Streaming has moved from being a disruptive alternative to becoming the default way people experience entertainment.

What began as a convenient way to watch shows without cable has evolved into a global ecosystem where billions of viewers expect personalization, cultural relevance, and seamless access anywhere, anytime.

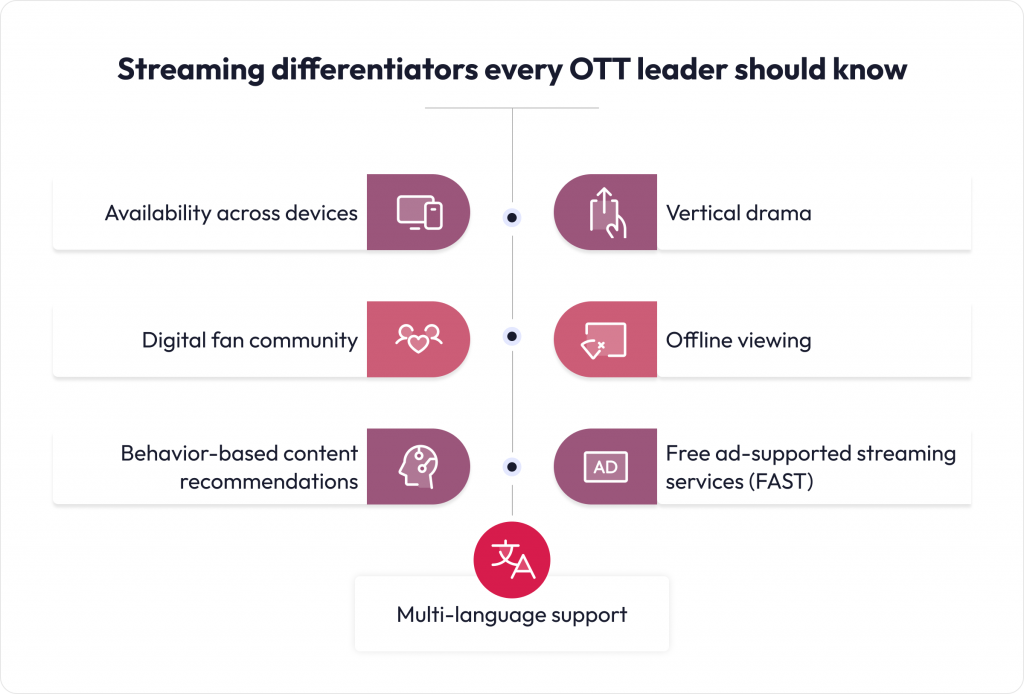

Focusing on the right streaming platform features is the best way for providers to keep viewers engaged, satisfied, and committed to the service.

In this blog, we break down 7 streaming features that set platforms apart and show you how to use them to deliver experiences your viewers love.

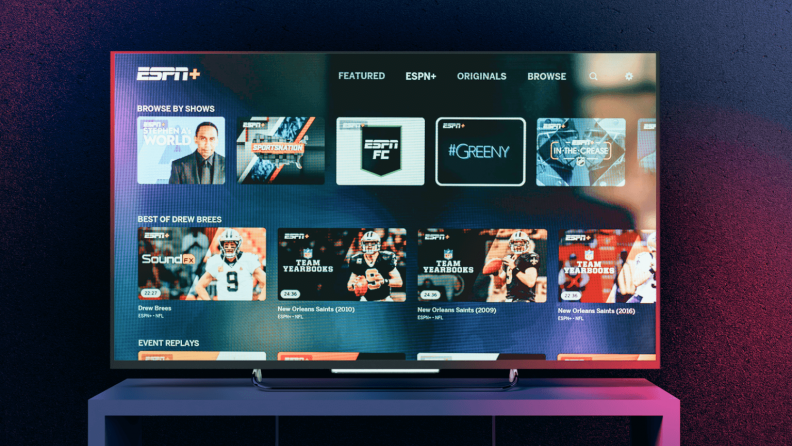

1. Availability across devices

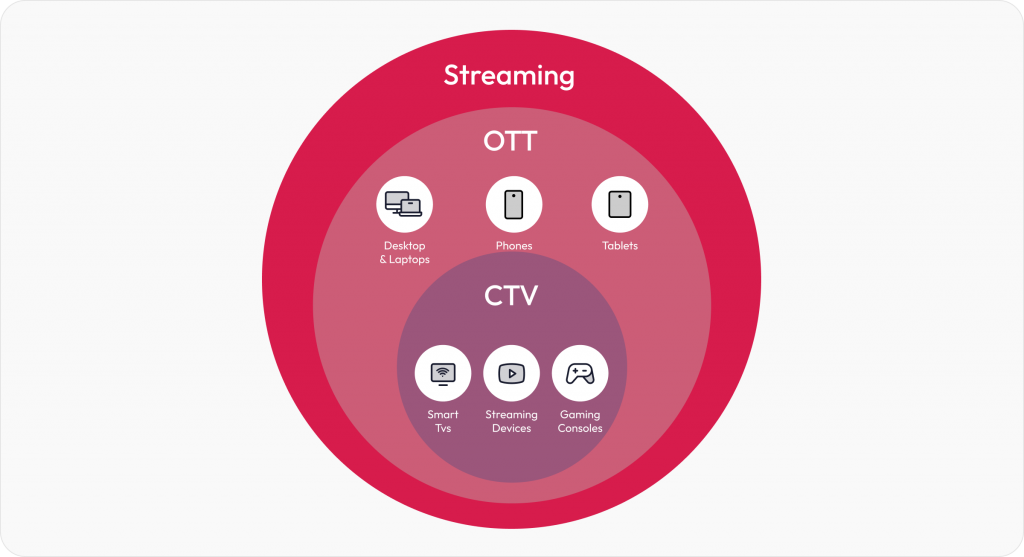

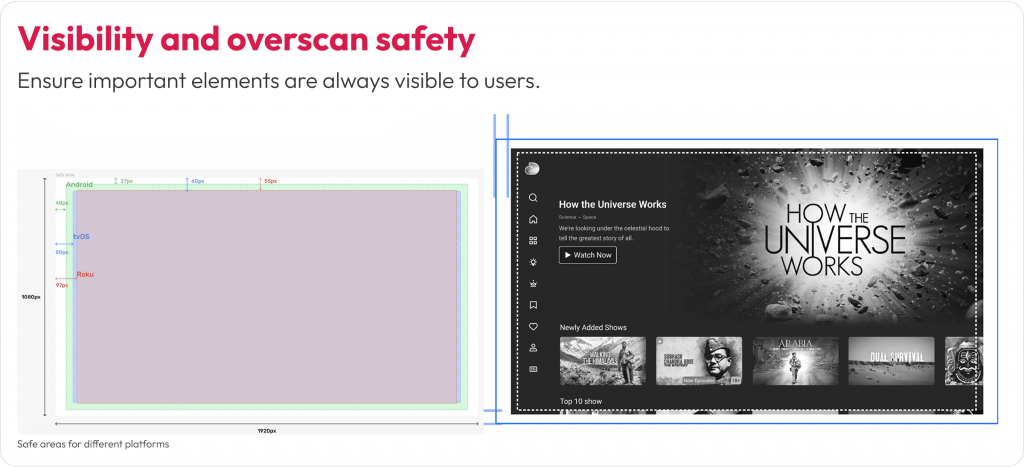

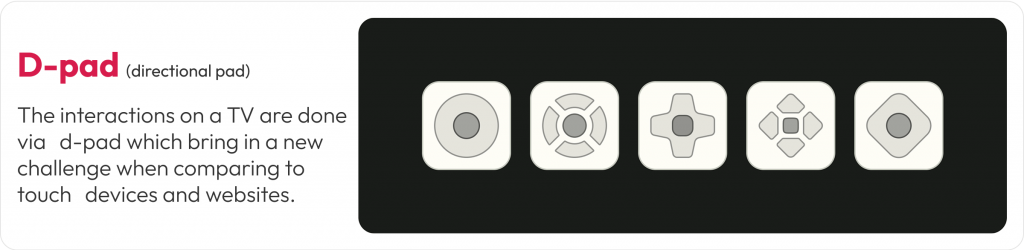

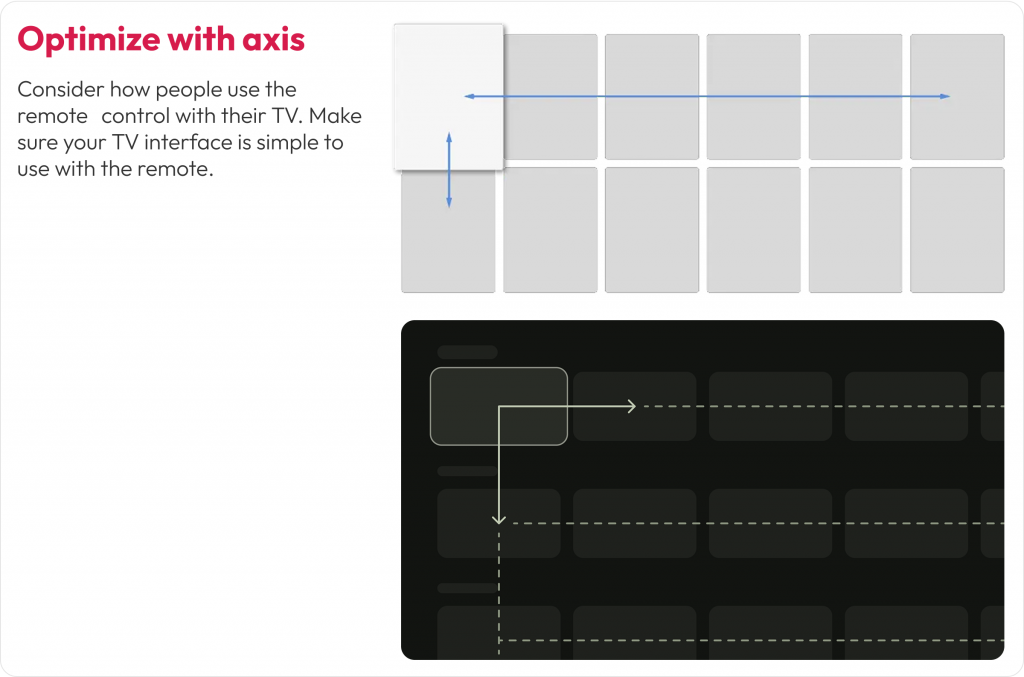

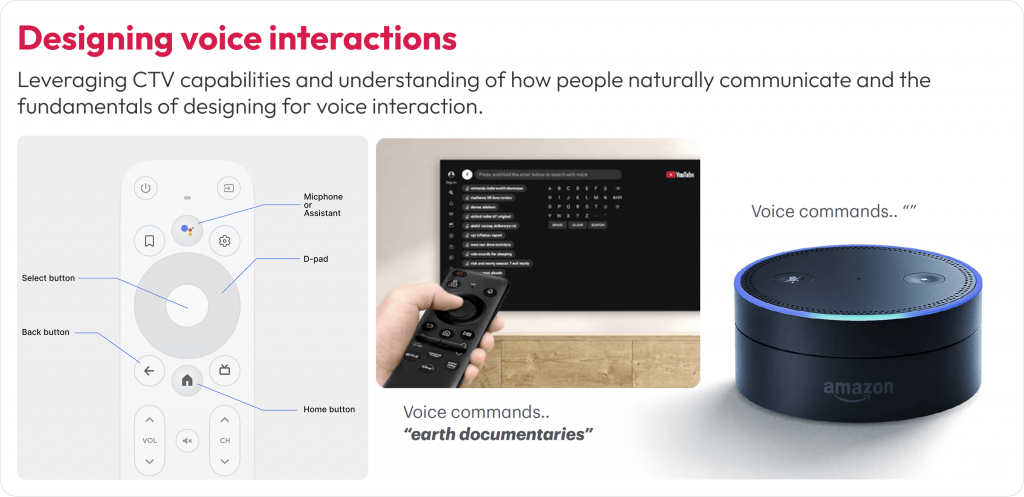

Viewers now expect streaming to work on every screen they own. What differentiates successful providers is how availability is delivered: instant handoff between devices, input-aware interfaces that feel native, and feature consistency with reliable performance across phones, tablets, browsers, and connected TVs like Roku, Fire TV, Android TV, Samsung’s Tizen, Apple TV, and Chromecast.

This fragmented yet converging environment demands a design approach that is deeply aware of cross-device expectations and platform-specific behaviors.

A typical user might start watching a match on their Android phone while commuting, continue on Roku or Fire TV at home, and later catch highlights on a Mac.

Challenges

Delivering this seamless experience comes with hurdles. High-quality streaming across multiple devices can strain bandwidth, particularly in regions with weaker infrastructure.

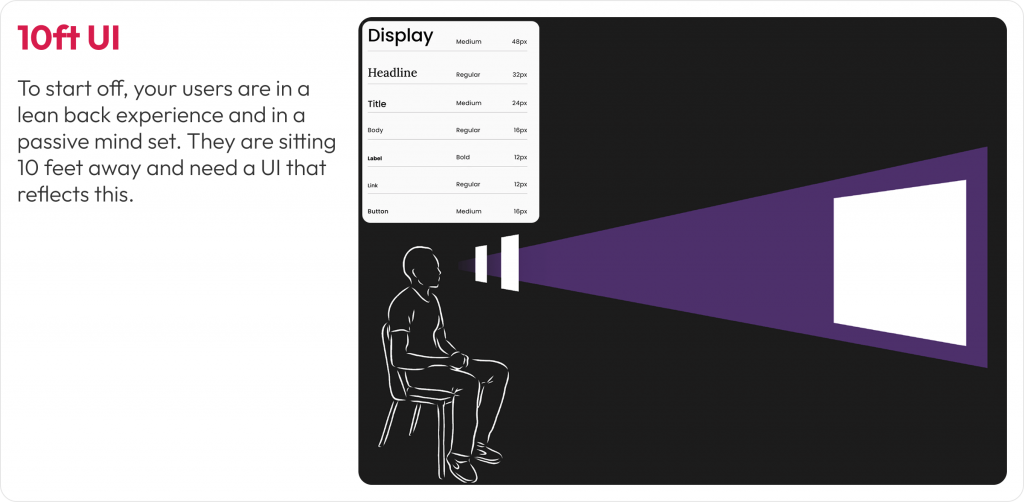

UX consistency is another challenge. Designing uniform yet adaptive interfaces requires careful integration across diverse screens. Costs also rise because each ecosystem has its own UI conventions and technical frameworks.

For example, Android relies on a back button, while Apple favors swipe gestures, and even their native players behave differently. Essentially, two different worlds to design for.

Solutions

OTT platforms are solving this by building cross-platform design systems that adapt layouts while keeping core interactions consistent. They also centralize playback state management, so sessions sync perfectly across devices.

Some platforms also invest in device-specific optimization, such as tailoring layouts for remote-controlled TVs versus touchscreens, to ensure a native feel without losing feature uniformity.

Immersive AR/VR interfaces could further expand what “multi-device” means in the streaming era.

2. Vertical drama

Vertical short-form content, typically in a 9:16 aspect ratio, is designed for mobile consumption. It delivers bite-sized, cliffhanger-rich micro-dramas (30–120 seconds per episode). These formats resonate strongly with Gen Z and Millennials, fueling a fast-growing corner of the OTT ecosystem.

In Q1 2025 alone, global in-app revenue from short-drama apps rose nearly 4× year-on-year, reaching about USD $700 million. Leading the charge, ReelShort and DramaBox not only secured the #1 and #2 spots globally with revenue growth crossing USD $490 million and USD $450 million in cumulative global revenue (Sensor Tower, 2025).

Challenges

The surge of vertical content introduces new hurdles for OTT players. Managing multiple aspect ratios is one. Long-form 16:9 content for TV, legacy 4:3 archives, and mobile-first 9:16 formats

Another challenge lies in adapting horizontal content into vertical formats, a process that is both resource-intensive and time-sensitive.

Finally, monetization can be tricky. Unlike long-form series, micro-dramas rely on high-volume engagement to sustain revenue, which not all platforms can scale effectively.

Solutions

To address these challenges, platforms are investing in advanced encoding and transcoding techniques that maintain quality across formats.

Many are also adopting AI-driven editing workflows to automate the repurposing of horizontal shows, reducing the manual overhead of content adaptation.

For monetization at scale, release cadences built around daily/serial drops, short ad pods designed for vertical feeds, and creator partnerships to keep a steady pipeline of snackable stories.

These approaches balance efficiency with audience demand for fresh, snackable content. Hence, vertical short-form content is emerging as an add-on and a critical differentiator shaping the next wave of OTT experiences.

3. Digital fan community

Building a strong fan community is becoming a core streaming feature. Beyond content libraries, platforms are expected to create spaces where audiences connect with each other and with creators. Social media tie-ins, in-app forums, and exclusive digital events help transform viewers into advocates, strengthening loyalty and retention.

Challenges

Creating sustainable fan communities is not as simple as adding a comment box. Platforms must balance moderation with freedom of expression, ensuring safe spaces without stifling interaction.

Engagement must also be continuous. Fan excitement peaks during a show’s release but often drops off between seasons. Scaling these communities is another hurdle, since extending from social media into owned OTT apps requires both infrastructure and resources.

Solutions

OTT providers are experimenting with multiple approaches. Netflix leverages real-time engagement on platforms like Twitter and Instagram during major premieres, while Disney+ extends the experience through virtual fan events for franchises such as The Mandalorian.

Dedicated tools like Disqus and Flarum enable forums within OTT apps, and platforms like TopFan provide direct-to-fan ecosystems across mobile and connected TVs.

Monetization opportunities also emerge through community features. Premium subscriptions, pay-per-view events, or exclusive behind-the-scenes access add new revenue streams while deepening emotional connections.

Effective tactics include embedding real-time commenting, hosting live Q&A sessions with creators or celebrities, and using analytics to refine features around audience behavior.

4. Offline viewing

Connectivity isn’t consistent everywhere, which is why offline viewing is a real differentiator. For example, in Brazil, even top networks like Vivo average 40.2 Mbps (Jan 2025, Opensignal), and in the UK, only 28% of connections are on 5G (Ofcom, Jul 2025), with clear urban–rural gaps.

Offline viewing lets users download content and bridge connectivity gaps. It gives uninterrupted access on flights, subways, or in areas with weak coverage, ensuring OTT platforms deliver on the on-demand promise regardless of network conditions.

Challenges

Supporting offline playback brings its own set of hurdles. Content must be protected with digital rights management (DRM) to prevent piracy, while downloads need to be compressed to optimize storage without sacrificing quality.

Platforms also face constraints around device and user limits, which are tied to licensing agreements and server management. Another challenge lies in clearly communicating expiration rules. Downloads that suddenly disappear can frustrate users and erode trust.

Solutions

OTT leaders such as Netflix, Prime Video, and Disney+ already offer downloads with device limits and expiry windows, demonstrating how offline viewing can be managed at scale.

From a technical standpoint, platforms rely on secure DRM, efficient compression algorithms, and plan-based limits to balance flexibility with licensing obligations.

Adaptive quality ensures that even low-storage devices can accommodate offline content, while in-app messaging helps set user expectations on renewal and expiry.

5. Multi-language support

As audiences demand content that feels closer to home, multi-regional language support and hyperlocal offerings will remain powerful differentiators. Cultural relevance not only drives emotional connection but also builds retention.

For U.S. platforms, this often means bilingual or Spanish-language options, while in global markets, regional dramas, local news, and vernacular content are key to building loyalty.

Challenges

Delivering localized and hyperlocal content is resource-intensive. Translation and dubbing must go beyond literal word swaps to capture cultural nuance.

Managing subtitles in real time introduces technical complexity, while maintaining authenticity requires local creative voices. There’s also the challenge of cost. Producing or acquiring regional content can strain budgets, especially when targeting fragmented markets.

Solutions

OTT platforms are already tailoring content strategies to meet this demand. Peacock and Hulu increasingly offer bilingual catalogs, while Netflix and Disney+ continue to expand Spanish-language libraries for the millions of Spanish speakers in the U.S.

Hyperlocal programming is also growing. The Roku Channel and Sling TV stream local news and weather, and Bally Sports+ caters to regional fan bases with coverage of teams like the Detroit Tigers and Dallas Mavericks.

To scale efficiently, platforms invest in regional content production, partner with local creators for authenticity, and use AI-driven subtitling and dubbing to speed turnaround times while reducing costs. Localized ad formats further enhance monetization by aligning with audience context.

6. Content recommendations based on behavior

Behavior-driven recommendations will soon move beyond simple watchlists. Features such as personalized trailers, dynamic ad insertion, and more precise regional suggestions are already emerging.

Deloitte’s 2024 Consumer Loyalty Survey found that 60% of users value tailored recommendations, confirming that discovery shaped by user behavior is now a core differentiator in streaming.

Viewing history, time of day, and location are analyzed to provide relevant and timely suggestions. This makes discovery easier, keeps users engaged, and reduces the likelihood of churn.

Challenges

Building effective recommendation systems is not without hurdles. Platforms must handle sensitive user data responsibly, balancing personalization with privacy and compliance requirements.

Another challenge is the risk of “filter bubbles,” where users are only shown familiar genres, limiting exposure to new or diverse content. Developing interactive formats that adapt to user choices also requires additional investment and technical expertise.

Solutions

OTT leaders have already demonstrated the value of behavioral recommendations. Netflix reports that close to 80% of its viewership comes from personalized suggestions, often tuned to patterns such as news in the morning versus movies at night.

Amazon Prime and Hulu tailor their catalogs regionally, highlighting Big Ten sports in the Midwest or Latino content hubs in California and Texas. These approaches ensure that recommendations are personalized and culturally and geographically relevant.

On the technical side, machine learning enhances streaming quality, predicts at-risk users for retention efforts, and even assists with content creation tasks such as storyboarding. Thoughtful use of these tools strengthens both user experience and platform efficiency.

At the same time, leading platforms are adopting privacy-first personalization models to ensure compliance with regulations like GDPR and CCPA while still delivering tailored experiences.

7. Free ad-supported streaming services (FAST)

FAST is now a mainstream part of the streaming mix. In May 2025, FAST platforms collectively captured 5.7% of total TV viewing in the U.S., underscoring their growing presence in mainstream consumption (Nielsen, 2025).

As economic conditions push many users to reconsider subscription spending, ad-supported models provide an accessible alternative. The platforms that balance user experience with effective monetization will continue to scale rapidly, shaping the future of free streaming.

Instead of charging subscription fees, these services provide content at no cost and monetize through advertising. With hundreds of free channels, platforms like Pluto TV, Tubi, and The Roku Channel are carving out a significant share of overall TV viewing.

Challenges

The FAST model introduces unique pressures. Too many ad breaks can frustrate viewers and lead to churn, while too few limits revenue potential. Balancing this ad load is a constant challenge.

Content quality and variety also matter. Audiences expect a wide variety of programming, and relying too heavily on older or lower-quality catalogs risks limiting engagement.

Solutions

Successful FAST providers optimize the viewing experience while keeping revenue opportunities strong.

Pluto TV, for example, has grown to more than 80 million monthly active users worldwide. It offers diverse channels in news, entertainment, and niche genres.

Tubi has surpassed 100 million monthly users, delivering over 1 billion hours of viewing per month with a mix of films, series, and originals. The Roku Channel also captures a substantial U.S. audience by leveraging its device ecosystem.

Key strategies include managing ad frequency to maintain user satisfaction, using AI-driven targeting for more relevant ad placement, and expanding offerings to include live sports, news, and local programming. These steps help FAST platforms compete not just with each other but also with subscription-based OTT models.

Hybrid monetization model

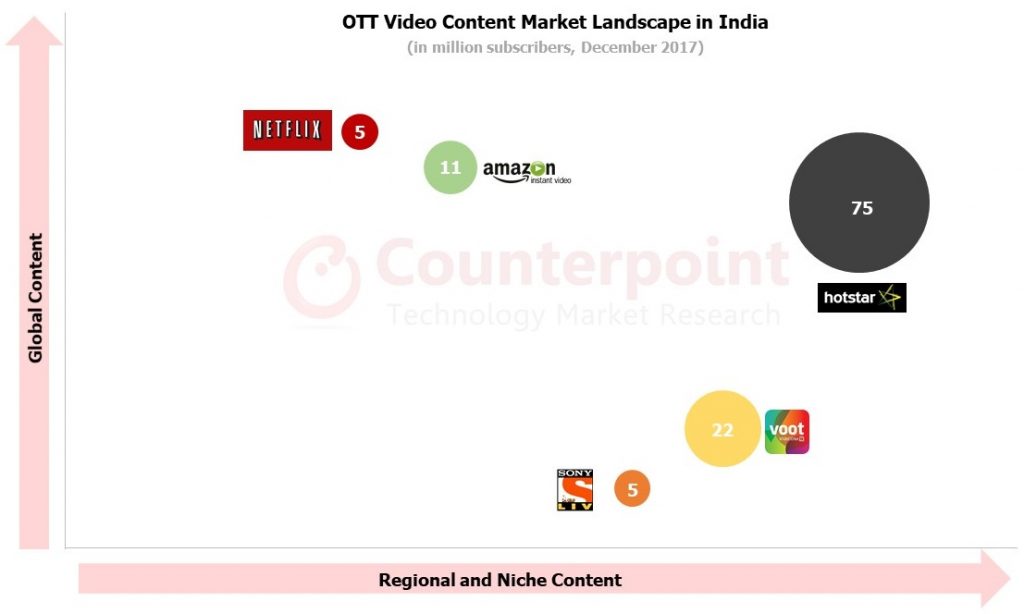

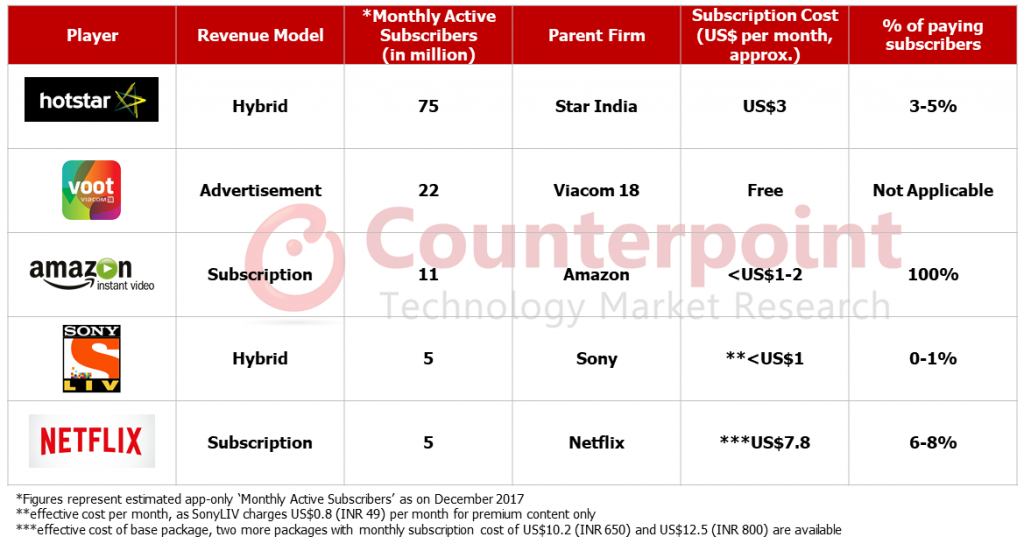

Hybrid monetization has become the standard for OTT platforms. Rather than relying on a single model, providers combine models such as subscription tiers, ad-supported options, and transactional pay-per-view.

This flexibility allows platforms to reach premium and price-sensitive audiences while maintaining steady revenue streams.

Challenges

Designing an effective hybrid model requires careful balance. Too many tiers can confuse customers, while poorly defined value between ad-supported and premium plans risks driving churn.

Integrating multiple payment models increases operational complexity, from billing to rights management. Another challenge is consumer perception. Users must feel that ad-free tiers deliver enough value to justify higher prices.

Solutions

Leading platforms demonstrate how hybrid models can work in practice. Hulu offers ad-supported and ad-free tiers, making users choose between affordability and convenience.

Peacock goes further, combining subscriptions with transactional options such as pay-per-view for live sports and special events. These strategies reduce reliance on a single revenue stream and adapt to varying consumer budgets.

Operational complexity can be reduced by using centralized billing platforms and integrated entitlement management, allowing providers to support subscriptions, ads, and pay-per-view under a single system.

Successful implementation often includes tiered plans differentiating value, flexible pricing to cater to different demographics, and bundled offerings combining services or perks. This approach helps platforms minimize churn while expanding reach.

Winning with differentiating streaming features

The OTT industry is entering a phase where success depends not on the number of features but on how seamlessly they work together to serve people across devices, cultures, and moments of engagement.

Every platform is an opportunity to reimagine how stories are told, how communities are built, and how technology can make entertainment more personal, accessible, and meaningful.

Differentiators like AI personalization, hyperlocal content, and hybrid monetization point to one truth: streaming is no longer just about access, it’s about creating lasting experiences.

At Robosoft, we see every OTT platform as a chance to advance that vision — to design and build solutions that meet today’s demands and anticipate tomorrow’s opportunities.