Staying competitive in the constantly evolving fintech landscape demands exceeding customer expectations — delivered largely through mobile apps. For fintech leaders aiming to create the next-generation mobile banking app, understanding what sets top-tier banking apps apart is essential.

Let’s review the key mobile banking app features that matter the most for successful FinTech app development.

1. Card management

Card management allows customers to control their debit and credit cards comprehensively from the comfort of their homes. These self-service options enhance customer convenience and reduce the burden on customer service teams, allowing banks to optimize their resources.

Key functionalities include:

- Card controls: instantly block/unblock cards, set transaction limits, and manage card preferences.

- Reward flexibility: tailor reward programs to user preferences, whether for travel, tech, or shopping.

- Event-based rewards: earn bonus points for actions like signing up for e-statements or meeting spending goals.

- Multiple redemption options: redeem rewards through cashback and point-based purchasing.

- Co-brand integration: convert points between cards and partner brands for maximum value.

Explore our Mercury Financial case study to see card management in action.

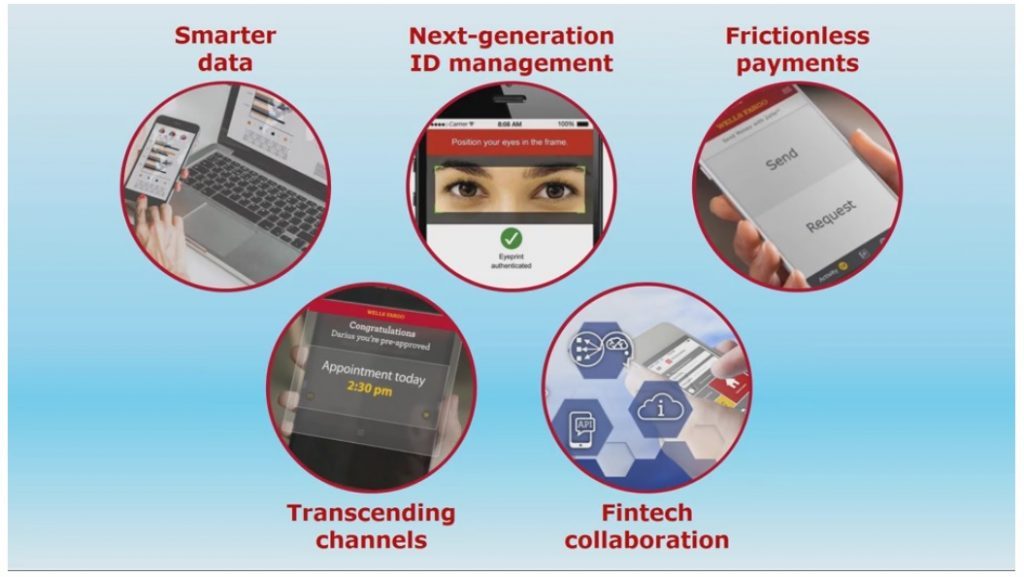

2. Security and biometric authentication

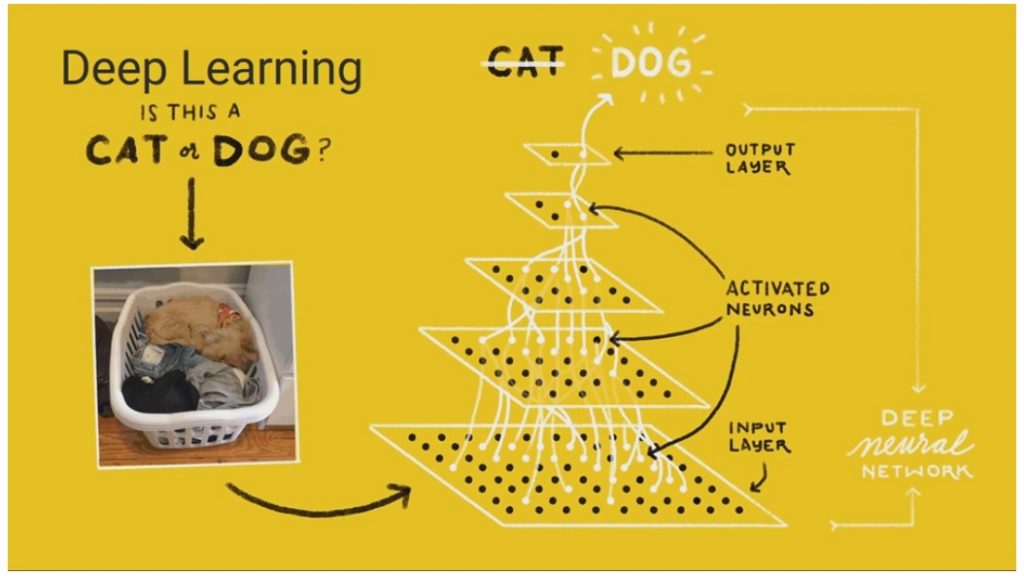

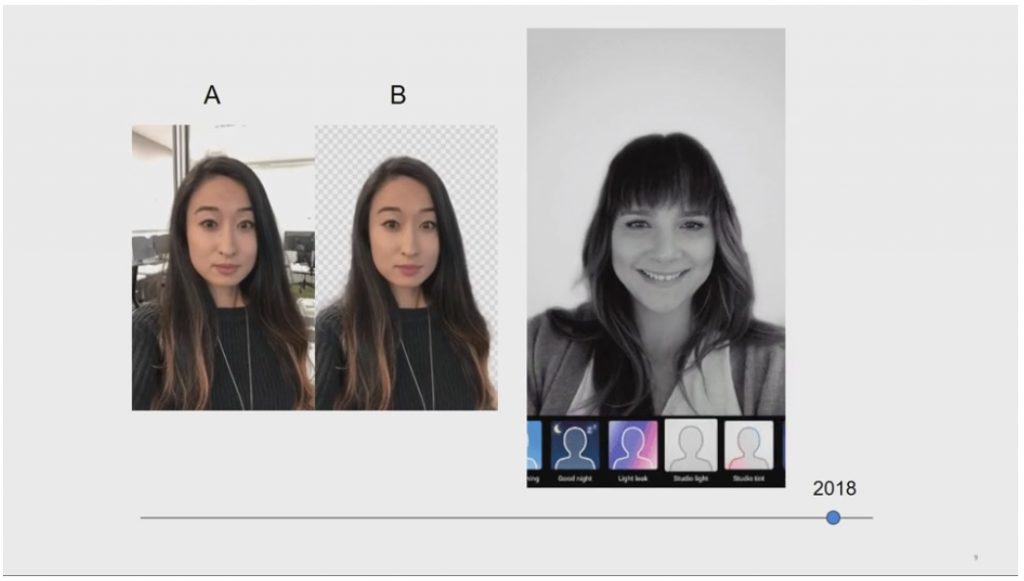

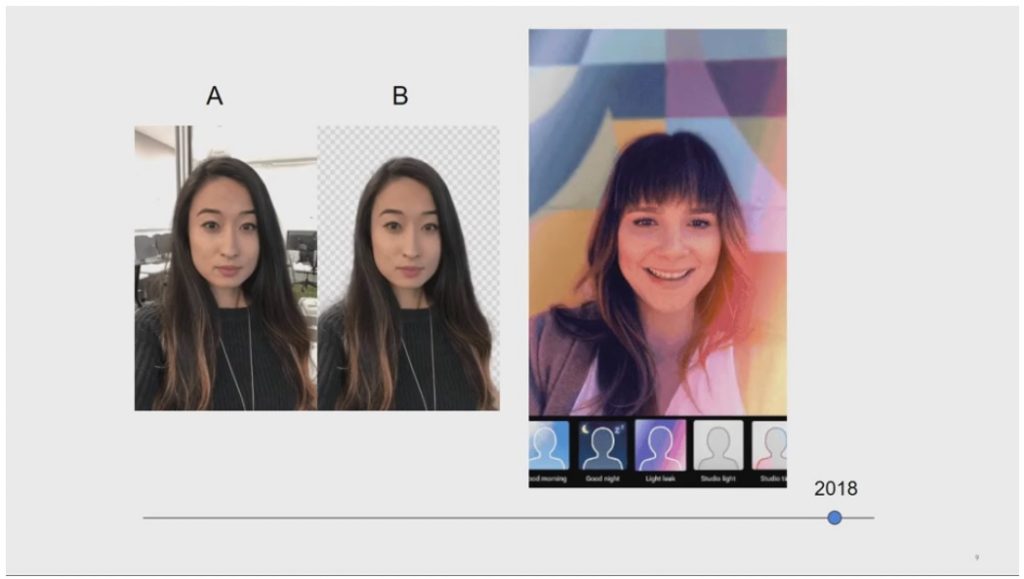

As users demand greater convenience and protection, FinTech app development must integrate robust security into critical mobile banking app features without increasing friction. Low-risk activities, such as viewing a “Quick Balance”, may require minimal authentication, whereas high-risk transactions automatically trigger full verification. Biometric logins, like facial recognition or fingerprint scanning, strike the perfect balance by delivering peace of mind without cumbersome sign-in procedures.

To strengthen app security further, mobile banking apps can incorporate:

- Multi-Factor Authentication (MFA): adding layers like PINs or biometrics.

- Liveness detection: verifying the presence of a real person to combat spoofing.

- Data encryption: converting sensitive information into unreadable code.

- Real-time transaction monitoring: automatically flagging suspicious activity.

3. Account management

Robust account management features are essential for any banking app. These typically include real-time balance checks, the ability to initiate one-time and recurring transfers, and quick access to transaction history, among other core functions. A well-designed interface allows customization of notifications related to balances, statements, and key account activities, further driving user engagement.

- Real-time balances: give users instant visibility into current funds.

- Transaction history: allow quick access to past transactions and insights.

- Expense monitoring: automatically categorizes spending to inform better budgeting.

- Multi-account management: combine checking, savings, and credit cards in a single view.

- Goal setting: help users track and achieve their financial targets.

4. Personal financial assistant and bill payment

Paying bills and setting aside funds for investments can often feel overwhelming. Integrating features like automated recurring payments and scan-and-pay functionalities (including QR codes) reduces the mental strain of remembering due dates. Whether it’s utilities, insurance premiums, or local taxes, these tools make transactions quicker and more convenient, eliminating the risk of missed deadlines.

Moreover, transforming banking apps into personal financial assistants empowers users with actionable insights and personalized financial advice. Features such as expense monitoring, budget management, and goal setting enable users to make informed financial decisions, promoting better savings habits and investment strategies.

5. Real-time transaction history

Real-time transaction history offers users instant updates on their account activities. It ensures every transaction is recorded and immediately accessible, often complemented by push notifications for timely alerts. This functionality serves as a foundation for additional tools, such as spending trackers and report generation, empowering users to monitor and manage their finances with ease.

6. Loyalty programs

Loyalty programs in mobile banking apps boost customer engagement by rewarding users for their everyday banking activities. From earning points on purchases and bill payments to receiving referral bonuses, these programs offer tangible incentives that encourage consistent app usage.

Rewards can be redeemed for various benefits, such as cashback, discounts, merchandise, or direct account credits. By integrating loyalty features, banking apps enhance user satisfaction, build long-term loyalty, and create additional value for customers beyond standard financial services.

7. Peer-to-peer mobile payments

P2P mobile payments transform how individuals send and receive money by eliminating traditional banking intermediaries. Instead of requiring bank details, transactions can be initiated through a recipient’s phone number, email, or username. This simplicity streamlines everyday scenarios like splitting bills or reimbursing friends, making financial exchanges more user-friendly and efficient.

With features like QR codes and digital wallets, P2P payments are reshaping personal transactions and setting a new standard for secure and instant fund transfers.

Explore our work with Paytm, the #2 top-downloaded finance app worldwide.

8. Investment and wealth management

The investment and wealth management feature in mobile banking apps allows users to manage and grow their finances without relying on third-party platforms. Users can invest in mutual funds, open fixed or recurring deposits, and create contingency funds for emergencies with a few taps. These tools simplify financial planning, ensuring users can make investments directly from their banking app.

Users can track their portfolios in real time, access performance insights, and stay updated on market trends. The feature also provides access to diverse assets like stocks, ETFs, and cryptocurrencies, enabling smarter and more convenient investment decisions.

9. Lifestyle

Lifestyle banking is fast becoming a core element of mobile banking app features, reflecting changing consumer habits where multiple services converge into a single digital platform. Millennials and increasingly other demographics favor “super-apps” that integrate everything from travel bookings to shopping discounts, creating a frictionless experience that blends finances with daily life. Neobanks and mobile wallets have embraced this model, offering user-centric designs and hyper-personalization to meet evolving consumer expectations.

Banks can tap into FinTech app development by partnering with lifestyle brands, leveraging personalization and customer-centricity for stronger loyalty. For example, Chase Bank’s collaboration with Starbucks rewards cardholders for coffee purchases, seamlessly integrating banking into everyday routines.

How Robosoft can help you build a successful mobile banking app

A successful mobile banking app goes beyond features. It delivers a seamless user experience that prioritizes speed, ease of use, and customer satisfaction. Collaborating with an experienced IT partner ensures your FinTech app development strategy is robust and user-focused.

At Robosoft, we specialize in transforming banking and financial services with intuitive, high-performance apps that drive customer engagement, loyalty, and operational efficiency.

Explore our work and partner with us to build the best FinTech app.