Have you ever wondered how you can work with offshore teams effectively? In this in-depth article, we cover 17 actionable ways to make it happen.

Working with virtual/ offshore development teams is as common in the technology space as having fries with your hamburger.

The top two reasons American companies outsource mobile app development are to reduce costs and improve service.

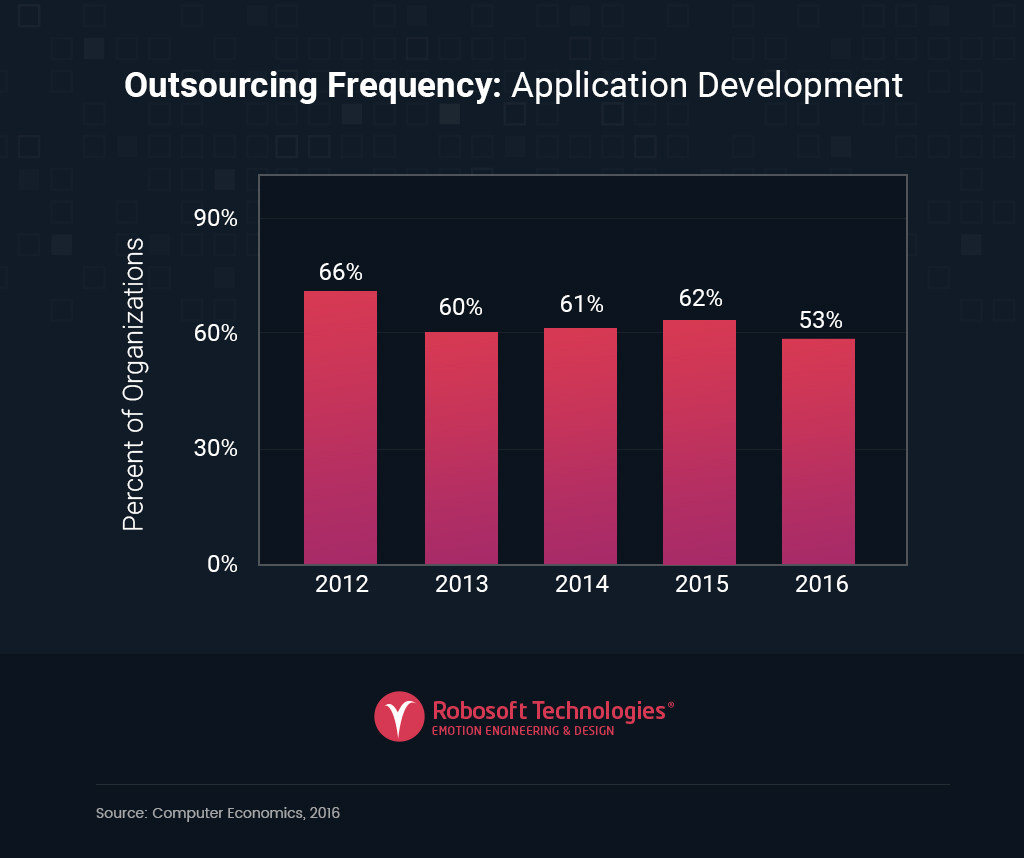

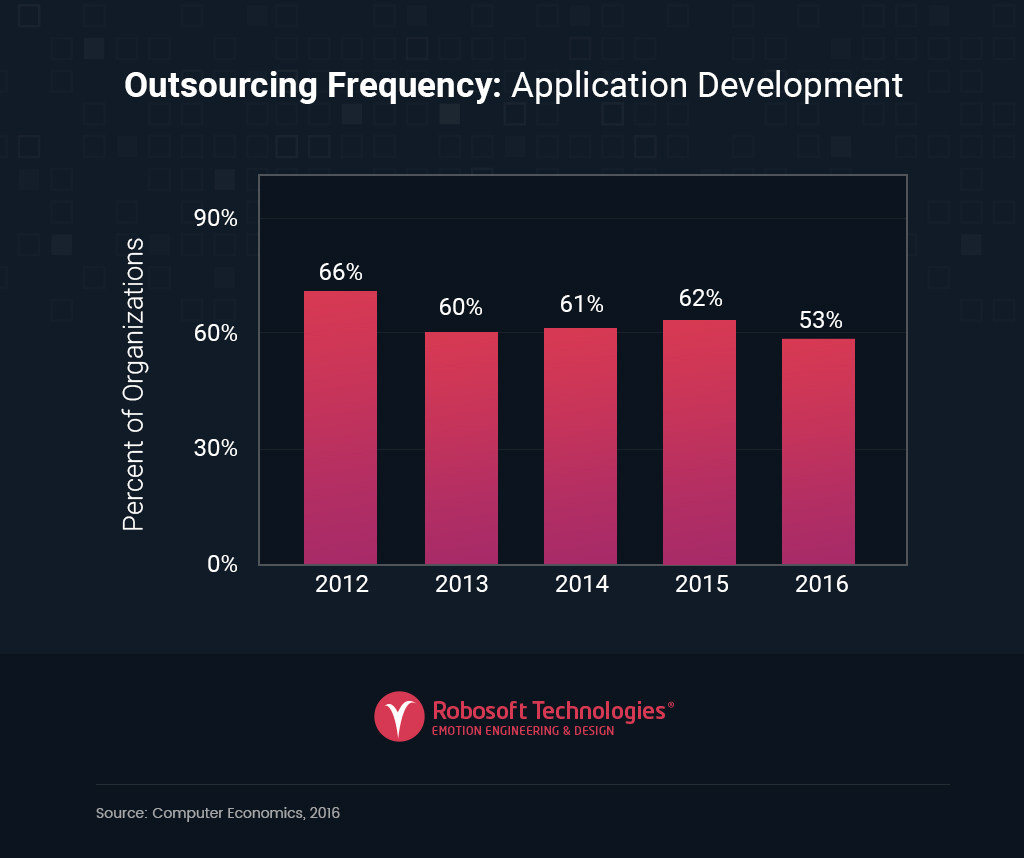

According to the IT Outsourcing Statistic Report for 2016-2017, outsourcing accounted for over 10% of the typical IT company in America.

The same report reveals app development services as the most frequently outsourced function in IT. Furthermore, 40% of the companies that outsourced mobile app development last year intend to increase the amount of work they outsource in 2017.

Among companies offering a mobile app product, the trend towards outsourcing such work is clear: a staggering 53% of companies with a mobile app outsource their development efforts:

Source: IT Outsourcing Statistic Report,

As US companies increase collaboration with offshore and virtual teams, a new set of challenges and opportunities arises. The greatest worry on every executive’s mind is how to work with offshore teams effectively and productively?

What if I told you there is a series of actionable steps you can take that are guaranteed to help you make the most of your partnership with offshore agencies, freelancers and remote teams you might consider hiring?

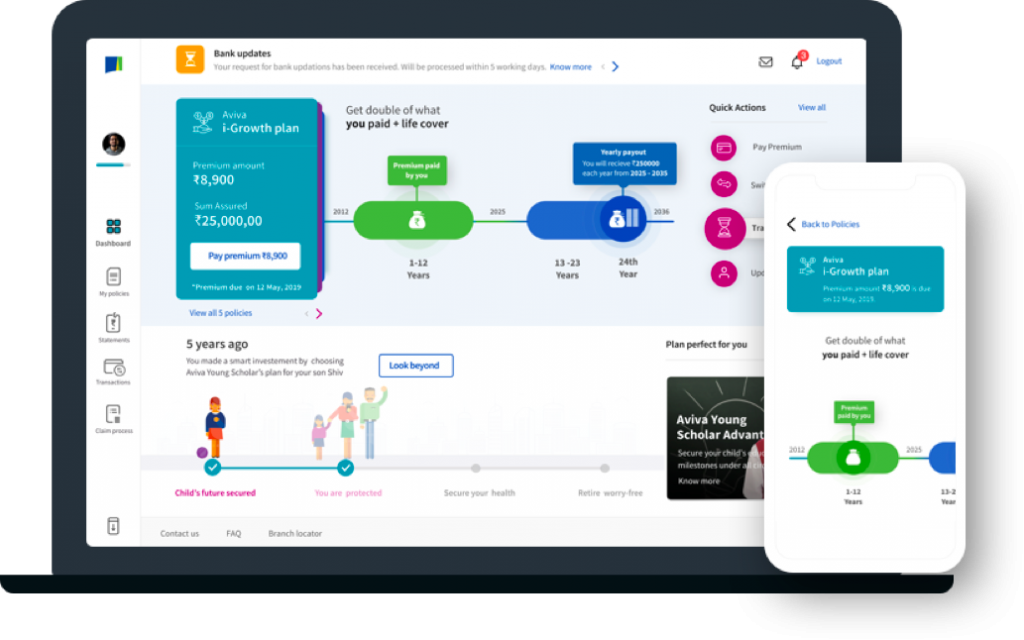

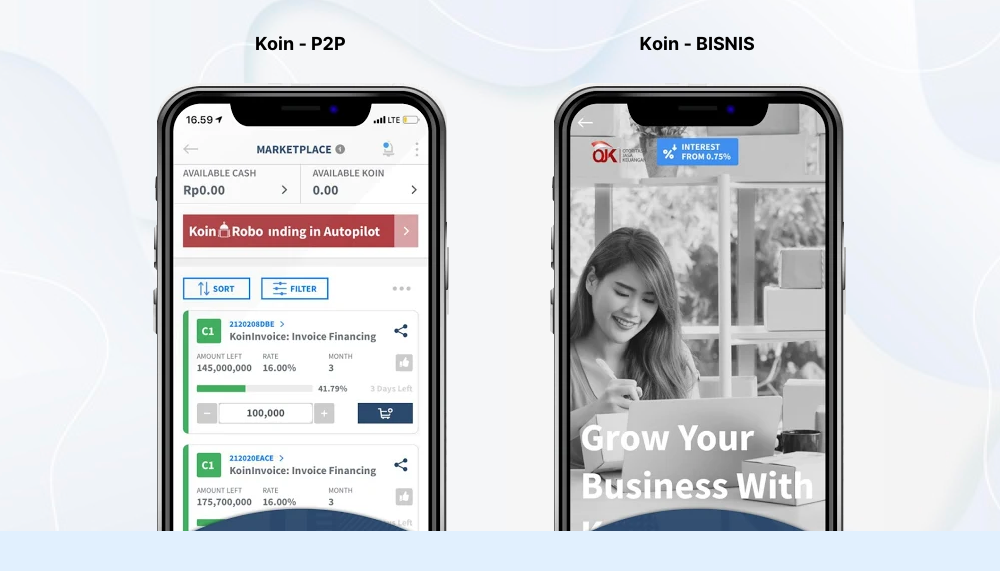

For over 20 years, Robosoft has worked with some of the biggest brands in the world to create mobile apps, websites and integrated systems that have wowed and delighted customers, vendors and internal users. We know more than a few things about how to optimize, improve and successfully work with offshore & virtual teams!

If you are a US or European executive interested in productively and efficiently working with offshore resources, please read this in-depth article.

Our considerations and recommendations are platform, agency and country agnostic. We look at 17 big picture, strategic considerations, along with process and day-to-day implementation strategies to help you get the maximum ROI when working with offshore teams.

Are you ready to learn how to work with offshore teams effectively? Take a look!

Big picture: vision, culture & engagement

In this section we discuss several considerations every product leader should note when working with offshore and onshore teams. Reading this section will help you become successful in building and launching a great mobile product, whether your teams are collocated in San Francisco or across the world.

Make no mistake – these actionable recommendations are even more important when dealing with offshore resources.

Creating a culture of belonging by describing your vision and end goal, clearly explaining what you want and helping to define the success criteria are all critical factors that make the difference between an awful and a great partnership with your remote team.

Share your vision and be inspirational

Source: AZQuotes.com

Once the ink on a partnership contract has dried, and you’ve selected your implementation partner, virtually all companies and their remote partners go through the same first step: gaining an understanding of what the client wants to build.

In this step, the person or company contracting with a strategic partner has the first opportunity to formally introduce their objectives, needs, and goals.

Too often, though, technology clients simply view remote/offshore teams as the execution partner for a specific feature, function or system. However, fundamentally, people work with people. The more you know about what a client wants to build and why, the more invested you can become in a specific idea or concept and its execution.

That’s why the most successful mobile app products in the world have amazing visionaries behind them. From the moment you start engaging with an offshore team member until the end of the partnership, you should always have a clear vision of your project that you consistently and constantly communicate to the people with whom you work – be those internal resources or outsourced team members.

This image summarizes how to best convey your vision to your team:

In short, the overall vision of your project is key to your overall success. When working with distributed team members, it becomes even more important to clearly articulate your idea, your vision and your product differentiator. To be successful, you want people to really believe and become invested in your vision.

Any professional team will work on a project with or without a clearly defined vision. But they will work harder and more effectively if they can identify with the problem you want to solve. Beyond getting paid, they work better when they can feel that they’re really making a difference through their work!

Define exactly what you want

Most developers we have met are analytical, organized and thorough people. If you tell them specifically what you expect to see, they will work hard to deliver a product based on your specifications.

As Antonella Pisani, CEO at Official Coupon Code correctly points out, in all dealings with offshore teams, when clients make their requests as specific as possible, everyone is happier. If the vision is the catalyst for the overall success of your mobile product, clearly conveying what you want is the engine for achieving each milestone required to build the overall product.

Emotional investment and effort from the client’s side is required to effectively communicate (more on that later!) with offshore team members and to articulate, through various means (covered below!), what remote team members are responsible for from an execution point of view.

Help create the definition of success

Knowing what you want from your offshore team wins only half of the battle. If everyone is to stay on the same page, clients and remote teams need to align themselves with the specific criteria for success.

This is true for both the overall success of a project and the intermediary milestones that need to be met along the path of development. Most mobile app projects take between two and six months. If we accept Murphy’s law, during that timeframe “anything that can go wrong will go wrong.”

In order to avoid any discontent when working with offshore teams, it is of paramount importance to clearly define success criteria upfront.

Here are some of the main factors that can have an impact on the success of a project and on which you should spend a considerable amount of time defining and monitoring.

Source: 10 success criteria for software development

Some of these factors, setting expectations, proper planning, milestones etc., will be discussed and brought up as dependencies by competent technology partners and great offshore consultants.

Remember, though, that success is a two way street. That’s why it is the client’s job to clearly communicate project objectives and requirements and to always be available in a timely fashion for questions and clarifications that may act as impediments for your offshore team members.

Both the client and the offshore teams are in this together and both are responsible for the overall success of any project. Which brings us to our next point.

Foster a unified culture among onshore and offshore resources

Whether you work with internal, collocated resources or with offshore team members, it is always imperative to create a culture of belonging. Most companies and executives stop short of realizing that this concept is important whether a person is a contractor, full time employee or a third party agency providing technology services.

Ultimately, everyone is working towards the same goal. If a product is successful, everyone wins. Together! It is this winning attitude we think every client needs to own and promote as part of their engagement with offshore distributed teams.

It doesn’t matter whether a person is sitting in San Francisco, Bangalore or Kiev. What matters is that everyone is aligned behind the same vision and set of goals.

Creating a unified culture of belonging across borders, time zones and employment statuses is, as Vishal Agarwal correctly points out, a product of leadership.

As the owner of a project, you should make it your mission to ensure that every single person contributing to your project’s success feels included, appreciated and part of your greater vision.

Strategic considerations:

All the tips and recommendations in this section relate to issues and opportunities that arise specifically because your resources are not collocated.

Working with remote partners can sometimes lead to disagreements, miscommunication, missed expectations and a culture of distrust.

In order to avoid these unpleasant situations, it is of paramount importance to pay close attention to these issues BEFORE you actually engage a distributed team, independent consultant or offshore mobile app development agency.

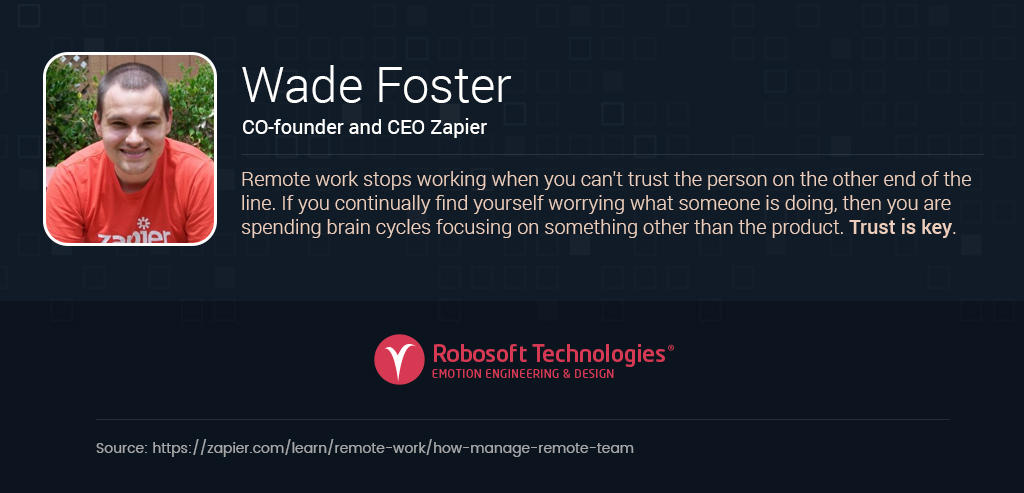

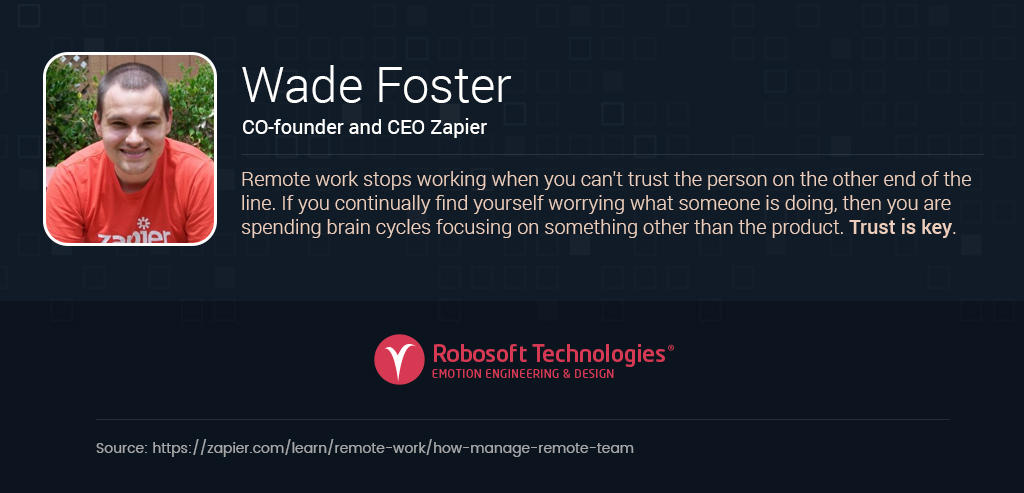

“Hire those you can trust”

Source: How to Run a Remote Team

Wade Foster is the CEO of Zapier, a SAAS company with more than 1 million active users allowing customers to link their various web apps and trigger different events from one digital platform. Foster knows a thing or two about offshore teams: their entire company (75 employees at the time of writing) works remotely across eight different time zones.

In an article he wrote about managing an offshore team, Wade makes an excellent point that is worth exploring here.

- You should only hire people and companies you trust.

- You need to trust that they will do what is best for your company and product.

- You must trust that they will work hard, to the best of their abilities to make you and your product successful – unless proven otherwise.

When dealing with offshore teams this becomes incredibly important. After all, things often get lost in translation – and we don’t mean in a literal way. We mean that with people working in different time zones, most communication is in a written form. When you talk to someone in person, you get a completely different experience because 93% of communication is nonverbal. However, more often than not, communication with offshore teams is done in a written format – emails, chat sessions, project management tools. This, in turn, opens the door to misinterpretations, incomplete information and, sometimes, distrust of your offshore resources.

Every client who selects an offshore vendor or team member should only sign on the dotted line if they fully trust that partner. Anything less will lead to uncomfortable interactions, bad faith and project failure.

Respect your team’s expertise

With trust, comes respect. You cannot have one without the other. With your offshore resources you should absolutely have both.

In the many interactions between a client and an offshore team, there will be countless times a problem can be solved in multiple ways. Some clients and employers feel the need to be very hands-on with their offshore resources. No one says a hands-on approach is bad – but clients should only exercise this right within reason.

After all, you’ve hired a team or a distributed resource for their skills, qualities and past achievements. It’s highly important for remote resources to feel their input is valuable and that they are trusted to make decisions based on their professional judgment during the implementation of a feature.

As Du Nguyen correctly points out in his article, Six Tips for Making Agile and Offshore work in Harmony:

“Showing respect and asking for opinions from the offshore team helps them feel included and could bring up useful actionable insights that can improve your processes. Encourage them to ask questions and get involved.”

When team members feel their input is valuable, they are more likely to take initiative, emotionally invest in your project and go the extra mile to deliver on their promises.

Choose teams that have worked on similar projects

When it comes to working with distributed teams, it is often smart to stick with what you know. In other words, it makes perfect sense to select a strategic partner with previous experience working on similar tasks and projects.

If a team or consultant has successfully delivered on similar projects in the past, it is a good indicator that they can produce similar results with your project.

As we argued in a different article on how to choose the perfect technology partner, most consultants and remote development teams will be more than happy to share their client contact information with you, so you can check their references. It’s downright suspicious, and a huge red flag, if they refuse or otherwise stall when you ask for references.

According to Kim Lachance Shandrow at Entrepreneur.com, talking directly with technology partners’ past clients also affords you the opportunity to ask them how efficiently and reliably the developer worked; both are crucial pieces of information you must know.

In short, when it comes to choosing distributed teams, it sometimes makes sense to do business with companies and employees previously in that situation. If they’ve successfully worked from a remote position with similar clients and have delivered good quality work for companies that launched products similar to yours, they will do the same for you.

Communicate effectively with your virtual team

Great communication is the key to a successful partnership, whether you work side-by-side or in different time zones. It is no different when working with virtual teams. However, as Luke Watson correctly points out, communication remains the number one issue when working with offshore resources.

Fostering an environment in which effective communication between onshore and remote resources becomes a goal in and of itself is the best way to avoid this.

To help offset some of the issues caused by non-collation of resources is to decide how to effectively leverage different communication channels. Here is a ranked list of how to efficiently use various communication methods between onshore and virtual teams:

- Email – use sparingly for project meeting notes, official communication, schedules and commitments

- Chats – always have a chat window open ( skype, slack, hangout etc). Use this for quick clarifications, status updates and questions.

- Productivity tools – JIRA, Asana, Trello, Basecamp, etc. are some of the best tools on the market for proper project management.Whatever tool you choose should be enforced across the team. Having a great project tool reduces friction, improves communication and documents assumptions about a project.

In short, communication with offshore teams can indeed be an issue. However, with the right process and tools set in place, it can absolutely be overcome.

Treat your offshore partner like a partner

Choosing an offshore company or individual partner is exactly this: teaming up with a partner someone you respect and who is more than merely a vendor doing business with you. Spend time to get to know the person or the team with whom you will be working.

Steve Mezak had this to say in an article titled “Six Can’t Fail Tips for Effectively Managing An Outsourced Software Development Team” (and we could not agree with him more!)

“If you treat your outsourcing partner as an equal, they are likely to work harder for you. They might feel inclined to stay late so they have longer workday to overlap with you, or forego their own national holidays to work to your schedule. Empathize with how hard they work to meet your needs rather than point a finger of blame.”

When working with a partner agency, the conversation naturally revolves around what should be done. That’s totally fine. However, as mentioned above, when hiring an offshore team you have people working with other people. Beyond simply getting a paycheck, people form connections, become emotionally invested in a project and go the extra mile for the clients and projects they care about. Treating your offshore resources like real partners will pay off in the long run. Every single time!

Look for flexible teams that are not afraid of change

Technology is constantly changing. One decade has passed since the first iPhone was released. In these ten short years, mobile app platforms, frameworks and programming languages have all significantly evolved. Think Eclipse versus Android Studios IDE or Xcode versus Swift, for example.

As technologies evolve, so should your remote teams.

When you have collocated resources, it is significantly easier for your team to attend meetups, conferences and events that improve their collective knowledge.

Of course, with the proliferation of online courses, one could argue that offshore and remote resources can also gather more knowledge, but it is not the same.

In other words, you want self-driven offshore teams who actively work on different platforms, improve their knowledge on their own and “have a broader perspective to view development technologies as tools in their arsenal to build the next great application.”

You want naturally curious, always learning teams and offshore consultants to join your ranks that will infuse your own team and product with fresh and exciting new development perspectives.

Hire companies with representatives in your time zone (hybrid approach)

Offshore teams are oftentimes more experienced and cost effective than local hires according to the IT Outsourcing Statistic Report for 2016-2017. That is why over 50% of IT departments outsource their work for mobile application development to third party vendors and agencies.

One problem remains: if you have an issue or need a clarification during work hours, how do you get your answers if the team you’re working with is in a time zone 8 hours or more ahead of you?

To resolve this issue, many vendors have started offering a hybrid model for business engagements. Hybrids are companies with an offshore development force and a registered presence in the United States as well as some local resources available within the client’s time zone. Local resources are typically project and product managers, design resources and account managers who are available during local work hours to take questions from a client and act as liaisons between the client and the development team.

This model has become so popular that most vendors with a predominantly offshore presence are now offering it to their American clients. This alternative to the traditional offshore model has made many startup founders feel more at ease with leveraging distributed teams to get their products to market in a speedy and efficient manner.

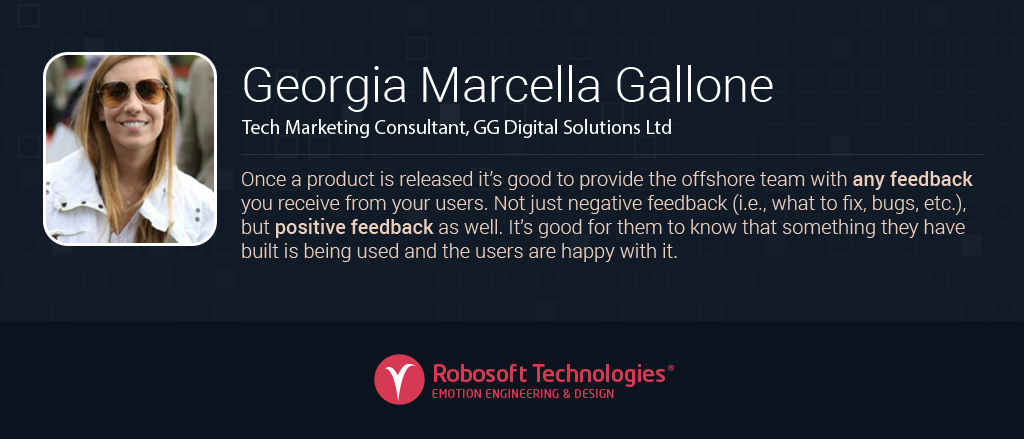

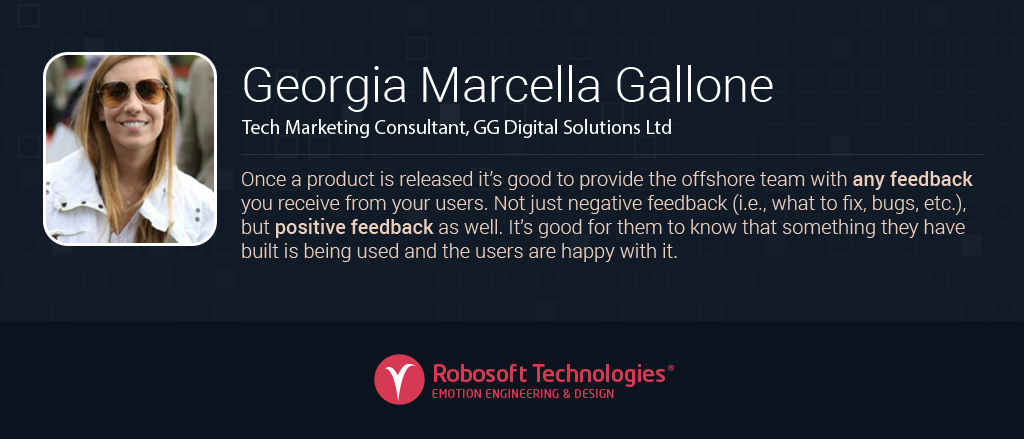

Recognize your offshore team’s achievements & share positive feedback

As we mentioned above, when you are working with offshore resources, it is natural to simply communicate with them about tasks that need to be completed, timelines and bug fixes that need attention.

However, as Georgia Gallone from GG Digital Solutions Ltd correctly points out, when you partner with offshore resources, it’s important to remember you are working with people. No matter where in the world you live, or what your cultural background, positive feedback can go a long way to improving your working relationship.

If the team has done a good job at delivering on time and on budget – express your appreciation. If users love the product, share that valuable feedback with your offshore teams. Treat your distributed teams as you would any other close partner: when something goes well, be sure to tell them so.

Great execution: process, deliverables, expectations

No team, virtual or collocated, can function properly without a clearly defined process that all parties recognize and abide by. In this section we focus on the specific considerations that need to be accounted for when working with distributed resources.

Have a regular check-in schedule

When you are dealing with collocated resources and you need to solve a problem, the solution is really simple. You walk over to the person’s desk and talk about it. Things get a little more complicated when dealing with virtual teams. But they don’t have to be!

Regular check-ins are recommended for any type of project where there are multiple stakeholders and decision-makers. This becomes significantly more important when working with offshore and virtual teams. As other experts have mentioned, a regular cadence of meetings is critical to the overall success of the project!

To get the most out of regular check-ins with your virtual teams, the best strategy is to maintain a very structured approach so everyone’s time is used effectively, as shown in the image below.

If you follow these tips for productive check-ins, you will likely cut through the noise and get tasks done efficiently in a timely fashion.

Establish one consistent process across teams

If you are a startup working with only one offshore development team, the process is simple. You align on a process of engagement which everyone then executes. Often, however, companies hire virtual teams to augment their existing team or to work on a new project.

We cannot emphasize enough how important it is for executives to ensure that all resources, onshore and offshore, follow the same processes and transfer deliverables in the same format.

In software development, many steps can and will be done differently by various people unless a common set of practices is put in place. From coding to testing, requirements gathering to production release notes, there are quite a few practices that must be absolutely standardized across teams. As others have mentioned, lack of standard practices in the development cycle is one of the biggest mistakes affecting the cost of software development.

Get alignment on monitoring the performance of a virtual team

One of the most frequent sources of discontent between clients and virtual teams collaborating on the same project is missed expectations. As a client, you expected to see something done in a specific way but it was delivered in a different manner.

The best way to avoid hard-feelings when working with remote teams is to agree, up-front, on how the performance of the offshore team will be monitored throughout the process.

Of course, no one expects every single detail to be outlined in the master service agreement. However, it is incredibly important for clients and service providers to discuss how the performance of a virtual team will be monitored and reviewed throughout the engagement.

As Tara Waddle from Allshore Virtual Staffing correctly points out, there should be alignment between onshore project managers and virtual resources on quantifiable KPIs, task turnarounds and feedback mechanisms, so everyone clearly understands what is expected for each step.

Know and learn the virtual team’s process

Another common source of discontent between clients and offshore resources involves how and why virtual teams deliver work products in a certain way. Professionals have different methodologies, processes and work methods of which clients may not be aware.

Of course, distributed resources and virtual teams will adapt their work deliverables to the clients’ needs, within reason. However, it always helps if clients and onshore managers are open to understanding and learning the process used by virtual teams.

In a globalized workforce, professionals come together and work on joint projects while sharing different socio-economic and cultural backgrounds. Much of the conflict between clients and service providers is due to a failure to understand the other party’s perspective or why something is being done.

Knowing a virtual team’s work process means meeting them halfway on the path to a long and strong partnership.

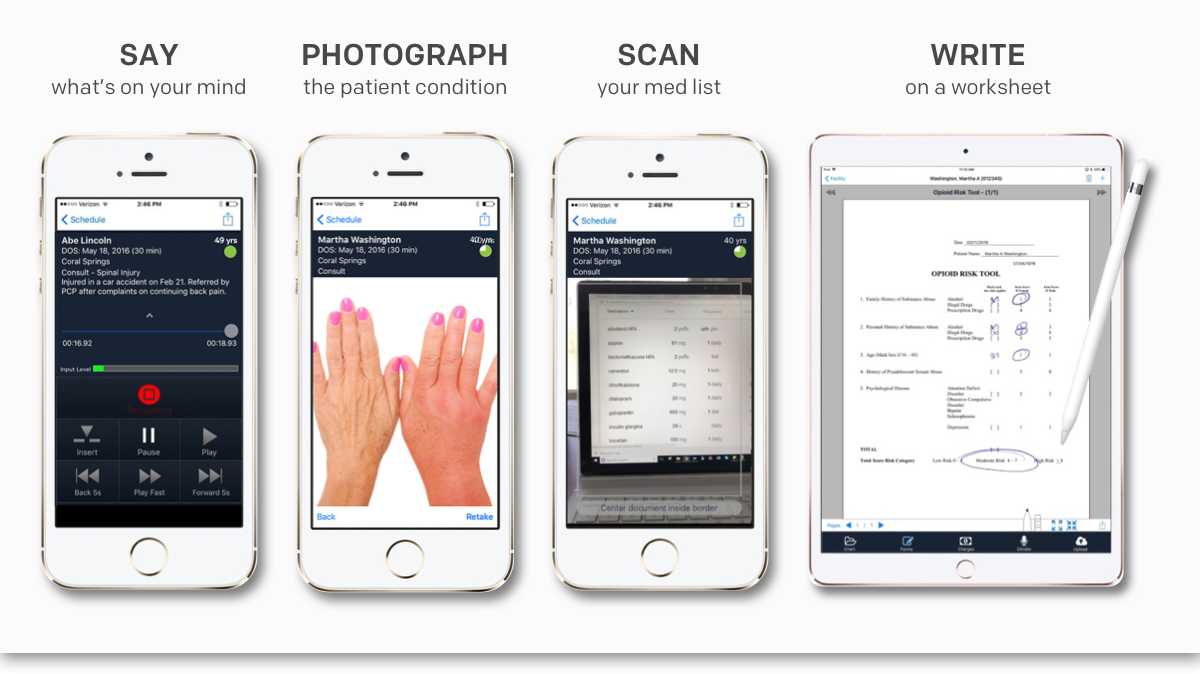

Humans are visual creatures – use tools to visually communicate what you want

Source: Can a Conference Room be Intelligence

As we all know, most people are visual learners; 90% of information processed by the brain is visual. That is why this article is a combination of text and summary images – to allow you, the reader, the option of skimming through our recommendations or reading them in their entirety.

The same concept applies to working with remote teams. What you write in an email or chat window, or what you say on a phone call may be subject to multiple interpretations. When you visually show what you expect, people can process that information and produce the necessary deliverable faster and more efficiently.

That is why it is absolutely critical to use tools that can help you convey your point in a visual fashion when working with distributed virtual teams. Luckily, many of these tools are free to use or very inexpensive. Google Hangouts sessions have a built-in option for screen sharing. This is also true with Skype. Many companies in the US use Join.me or Gotomeeting.

Ultimately, whatever option you choose is less important than making sure you have an easy and effective method to visually convey your thoughts and desires to your virtual team members.

Summary:

Working with virtual teams is a reality. Whether you choose a development partner with an offshore base of operation or you decide to hire a professional in a different city, this is an everyday scenario for many companies in America.

Although the benefits of collocated resources are well-known and understood, companies are naturally looking for the best people for a job. Those people may be on the other side of the country or the other side of the world.

In this article, we looked at 17 distinct strategies that have already been implemented in one form or another by different US companies to ensure that teams can work effectively and efficiently, regardless of their office locations .

If you are a company wondering whether a distributed model will work for you, don’t bother. Working with virtual teams has already been proven successful. The only question should be what you can do to ensure that the virtual team model is implemented in an efficient manner. We hope our 17 actionable recommendations provide a good overview of how you can make it happen.