Can you imagine taking financial advice from sophisticated robots and AI-based apps before making an investment on a real-time basis? This will be the norm sooner than you can imagine. Online banking has become the primary interface channel for most consumers today. It is now becoming evident that the mounting pace of technological reforms is the most powerful force driving the financial services ecosystem globally.

The banking industry has seen radical technology-led transformations over the last decade. Most banking executives look to their IT support teams to maximize efficiency and facilitate groundbreaking innovation, while supporting the legacy systems & lowering costs. In the interim, FinTech start-ups are exploiting established markets and winning with customer- friendly solutions. Customers today have a slew of options and have scaled their expectations demanding agile, responsive, real-time, seamless, innovative and an integrated experience. And the pace of change & technology trends shows no sign of slowing.

As per a trend analysis from Gartner, within 12 years, “80% of financial firms will run out of business or be rendered inoperable due to changing customer expectations, competition and technology advancements.”

In 2018 alone, banks worldwide had planned to invest $9.7bn to improve and enhance their customer-facing digital banking tools. In the coming years, digital solutions in banking will include more nuanced approaches with big data, advanced analytics, and new platforms that automate tasks—enabling banks to increase both personalization and quality of customer service. To stay relevant to the ever evolving customer who is increasingly aware, time poor and tech savvy banks need to reevaluate customer interaction frameworks for a more personalized, flexible and value-driven experience.

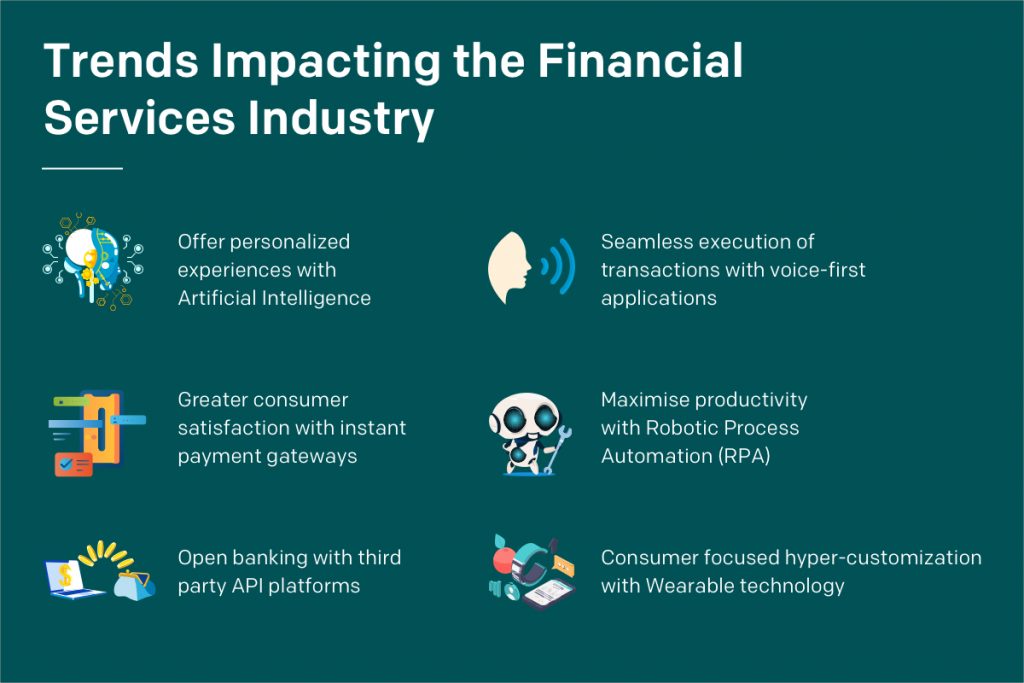

Trends Impacting the Financial Services Industry

According to a research from Atos, the most transformational challenges and opportunities for the future of banking include, response to customer needs, cost optimization, creation of new revenue streams, developing security & compliance systems, expanding digitalization and innovation. All of these have a few things in common: a customer-centric approach, real -time & intelligent data integration & an open platform foundation. While some of these transformations would require modernization of outdated technologies & rethinking the traditional legacy models, the others would demand strategic partnerships & collaboration with Fin-tech firms. But there’s one thing that’s certain – the need for transformation. Financial firms that use advanced digital tools could potentially see a 30% reduction in IT costs if implemented effectively.

The choice is clear – lead the industry with customer-friendly digital experiences or be led by the competition.

The banking landscape is set to evolve at a greater magnitude in the next few years. While safety-features like biometrics and cryptography will explore ways to arrest scams faster, technology applications will make banking more of a virtual experience without having to visit one. The good news is that many of the new technologies that are threatening the banking industry today also present significant opportunities. Organizations that can capture analytics, data and technologies to enhance user experience can inspire customer trust which is the key contributor to success.

Here are 6 technologies banks must consider, to deliver an exemplary customer experience:

1. Personalize with AI

The benefits of using Artificial Intelligence in banks and credit unions include optimizing back-end operations, data management, customer experience, compliance, product delivery and risk management. It’s not just about products and services on a well-integrated digital interface anymore; customers expect personalized experiences that are aligned with their preferences and behavior patterns. In other words, they expect you to give them practical & profitable alternatives that they did not think of themselves. Customers want you to assess their financial moves and reward them regardless of the platform they use. Bank of America piloted its popular chatbot, Erica, in late 2017 and boasts of 6 million users as of March 2019. With AI-backed models, the potential to transform banking experiences with a holistic overview of the customer behavior is truly exponential. What’s needed is a robust integration of an AI model infused with human expertise to provide personalized experiences for different customer prototypes.

2. Voice-ready banking

Just as how voice assistant Alexa was unfathomable a decade ago, so will be the trend for banking experiences without voice-first devices, where more than 50% of banking interactions will be voice-based.

As per a report from Analyst Firm Juniper Research, voice-based commerce will reach $80 billion by 2023. Voice-first devices are becoming an integral tool with consumers accomplishing tasks such as shopping, banking and home automation more seamlessly, due to which many banks and credit unions are taking to voice-first applications. Moving from the basic dialogues & account inquiries to more sophisticated transactions like executing payments, account transfers & setting account alerts using voice commands.

3. Instant Payment Gateways

The payments industry is by far one of the most dynamic areas of innovation in the banking industry. With the heightened surge of instant payment platforms, banks can influence greater customer satisfaction with customers expecting faster & seamless payment experiences.

Today, instant payment methods are available across most countries and a few where banks collaborate to offer an instant P2P payment experience, catering to a larger customer base. While large fintech firms, tech players and financial institutions continue to innovate based on evolving customer expectations and technology advances, this industry will soon be a part of everything customers do. Innovative payment trends will occur in conjunction with the Internet of Things (IoT), point of sale (POS), mobile wallets, cryptocurrencies, and blockchain. By diversifying and infusing instant payment capabilities across the e- and m-commerce space, banks and credit unions have a greater scope to build an innovative portfolio of customer-friendly services. And organizations that value customer payment insights as an intellectual organizational asset, can further segment and create personalized customer experiences basis their core behavior patterns.

4. Robotic Process Automation (RPA)

The robotic process automation refers to the use of virtual assistants that can perform repetitive and laborious tasks; making it ideal for the banking industry. As per a report from P&S Market Research, the global RPA market is expected to reach $8.6 billion by 2023. RPA in banking can disrupt the business-process-outsourcing models, as it minimizes costs while maximizing productivity.

The robotic process automation (RPA) is assisting banks to create meaningful customer engagement that is real time, quick, efficient and productive. It helps in executing pre-programmed rules across structured & unstructured data, for both customer-facing and back-office functions. RPA helps in minimizing costs & simplifies compliance with detailed logs to extract automated reports & enables automated decisions, based on previous data patterns, eliminating room for human error.

Deutsche Bank is deploying RPA to manage repetitive tasks more efficiently. It has reported 30- to 70-percent automation in areas where software is integrated and noted a remarkable decrease in the time required for employee training. With effective RPA implementation, banks can reduce manual work and enable banking executives to focus on the more complex strategy driven tasks.

5. Open Banking with API Platforms

Open Banking is based on open application programming interfaces (APIs), that allow trusted third-party developers to build services & technology interface for financial institutions.

APIs help to develop innovative products for a better customer experience, where the bank serves as a platform, over which third party companies build applications using the bank’s data. In this context, the Mastercard offering is designed to assist open banking efforts in better connectivity, consulting, dispute resolution and security & compliance. Emphasizing how Europe and its regulators inspired the Open Banking and the associated PSD2 regulatory regime, the Mastercard service is currently focused around UK & Poland and includes several payment and financial service providers including Alior Bank and Kikapay. Mastercard’s vision is to develop a host of Open banking services with optimal standards of clarity and consistency. If you are looking to deliver financial innovations, API partnerships are the fastest way to get there.

6. Wearable Technology

Being able to pay with just a gesture takes a lot more than a gadget on your wrist. It requires a huge amount of data available anytime, anywhere. The device needs to store payment & location information while authenticating the user, to avoid fraudulent transactions. This is possible through a host of technologies like sensors, communication devices, servers, analytics engines, and decision-making aids that gather data and analyze it before making any decisions.

Wearables offer extensive personalization with an individual focus to every single customer. Banks can use Bluetooth beacons for personal greetings every time a customer enters or exits a location via their smart watches. Smart glasses can help bank tellers process customer banking information while simultaneously doing other customer service tasks, as per a report from Deloitte. The ever-evolving consumer behavior and smart device trends are scaling the consumer banking experience to a whole new level of convenience. Wearable Technology helps to seek customer insights through interaction with other apps, services and technology. Embracing the technology crossover for instance is an ideal method to achieve this. Delivering a bank statement to a customer’s Apple watch or enabling them to make voice-based transactions while driving are two examples of how the banking interactions can be a part of the customer life cycle without being intrusive.

The Way Forward

The pace of the banking technology landscape is increasing and shows no sign of slowing. To excel in this rapidly evolving ecosystem, financial institutions need to devise a clear strategy with a laser-sharp focus on customer preferences; even if this means partnering with FinTech firms or adapting strategies from other industries. Here’s what you can get started with:

- Minimize costs by simplifying legacy systems

- Develop technological capabilities that can help predict customer intent & retrieve behavior patterns

- Build an integrated & user-friendly architecture to connect to anything, anywhere

While all these priorities are equally important and most certainly achievable, to stay relevant, the trick is to combine short-term & long-term initiatives that are aligned to your overall brand vision.

Summary

Even with the best of technologies in place, no one can predict what the future holds for the banking industry. What seems certain however, is that the disruption in the banking sector will continue at a steady pace and banks will continue to transform and embrace digital technologies that are here to simplify the customer experience. Developing a proactive approach rather than responding to trends will define your success in the long run. There is no single technology that is a universal solution, finding the right combination that aligns with your vision will determine your success in the near future.