The use of automation to drive tangible business benefits has become a reality today, with nearly all organizations riding the wave of emerging cognitive technologies. The insurance industry is no exception and lies at the crossroads of digital disruption. Traditionally considered as a highly regulated and cautious sector, today it faces a radical shift due to the rising benefits of intelligent technologies.

According to a research, up to 25% of full-time positions in the insurance industry will either be consolidated or reduced in about a decade as a result of the prevalent digital disruption. With such headwinds in the industry, automation can be a game-changer strategy that can help insurance companies increase their profit margins and revolutionize customer experience.

To gain a competitive advantage, several insurers have already deployed an automation strategy in areas like New Business Processing, Claims Processing, & Finance, and more are following suit.

The insurance industry is now aggressively evaluating use cases for cognitive automation to boost efficiency in their current processes and thereby lower operational costs. They are embracing digital solutions to remain profitable amid stringent regulatory norms while handling complex portfolios in a low-interest rate environment.

The good news is that the insurance sector is quite digitally savvy and an early adopter of new technologies. Especially, the players in the short-term insurance sectors (auto, home, health, etc.). Prudent players who have been the disrupters have reaped the benefits of digitization and will continue to do so. According to a Mckinsey report, a large insurer could more than double profits over 5 years by digitizing existing business.

For digitally savvy insurers, most of the routine activities like quote, purchase, policy documents, renewal, claims (processing) etc. are completely digitized and requires least human intervention and offer higher customization. For example:

- LexisNexis Data Prefill solution helps in pre-populating insurance applications using only a few customer data points leading to reduce costs, and faster & and accurate quoting and underwriting process.

- Progressive Insurance, enables customers to “name their price” and choose elements of a policy that fit their budget—the level of deductibles.

- Some insurers offer pay-as-you-go auto insurance whereby drivers are charged by the mile.

- Ladder Insurance has partnered with Fidelity Security Life to offer life insurance without the use of agents directly to consumers online without charging any annual policy fees.

Opportunities in the Insurance Industry

The insurance market has become competitive and more robust over the last few years with the coming of the online P2P insurers, technology, and insuretech players.

Far-sighted insurers acknowledge the looming competition from companies such as Amazon, Google, and Facebook, which can leverage their users’ pool of data to provide customized insurance products. Amazon has already taken in a leap in this area by hiring insurance professionals and is set to transform the insurance market in several European countries.

While digitization in the insurance sector is set to create opportunities, it will also present newer challenges for traditional players. With low-interest rate scenarios, the revenue streams of legacy insurance companies are quickly drying up, as investing customers’ premiums in several financial institutions are not paying the same returns when compared to the last few years. In the future, these challenges may increase, owing to the fast pace of digitization and changing customer preferences.

For instance, in the auto insurance sector, traditional insurers might face challenges as the use of sensors and telematics makes driving less risky and liabilities from autonomous cars go to manufacturers. The McKinsey report suggests, in the future profits for traditional personal lines, auto insurance might fall by 40 percent or more from their peak.

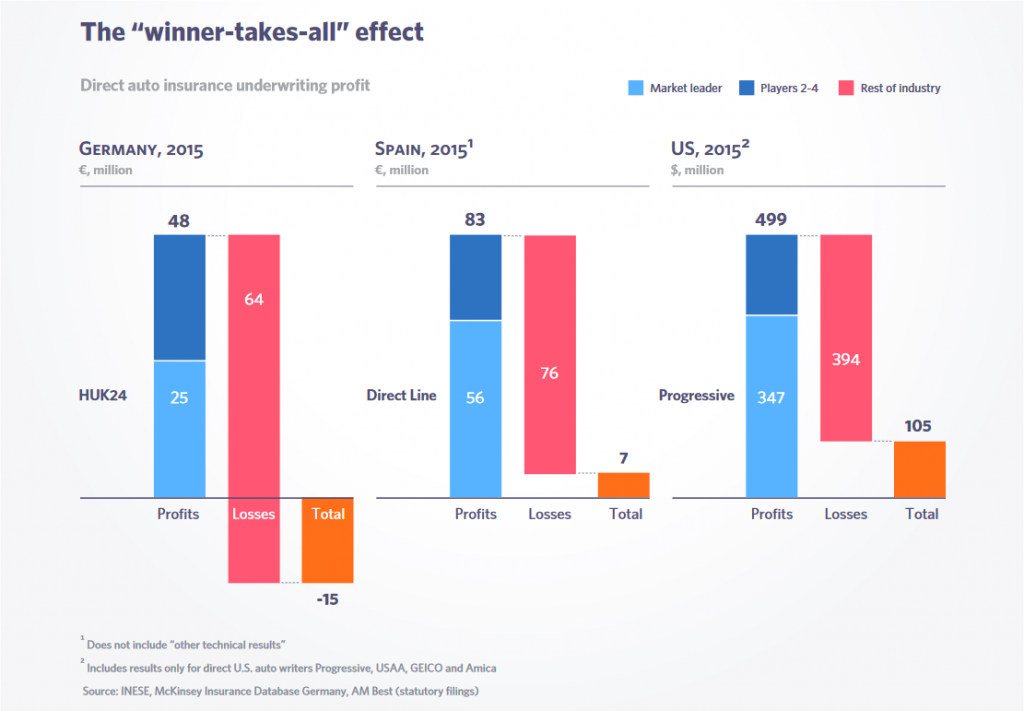

Insurers who have picked the pulse of the digital disruption and have innovated their products and value chain have seen growth. Some of these insurers are Progressive, Direct Line, Geico and more.

Image Source

It is only a matter of time when the likes of Facebook jump onto the bandwagon and provide stiff competition to the traditional mortar and brick insurance companies. Therefore, the need to adopt cognitive automation in the insurance industry has never been so pressing. And the call of the hour is to optimize operational costs, enhance accuracy, improve customer experience and get the most returns out of the allocated capital.

Challenges Faced By Insurance Companies In Adopting Automation

- Scattered Data

One of the biggest challenges in the insurance industry is that data is collected both electronically and on paper, making it extremely difficult for cognitive technologies to play their role efficiently. Dealing with mixed data format means that companies need to transfer this data into their machines, which can be costly and susceptible to human errors.

- Legacy Applications

Larger insurance organizations today use several legacy applications and point solutions. This leads to operational inefficiencies and excessive costs used by administrative functions.

- Manual Processes

The insurance companies are infested with several back-end processes which are usually labor-intensive, time-consuming and repetitive in nature such as underwriting, renewing premium and conducting compliance.

Use Cases of Intelligent Automation in the Insurance Industry

- Smart Data Reader

RPA (Robotic Process Automation) can be used to replace the manual paperwork involved during policy issue and claims processes. With the help of RPA, a smart media reader can be developed that can extract relevant information from the scanned documents. This solution has the potential to eliminate the manual extraction of data and its entry into the systems.

The RPA in insurance can use capabilities such as OCR, NLP, and machine learning to read, extract and validate data. This system can be seamlessly integrated with existing operations that deeply rely on extracting information from documents.

- Customer Service With Chatbots

Over the last few years, there has been a growing geographic and functional diversity of chatbots. Whether it is US-based Liberty Mutual Insurance’s “skills” for Alexa or “Nienke,” the “virtual host of Dutch insurer Nationale-Nederlanden or India’s HDFC Life’s chatbot collaboration with Haptik, all these chatbots have been deployed to enhance the customer support services.

Chatbots in the insurance industry can be used to analyze customer needs, modify product offerings and even solve the customer’s questions or provide them useful links.

- Automated Underwriting Solution

Creating a rule-based system for underwriting processes can increase efficiency and productivity. The automated system can identify if a submission or renewal can be handled by a machine or needs human intervention.

In the case of the first scenario, predictive models and machine learning algorithms can easily evaluate and provide a price for the submission. In the latter case, human intervention would be required in addition to the insights provided by the system.

- Smarter Process Analytics

One of the fundamentals to improve processes is by measuring several parameters including the number of requests and transactions processed. In the paper-intensive insurance industry, failing to measure outcomes can result in hefty losses in not just operational efficiency, but also in customer satisfaction.

With automation, organizations can measure not only the number of transactions but also have an audit trail that can be really beneficial for complying with regulatory norms. All this further enhances customer satisfaction, streamline applications, claims, and response of the customer service.

Quick Points to Remember

- Now that you know the use cases of automation in the insurance industry, let us look at some important points to remember before you decide to automate processes.

- Identify the areas to be automated. Trying to automate all complex processes is of no use if they do not provide any substantial savings.

- If you are new to automation, then try to begin with baby steps and then eventually expand. Starting small can help you clearly define objectives, the scope of work and the desired outcomes.

- Understand the extent of automation and avoid going overboard. Using cognitive automation in all areas may not lead to significant savings. Rather than automating all complex processes, insurers should focus on hybrid processes to achieve desired goals.

Future Of Automation In The Insurance Industry

Use of automation in the insurance industry has had a positive impact on customer experience and satisfaction. Several insurance companies have benefited from this, including a UK-based company that used automation to proactively identify customers inflicted by floods. The system then created a waiver plan for the next month’s credit and notified those people that their dues were waived.

With cognitive automation in the insurance sector becoming more and more sophisticated, it will provide a cost-effective way to meet rapidly changing regulatory requirements and help businesses concentrate on strategic long-term issues. Artificial intelligence enabled assistance can lower the documentation time by as much as 80%, thereby making insurance companies more profitable.

Today, companies need to rethink how they want to use human potential and how much they can trust a computer to handle their operations. By doing this, one thing becomes clear that human touch will become premium in the future, especially when robots will do most of the repetitive and mundane work.

Only the work involving a higher degree of human intelligence will not be automated. Positions in operations and administrative supports will likely be prone to layoffs or will be consolidated. However, the extent of the impact of automation will greatly depend upon the market, group, and the potential for automation.

The high-frequency products are digitized and automated to a larger extent. Whereas there could be challenges in converting the legacy policies into this new arena, it is not just technology challenge, but also the product has to evolve to meet current market conditions and tech/regulatory landscape. Insurers will have to re-look at digitization from a broader perspective which is inclusive of product innovation, services, and business models.

Looking Ahead

While the prospect of automation has been there in the insurance industry, the speed of its adoption has been increasing over the last 12 months. As disruptive technologies challenge the traditional ways of operations, organizations need to become “comfortable” with being “uncomfortable”.

The insurance sector can only optimize costs, enhance decision making & productivity, lower costs, optimize the customer experience and alleviate accuracy by embracing smarter technologies such as RPA, artificial intelligence, and machine learning.

As digital technologies continue to disrupt the insurance sector, the industry will have to move from its current – ‘reactive’ mode to ‘predict and prevent’ mode. And, this evolution will have to be at a faster pace than ever before as the stakeholders in the insurance value chain like the brokers, consumers, financial intermediaries, insurers, and suppliers become more adept at using advanced technologies.

Cognitive automation in the insurance sector can help businesses automate key operational processes and maximize returns amid stiff competition. As insurers evolve, the focus will be more towards adding value to key functions by working with intelligent solutions.

All these can only be achieved if organizations strike a balance between automation and human intervention. Businesses who fail to adopt smart solutions will eventually lose to new market entrants, while the ones who do too much too soon to get the early mover advantage will also be at risk.

The key is to have a balance by running test programs to see the capabilities of these technologies and align them to the business’ objectives and expectations. These are extremely interesting times for the insurance sector.