In 2021, online learning platform Coursera reported 20 million new learners in the year, equal to the total growth of the three years prior. The COVID-19 pandemic triggered an exponential jump in the already upward trajectory of online learning. Work from home, virtual classrooms, and time to pursue learning new skills saw the US record the highest growth in online learning with more than 17 million registered learners followed by India, Mexico, Brazil, and China.

Amid the devastation caused by the pandemic, governments, teachers, students and corporates benefited by accelerating digitalization efforts. For sure, today’s generation of digitally native learners lapped up this transition by educators. And although initially resistant, teachers discovered digital tools to be welcome assistants while managing schedules, keeping parents included, and doling out and marking assignments. The forced adoption of digital technologies accompanied by wider access to smartphones, made online learning accessible and affordable to larger masses globally. The shift to remote working also saw more professionals sign up on digital learning platforms to upskill and keep pace with the evolving demands of the workplace.

With the global EdTech and Smart Classroom market size expected to reach US$ 259.07 billion by 2028, the future outlook for eLearning platforms and EdTech is bright. Touted to be the mainstay of education in the future, smart classrooms will rely on a wide range of teaching tools and technologies to assist the learning experience end to end. Companies, on their part, already heavily invest their learning budgets in online resources for their workforces. A lot depends, however, on how much EdTech companies invest in the right set of technologies that fulfil the expectations of educators and learners. Their solutions must help the teaching community reduce the burden of administration and deliver affordable, quality education.

The top use cases of emerging technologies that will redefine education and the learning journey include:

Modern learning is student centric. It’s about each student getting to choose what and how to learn, anytime/anywhere, at their own pace, receiving personalized feedback, and accessing tailored recommendations based on their interests, capabilities etc. With the education sector finally on board with digitalization, EdTech offers a delightful range of possibilities to make learning experiences student-centric.

Surgent CPA Review, for example, is an AI-driven, adaptive learning exam prep course. Its proprietary algorithm evaluates performance on questions, student learning styles, exam date available study hours etc. to produce tailor-made study plans. Prodigy is an educational math game that’s becoming popular globally because it can customize content that allows for different learning styles to address specific areas that pose learning difficulties.

Edtech as a teaching assistant

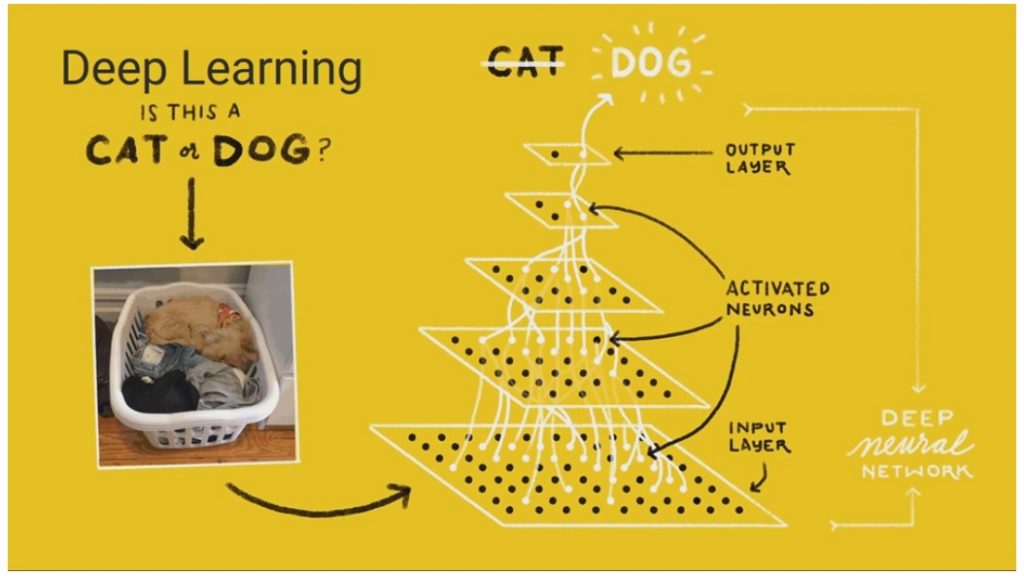

Technology that enables adaptive teaching and learning experiences plays a critical role as it can deliver personalized, updated content that is focused on the unique needs and abilities of each learner. It can also assist teachers across all levels of education. AI supported by machine learning can be used to automate daily administrative tasks like grading/assessments, plagiarism checks, report generation thus freeing up time for teachers and trainers to focus on improving core aspects of their course content and teaching methods . For instance, LEAD’s app for teachers comes with customized curriculum, consistent lesson plans across all partner schools, and a handy AI-driven system automatically generating assignment status updates and assessment reports.

Georgia State uses Jill Watson, a human-like yet affordable AI assistant to respond to student queries round-the-clock. An elementary school in New Jersey uses an AI-based teaching assistant to help teachers figure out problematic areas of learning mathematics and fine-tune learning methods for each young learner.

Learning companions to improve the inclusiveness of education

Assistive technology is increasing in acceptance as educators are able to extend the learning experience to students who are unable to attend regular classroom sessions. Those with special needs require simpler, easy access to educational content and personalized monitoring because of certain developmental challenges. For example, robots are helping preschoolers with autism practice non-verbal communications skills. The biggest advantage offered by these robots is that they can engage each student with the kind of individual attention and assistance required to help ease their learning journey.

Research is also being conducted to use Artificial Intelligence (AI) for improving learning for those with visual and auditory challenges. For example, the National Technical Institute for the Deaf, housed at the Rochester Institute of Technology, has developed an app that turns speech into text to help deaf/hearing impaired persons interact more easily. This was in response to the communication barriers that came up for persons with hearing difficulties when face masks became compulsory during the pandemic.

[su_youtube url=”https://youtu.be/QuKIWUEd_w4″]

ASL TigerChat explained

Another use case of AI that can be a game changer in special education is detecting patterns in large amounts of data and applying these insights to identify and define certain disabilities like dyslexia with greater accuracy.

New immersive experiences shaped by technology

Research suggests that learners retain knowledge better when they are taught using multiple modalities and delivery methods. Both formats are likely to coexist in the future.

With video becoming a popular means of consuming content, digital devices and broadcast technologies finally have an opportunity to converge. OTT platforms and 5G connectivity in combination can deliver higher quality video at reliable speeds. Through the possibilities unlocked by live streaming in 4K and 360-degree videos, learners will be able to consume educational content of their choice at an enhanced level of immersiveness and engagement in multiple formats and modes.

Augmented Reality (AR) can help medical interns fully immerse themselves in training and practice, via virtualization, of a complex surgical procedure without putting any lives at risk or incurring huge expenses in the real world. NASA teaches budding astronauts how to take a walk on Mars employing visuals generated through AR. The Metaverse too will enable close to real-life experiences, a safe way to simulate learning experiences until a desired outcome has been achieved. It provides another dimension to educational storytelling and gamification to make learning more fun and engaging. For example, Arizona State University and Dreamscape Immersive, a VR entertainment and technology company have collaborated to create virtual zoology labs for an explorative learning approach inspired by the metaverse.

Gamifying education

As learners of every age are becoming more digitally savvy, gamification ensures engagement in a highly personal and interactive manner. Kindergarten can become more enjoyable with interactive games catering to young learners. Like Pearson’s interactive education app, which is brimming with images, videos, and interactive games at varying levels, difficulties, and types, to offer fully immersive learning, individualized experiences for children – each gets their own avatar and personalized learning journey. At the same time, teachers, and parents can track the child’s progress easily.

Traditional learning methods can be gamified and infused with elements of fun and healthy competition through interactive quizzes, dynamic leader boards, reward systems, badges to acknowledge and motivate learners. For example, Tinycards has gamified the flash card learning technique and made it more enjoyable. As the learner advances through the cards, their progress is tracked and earns them brownie points for every milestone achieved.

We are rapidly entering a future where education will find its place in a hybrid environment – the offline and online formats will coexist and support each other by bringing the best of their respective worlds. Rather than being seen as a makeshift alternative to physical/classroom learning, EdTech can potentially become the enabler of a robust and resilient system of education, acting as a multiplier to the current in-campus models. With the ability to extend the reach of education across geographies, reduce the burden on teachers, and include those sections who earlier did not have access to learning, the convergence of education and EdTech will see a new era emerge.