The banks and lenders today face a stern test of how they can reduce the customer attrition rate for their institutions. Today’s borrowers expect the onboarding and lending process to be fast and convenient – more and more customers now expect it to be done digitally without an actual visit to the lender’s premises.

It is the driving factor behind lenders going through a digital transformation for their services to provide the best customer experiences.

Digital Lending has been an exponentially growing global phenomenon over the past few years. It may have been initially dismissed as a ‘buzzword’ with no universally articulated definition, but the bold foray of Fintech startups and tech giants into the grey space has resolved all market doubts.

And the result has been spectacular.

The global market size of digital lending platforms reached a value of $8.6 Billion in 2021 and expected to reach US$ 20.3 Billion by 2027. This translates to a Compound Annual Growth Rate (CAGR) of 15.39% during 2021-2027.

Increasing consumer demands and expectations have created new markets for alternative methods of borrowing money. And businesses have been quick to understand the importance of customer experience as a differentiating factor. They are proactively leveraging the opportunity to drive efficiency, cut down on costs, and expand.

The competition in the post-pandemic digital lending market is intense, especially for the prime Millennial segment. With a plethora of such players in the market today, it is indeed becoming increasingly difficult for companies to differentiate their offerings. This is precisely where customer experience takes precedence. A great digital customer experience involves understanding user needs, creating a strategic design framework, creating design with emotion and empathy among others. With all other key variables being in a level field, customer experience in digital lending is set to be in the driving seat.

Digital lending: primary drivers of growth

Here’s a close look at the primary factors that are driving this revolution and contributing to superior customer experience in digital lending today:

Market Impact of Millennials and Generation Z

An influx of tech-savvy Millennials and Generation Z consumers into the financial markets has brought a fundamental shift in consumer ideologies and behaviors. ‘Instant gratification’ is the key for them and digital habits such as online food delivery, cab booking, and grocery/essential shopping has only reiterated this mindset. They have a stronger emotional connection with technology and new-age brands such as Apple, Uber, Amazon, and Google. The perceived ease of use and delight of digital-only products (e.g. Dropbox) is sought to be emulated across all digital experiences.

Hence, this is both an opportunity and a threat for financial organizations. To stay relevant in the market and fend off competitors, there was a dire need for both short and long-term financial instruments that fit into the profiles of such consumers.

Data Collection and Associated Analytics

The proliferation of smartphones in consumer habits is driving more than half of the traffic on the Internet today. With access to a number of digital services, engagement is being driven like never before. The result is an accumulation of data points that can be smartly leveraged by financial companies.

The silver lining? Lenders have the ability to actively analyze the spending habits and repayment schedules of users and profile them with unprecedented accuracy. With such abundant data sets, significant value in the financial sector can now be driven.

Added capabilities in their arsenal include:

- Generating new revenue streams via data-driven offers and recommendations.

- Extending better services and security features to customers, such as the detecting card frauds.

- Managing the risk of lending to customers by determining the probability of repayments.

- Leveraging Machine Learning techniques to connect relevant card members with the right merchants.

- Offering market insights to customers while boosting engagement and trust.

Introduction of Innovative Business Models

The inception of multiple digital lending business models to meet varying customer needs and regulatory requirements has only made the case stronger. With niche operations, companies are now able to reach customers who were not able to access financial services in the past. Innovation in space has fended off challenges related to geography, higher transaction costs, and transparency.

Primary digital lending models today include:

- Online and Mobile Lending Platforms: Offer end-to-end digital lending products via purely mobile or web-based platforms. The entire workflow of lending ranging from customer acquisition, loan distribution, and customer engagement is digital.

- E-commerce and Social Platforms: Lending is not the core value proposition of such platforms. They instead leverage it as an engagement strategy to boost customer retention and sales.

- Marketplace Platforms: A typical marketplace where specific algorithms match borrowers and lenders. An initiation or subscription fee is usually charged by lenders.

- P2P Platforms: Such platforms use profiles and data to match borrowers with institutional or individual lenders. They often include support for repayment and collection processes.

- Supply Chain Lenders: Short-term and digital working capital loans for SMEs for various needs such as purchasing inventory from distributors or pay-as-you-go financing.

- Tech-powered Lenders: Traditional lenders with digitized lending processes that include digital acquisition channels and repayment options.

Enablement of Regulatory Environments

With the economic benefits of digital lending now evident, governments around the world have been embracing the shift. In fact, they have been coming up with regulatory frameworks that protect the interest of all the involved stakeholders. Prominent motivators in the sector by global governments include:

- Issuance of Bit Licenses by the US Government for businesses that deal in cryptocurrencies.

- Drafted rules for digital lending, such as the ‘Guiding Opinions on

- Promoting the Healthy Development of Internet Finance (GOPHD)’ by central regulators in China.

- Implementation of India Stack, an open architecture platform for authentication and data access in India.

- European Union’s PSD2 (Second Payment Service Directive) regulation enables customers to share sensitive financial data through secured third-party APIs.

With a legal and officially recognized framework of operations, market inhibitors have been efficiently combated. For instance, due to the legal, regulatory vacuum in China, ‘shadow banking’ participants prevailed in the market. This often led to funding mismanagement and liquidity issues for key stakeholders.

Better Speed of Operations and Lower Costs

Digital lending is backed by technologies that eliminate operational bottlenecks and significantly speed up the process of loan approvals and dispersals. An ideal tool can automate the underwriting and approval processes. As a result, lenders are now able to:

- Execute real-time data assessment for application approvals or rejection.

- Undertake quicker loan decisions and maximize customer engagement.

- Constantly monitoring the creditworthiness of borrowers.

At the same time, digital lending business models are much more cost-effective than traditional banking models. Lenders do not have to maintain brick-and-mortar structures or pay for expensive legacy IT systems. Hence, with a significantly lower cost structure, customers receive more affordable loans and access to new financial tools.

How to build a great customer experience in digital lending

The first step to building a great customer experience in digital lending begins with the onboarding process. The very first contact with your website, company and services need to leave a lasting impression. You need to prove why your lending terms are good for users, how they can get money, and which services might be in their scope of interest. The whole interaction should make the potential customers familiar with your services. It inadvertently increases the chance of them wanting more and coming back often to you. Below are 5 ways you can enhance the customer experience to lower the churn rate.

4 Ways to Enhance Customer Experience in Digital Lending

#1. Allow customers to self service

Lenders can provide a good customer experience by eliminating excessive or unreasonable document requests or the submission of multiple applications for multiple products. They can include provisions for easy-to-use and quick processes such as eKYC, e-sign and digital locker with intuitive third-party integrations. Also, easy access to credit scores from the relevant credit bureaus and the subsequent verification of documents in real-time enhance the experience.

A borrower will need more than just necessary product information to make an educated choice. A website or app that can provide support related answers to all their queries across the platform is what every customer requires. Allowing such self-service capabilities improves consumer satisfaction levels, customer retention, and increases conversion rates. User-friendly design, cohesive domain, and consistent web design show customers that they can trust you.

#2. Maintain consistency across all touchpoints

Modern borrowers expect an omnichannel experience from their lenders.

People using digital lending services often switch between devices before completing the activity. Today lenders need to understand the importance of cross channel journeys and the need to extend innovative cross-channel integrations. Also, frictionless digital experiences with near-real-time accountability and continuity across digital and in-person experiences go a long way.

Successful digital lending customer experiences are the ones that deliver a truly seamless multichannel experience.

#3. Adopt financial technology

The time is now for lenders to catch up with the latest technologies to find great opportunities to improve their customer experience. Enhanced security of platforms using biometrics such as voice identification and eye scanners is a great example of how digital is improving the lending business in appeasing customers. Not only this, lenders now have provisions in place for detecting frauds and integration with payment gateways for quicker decision making and disbursal.

Old obsolete banking systems are one of the major attrition factors for lenders as customers now have multiple options to choose from. Good-architectured mobile apps, statistically, have lower churn rates after customer onboarding. This is because the majority of users download an app following the reviews in the Play Store or App Store or recommendations of friends or relatives.

However, when developing an app, consider making it easy to navigate. Solutions with everything at hand are highly appreciated by customers.

#4. Curate personalized customer experience

Personalization and segmentation of messaging and services using marketing automation tools such as CRM systems help a lender stay relevant in this highly competitive market. Successful lenders offer relationship and loyalty pricing tiers and exclusive benefits in a bid to boost retention. They also extend real-time visibility into the status of applications and deliver effective customer-centric communication.

Lending institutions need to leverage customer data to capture untapped opportunities for personalization. According to HubSpot, 59% of customers value the personalized banking experience approach over response speed when it comes to customer service.

Transforming the loan origination journey

#1. Customer Acquisition and Data Capture

Banks use a combination of online channels like emails, social media, SMS blasts, AI chatbots, etc. to attract customers and gather customer data. Banks then use this data to curate personalized digital lending offerings to the customer in an attempt to acquire them to offer their services.

Once the customer data is acquired, banks use the eKYC (electronic Know-Your-Customer) system to automate identity verification. The customers no longer need to physically visit a facility to submit documents for verification. The majority of eKYC platforms also give users access to public or private sector records, which can be useful when a bank wants to improve the quality of its customer data.

#2. Analytics & Data Consumption

Digital lending is mostly about having access to more data and using that data to generate more precise, timely, and automated underwriting decisions. Banks can quickly rate customers and make credit decisions automatically by deploying sophisticated algorithms and data.

A lending software called a Loan Origination System (LOS) uses relatively little manual intervention to automatically gather customer information from pertinent sources, score their credit, and make loan credit choices. The data is loaded into sophisticated algorithms or a ready-made solution to forecast customers’ ability and willingness to repay. The result is obvious: decisions are taken quickly, turnaround times are shortened, and customer satisfaction levels are raised.

#3 Disbursement and Repayment

In the case of digital lending, banks use digital means to both remotely disburse loans and collect repayments. Effective channels for loan disbursement and repayment from partners include things like mobile wallets and e-commerce accounts. By removing pointless paperwork, these cashless channels demonstrate that operational efficiency may be increased.

Additionally, they offer a transparent audit trail, which can help lenders stop fraud. Banks can also consider a Loan Management System if they wish to get a comprehensive perspective of each customer’s lending journey. Customizable repayment plans and durations, aid banks in the proactive identification, classification, and management of loans.

#4 Collection and Asset Management

Data and algorithms are used by banks to support their collecting efforts. Software called Loan Collection System can also assist banks in streamlining disbursement and repayment.

Digital loans, like other loans, include delinquent borrowers being blacklisted and losing access to future credit, which can be a great motivation for them to repay. To help customers comprehend the long-term financial consequences of a bad credit score and to minimize collection efforts, banks are advised to provide them with the required information.

#5 Customer Engagement

By utilizing digital channels and client data, one may create an intuitive, practical, and customized customer experience. This is a two-way communication that involves both inbound (borrower to lender) and outbound(lender-to-customer) channels.

Banks analyze a customer’s spending pattern and send them personalized messages, reminders, and product offers. Customers also can take control of their loan account and manage repayment schedule, raise complaints, ask queries via simple SMS services, contact center help, self-service portals, chatbots etc. This clear open two-way communication enhances a bank’s effort to improve customer experience at every touchpoint of the customer’s digital lending journey.

Additional tips to design a human centric borrowing platform for customers

Appeal to the rational mind

When it comes to money, the rational mind takes over the emotional mind for humans. And if someone had a bad lending experience previously, they are less likely to entrust a new lending platform. Thus, it is important to be as transparent as possible in all the digital lending steps from onboarding to payback by customer. Despite all that, some customers just won’t use your platform more than their utmost requirements and you have to accept that fact.

Give back control to customer

People like to be in control of their finances. A lending platform that allows customizing loan offers based on loan tenure, loan amount, repayment dates, repayment modes, etc. will always be preferred by customers. Designing the app for simple navigation and actions allows customers to have a great experience during the whole lending process.

Keep it simple

Customers already feel overwhelmed by their monetary needs, they don’t need a poorly designed app to add to their misery. The whole process of onboarding, loan assessment and EMI calculation, document uploading and verification, and loan disbursement should be as simple as it can be. Every step should be clearly instructed on what’s been asked from the customer and how to proceed further.

Build intelligent chatbot AI

Another factor that can surely enhance customer experience during the whole lending process is the presence of an assistant. An intelligent chatbot AI can actively help the user to not only guide to their required sections in the app, but also provide necessary information on the go to help ease the whole process.

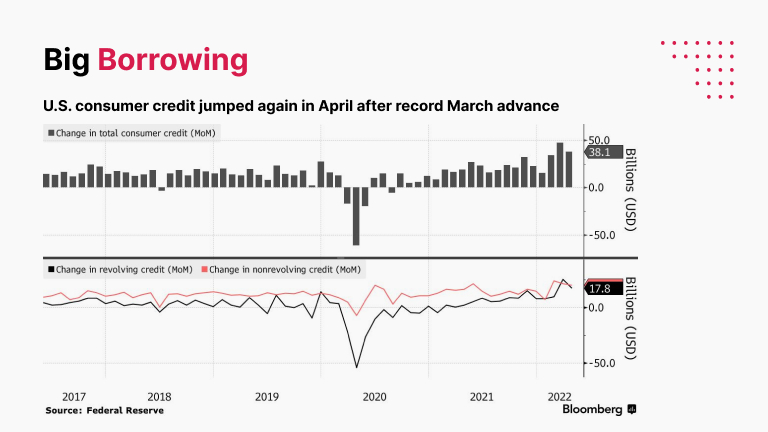

Consumer credit market trends in the USA

The immediate effect of the COVID-19 pandemic saw a dramatic slowdown of unsecured credit products such as personal loans and credit cards when compared to previous quarters. However, after the reopening of America and the expected addition of jobs and wages helped turn around the declining trend and enable consumers to manage their debts going forward. The US consumer borrowing witnessed a month upon month surge in March-April 2022. This growth was aided by rising prices and continued purchasing power of American consumers.

As the image below shows, the total credit increased $38.1 billion from the prior month after a downwardly revised $47.3 billion gain in March.

Source: Bloomberg

Digital Lending Platforms: many players, many intents

Let’s take a quick look at the existing digital lending ecosystem and look at what global market players are offering in this space:

- U.S Bank: Recently launched a digital lending platform that automates the process from application to funding. Applications can be submitted and reviewed on any device and borrowers can even review loan terms remotely and electronically sign documents. And with an integrated ecosystem, customers can initiate application processes on one channel and pick them up on another.

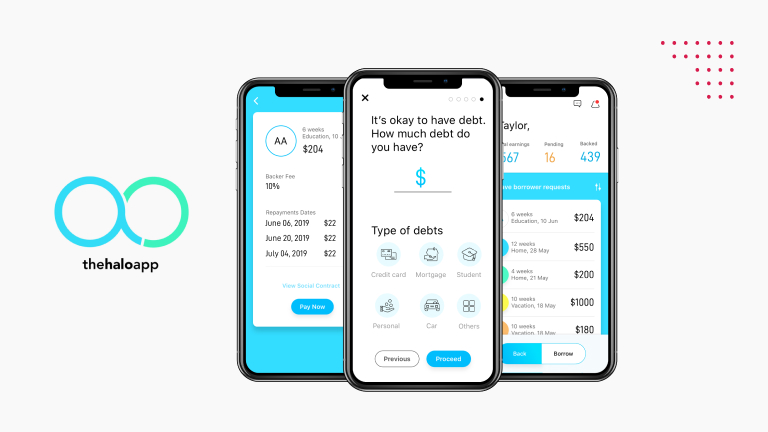

- The Halo App: This is a peer-to-peer digital lending platform that leverages an intuitive mobile application to connect borrowers and lenders. It has been specially created to cater to the small-dollar loan requirements of users. It is borrower-centric in the sense that they can slice their payments into smaller pieces. Lenders are available round the clock and borrowers can receive instant cash.

- Kabbage: Dedicated platform for entrepreneurs and small businesses that provides them access to up to US$250,000 in loans. It takes users just 10 minutes to verify their eligibility. A highlight of the platform is the elimination of origination fees and prepayment penalties. And with an integrated interlinking of business-related information, users can drive automated financial reviews.

- Faircent: a P2P lending platform that ‘connects individuals in need for credit with individuals and institutes willing to lend their access funds’

- TurnKey Lender: Intelligent and all-in-one lending automation platform that leverages AI and big data to streamline the elements of a lending process. This ranges from origination to underwriting and servicing to the collection.

- Better: Better provides mortgage lending, real estate, title insurance and homeowner’s insurance while removing lender fees and commissions. Better’s lenient lending policies and large agent network resulted in acquiring more than $400M in funding and providing $7.9B in home loans to date.

- PayPay: PayPay is a fintech giant in Japan who is revolutionizing cashless payment. It has more than 47 million customers and offers a range of financial services, including banking, securities, loans, investments, and insurance, to services available across various scenes, such as tax & bill payments, online shopping, restaurants, hotels, and more.

- Open Lending: Open Lending serves automotive loan borrowers using big data and high finance to provide risk modeling and decision-making software. The company’s Lenders Protection solutions help lenders utilize proprietary data and advanced decision analytics to increase near and non-prime auto loan volumes, leading to higher yields with less significant risk.

- SALT Lending: The unique feature of SALT is that it lets borrowers leverage their cryptocurrency for loans. Borrowers can agree to terms ranging from one to 36 months on loans available for Bitcoin, Ether, Litecoin and Dogecoin. It uses blockchain evidence-based, chain-of-custody smart contracts to ensure the crypto is safely transferred. After its huge success in the US, SALT is now expanding its business to countries like New Zealand, Brazil, Switzerland and the U.K.

- OnDeck: OnDeck is a B2B digital lender which provides personalized loans and lines of credit to small and midsize businesses. Businesses can identify the type of business they operate (restaurant, retail, tech company, etc.) and even define the purpose of the loan (expanding business, hiring employees, etc.). OnDeck accordingly personalizes the payment structure that best fits the situation.

The Verdict

As we venture into a bold new era of digital lending, customer experience is set to play the lead role in the story of financial empowerment. Lenders that can smartly manage ever-changing customer expectations, emerging technological capabilities and shifting market conditions will always be a step ahead of their competitors. As sources of consumer data grow every year, lending institutions will be able to increasingly focus on consumer needs.