagement and forward-looking technology in order to maintain strong client relationships and retain their competitive advantage.

Overview

Below, we explore how innovative technologies (apart from blockchain) are leading to digital transformation in the banking industry, with customer-centric solutions front and centre.

- Artificial Intelligence & Machine Learning

- Chatbots, Robo-advisors, & Voice Assistants

- Big Data & Analytics

- Internet of Things & Wearables

While these technologies are in different stages of development and adoption, they have varying and increasing degrees of potential to drastically transform how clients bank in the next decade. And with nearly 75% of consumers banking digitally, banks and financial institutions that haven’t adopted future-proofing technology strategies will find themselves obsolete.

Artificial Intelligence & Machine Learning

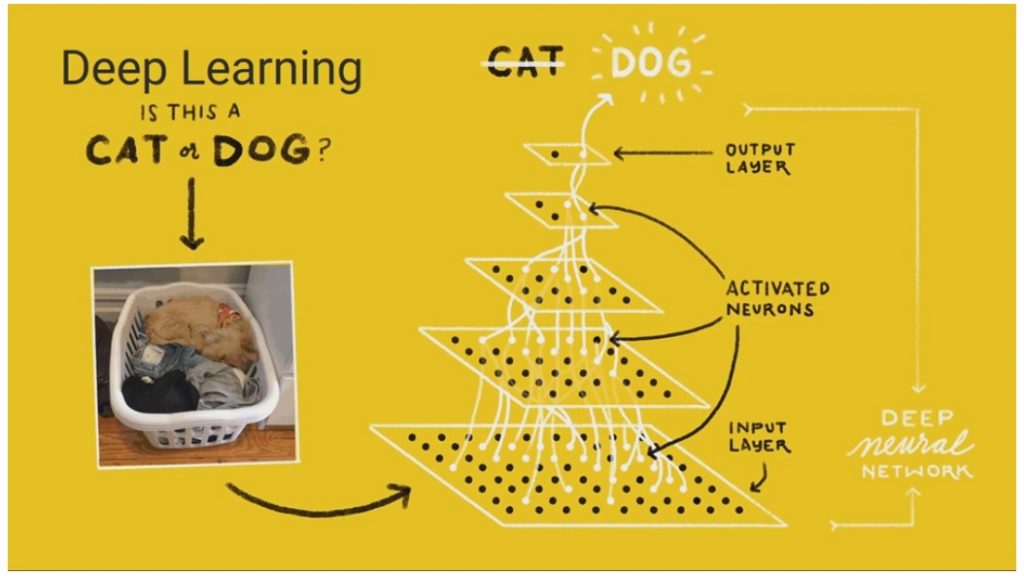

Artificial Intelligence (AI) is defined as technology that learns as it researches and analyzes good data. It’s currently being used in the financial and banking industries in areas such as risk and compliance management to better predict and make decisions “beyond human scale”.

Machine Learning (ML) “automates analytical model building, enabling computers to learn without explicit programming when exposed to new data.” ML technology can occur both supervised (using historical data) and unsupervised (finding patterns) to predict future events and to detect fraud, respectively.

Several notable financial institutions have implemented AI and ML technology to ensure they can streamline menial tasks and allow more time to help clients with a more bespoke approach to their finances.

For example, the AI assistant from RBC, NOMI (“know-me”), has over 3.6 million customers and facilitated a two-thirds increase in mobile app usage and a 20% increase in new savings accounts being opened in only eight months after launch. Discount Bank’s DiDi (“Discount Digital”) offers personalized advice and financial management services, along with suggestions to automate transfers of funds to maximize savings goals and to reduce costly transactions in the future (ie: unnecessary banking fees).

FINRA is testing new ML software to detect typical patterns and use a wide net to catch situations that merit a flag for suspicious activity before humans do, by learning which repeated scenarios have raised flags in the past due to legal action.

While many large banks recognize that banking is not a one-size-fits-all approach, using AI to automate tasks and ML to provide more accurate, up-to-date information about clients helps bank staff create a more nuanced approach to their clients’ financial questions and issues.

Robo-advisors, Chatbots & Voice Assistants

Nearly 4 billion people use at least one messaging app, such as Facebook Messenger or Whatsapp to communicate with their peers and businesses around the world. Banks can reach clients with chatbots or robo-advisors to engage clients ranging from Millennials to Boomers through platforms “like Facebook Messenger and Whatsapp without extending business logic.”

With technology in voice assistance and natural language processing (NLP) advancing at a rapid pace, banks can harness chatbots in messaging apps to deliver advice, assessments, and customer support in an environment rich with a user base that is already familiar with the technology.

Today’s technology can analyze and determine the nuances of our voices to grant us access to our bank accounts, and several large financial institutions have deployed speech analytics software to enhance sales personalizations, customer service processes, and regulatory compliance requirements.

Credit Suisse has offered individual clients and legal entities a completely digital onboarding experience since 2017, providing a convenient method to attain new clients. Since the launch of this Online Relationship Onboarding program (or ORO, for short), Credit Suisse has seen a 65% reduction in the number of data entry errors that typically plague bank employees during a conventional onboarding process.

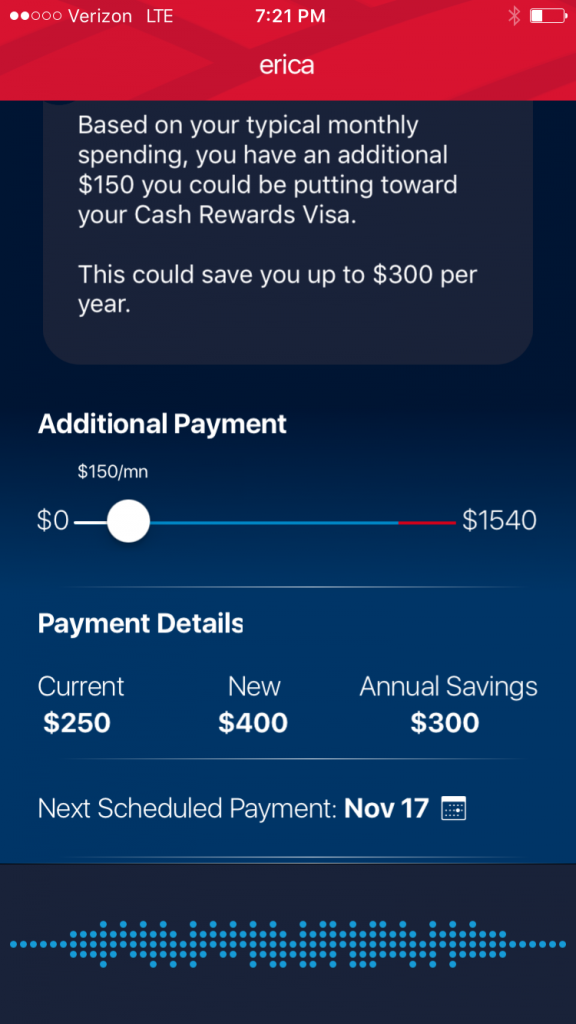

Erica, the chatbot behind the Bank of America, helps customers through a variety of tasks, from showing the progress for financial milestones to helping track unnecessary payments and fees that could reduce the drain of their resources. The typical use case shared by Bank of America shows Erica sending a predictive text that outlines how a client might reduce their annual fees while also reducing their credit card balance: “Based on your typical monthly spending, you have an additional $150 you can be putting towards your cash rewards Visa. This can save you up to $300 per year,” she writes.

Image source

Technology like Erica offers clients much greater control over their finances and the sense of security knowing their bank is working diligently to anticipate and meet their needs.

While banking can be frustrating for many people, if technology is used intuitively, banks can leverage chatbots and robo-advisors to reduce errors and simplify signups and transactions for clients, freeing up valuable time and solidifying client relationships.

Big Data & Analytics

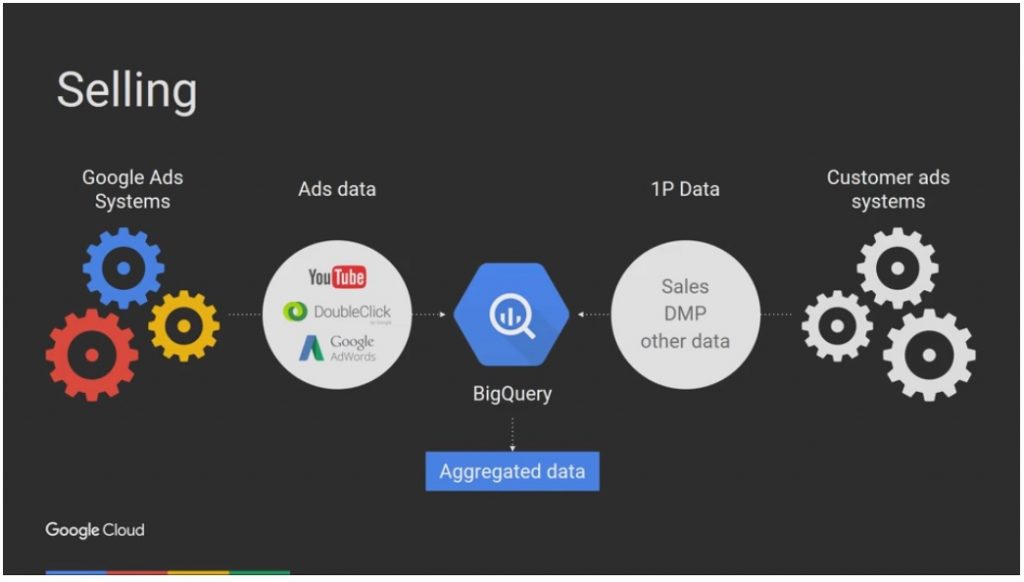

Big data enables “the sourcing, aggregation and analysis of large amounts of data,” while analytics is “the discovery, interpretation and communication of meaningful patterns within data,” giving banks the power to predict future trends and evolving client needs, and subsequently offer actionable items for areas such as risk management and personal goal tracking.

Based on research from IDC, over $20 billion was invested into Big Data in banking in 2016 alone; the amount of data created each second is predicted to increase 700% by 2020, with banking and financial data dominating that increase.

Today’s advanced data analytics tools harness valuable data related to customer spending habits, personal goals, and general financial activity. Digital strategies should not be focused on new UI, but rather on transforming how quickly and efficiently customers can be reached. Advanced Big Data and Analytics tools offer banks access to new customers and greater visibility into their behavior, to be able to predict future financial patterns and to suggest suitable products for their customers.

Programs such as GDPR (General Data Protection Regulation) are at present viewed rather negatively by Tier One and Tier Two banks because they are seen as restrictive and a barrier to be overcome in order to do business effectively. However, banks can and should see these regulations as a way to become a leader in the governance of their clients’ data and privacy.

GDPR compliance offers banks an opportunity to reform their data collection and storage systems, not only giving their teams a better understanding of the flow of data throughout the organization, but also instilling confidence in clients that their data is secure. Build your bank’s ecosystem and infrastructure around the needs of your clients, using what data they share with you to create a nuanced, tailored solution to their needs.

Internet of Things & Wearables

The Internet of Things (IoT) is a network of physical devices connected to one another through the Internet in order to collect, send, and share data across the web with people and other devices. IoT offers greater connectivity to the existing data being shared by clients and other industries, and creates more opportunities to use that information to improve and enhance their internal processes and external exchanges with clients and third-party vendors.

Also referred to as the Internet of Everything, IoT is the intersection of the physical and virtual worlds to allow people and technology work more seamlessly. While IoT is still in its infancy within banking, early adopters will focus on applying it to digital product enhancements and harnessing its capabilities for financial services to other industries (such as mobile payments).

Much like IoT, wearables have become commonplace in daily activities, supporting users as they search, process, and utilize data when and where they need it. The best example of wearable technology is smartwatches that connect to a user’s mobile phone, transmitting data in an easy-to-digest format. Through banking apps, clients can access their account data using a series of voice commands or simple clicks.

Australian bank Consumer Bank launched its own version of wearable tech PayWear through the Westpac Group in 2017, allowing users to arrange payments, alerts, and other account options hands-free and on the go. PayWear was developed after Apple banned a keyboard function which would have allowed users to pay through Facebook Messenger or Whatsapp. bPay in the UK allows users to pay for anything under 30£ using something as simple as a fob or a sticker at select retailers.

Summary

Banking leaders that prioritize a digital-first strategy to carry them into the next decade with a clear path to customer-centric solutions understand that embracing technology won’t make banks redundant. Implementing the right technology offers security, more personal interactions with clients, and more intelligence for issues that arise. With financial markets in turmoil as we near the end of 2018 and consumers losing confidence in large financial institutions, banks need to prioritize client relations now more than ever…and technology can help tremendously.

“The whole notion of customer experience for banks is so, so critical right now,” said Daniel Latimore, Senior Vice President of Celent. “They have challenges like security and being bulletproof — but consumers don’t care about all the constraints. They just know they can get great experiences elsewhere and they want it from their bank too.”