What lies ahead in the post COVID19 era?

It is believed that the world of payments has fundamentally transformed over the last few years and is set to change even further. The industry is witnessing an accelerated growth in electronic payments with the advent of new and disruptive market players. As per the World Payments Report 2019, growth of non-cash payments is set to skyrocket globally, with digital payments reaching at more than $1 trillion transactions by 2022. Additionally, the on-going Covid19 crisis has fueled the need to opt for non-cash payments. Digital payments once a convenience, is now seen as a necessity for consumers across the globe.

Even before the coronavirus crisis, the global digital payments industry had been reshaped by technology and redefined by regulation, with the emergence of new economic powers, and changes in the global currency landscape. Most importantly, payments refocused from a commoditized proposition to a strategic, value-adding solution; one that is offered with greater focus on the broader commercial and transactional context within which a payment (or a transfer of value) takes place.

Indeed, the world of payments in 2020 will look very unlike as it was, as market transformation had already begun. The competitive landscape will be redefined by the entry of non-traditional providers, the evolution of new solutions provided by financial institutions, and the development of strategic alliances that cross traditional sectoral boundaries. Besides transformation, there will be major convergence around products and solutions linked to payments; around technology platforms that will be driven by innovation in nature and reach.

In this article, we will take a closer look at some of key trends that will change the global payments outlook beyond 2020 and how digital payments will create a future in itself. But, before we go through the major trends, let us identify some of the active digital payment methods already available to consumers:

Digital payment methods for seamless consumer experience

Convenience is the key for extensive usage of banking cards

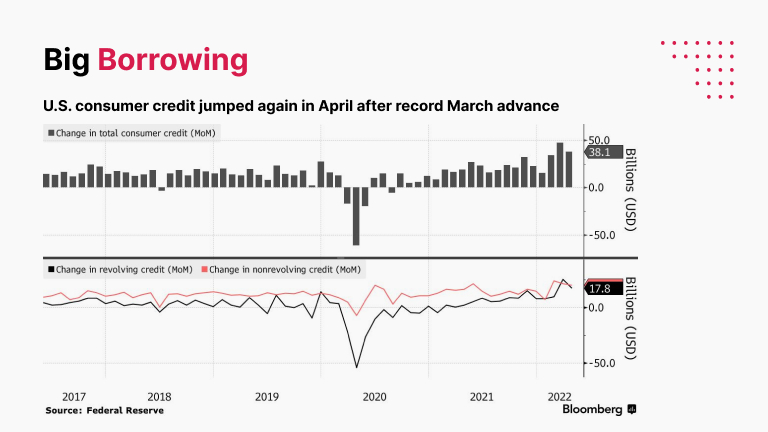

Banking cards such as Mastercard, VISA, Credit and Debit cards are the most widely used method for online payments. Consumers conveniently pay using their debit or credit card on online platforms as well as in-store. As per a recent PWC report, transactions happening through cards had seen an upward trend as there were concerns around transmission of virus through physical currency boosting online transactions. While in the US, credit card usage has made an upsurge to a level that many finance firms also opt to develop mobile applications for their customers to manage their credit card transactions and other details.

Financial inclusion for underbanked through USSD

USSD is the most innovative payment service that works on an Unstructured Supplementary Service Data (USSD) channel. It is introduced specifically for the underbanked who does not have the convenience to use the mobile banking or internet banking functionality. USSD only requires to dial *99# through your mobile device and enter the details asked to initiate banking services, he/she will be able to check their bank balance or get to know about their bank account statement.

Powering multiple banks through single application

With recent real-time payment systems available like UPI, customers can easily send and receive money or make online payments. UPI or virtual payment address has been one of the most widely used digital payments methods. It is a system that powers multiple bank accounts into a single mobile application, merging several banking features, seamless fund routing & merchant payments into one hood.

UPI will only require a Virtual Payment Address (VPA) to make the payment successful. The PWC report states, post Covid19 scenario has resulted in a surge of UPI transactions for essential services including the QR Code based payments.

International funds transfer via Fedwire and CHIPS

The US payment clearing and settlement process consists of 3 different systems: Fedwire, CHIPS (Clearing House Interbank Payment System), and ACH (Automated Clearing House). Both CHIPS and Fedwire are considered for wire transfers and for large value domestic and international USD payments. While ACH is considered for low value but higher volume domestic payments.

CHIPS is the largest private-sector, US based, money transfer system. It is a competitor as well as a customer of the Fedwire service of the Federal Reserve as it allows banks to make transfers of international payments efficiently, without the need for bank checks. When it comes to large transactions, CHIPS is the main clearing house in the United States. By using electronic bookkeeping entries, it settles, on an average, more than $1 trillion USD every day. An average transaction using CHIPS is over $3,000,000.

Many people prefer CHIPS to the Fedwire service because it’s more affordable, even though it isn’t as fast. Transfers could be made internationally or domestically, but usually of large sums of money.

Introducing FedNow for faster P2P payments

In the U.S., the Federal Reserve believes that the U.S. payment system is in the midst of its own modernization transformation. They have urged US banks to look at what is happening around the world, including evolving consumer payment preferences, and begin to create a real-time ecosystem that has the ubiquity, safety and convenience of legacy payments networks. Last year around this time, the Board of Governors of the Federal Reserve System (Board) issued a notice and request on its determination that the Federal Reserve Banks (Reserve Banks) should develop a new interbank faster payments system named as “FedNow” service.

The Board expects FedNow to be an interbank real-time gross settlement (RTGS) service with integrated clearing functionality that can serve as the infrastructure upon which other parties could build faster payment solutions. FedNow would involve real-time payment-by-payment settlement of interbank obligations through debits and credits to banks’ accounts at the Reserve Banks. The service could be designed to support credit transfer use cases, including P2P payments, bill payments, and low-value B2B payments (the service initially would support payment values up to $25,000). The Reserve Banks’ has put forth the launch date of this new system in the year 2023 or 2024.

Mobile wallets enables us to carry cash in digital formats

Recently, with the advent of Paytm, Google Pay, Phone Pay, Amazon Pay etc, mobile wallets have gained more popularity as it has become a way to carry cash in digital format. It is a virtual wallet service that is available for usage once the application has been downloaded from the app store.

From cab drivers to businessmen, this payment method is used by all as they are easy and convenient. As mobile wallets let consumers recharge their mobile, DTH and data card, pay utility bills, compare and book flight tickets, hotel bookings, shop online, buy movie tickets, avail great offers, and send money to anyone via their contact list on smartphone. Various mobile wallet applications also provide cashback facilities and other discount coupons to consumers.

Internet banking or online banking has long been doing the rounds

Internet banking has been in the business for years and almost all the government as well as private banks provide internet banking facilities to its customers. Internet banking allows us to transfer funds, check account statements or open new accounts online. One can carry out all their banking transactions online by logging in with your username and password. Internet banking is usually used to make online fund transfers via NEFT, RTGS or IMPS and customers can avail all these facilities by logging in their website.

Remote transactions enabled by mobile banking

Mobile banking is also one of the most widely used digital payment methods stirred by higher usage of smartphone and tablet. It is also one of the easiest payment methods enabled by an application, provided by the banks or financial institutions. Nowadays, each and every bank provides its own mobile banking application which is available on all the operating systems like Android, Windows and iOS platforms.

To sum it up, all of the above payment methods were already in place for consumers even before the COVID19 hit. But now as the crisis has changed the industry and market dynamics dramatically, a recent Accenture report identifies how COVID-19 impacted the payments industry influencing payment providers’ present as well as future actions.

The report mentions these points:

- Payments markets affected badly due to COVID19

- Consumer spends have drastically slowed down

- Payment companies to re-think short term priorities

- Cash transactions have declined significantly

- Tokenized payments on the rise

- Conditions are highly favourable for frauds

- Embedded payment experience will be encouraged

- Payments experience that offers more control will be accepted by consumers and businesses

Hence, it is inevitable to say that the payments industry especially the payments providers will have to relook and redefine its strategies to come up with cutting-edge tech-focused payments methods. They will have to achieve the goal of digitization of payments which provides an easy, convenient, fast, and secure payments experience to consumers. To attain this, what are some of those digital payment trends that will make it big in the year 2020 and will require payments providers to consider as their offering. We will take a look at each one separately:

Digital payments trends to become trailblazers in 2020

Biometric authentication will emerge rapidly

Biometric authentication will be a fast moving trend that will rapidly emerge in this year. Biometric authentication is a verification method which involves biological and structural characteristics of a person. Fingerprint scans, facial recognition, heartbeat analysis, vein mapping, and iris recognition are some of the verification methods included in Biometric authentication.

With the rise in the problems of identity theft and fraud, biometric authentication can become a reliable and secure option for all the digital payments to take place going forward. As per Juniper research, mobile biometrics will be used to authenticate $2 trillion worth of in-store and remote payments annually by 2023, driven by the rise of WebAuthn standards adoption.

Biometric authentication is a unique and important digital payments trend as it incorporates and provides accuracy, efficiency, and security under a single package.

EMV technology leads a shift from cards to codes

Earlier, we had bank accounts that were simply recognized by random combinations of unique digits present on card. However, the EMV technology (Europay, Mastercard, Visa) has been picked up gradually and introduced in the US markets with more computerized and secured mechanism for payment.

EMV uses a smart chip instead of a magnetic stripe to hold the data that is required to process a transaction. The technology is known for using codes that vary each time a transaction takes place. A smart chip has the power of a small computer, allowing it to run applications that can perform advanced authentication.

The chip’s processing power, along with its capacity to store more information means that EMV cards can hold encrypted data, perform cryptography, and generate a unique code assigned to each transaction. Hence, it becomes virtually impossible to make a counterfeit EMV card because the chip is tough to tamper or clone with.

Increasing demand for Mobile Point of Sale

Mobile-point-of-sale (mPOS) is a revolutionary technology for all the merchants having their bricks-and-mortar structures and in-store cash payments. The mPOS gives them the freedom to operate in areas where they can find more customers and move remotely with their products or services. Small and medium business owners and retailers can move to various places like concerts, trade shows, events where they can seamlessly accept payments from their customers.

Additionally, the mPOS technology also enables in-store payments more streamlined and flexible by replacing the central checkout areas with sales staff equipped with mPOS devices. It is surely going to be one of the most widely used digital payment technologies as it enables contactless payments and speeds up the checkout process.

Conversational UI to make your payments

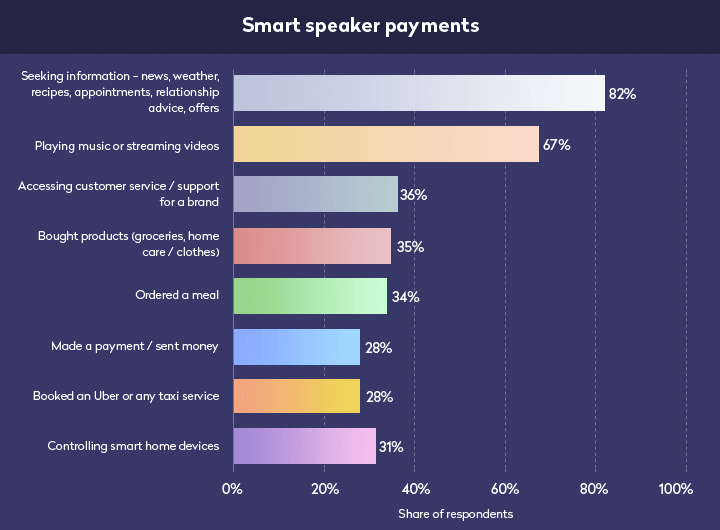

Nowadays, home assistants, conversational devices or smart speakers are widely used by customers as it allows users to give voice commands to a speaker and receive a voice response in return. The user can give voice commands for various things such as getting weather updates, traffic updates, ordering from Zomato or booking a cab from Uber.

We are all aware of Amazon Alexa that came in the year 2014, then joined Google Home and Apple followed the race in the year 2016 and 2017 respectively.

The speakers which evolved from the smart assistants were primitive in nature as they were restricted to just phone devices. However, with the growth of home automation, the smart speakers also started to go mainstream. According to Statista, 35% of users use smart speakers for buying essentials like home care, groceries, and clothing.

Image source

Interestingly around 28% of the people used smart speakers for sending money or making direct payments. This is not a huge portion as fewer people choose to make payments over smart speakers due to the security reasons.

However, the future looks promising for smart speaker payments as a Business Insider report suggests that the smart speakers usage will rapidly grow from 18.4 million users in 2017 to a whopping 77.9 million users by 2022.

Banks will move towards AI and machine learning powered payments

Whenever it comes to payments, security is the most crucial element. People will always prefer using a payment method that has a high security. That’s the reason why payment technologies won’t be able to go forward without developing a top-grade security. Banks receive a lot of customer details and payments data each day and to detect all the possible threats within seconds, banks need to empower themselves with AI and ML.

The best example of this is when you receive a text from your bank asking if the transaction was done by you or fraudulent. This cautionary message helps the user and bank to prevent a major mishap. This is an automated message sent by a machine learning software to understand the authenticity of the transaction you took place.

Contactless payments using the NFC technology

Contactless payments are another payment method which will see a high growth trend in the near future. As per its name, contactless payments allow the customers to simply wave their smartphone across any QR code reader. This particular digital payment method of waving has proven to be way faster and convenient than making card payments or cash transactions. Especially now during the COVID19 phase, contactless payments will be the way to go for customers where maintaining hygiene standards and social distancing becomes a norm.

Contactless payments has also proven to be a more secure technology as it transfers the encrypted data to the point-of-sale device instantaneously. Many mobile wallet providers like Paytm, Google Pay, Apple Pay etc have their contactless payment system in their respective applications.

Contactless payments are possible with the NFC (near-field communication) technology. That’s the reason why they are also termed as NFC payments. The benefit of the contactless payments has been realized by retailers globally and the market size for contactless payments is expected to grow from USD 10.3 billion in 2020 to USD 18 billion by 2025, at a CAGR of 11.7%, states a recent report by Business Wire.

Cryptocurrencies and blockchain based digital payments

Apart from the above list, other digital payment methods will also emerge as a result of the vast technological possibilities. For example, digital cryptocurrencies will be viewed as a major trend among Gen Y who are more profound to use new-age technologies. Cryptocurrencies will revolutionize the whole ecosystem of investments and monetary financing due to its instant and borderless nature of transactions. It was in 2019 that JP Morgan Chase, the largest bank in the US announced to create and successfully test a digital coin representing a fiat currency. The JPM Coin is based on blockchain-based technology enabling instant transfer of payments between institutional clients.

Traditional financial institutions and banks need to act swiftly to technological developments

In an industry traditionally served by banks, these new and innovative non-bank payment providers are entering the market and rapidly gaining ground. Technological development could easily accelerate to a tipping point if banks do not act swiftly and decisively, positioning themselves to offer attractive, value added propositions to both individual and corporate customers.

In fact, a significant threat is posed by large technology and social media companies, for example Facebook introducing Libra to make crypto-based payments. If these companies can leverage, even monetise, their considerable customer reach by presenting attractive, straightforward and secure payment propositions alongside their other non-payment offerings, they could succeed in disintermediating banks, particularly in growing segments of the global payments business.

It is also of particular relevance as a young, ‘tech-savvy’ generation starts to take on leadership roles in global commerce. The new generation of leaders, all very familiar with the world of social media and e-commerce, will expect to run their businesses using 21st century tools in the post COVID19 age.