A few years ago, the customer experience was how a customer was treated when they were at a store, a restaurant or a hotel. It perhaps began when the customer entered and ended when they left the premises. In that context, enterprises, especially in consumer goods, placed a lot of emphasis on in-store experiences right from point of sale material, shelf display and packaging. Service brands laid emphasis on people-driven customer service.

Procter & Gamble, coined the phrase ‘First Moment of Truth’ to an in-store experience, especially when the customer is interacting with the packaging or POS material. It is believed that it occurs within the first 3-7 seconds of a consumer encountering the product and it is during this time that marketers have the capability of turning a browser into a buyer. The actual product experience was the ‘second moment of truth’ – as it was about the product living up to the claim. As the world became more digital, enterprises realized that the web played a big role in influencing brand choice even before they entered a retail store or went to an e-commerce portal. Google called it Zero Moment of Truth – as the web, especially search results, expert & customer reviews influenced the consideration set before the final brand purchase. So what the consumer saw in the digital world influenced the sale. In a way, it paved the way for Customer Experience – heavily influenced by digital, as we know it today.

Customer Experience (CX) today goes beyond the product or service a customer is looking to buy (or has already bought). Technology has made communication quick and easy, and customer experience today is a continuous, on-going process. When Amazon, for example, receives an order, they follow a process to ensure the customer is happy and informed throughout the journey. Constant email and message communications inform the customer where their product is, and when it will arrive. Once it is delivered, they ask for feedback and offer a return-back window. They have a 24×7 service line that customers can use to express issues. They send periodic emails about other products that a customer could be interested in. All of this culminates in ‘Customer Experience’. It may begin with a web search and include an app experience, interactions with customer service or the website. CX today is associated not just with the product, service, store or salesman, but with the entire brand that is delivering the experience.

In many cases today, the digital experience is perhaps the most dominant factor in customer experience. [click to tweet]

However, this is not to say that a great customer experience in digital can be a substitute for a poor product or service experience. It is said that good advertising can kill a bad product faster. Similarly, today’s savvy consumers will see through ‘all style and no substance’.

Why Customer Experience is Important

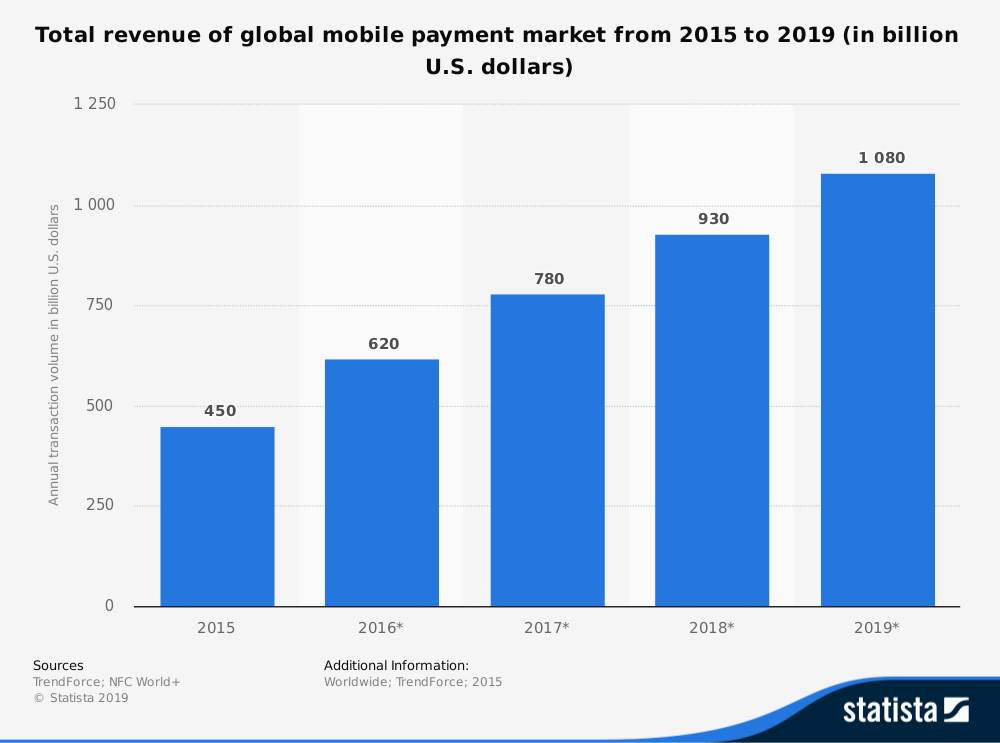

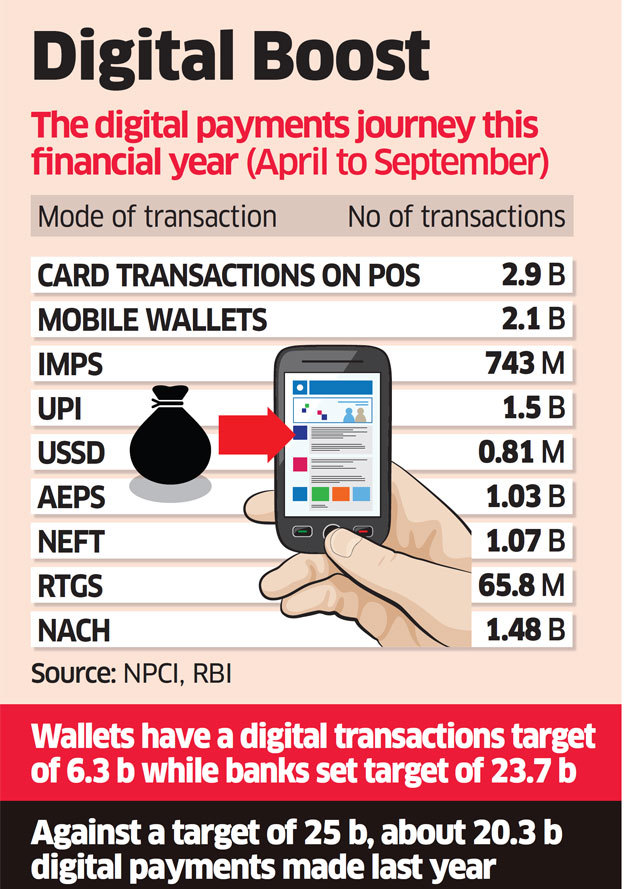

The sheer variety of options that are available to consumers today, makes CX the primary differentiating factor. Consider the e-wallet market, for example. Customers looking to perform the simple task of making quick transactions have over 100 options, as listed in this blog alone. In terms of functionality, there’s not much these apps can do differently. The only factor setting them apart is how customer-centric the brand is, and that encapsulates the app, the support team, the customer-facing representatives, etc.

13% of customers will share with 15 or more people about a bad experience with a company, and 72% of consumers will tell 6 or more people about a happy experience.

It’s quite evident that in 2020 and for the foreseeable future, customer experience is going to play a vital role in the growth of sales and customer retention. Here are 3 factors that sum up the importance of CX:

1. Customer Experience Enforces Customer Retention

More often than not, customers return to a brand because of their experience than only due to the product or service itself. ‘Build it and they will come’ is simply not true. A product or service with great functionality needs the expertise of customer experience design too. In today’s world of product parity, this is even more important. There is very little that separates one bank’s services from another and hence the primary interface – in many cases, the mobile app becomes crucial for customer retention. According to Forbes, 96% of customers pledge loyalty to a brand based on customer experience. Acquiring new customers is important, but retaining customers and getting repeat orders can propel a business.

2. Consumers Decide Based on the Experience, Not the Product

Yes, having a great product is important, but it does not ensure a sale. Research shows that CX plays an important role in consumer decision making. In fact, consumers who have a good experience with a brand tend to spend more, return and refer. According to GrooveHQ, a customer that is highly engaged is 6 times more likely to return to try a new product or service. The report also states that customers who have had a pleasant experience with a brand spend 140% more compared to the customers who have had a bad experience in the past and 69% of these happy users would recommend the brand to others.

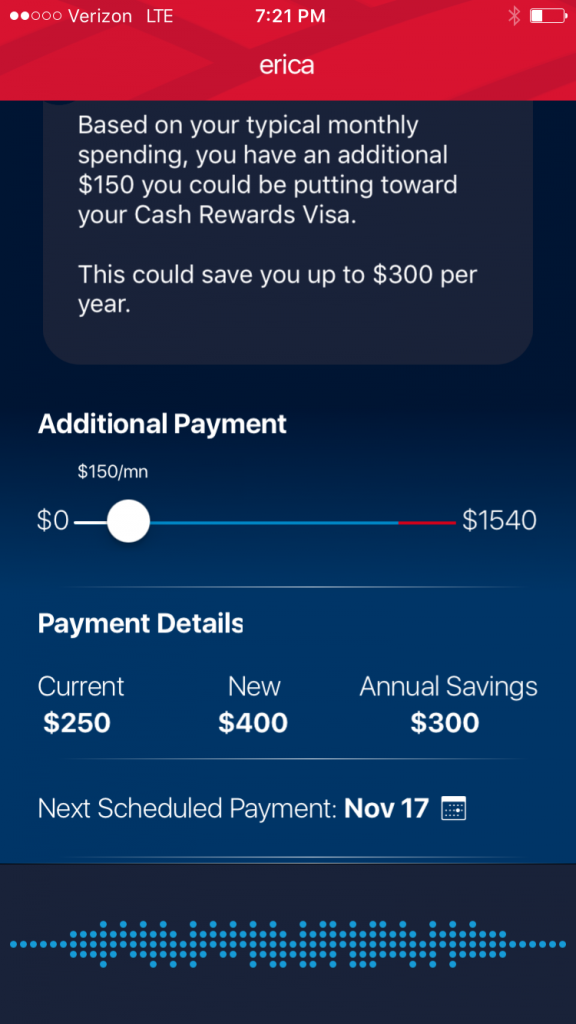

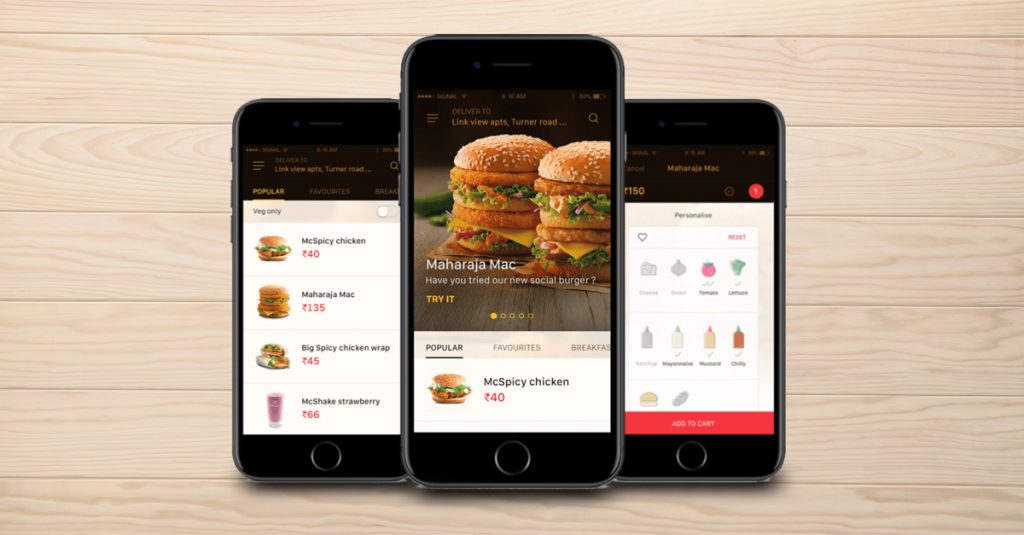

Here’s how McDonald’s was able to scale their CX with a user-friendly mobile app. McDonald’s India had a vision to make its mobile app the preferred medium for ordering. The goal was to bring the emotions of joy and delight from the in-store experience to the new McDelivery app. By analyzing the pain points in their current user journey and crafting a strong intent for the desired experience, McDonald’s was able to simplify the process of discovery, personalization, decision making and create delightful interactions. With the best UI in place, they increased orders by 103% with the new app, redirecting traffic from web-based ordering.

3. CX Gives Brands the Information Needed to Make Their Product or Service Customer-Centric

Customer experience involves customer engagement, which gives businesses the data needed to improve products, services or the experience itself. According to this article on Hubspot, 70% of dissatisfied customers are willing to shop with the same brand again if their issues are promptly resolved by customer care. Enabling customer feedback channels through store forms, online chat windows, email, and telephone is a great way to initiate communication between the brand and a customer, and also seek feedback that allows brands to improve.

However, customers do not think about these things as much as enterprises do. They do not segregate an ‘offline’ and an ‘online’ experience in their minds. They simply want to get things done irrespective of the channel or technology.

Customer Experience Strategies That Brands Should Adopt to Scale Acquisition, Engagement & Retention

1. Collect Data & Infer Results

Collecting customer feedback is quite easy with numerous options available. A simple NPS survey or customer effort score (CES) survey can give brands valuable information about their product/service and CX. Advanced technological solutions like AI and Machine Learning enabled bots that can interpret a customer’s mood through Natural Language Processing allows brands to take proactive measures in solving a customer’s problem. There are many solutions at a brand’s disposal, and it is important to collect consumer experience data to derive useful insights.

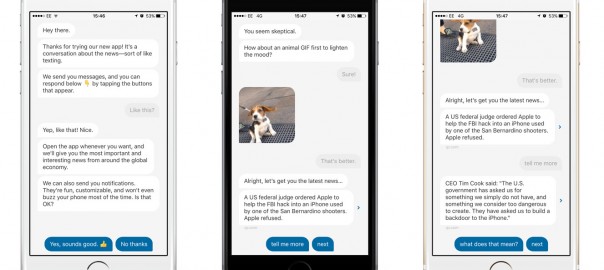

2. Find a Balance Between Automation and Human Intervention

Anyone who has dealt with customer service calls (and the hold timings) can say how frustrating it can be. Chatbots, powered by Artificial Intelligence was meant to be the solution to resolve customer issues. However, we can safely surmise that neither of the routes have reached perfection. It’s vital for brands to implement a smart mix of technology and human intervention. The first step is to identify roles that are best addressed by humans. AI can play the role of enhancement by analyzing interactions, the context of queries and automating several processes. An often neglected aspect of human intervention is the role of strategy and the role of design thinking prior to crafting or solving a customer experience issue.

3. Implement Immersive Technologies

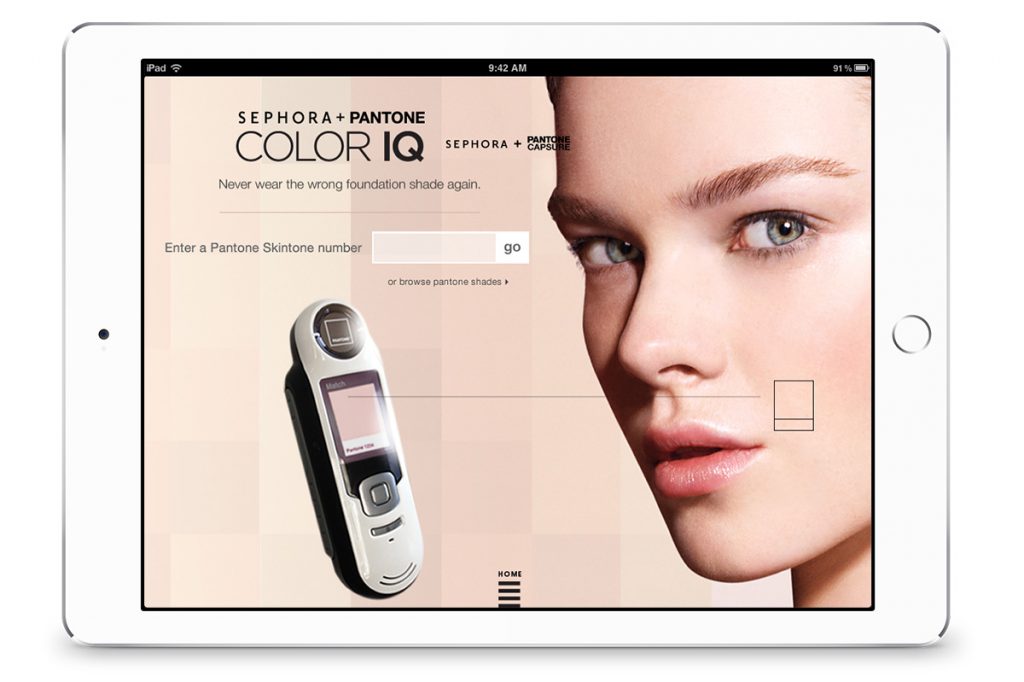

During the launch of their SUV XC90, Nissan rolled out a VR enabled application that allows customers to take a test drive, virtually. Advertising and marketing methods have changed with the changing technological landscape. Technology like AR, VR, 3D Images/Videos, etc present customers with an immersive shopping experience that helps them better understand the product, in turn improving customer experience and satisfaction.

Video source

4. Deliver Hyper-Personal Services

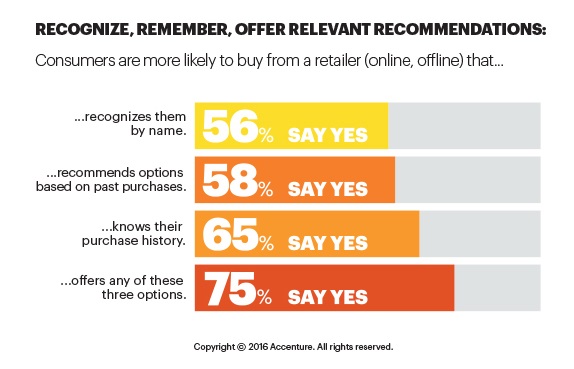

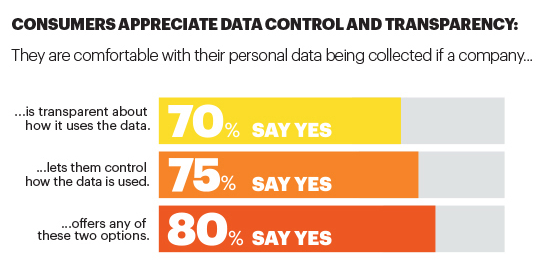

An article by Accenture stated that 75% of customers are more likely to purchase from a brand that knows their name, purchase history and/or recommends products based on past purchases. This forms a part of several design thinking principles that can help in customer retention and help prevent churn. With smart feedback systems and CTAs in place at customer exit locations (in-store or on a website/app), it’s not difficult to gather relevant customer information. Brands should then segment their marketing campaigns based on customers’ data, which increases the chances of engagement and purchase.

5. Have a Relevant Omnichannel Presence

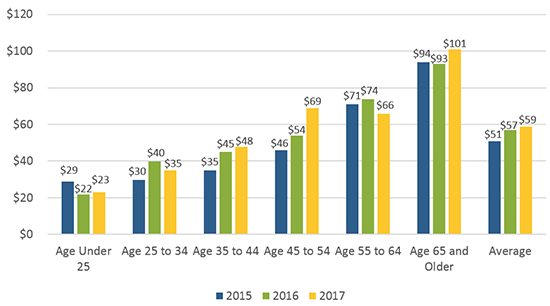

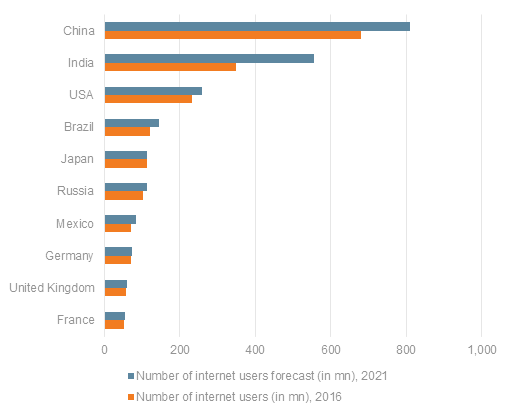

Customers will not articulate that they choose a brand because of its omnichannel presence. But a relevant usage of platforms and experiences adds to a brand’s aura and helps in creating a ‘big brand’ feel. It can lead to brand affinity – a key differentiator in a parity world. The modes of communication consumers prefer, depend on demographics, location, age, gender, lifestyle etc, making it vital for a brand to be active and reachable on multiple channels today.

An omnichannel service does not simply mean having a token presence across channels of communication, but a one that is relevant and adds value to the consumer [Click to Tweet]

Success Stories Resulting from Exceptional Customer Experience (CX)

Hewlett Packard’s Virtual Agent for Customer Service

HP Inc sells over 50 million PCs every year, and with every PC they acquire a new customer who will in some time in their journey be in need of service and support. In fact, HP Inc handles over 600 million technical support contacts every year. Working with Microsoft, HP rolled out an AI-enabled virtual assistant that interacts with customers and helps them solve issues they face with a product. It guides users through a troubleshooting process and provides solutions. If a solution isn’t available, it transfers the customer to a human representative. Here’s a brief overview of the key benefits:

- Prior to implementing the virtual assistant, HP would address 15 % – 20% issues digitally. Now, they address close to 80% issues successfully.

- The bot helps customers navigate over 50,000 pages of product information by understanding their needs.

- All of this resulted in increased customer satisfaction.

Mercedes-Benz Leveraged Predictive Analysis and AI to Better Serve Customers

Image source

Mercedes-Benz was looking for a solution to better serve its customers in Brazil, which has the second-largest plant followed by Germany. They invested in a Microsoft Azure cloud solution coupled with Power BI and Cortana Intelligence to map their sales processes, and analyze decades worth of data like license plate records, macroeconomic indicators, regulations, sales information, and statistics by each region of the country. Through this change in data analysis and interpretation model, Mercedes-Benz was able to:

- Provide 180 service locations around Brazil with consistent, actionable information to ensure each location could provide accurate proposals to their clients.

- Assist sales reps to engage with consumers proactively before a need is even expressed with the help of predictive analysis.

- Support employees in engaging and serving customers better, and in improving overall customer experience and satisfaction.

Thomas Cook’s Nurture Program

Thomas Cook was looking to establish a better and direct relationship with their existing customers, and prospects. They wanted to influence customers to be able to recommend their travel packages. Thomas Cook ran a CX improvement program a few years ago and collated data to study their customers’ interests and ran campaigns to request for personal recommendations based on past interactions and through display re-targeting. Through these hyper-personal campaigns, they were able to:

- Receive over 15,000 leads.

- Increased ROI, as high as 7.5 : 1 in a span of 3 months.

Hotel THE PIG Revamped their Online CX Experience to Boost Revenue

Kitchen garden hotel THE PIG wanted to increase their customer acquisition through online channels. They revamped their online booking process to make it more customer-centric and easy to use. In collaboration with Etch and Micros, the hotel implemented Opera Reservation System (ORS) in order to put in place a customized booking system that is customer-centric. By simplifying the customer’s booking journey, they achieved a 250% growth in online revenues over a two year period.

Improving customer experience is a seemingly simple two-step process: understand the needs of the customers, and implement effective methods to satisfy those needs. However, it is a lot more complex to accomplish and calls for collaboration with experienced partners who understand customer journeys, the role of digital experiences and the technologies that help craft them. There are also a plethora of tools available that help to collate consumer feedback, analyze customer satisfaction levels, and serve customers better. With the right strategy and tools in place, brands will be able to scale their customer experience alongside brand reputation, sales, and customer retention.