Across the age spectrum, more people are opting or are at least open to using financial apps for managing tasks ranging from daily budgeting, stock investments, banking services, payments, or insurance needs. In 2019, consumers accessed financial apps over a trillion times. China, India, Brazil, United States, and South Korea were the Top 5 nations in terms of total sessions in finance apps.

Consumers love finance apps

According to the 2020 Mobile Finance Apps Report by Liftoff and AppAnnie, the install-to-register rate of finance apps is a healthy 46.2% indicating the willingness of users to not just download such apps but engage with them too. The install-to-purchase rate dips to 19% pointing to a lot more work needed to encourage usage. Entrepreneurs and the start-up community are betting big on FinTech, as well. Many of the breakout apps of 2019 were in FinTech from digital banking (e.g. Nubank), payments (Google Pay), and loan disbursement (e.g. KreditBee) to all-in-one super apps like PhonePe.

Traditional banks, long dependent on brick and mortar retail-based banking are trying to keep pace with changing consumer behaviors and digital experiences. Data shows that growth in average MAU from 2018 to 2019 was higher for FinTech apps than for legacy banking apps.

Change is the only constant

Fact is, the mobile app revolution, and how it would affect businesses, was a disruption that many industries did not foresee. Consumer preference and user experience in one domain has had an impact on other domains too. For example, urban mobility apps such as Uber have raised expectations of user experience for all transactional consumer apps. In that context, legacy banks must compete long used to brick & mortar banking are trying keep pace with new-age digital banks and FinTech companies in terms of ease-of-use, design aesthetics and ‘cool quotient’.

According to UserTesting of UK, a company focused on testing as a service, consumers were drawn to FinTechs for 3 major reasons: In-demand products and services, trusted recommendations and ease of use.

Utility bill payments, peer-to-peer lending, bank transfers, and more were made possible by FinTech apps, many of which started as digital wallets or simple payment services. The social buzz and recommendations from friends helped these apps gain traction. Ease of use is another factor that works in their favor.

Traditional banking apps have acquired a reputation, rightly or wrongly of being difficult to use. According to research from US-based finance portal. PAYMNTS, 54.1% of consumers surveyed said they would use their banking apps “much more often” if only they had more control over the authentication requirements of their apps.

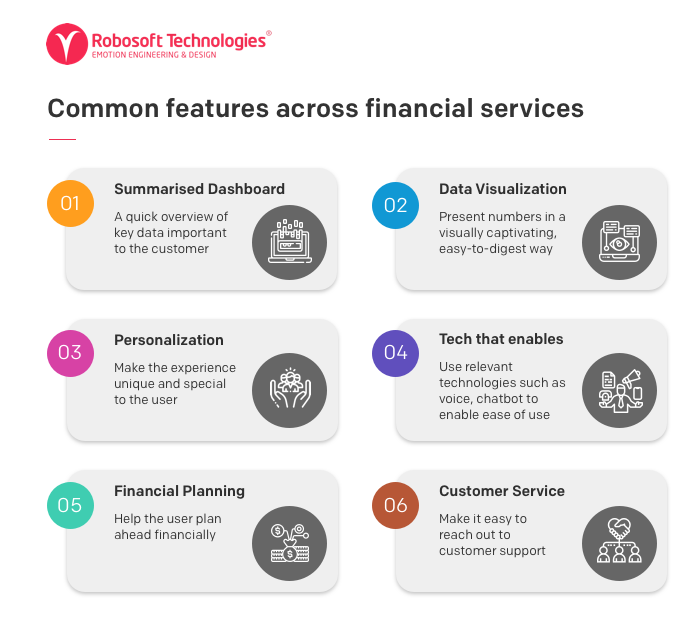

Across financial services, especially banks, one can observe these common features:

The FinTech and FinServe industries have two unique characteristics – the tasks consumers perform can be clubbed as ‘routine’ and ‘risky’. Product owners need to address these through a mix of technology and human instinct. In other words, Artificial Intelligence for the routine and Emotional Intelligence for the risky. Banks are already using AI technologies to automate routine banking tasks such as resetting passwords, checking account balances, transferring funds between accounts or paying monthly bills.

According to a Bain & Co report, consumers prefer digital channels, but they give higher Net Promoter Scores to companies that allow customers to speak with a representative to resolve a problem. Emotional intelligence has a role to play especially in providing a personal service experience during a stressful situation.

The post COVID world and financial services

Shifts in consumer behavior during uncertain times, such as the current global pandemic, accelerates the need for digital even more. According to a recent report “Credit Union Innovation Playbook” by PYMNTS, “the COVID-19 pandemic has led to a remarkable shift in the ways consumers want to bank — away from brick-and-mortar branches — making it much more crucial to improve digital banking services”.

It is not all black and white when it comes to consumer behavior towards financial services. The one factor which legacy brands enjoy, at least among the older consumers, is familiarity and trust. Longevity and the comfort factor of seeing physical branches dotted across the city subliminally can create positive brand equity – a feeling of ‘having been around’. In contrast, new-age digital banks may have to work harder to earn the trust of consumers. 51.1% of credit union members in the US cite “trust” and “risk of fraud” as the biggest barriers to trying new-age banks. According to EY, ‘responsible banking’ is more important than ever as consumers indicate their ‘future purchasing decisions will be impacted by banks actively supporting the community, being transparent in all they do, and ensuring they are doing good for society’. What does all this have to do with customer experience? The short answer is: everything. Here are the reasons why:

The business success of financial services and FinTech brands will increasingly depend on how they master the digital experience. Genuine, meaningful product differentiation is difficult in the highly regulated banking and finance industry. Enterprises are faced with two challenges: How to drive customer engagement with limited differentiation at the product level while increasing volume and velocity in customer acquisition? The answer is crafting a superior customer experience across all digital channels.

Retention is the new growth. Enterprises know that new customer acquisition comes at a high price. However, retaining and growing the lifetime value of an existing customer (active or inactive) is usually a cheaper way to increase revenue. Design Thinking methodologies come into play here. Implementing strategies to encourage loyalty (and therefore retention) can often be a more successful strategy than chasing new audiences. Citibank’s research found that 83% of consumers (that number goes up to 94% among Millennials) are more likely to participate in a loyalty program if they can access the program easily from their mobile phone.

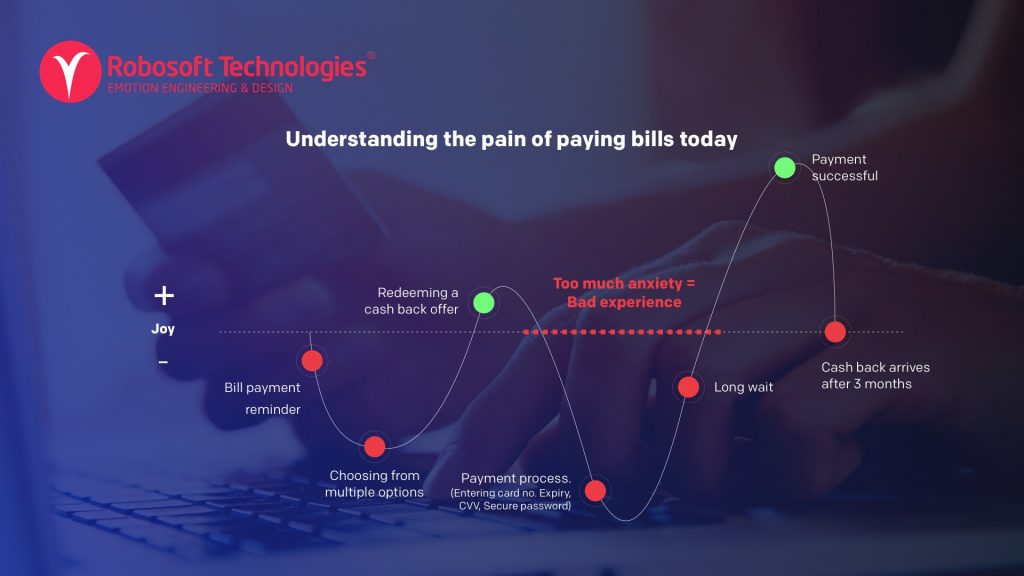

Now more than ever before, Empathy is the key. It is said that all our decisions in life are driven by the emotional brain, rather than the rational one. One would imagine it is even more so in the current times. At Robosoft we strive to understand the emotional triggers that act as barriers or motivators for actions when interacting with a digital product. When working on a FinTech product even a simple task of paying bills can evoke a diverse set of emotions.

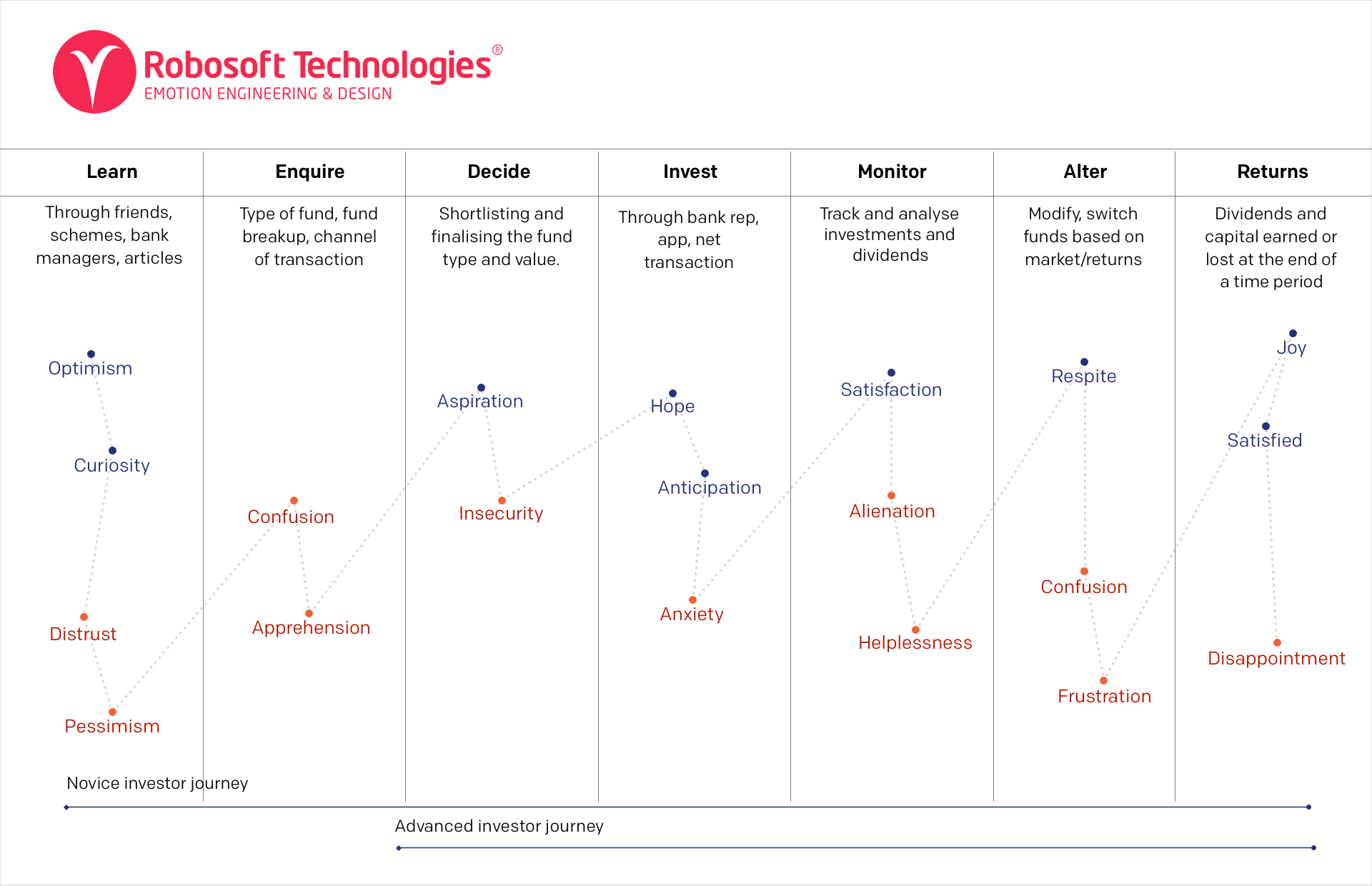

When working on a peer-to-peer lending product for the US market, we created an emotional map of a user which looked like this:

In a world that is increasingly adopting remote working, marketers may not be able to get a first-hand feeling of consumer motivations or behavior. In this context, getting the customer experience right throughout the consumer buying journey is a critical building block for brand loyalty. The key is in approaching product creation from the POV of building long-lasting customer relationships rather than regular transactions.

Human instinct and customer experience

The advertising legend Bill Bernbach once famously said in the context of marketing communications that ‘It took millions of years for man’s instincts to develop. It will take millions more for them to even vary. It is fashionable to talk about the changing man. A communicator must be concerned with unchanging man, with his obsessive drive to survive, to be admired, to succeed, to love, to take care of his own.” One can extrapolate this observation to digital experiences too as product owners should remember that basic human instincts will remain unchanged and are common across domains.

In the context of customer experience which can drive brand loyalty there are common principles applicable across categories – be it FinTech, OTT streaming services or food delivery apps. Some of the principles applicable to Financial Service are:

Focus on users over products: at a recent webinar, famous author Seth Godin spoke about enterprises designing more for their benefit than that of the users. As an example, he mentioned how easy it is to remember secure 6-digit numerical passcodes for apps. But when an enterprise introduced a seven-digit numerical passcode citing seemingly extra security they have not considered the friction it is likely to cause. It is an example of doing what matters to the enterprise first rather than the user.

Image source

Design Thinking workshops and user research tools help gain insights into consumer needs. Remember, users may never be able to explicitly convey or may not even know what they need. It takes expertise to interpret their pain points and derive meaningful insights that can be put into action.

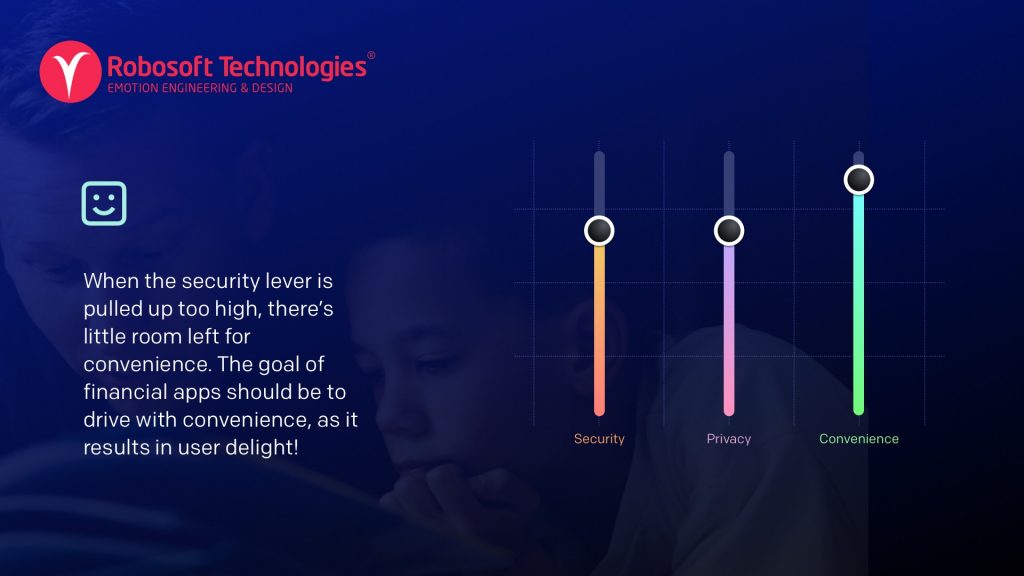

Think experience, then features: it is always tempting for product owners to pack in all the features that they think are ‘nice to have’ or likely give a competitive edge. But what is sacrificed is simplicity which could lead to a sub-optimal product experience. At Robosoft, our strategy & design teams work closely with product owners in enterprises to prioritize features that are important to the user at every stage of the product roadmap. We must also remember that we can’t have it all – we have to lose some to gain some. In a banking product, a balance needs to be sought between convenience and security.

Create an emotional connection: just as some movies, books, and songs evoke an emotional response in us, digital experiences have a potential too, in their own way. It doesn’t mean that using a bank’s mobile app should move one to tears (may happen if it is out of frustration!) just as some movies impact us emotionally. It is about creating a subtle feeling of accomplishment, productivity, safety or whatever is the relevant parameter for that category and product.

Key emotions that a Financial app should address:

Copywriting for UX is also an aspect which product owners need to pay attention.

‘UX copywriting, or user-experience copywriting, is the act of writing and structuring copy that moves digital users, like visitors and customers, toward accomplishing a goal in an intuitive way.’

There is both science and an art to copywriting which helps accomplish tasks better. Tone of voice and brand personality can also be reflected in the copy. The language used in say, a small-loan lending platform will vary from that of a high-end wealth management app.

Provide clear and precise directions: unlike say a trivia game where confusing instructions could lead to minor irritations and friction, financial services deal with a lot more ‘serious subject of money. Confusing navigation or language can lead to errors that can cost money to the user and erode trust in the brand.

Use analytics regularly to give users what they want: baking analytics into the product at the very beginning ensures that the right metrics are tracked for continuous product improvement and personalization.

Integrate technologies seamlessly: both consumer-facing experiences and backend processes can be made better by emerging technologies. Blockchain, robo-advisors, process automation, voice, and chatbots have roles to play in improving customer experience. In the post COVID world, video banking may see a surge as well as the need to invest in

Provide an intuitive & interactive experience: According to Interaction Design, ‘a user is able to understand and use a design immediately—that is, without consciously thinking about how to do it—we describe the design as “intuitive.” In the context of FinTech or FinServ apps the process could start right from the login method, conveying a sense of safety & privacy, using AI to monitor and predict transactions and more.

Be inclusive: user experience which works for all must be the mantra when crafting digital experiences. Websites and mobile apps that understand the needs of visually or hearing impaired and other eventualities must be considered. Uber’s consumer app, for example, notifies the commuter of any special needs the driver might have. Some food delivery brands think not only of the consumer but of the delivery executive too by urging the user to consider a tip. Food delivery apps like Zomato also highlight the profile of the delivery executive, giving a brief summary of his or her aspirations thus making the experience more humane and inclusive.

In sum, the unchanging human instincts we spoke about earlier, the‘obsessive drive to survive, to be admired, to succeed, to love, to take care of our own’ has come to the fore more than ever. The recent global pandemic has added new dimensions to customer experience in financial services. It is a great opportunity for enterprises to build a competitive business edge through great customer experience.