The banking & finance industry has seen tectonic changes over the last few years. With the advent of smartphones and mobile applications, many consumers choose to bank on their mobile, buy financial products on digital platforms, reducing their dependence on visiting a branch or brick & mortar office. Living in a digital world has created its own set of challenges for both end users and enterprises. Alongside this digital savvy, demanding consumer is another audience (in developing markets largely with a rural bias), which is yet to experience the entire gamut of banking services. They are expected to fuel the growth of the entire banking sector, driven by rising incomes.

Earlier, a bank account at a branch was for life. Today, switching brands to suit one’s financial needs – be it investments or loans, is easier than ever before. So there is no room for complacency in the banking sector as brand loyalty cannot be taken for granted. Millennials – a sought after segment for many categories are earning and their trust factor vis-à-vis banks will be measured solely by digital experience of services. They would be a demanding lot as they seek self-service dashboards, are comfortable with humanized banking with natural language support and demand curated recommendations on financial products.

Our interactions with consumers tells us that they have a stronger emotional connect with technology and new-age brands such as Apple, Uber, Amazon, and Google. The ability of some of such companies to blend experiences from the physical and digital worlds is also admired by consumers. The perceived ease of use and delight of digital-only products (e.g. Dropbox) is sought to be emulated across all digital experiences. Unfortunately, banks have not been known to provide great customer experiences either in the offline or online world. Nearly half of millennials using mobile banking are dissatisfied with the existing online banking services.

Many enterprises with no legacy banking experience may seek banking licenses with a digital-first and branch-less strategy. They can collaborate with FinTech partners to acquire and own segmented customers and offer a wide-range of services as opposed to legacy institutions, which were primarily a safe vault for deposits or lending to one-off needs. As compared to traditional banking brands, FinTech players anyway have an edge when it comes to better user experience.

In this context, banks are at a higher risk than ever before of losing customers. They will have to adopt a top-down strategy comprising five pillars of innovation covering Business, Technology and Operations.

Not just money-keeping but lifestyle enrichment

Banks remain one among the many domains, which can potentially own the customer for life and fulfil an individual’s aspirations and needs. Hence, banks can play a far greater role than mere money keepers. They can offer a suite of services to match both lifestyle and life stage requirements of individuals. This could include anytime advisory, spend analysis across financial institutions and touch points, life-style goal planning & tracking, consolidated analysis of assets & liabilities, need-based in-app marketing, rule-driven payments automation and more.

Based on lifestyle services (e.g. shopping, bills, recharge, tax, fees, EMI, ticketing, travel, transportation, toll pay, grocery, entertainment, donation, stocks, mutual funds, insurance, deposits, person-person payments) and past transactions, a bank can make just-in-time recommendations and make customized offers. They have an opportunity to be the single life-style app unifying loyalty, rewards and cash back with frictionless redemption. For example,our primary objective while revamping the app of a large private bank was to upgrade it from a merely transactional app to an all-purpose platform. We partnered with the client and created an app which wasn’t just a transactional platform, but offered a seamless and delightful experience to consumers, with features like one-touch payments, bill payment reminders, AR based smart ATM locator, etc.

Data of customers and their preferences should move across channels (app, web, wearables, bots, social, smart TV, kiosk, branch, call center, advisor, distributor) and will be expected to be available, rendered or resumed on most-preferred channel at that moment or location with secure authentication.

Customer Experience is the new business battleground

Many enterprises are familiar with the concept of Design Thinking and acknowledge its role in shaping customer experiences. But there is scope to apply this discipline across all aspects of a business. Many of the enterprise apps in the market may be colorful in design, but weak on purpose, interaction style or blending cutting-edge innovations. Enterprises too are grappling with the problem of app abandonment both in consumer-facing and employee-focused apps. There is ample scope for design thinkers and data scientists to partner with software engineers to create digital solutions, which delight.

Banks should think holistically to offer a great customer experience beyond just the digital interface. In the US, while lots of millennials use and prefer digital banking almost 50% of them wouldn’t even consider switching to a digital-only bank. Beyond the digital world, banks can also consider hybrid solutions – a personalized greeting at branch entry via facial recognition and BLE, extended service hours through virtual remote services, the option to have a video call with a bank representative, a plug & play service at a branch resembling a café and so on.

Don’t just thinks apps, think enterprise grade platforms

Gone are the days of IT teams executing monolithic applications from disparate vendors as sequential projects and siloed business units resulting in a roadblock to faster innovation to markets. Many large enterprises have now carved out separation of responsibilities between the CTO, CIO, CD and CMO. Enterprises should decouple Digital from Core via Open APIs (e.g. PSD2 Open Banking Standard in UK) and monetize services usage by partnering with best-of-breed service providers built on open-source technologies via a plug-n-play integration.

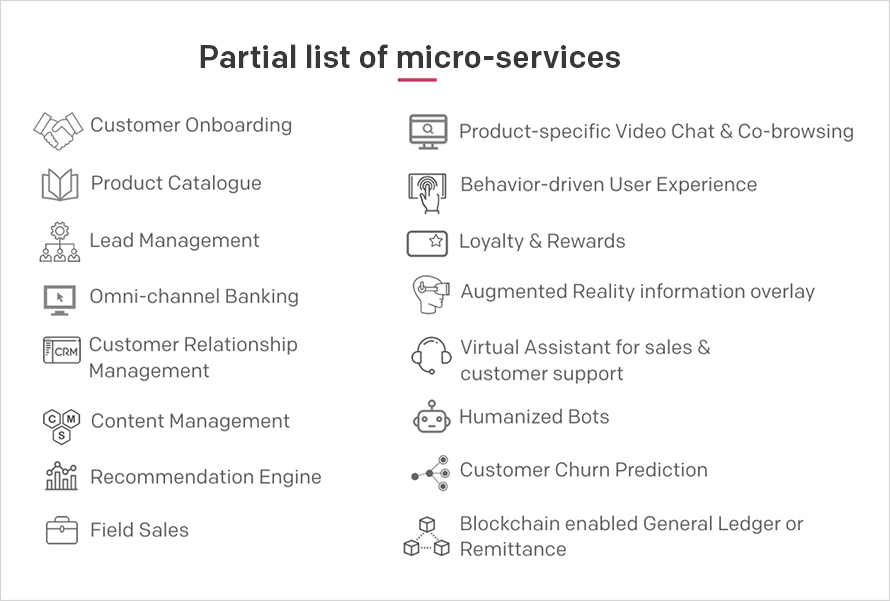

Each business application across business units should be well architected as a collection of cloud-ready enterprise-level micro-services that can be discovered, re-used and deployed across the Enterprise in its lifetime.

Automation which delivers better processes & results

Many financial institutions have only scratched the surface on operational process and customer interaction automation. Typically, it has been automation of easy mundane back-end jobs and less of a hybrid approach of humans and robot’s judgment working in tandem. Successful digital transformation initiatives must focus on enterprise productivity, contextual interactions and real-time recommendations with customer at the center.

Robotic Process Automation is one form of automation that enables an enterprise to be agile, lean, data-driven and customer-centric by speeding up tasks non-intrusively and 24×7 operational. RPA unifies enterprise-level data to bring context to customers, integrates regulatory compliance into SOPs with exception reporting, delivers always-on services and enrich human interactions. Hence, convergence of RPA and AI covering client and server-side applications must drive enterprise revenue and profitability, cross-sell to customer’s precise needs, prevent fraud and non-performing assets, as opposed to seen as disparate technological innovations.

Financial institutions must certainly bring automation to software development, deployment and rollout to markets faster. This would involve adopting Agile practices at scale. These could be in-house or with innovation partners by institutionalizing DevOps best practices of Continuous Integration, Deployment and Monitoring of services. Another area of automation is just-in-time marketing driven by AI, location intelligence, big-data driven customer profiling.

Actionable insights at the core of decision-making

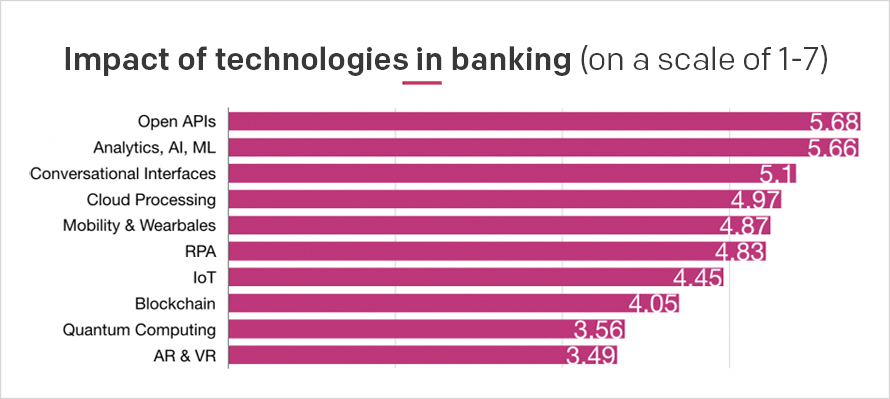

Big or small decisions in enterprises are based on the right information. Today, the need is to go beyond information and depend on insights. Such insights can be drawn from every conversation, transaction, relationship, complaints, social sharing between customer and bank or between customers, and not remain siloed inside proprietary application as MIS reporting. In a 2018 survey, senior industry professionals placed open APIs, Analytics and Conversational Interfaces among the top 3 technologies which will have an impact in banking.

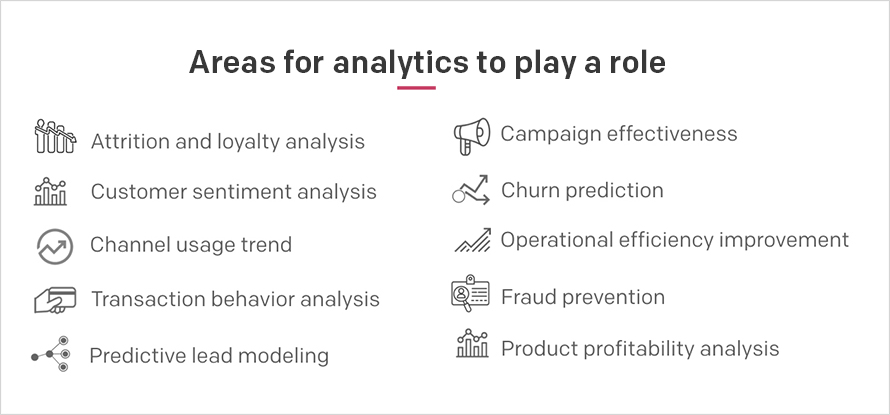

Analytics is enabled at edge of the network and at servers on cloud and utilized real time to bring value to customers. Such insights can be put to use in customer micro-segmentation, cross-sell and product holding analysis, customer profitability and lifetime value analysis to name a few.

Dashboards are useful, but the real value lies in interpreting the data in order to anticipate what your customers want faster and accurately than your competition and acting on it.

Summary

Banking will remain across generations to come. The entities, actors, relationships will take different shapes. Financial institutions must think customer-first and user scenarios to drive service features and not invest upfront in off-the-shelf products without knowing how to realize the enterprise vision on time and budget.

A customer-focused data-driven company, which measures critical moments of interaction to cross-sell or up-sell has an edge in the future. A reliable long-term partner who can provide the right advice, design a human-centric experience, engineer a scalable solution, and launch or enhance defect-free cloud-ready solutions to market is key to success.