The automotive industry is one of the major industries that has witnessed a massive digital transformation in recent years. Digital is revolutionizing the automotive experience for consumers. The recent innovations in automobiles are designed to complement the overall driving experience of a consumer. One could even go on and say there is a clear shift from RPM (Revolutions Per Minute) to EPM (Experiences Per Mile) when it comes to customer needs from their automobile. The industry must quickly find new ways to adapt to this growing customer need or risk being left behind. One major factor of digital transformation is mobility where customers want to get everything done from their always evolving smartphones. But the future of mobility in the automotive industry doesn’t lie in the features offered for the vehicle but lies in redefining what “moves consumers” emotionally when they purchase an automobile.

Here are 5 trends on how the automobile industry is evolving to meet changing consumer behavior and expectations.

Customer experience and behavior trends in automotive industry triggered by digital transformation

1. Automobile buying experience shifting from physical to digital

The traditional model of car buying experience involved physical visits to the car dealerships to know about the cars and their features before deciding to purchase one. However, two disruptions in recent years have somewhat changed the entire complexion of this car buying experience.

The first major disruption was the emergence of the mobile-first generation with the purchasing power who value experience over possessions. And the second disruption was caused by the pandemic which forever changed the way a few industries and their customers operate and behave. The pandemic prevented customers from visiting the commercial premises and the dealerships too started closing to prevent the virus from spreading. These two disruptions, on top of the arrival of technologies such as AR/VR, 360-degree views, and standardizations in other areas, have made Digital possible in the car buying space and accelerated the digital transformation.

[su_youtube url=”https://youtu.be/kt3e-90JTQ4″]

In one of their insights, McKinsey validates the importance of car dealers having a digital presence for their customers. The report suggests the purchase intent of customers mainly using digital channels dropped by only 2 percent while for offline buying journeys the purchase intent dropped by 8 percent post-pandemic. As digital is becoming increasingly important in the automotive buying experience, those brands that dive in and create brand affinity through experience on the digital channel are reaping the benefits.

[su_spacer size=”10″]

[su_spacer size=”10″]

2. Auto manufacturers and OEMs must adopt a retail approach for digital-savvy customers

Leading e-commerce brands not only changed the retail industry forever, but they also trained consumer minds to expect a retail service in every other industry, the automotive industry included. The abundance of information and availability of data along with the latest technology made it possible for modern consumers to do thorough research and compare the products themselves, replacing the need for in-person discussions.

The post-pandemic era saw more and more consumers choosing a digital-first approach for many touchpoints of their buying journey. In this approach, the customers are demanding online platforms that enable accurate product searches and comparisons which in turn enables them to finalize buying decisions online.

It may be noted that so far very few auto manufacturers like Tesla and Mercedes Benz have adopted a direct-to-consumer e-commerce approach. This is a unique opportunity for auto manufacturers to create a competitive advantage by positioning themselves as digital innovators.

3. Seamless customer experience journey management with digital adoption

Customers now have the privilege to enjoy the benefits of a connected vehicle making it safer to drive and less stressful. This increased connectivity not only improves the overall driving experience, but also enables the vehicle to generate and process a large amount of customer data for a more seamless experience.

However, there are still some areas of improvement in handling such a large amount of customer data by the dealerships and OEMs. Since most of the dealers still rely on physical processes in the customer journey, it invites greater chances of human error in data handling. With proper digital systems in place, making the jump from physical to digital will eradicate such minor issues leading to better management of customer journeys. Once you assess the viability of digital transformation in your organization and adopt the way, it opens up a world of opportunities for you. Adopting a digital approach minimizes errors, makes your team more agile and responds better and faster to clients’ requirements. As a result, it improves customer experience operationally as well.

Mercedes-Benz was looking for a solution to better serve its customers in Brazil, which has the second-largest plant followed by Germany. They invested in a Microsoft Azure cloud solution coupled with Power BI and Cortana Intelligence to map their sales processes, and analyze decades worth of data like license plate records, macroeconomic indicators, regulations, sales information, and statistics by each region of the country. Through this change in data analysis and interpretation model, Mercedes-Benz was able to:

- Provide 180 service locations around Brazil with consistent, actionable information to ensure each location could provide accurate proposals to their clients.

- Assist sales reps to engage with consumers proactively before a need is even expressed with the help of predictive analysis.

- Support employees in engaging and serving customers better, and in improving overall customer experience and satisfaction.

Digitization enables manufacturers to identify additional customer touchpoints to make them understand the customer better. They can now better understand what motivates customers to defect to other brands before it happens and find resolutions for these issues.

4. Possession or ride experience – changing preferences

According to a survey of 7000 people by Accenture, 48% of respondents said they would consider giving up car ownership in favor of using autonomous mobility solutions. Another research by PwC suggests that by 2030, more than 1 in 3 kilometers driven would involve sharing concepts. These researches point to a shift in the attitude of car owners from possession to ride experience. Personal mode of transportation is being avoided by the younger generation in favor of mobility solutions like ride-sharing, subscription models, or even rental services.

This changing scenario is forcing manufacturers and dealerships to find new ways to keep their customers satisfied and loyal to them. One such example would be Porsche launching its ‘Porsche Passport’ service back in late 2017. According to this service, Porsche customers could pay a fixed fee per month in return to use up to 22 different cars based on their needs or desires. The idea was to offer greater flexibility to customers in terms of options to switch along with insurance, maintenance, and roadside assistance. The whole idea underscored the need to cater to consumer experience rather than ownership.

5. Increased focus on both purchase and service experience

As mentioned previously, digitization offers auto manufacturers and OEMs a larger pool of actionable customer data. Companies can collect and connect millions of such touchpoints from call centers, surveys, dealer management systems, and communications to visualize each customer journey. The companies can now use this visual map to better monitor and action planning of each customer’s journey experience by appointing “journey owners”. Thanks to technology, dealerships can offer IoT based servicing and car care to their customers.

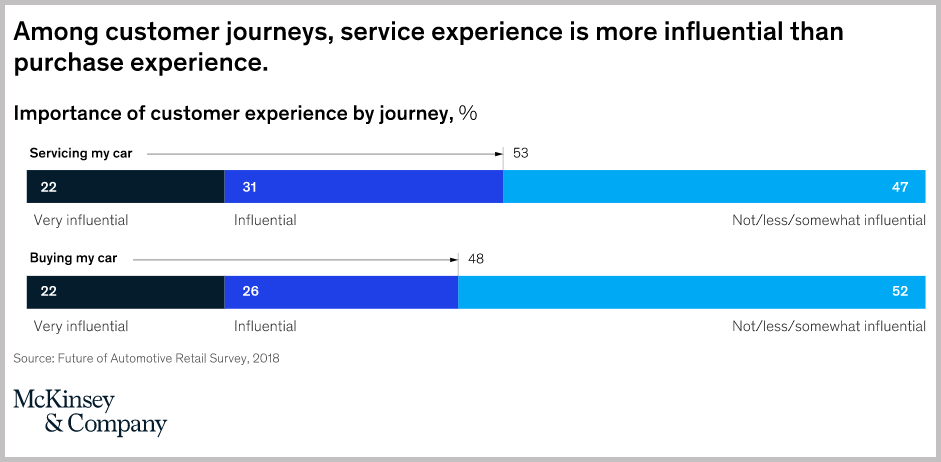

A survey by McKinsey & Company shows almost 50 percent of customers believe a better service experience is more influential than the actual purchase experience in the customer journey.

As millennials are increasingly becoming the foremost segment in car ownership, it is becoming more difficult for dealerships to attract them with the traditional approach. This customer segment is accustomed to instant gratification in the digital space and hence very time-intensive. Dealerships who cater to these specific requirements from the millennials along with their other services will increase conversions and thereby increase revenues.

Digital Transformation is building a case for CASE to improve CX in the automotive industry

The automotive industry is in a state of continuous disruptive transition. Newer technologies like AI, ML, AR, Big Data are influencing the customer experiences more and more with each passing day. Dealerships are using eCommerce as an option to improve customer experiences or sell their products be it vehicles, automobile parts, or even accessories. For example, we can see how Tesla has included artificial intelligence, solar panels & electric vehicles in its portfolio.

Customers are now experiencing newer vehicle capabilities and changing behavior according to newer realities and increased convenience. This led to the industry aggressively shifting gears and setting forward on an ambitious new course: “CASE”— the push for more Connected, Autonomous, Shared, Electric vehicles, and mobility solutions.

Connected

A fully connected car relies on three pillars of connectivity – infotainment, infrastructure, and telematics.

In today’s digital age and mobile-first generation, customers are expecting similar seamless experiences everywhere. The same expectations are there from newer vehicles in the market. These expectations include everything from high-quality infotainment systems for passengers to assisted driving and parking with payment from the dashboard.

People can now watch movies, use Google Maps, listen to music with Bluetooth connectivity, and more thanks to connectivity capabilities like Bluetooth and Wi-Fi. Smart vehicles detect drivers’ sleepiness, and the galvanic skin-response sensors can give a metric for stress to warn the driver and avoid any harmful accidents. On the outside of the car, radar, cameras, and laser scanners can “read” the road and then respond. All the above features and more come preloaded or customized based on the demands of the consumer.

Automotive telematics assesses the driver’s behaviors from timely insurance payments to driving routes. It also can be used to optimize the fleets in a car-sharing model. Automobile manufacturers have released their own telematics apps that connect with their selected cars. Honda Connect lets your car get connected with Amazon’s Alexa provides over 32 ingenious features for the safety and convenience of the riders. Similarly, Suzuki Connect lets you connect with the car and offers dynamic attributes such as 24X7 roadside assistance, driving analytics reports, functional alerts, live vehicle tracking, and many more.

Autonomous

The vehicles are being manufactured with the increased ability to safely operate with less and eventually no input from the driver. With no driver, the autonomous vehicle experience is all about making an impactful product design. The driving pattern of automated cars can be algorithmically optimized, increasing the capacity on any highway.

Although with autonomy comes the fear of the unknown and being out of control. It is our innate human nature to be in control of things to feel calm. So here is an opportunity for automakers to make it a much more fulfilling experience for customers via the following:

1. The rider of an autonomous vehicle is quite likely to experience anxieties arising from loss of control. It presents a huge opportunity for CX to help calm the rider by providing several inputs and communications.

2. From a servicing perspective, the car can book a servicing appointment and drive itself to the service station at the scheduled time and return after servicing.

3. The rider can use their mobile to summon the vehicle when required.

[su_note note_color=”#e6e6e3″ text_color=”#2f312f” radius=”4″]All autonomous vehicles in near future will require a human-machine interface (HMI) to communicate with the driver as well as the pedestrians. The features of this HMI interface include – Haptic controls with embedded touch controls, a touch screen with possible haptic feedback, gesture control with visual feedback, and voice control and feedback. These cars could not only understand, inform, and ensure passenger safety but also entertain passengers.[/su_note]

[su_spacer size=”5″]

4. Speech recognition (Voice to Text) to tell the car your destination, temperature control, music choice, etc. The autonomous vehicle would store these preferences and recreate via voice detection/face detection of the customer.

Increased acceptance of autonomous vehicles presents a unique opportunity for ambitious automotive companies to break away from the clutter with an increased focus on optimal customer service as a point of differentiation. They need to develop new business models that cater to field services of these autonomous vehicles by offering after-sales customer support and maintenance “in the field”.

[su_note note_color=”#e6e6e3″ text_color=”#2f312f” radius=”4″]Autonomous vehicles however present a big dilemma in front of the insurance industry and could prove to be a big disruptor in the future. If the driver is taken out of the question, who does the risk shift to in case of an accident? Who will be liable for the payment of the insurance? As of now the OEMs and manufacturers are taking the heat as we see Tesla being charged with many lawsuits for its driverless vehicle accidents. But with time, the vehicles will be safer which in turn brings down the risk and then will bring down the insurance amount – making a huge dent in the insurance industry. There is also the case of reimagining traffic management by regulating autonomous and self-driven vehicles.[/su_note]

[su_spacer size=”5″]

Shared

In major markets like the US, the ownership of vehicles per household is almost double the number of households which leads to vehicles sitting idly for a large portion of each day. To lessen this implication, the mobility industry is rapidly deploying new forms of car ownership models – carsharing, ridesharing, and ride-hailing services, to the customers. Combining ride sharing and car sharing could take every passenger to a destination with nearly 80% fewer cars in metro cities.

The negative implications of newer forms of car ownership models are seen in declining sales figures for automotive companies. The automotive companies now not only have to battle against each other for market share but well-funded car-sharing technology companies as well. To tackle this situation the automotive companies are now starting their ride-sharing or shared leasing systems with the help of capable technology partners.

The benefits of these new car ownership models are seen around us. Fewer cars mean a lower cost of building and maintaining the roads. Also less noise pollution, less environmental damage. This is one of the main reasons most Governments are pushing for completely having electric vehicles on the road.

Electrification

Disruptive OEMs and startups are expanding the capabilities of a vehicle and demonstrating compelling options for the end consumer. Add this to the rising global energy costs, resource scarcity, global climate change, and increased government incentives/regulations leading to the invention of green energy and environment-friendly vehicles.

Electric vehicles are perfect examples of sustainable mobility solutions that will revolutionize the automotive industry soon. The need of the hour for existing manufacturers is to support new software-based architectures capable of driving needed chemistry efficiencies.

Initially, the adoption of EVs was slow among customers. But with each iteration, electric vehicles are becoming more and more cost-efficient with increased access to charging stations everywhere.

[su_note note_color=”#e6e6e3″ text_color=”#2f312f” radius=”4″]However, all is not well for the future of Electric Vehicles or EVs if proper measures aren’t taken now. One such would be making a proper scrappage policy. The rise of EVs on the road would lead to scrapping a lot of polluting vehicles. Also, the batteries of the EVs need to be scrapped properly. A standard battery has a life of 4 years. We can expect massive battery junk to pile up if a disposal strategy isn’t in place.[/su_note]

[su_spacer size=”5″]

Hitachi’s new compact, lightweight direct-drive system combines the motor, inverter, and brake into a single unit and installs the entire system into the wheel. This EV claims to reduce the energy loss by 30% and increase the single charge range of the vehicle.

[su_youtube url=”https://youtu.be/mnuQI83idEc”]

Key stakeholders of digital transformation in the automobile industry

Customer

Sam Walton, Founder of Walmart, once famously said, ”There is only one boss. The customer.”

The center of any digital transformation for any industry is the customer. Everything done by the automaker is intended to provide a seamless, delightful customer experience. Online car purchases without a single visit to dealerships, safer cars with driverless assistants, sensors, radars, and cameras are some positives for customers. HMI is being used more and more to operate vehicles. Smart virtual assistants take care of activities such as taking a call, sending a message, playing a track, and rerouting while the driver can focus on driving down the road.

Auto manufacturers and Distributors

Auto manufacturers now are looking towards technologies and software capabilities like IoT, connectivity, autonomous, 3D printing while designing a car. Software competencies are increasingly becoming a key differentiating factor for providing ADAS – Advanced Driver Assistance System.

Huge car manufacturers are partnering with Google, Tesla, or Apple for in-car infotainment systems and car connectivity with customers’ smartphones. Manufacturers are using data collection methods and analytics to make various decisions during the lifecycle of the vehicle. They can also predict the car inventory replacement cycles and new sales thanks to digital transformation.

What are the key takeaways from the trends discussed?

The sales of automobiles were at an all-time low in recent years due to many reasons – the pandemic and chip shortages among major reasons. This led to manufacturers finding new ways to connect and retain their customers. Manufacturers are now exploring going direct in addition to going via dealers to establish a connection with their customers.

The pandemic was a boon in disguise for the physical to the digital movement of products and services. The increased acceptance and affinity towards contactless services opened the doors to a complete digital customer journey in the automotive industry. The dealerships are moving on from pull marketing strategies to push marketing strategies. The focus is not much on bringing customers to the dealership and building relations but to showcase the product and stand out among the competing products.

Autonomous cars have become a reality and it created a few more avenues for automakers to provide a seamless customer experience. Electric Vehicles are becoming the new normal in the automotive industry and we can now see many manufacturers and even governments promoting the usage of EVs.

There is a clear indication of buyers, especially millennial buyers, inclining more towards vehicle riding experience rather than possession. They are ready to give up their car ownership in favor of convenient mobility solutions that fulfill their needs of transporting from one location to another.

These new trends and other disruptions mean automakers and dealerships are now focusing more than ever on delivering the perfect customer experience.

How automakers are delivering perfect customer experience

Customer experience is primarily about establishing an emotional connection with the client. We can dissect customer experience at the brand level and product level. Automotive manufacturers and OEMs can establish an emotional connection with their customers at both brand and product levels. Let’s discuss these two in detail.

Brand level connection

The human brain is divided into two halves, one part is emotional while the other part is rational. A brand-level connection with the customer would require engaging with both these parts and evoking a response. All the branding and marketing efforts from the automakers and dealerships focus on either of these two halves to position themselves in the minds of their consumers.

Typically the brand connection can further be subcategorized into – Sentimental connection and Rational connection.

i) Sentimental connection

A strong emotional connection gives an extra advantage over your competition. More often than not customers are swayed by their emotions when making a purchase. Automakers run campaigns that try to evoke a response from the consumer.

[su_quote cite=”The New Science of Customer Emotions, Nov 2015, Harvard Business Review” url=”https://hbr.org/2015/11/the-new-science-of-customer-emotions”]“The advent of big data analytics brings clarity, discipline, and rigor to companies’ long-held desire to connect with the customer emotions that truly matter.”[/su_quote]

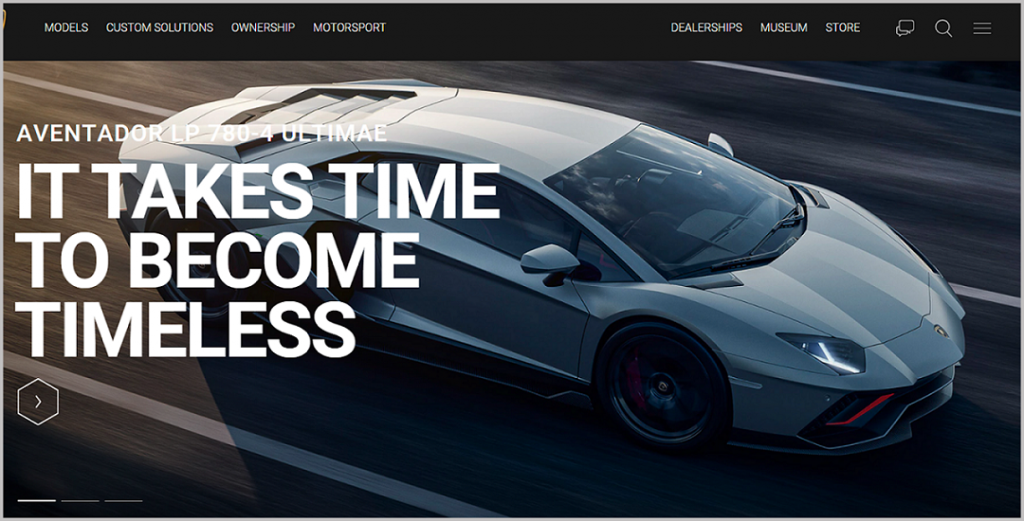

In the middle of 2021, Lamborghini ran a campaign with the tagline “It takes time to become timeless.” Here the intention of the automaker was to position themselves as someone who had been there forever for the consumers irrespective of time, and situation. The goal is to free Lamborghini designs to any new automobile design trends and separate itself from the competition as one of its kind.

Not everyone likes a drastic change to an old hit – be it music, a motorcycle, or a car. Lamborghini banked on that human emotion towards finding similarities to drive their campaign.

Similarly, there are other examples of automakers targeting particular sentiments of consumers to run their campaigns.

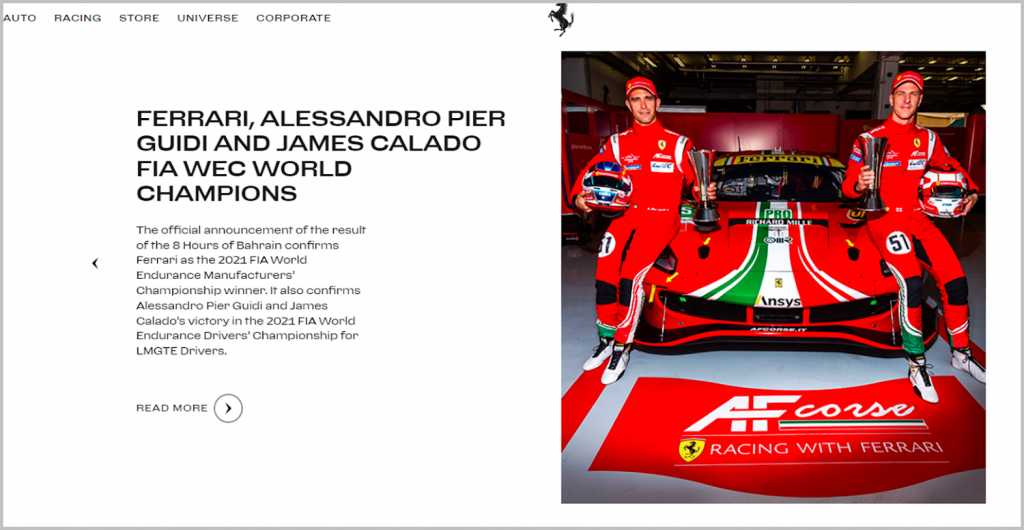

Ferrari never talks about luxury or driving as its customer segment only cares about sports cars. Hence, Ferrari takes extra care in hugely popular F1 grand prix and other such racing tournaments to promote its brand.

BMW collects goodwill by taking calculated measures to become a fully sustainable company in the future. It has firmly embedded ecological and social sustainability along with the entire value chain into its strategies. Environment-friendly and sustainable approaches are what drive the corporate strategies of BMW – be it cutting CO2 emissions and recycling to expanding hydrogen technologies.

People like to associate themselves with something good. And when you drive a BMW, you are bound to feel better knowing you are contributing something good for the environment.

ii) Rational connection

Unlike purchasing groceries, buying a car isn’t a decision made in a matter of seconds. It may come down to a final standoff between two or three options and the consumer may make the decision based on emotional parameters. But the period between recognition of the need to buy a car and the actual purchase may run into many weeks or even months. During the whole period, consumers will assign certain values to different parameters involved in purchasing the car. It is up to the automakers to keep persuading their consumers with the right message at each decision-making journey so that the consumer continues to keep them in consideration.

“What I try to impress on people is that the rational brain is not good at being rational, but instead is good at simply rationalizing what the emotional brain has already decided to do, and this happens non-consciously. You need to know how to structure decisions so that, when the context demands it, you can minimize the role of emotion. The easiest way to do this is distill whatever variables you can to numbers.”

~ Baba Shiv, Professor of Marketing at Stanford GSB

Along with the features of the vehicle, several rational parameters come into play when forming a buying decision. Some of these are value for money, a better resale value, access to service centers in proximity, higher quality, and reliability of the material and engines, low cost of spares, and a lower total cost of ownership. These parameters may not affect the buying decision much when it comes to luxury cars. But the luxury car segment only covers about 20% of all vehicle sales in the US. The remaining 80% is still going to consider the above factors.

In price-sensitive markets like India, where consumers seek great value and prioritize rational parameters, brands such as Maruti and Hero do well. This is the reason Maruti and Hero MotoCorp are market leaders with a market share of 48% and 37% respectively. Both these vehicles have lower costs of ownership, better sale value, lower costs of spares, and easily available service centers.

Product level connection

The brand-level connection ensures the consumer has your attention, but you still have to deliver a perfect vehicle of their choice to them. The automakers and OEMs need to create a fascination with the product in the minds of the consumer.

In the earlier days, buyers would look for design, mileage, material, and comfort in their vehicle. But thanks to continuous innovations and changing customer expectations, vehicles are now equipped with much more hi-tech features which make a difference.

Features such as infotainment, voice-activated facilities, autonomous parking assistant, wireless charging, proactive servicing, and parts replacement, roadside assistance, looks, mileage, comfort and convenience, cockpit, charging stations play a major role in helping customers choose their ideal vehicle.

Delivering a superior overall purchase experience has become first and foremost priority for automakers.

Consumers constantly search for review videos on YouTube and get a 360-degree view of the vehicles they desire to own. This process goes on for weeks to months, collecting all possible information from the automaker website to third-party websites. If a consumer has his priorities set and is well researched, it is more likely he will purchase the vehicle after just one test ride. So it becomes imperative for the dealerships to present all required information easily to their consumers through various sources and assist them well in their purchase journey.

Establishing a product-level connection also includes delivering a superior service experience.

Some of the ways automakers and OEMs can ensure superior service are mentioned below:

(i) Proactive reminders to the customer for servicing and parts replacement.

(ii) Digital appointment setting with the service centers and dealers.

(iii) Automated fault detection in the car.

(iv) Auto estimate preparation for the service entailed.

(v) Auto payments for the services to the dealerships and service centers.

(vi) Autonomous cars driving to service stations and back without interference from the customer.

Key benefits of digital transformation for manufacturers and OEMs

1. Improved campaign effectiveness

“The secret to developing personalized campaigns that will reach the right customers in the right moments is data. In the digital age in which we live, we must live and breathe data.”

~ Shashi Seth, Sr. Vice President of Oracle Marketing Cloud

The biggest advantage of increased customer touchpoints and a multitude of data is the number of accurate information companies could get about the customer. They can now leverage the power of technology and advanced software tools to run personalized and targeted advertisements. It gives the capability to adjust the messaging to individual customers for increased engagements during a campaign.

2. Build customer satisfaction

Manufacturers and OEMs can reduce the overall transaction time using customer insights to connect and extend key business processes. Digital transformation gives an opportunity to provide an enterprise-class, comprehensive, cross-channel solution for managing the complete loyalty life cycle of the customers. Dealerships can now track, reward, and recognize customer behavior in every aspect. This includes tracking and analyzing repeat purchases of products, referrals, social activities, and business with loyalty partners.

3. Increase prospect generation

Running personalized targeted campaigns ensures proper incentives are offered to customers who demonstrate a higher willingness to purchase specific products. It also helps in delivering adaptive, intelligent recommendations through optimized analytics and algorithms.

4. Achieve the coveted 360-degree view of the customer

Digital transformation with proper partners ensures you have single cloud analytics and data platform. It helps you visualize a single, consolidated view of the customer through their entire lifecycle journey. You can now reap maximum benefits after providing the best experiences to your customers.

Look beyond the horizon

The digital transformation in the automotive industry is bringing some big changes for automakers worldwide. It opens up a vast level playing field for all the automotive players. The industry incumbents need to come out of their comfort zones and match stride for stride with technology to succeed. The automakers need to better understand the customer experience demands of their new-gen mobility customers so that they can be provided with new value opportunities.