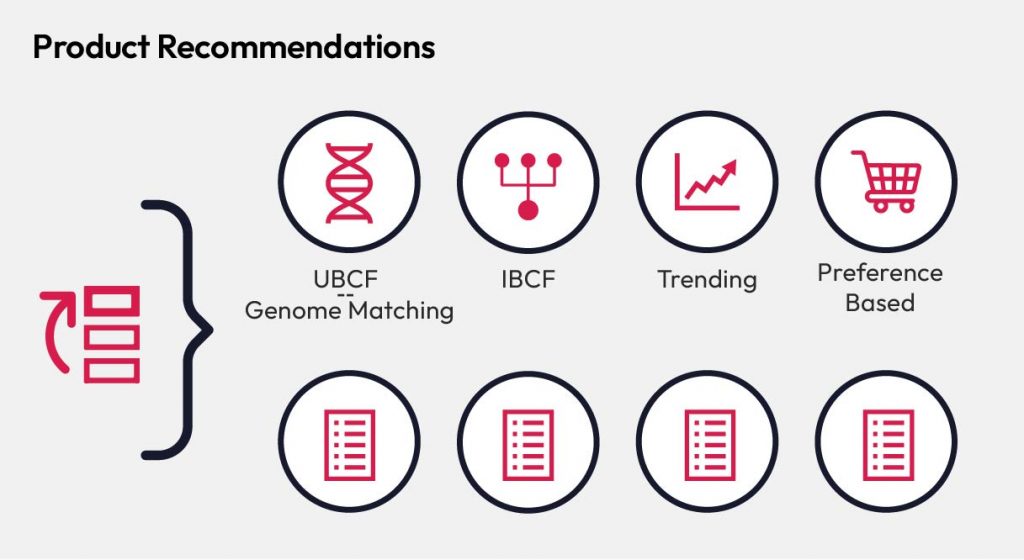

Recommendation systems are powerful tools that guide customers to relevant products and services. Yet, they often face significant challenges, particularly when dealing with sparse data from new customers or unexplored product offerings. In this blog, we’ll dive into four types of product or service recommendation systems:

- User-based collaborative filtering

- Item-based collaborative filtering

- Trending

- Preference-based systems

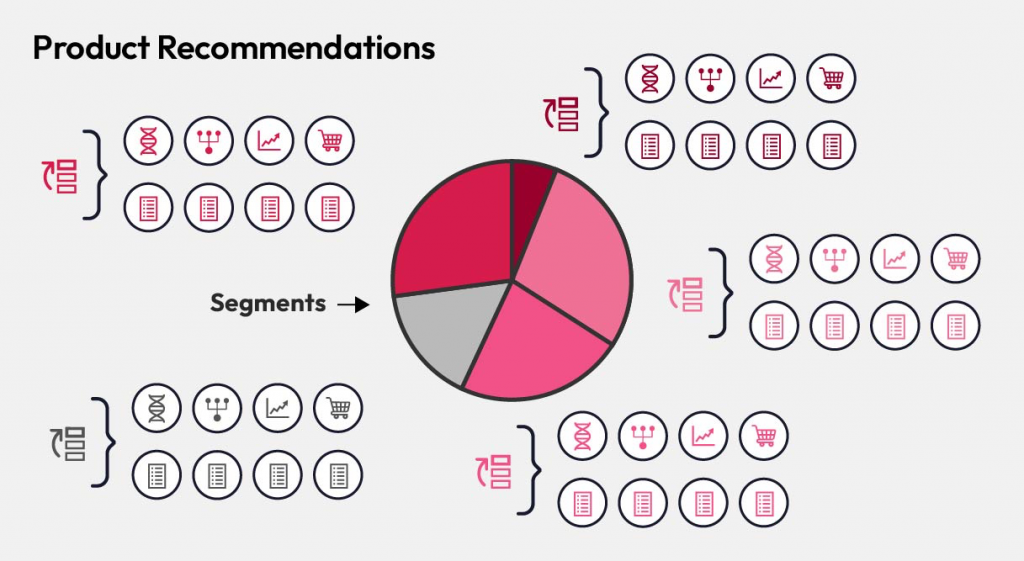

Next, we’ll review how a hybrid system works to curate the best recommendations from multiple models, like those mentioned above. Finally, we’ll explore why applying hybrid systems at the customer-segment level can improve accuracy even further, rather than using a generalized approach across the entire customer database.

Types of recommendation systems

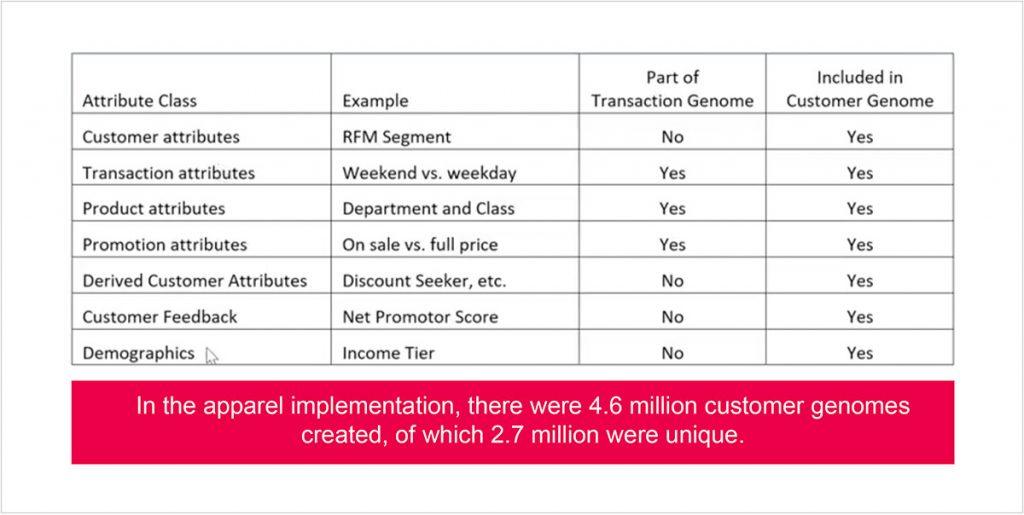

1. User-Based collaborative filtering

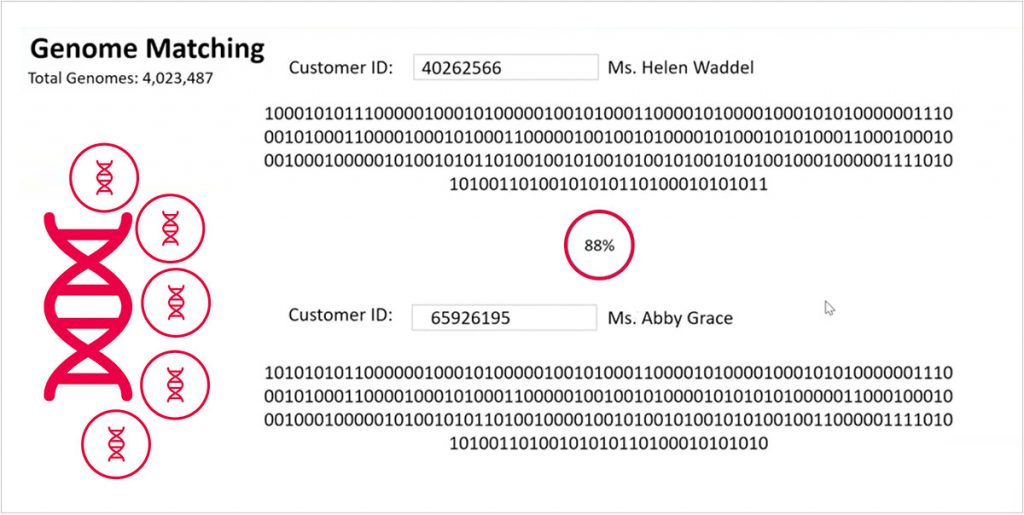

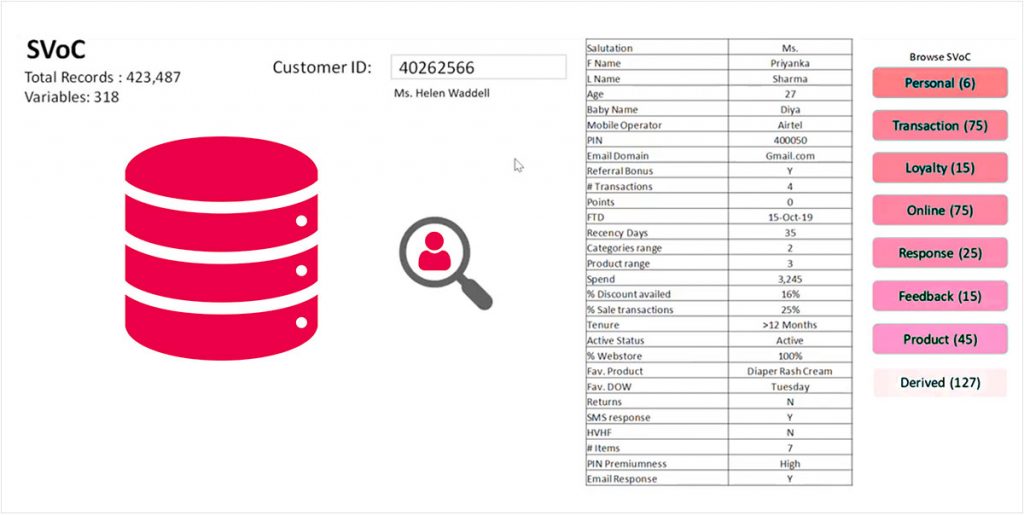

User-based collaborative filtering is a popular recommendation engine algorithm that connects similar users based on their past behaviors. Essentially, it identifies users with comparable tastes and recommends products that have interested those users. However, it requires a large dataset to work effectively, as it relies on finding significant overlaps in user activity. A more recent approach within this category is genome matching, which creates a detailed profile of a customer based on numerous attributes, even if they are new. By comparing these profiles using methods like cosine similarity, we can infer what new customers might like based on what similar, more established customers have enjoyed.

Genome matching

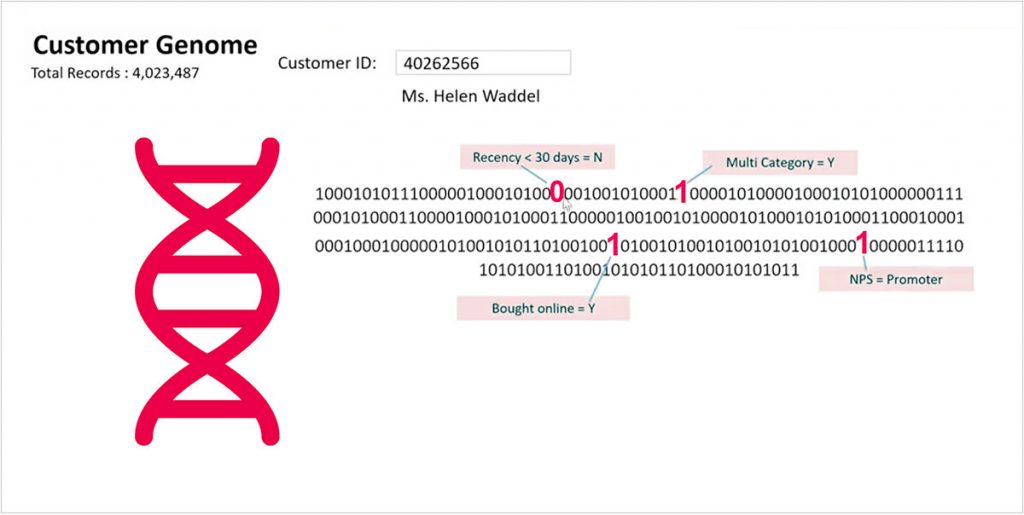

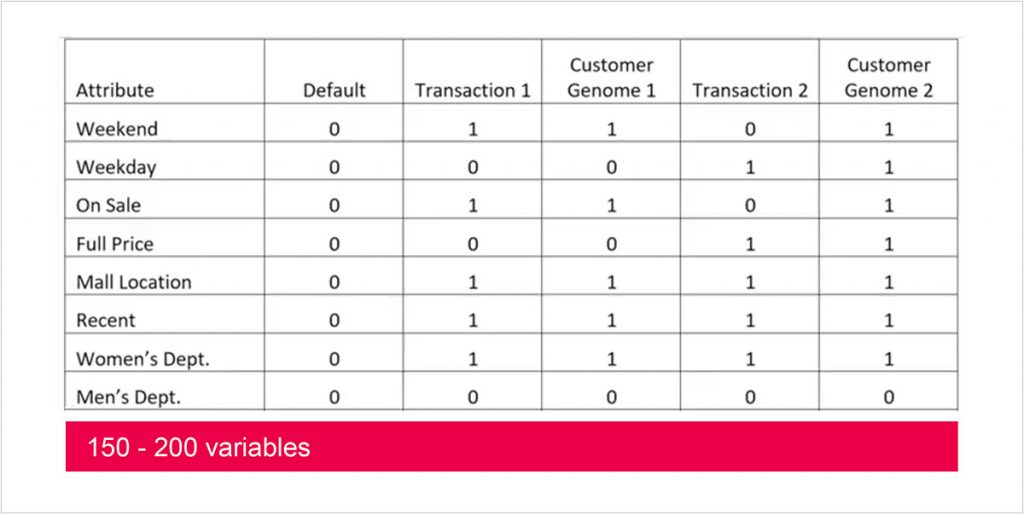

Genome matching is a more advanced technique under user-based collaborative filtering. It involves creating a detailed profile of customers using numerous binomial variables (e.g., time of day of purchase, discount usage, etc.). By mapping new customers to similar profiles of existing customers, marketers can derive meaningful insights and make more accurate recommendations, even with limited initial data.

If you’re a marketer deeply invested in understanding your customers, read our blog about the “Customer genomes approach” – Solving the cold start problem in recommendation systems.

2. Item-based collaborative filtering

Item-based collaborative filtering takes a different approach by focusing on the relationships between items rather than users. This method suggests products that are frequently bought together. For example, if a customer buys a hamburger, the system might recommend fries. This approach is effective in providing relevant suggestions based on item-to-item correlations and is reliable for delivering useful recommendations.

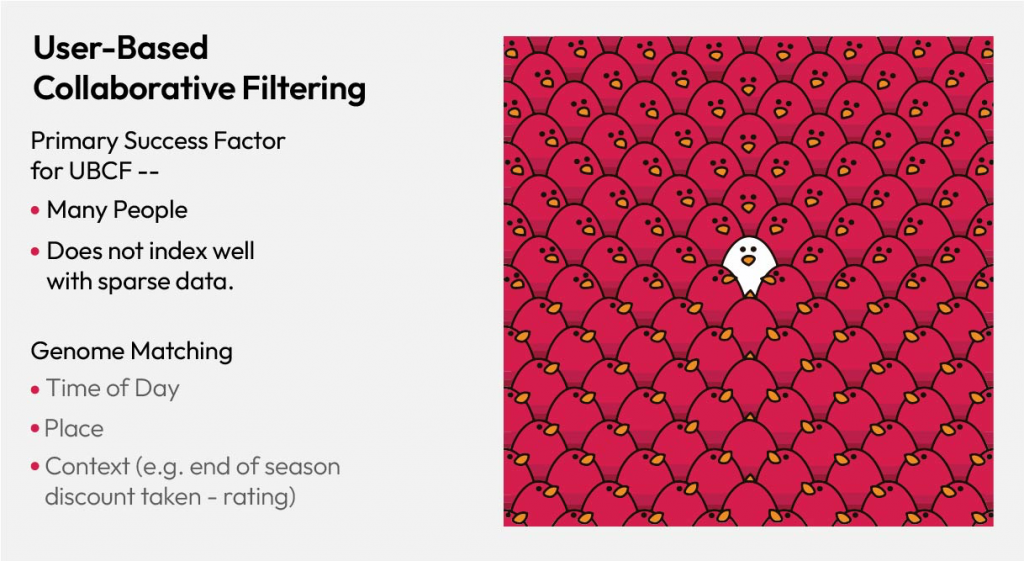

3. Trending (Hot selling)

The trending or hot-selling approach highlights what is currently popular among users. By stack ranking products or categories, marketers can feature items that are in high demand. This method works well for surfacing popular items and can be particularly effective in categories with high turnover or seasonality. For instance, dynamic environments where trends change rapidly, such as fashion or tech gadgets. Determining the right level of granularity and excluding less relevant attributes (like size) are key to making this approach work.

When implementing it’s crucial to consider the granularity of the categories. For example, while stack ranking by size – may not be effective, identifying trending categories and then tailoring recommendations within those categories can be highly impactful. The “last mile” in this process involves fine-tuning recommendations based on additional factors like size preferences or introducing the latest variants of popular products.

4. Preference-based recommendation systems

Preference-based systems analyze individual purchase patterns to identify tendencies toward certain categories or types of products. If a customer frequently buys formal pants, the system will continue to recommend similar items, keeping in mind the latest trends within that category. This method personalizes recommendations based on observed preferences, ensuring that suggestions remain relevant over time.

The hybrid approach: Coalition recommendation systems

A coalition recommendation system, also known as a hybrid recommendation system, combines multiple recommendation methods to enhance accuracy (as shown in the below image).

By evaluating and integrating suggestions from user-based, item-based, trending, and preference-based models, it determines the most relevant products to present. The hybrid approach increases confidence in recommendations, especially when multiple models suggest the same item or when a model has a high confidence score based on recent performance metrics like Mean Average Precision (mAP).

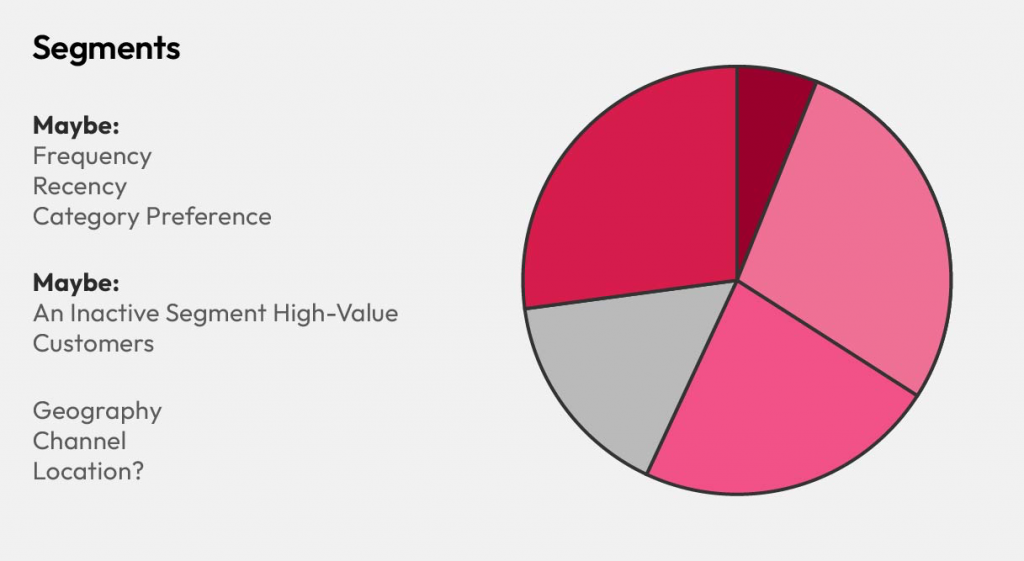

Enhancing accuracy with customer segments

Applying hybrid systems at the customer-segment level rather than a one-size-fits-all approach can significantly boost accuracy. Customer segments can be based on various factors such as geography, shopping frequency, recency, or product category preferences.

By tailoring recommendations to these specific segments, marketers can deliver more personalized and effective suggestions. This nuanced approach combines customer segmentation with the precision of coalition recommendation systems, leading to more accurate and engaging customer interactions.

Conclusion

We explored various recommendation models and how combining them into a hybrid system can significantly enhance accuracy, especially when tailored to specific customer segments. This approach allows marketers to better understand and meet their customers’ needs, leading to improved engagement and business success.

In summary, using a mix of different recommendation techniques enables the creation of highly accurate and personalized customer experiences. When combined with customer segmentation, the coalition approach ensures each recommendation is relevant and effective, driving engagement and satisfaction.

By continually refining these systems and incorporating the latest techniques, marketers can stay ahead in the ever-evolving landscape of recommendation systems and deliver the best possible experience to every customer.

Next steps

Refer to this eBook for more details on retail transformation and consumer solutions. At Robosoft, we’re revolutionizing retail space by focusing on hyper-personalization and dynamic user experiences. If you’re a marketer, partnering with us will redefine:

- Omnichannel experience: Immerse your customers in a unified commerce shopping experience with seamless online/offline integration.

- Real-time analytics: Enhance your inventory management, demand forecasting, and personalized customer recommendations.

- Customer Data Platform (CDP): Organize, segment, and digitally enhance your customer data for better insights and actions.

Connect with us to unlock the power of data-driven retail marketing.