If CXOs are asked to name the one aspect which is likely to impact their future business the most, chances are ‘customer experience’ will likely rank high. Providing a great customer experience at every touchpoint is an imperative for every business across domains – be it retail, healthcare, media & entertainment, banking and more. Even enterprises in the B2B domain which hitherto did not give priority to a great design experience have come to realise their folly.

Consumers are consumers everywhere – be it as someone interacting with a beautifully designed taxi-aggregator app or a poorly designed human resources tool within the office. So a consistently good customer experience today improves chances of brand loyalty, strengthens brand affinity and may even result in brand evangelism. 81% of companies recognize customer experience (CX) as a competitive differentiator, yet just 13% rate their CX delivery at 9/10 or better. This is not relevant only for consumer-facing businesses – even enterprises which have niche B2B communities as target audience – say, healthcare professionals, logistics and more should take cognizance of these developments.

There are several sets of numbers floating around to indicate the huge market potential of IT Services. According to a report, the ‘global customer experience management’ market size is expected to reach USD 32.49 billion by 2025. The report goes on to say that the retail sector is one of the largest end-users segment of customer experience management software. However, software is only one aspect of ‘customer experience management’. In fact, digital solution providers are only a small component of the larger digital transformation market: Digital Solutions Providers, Cloud Solutions Providers, System Integrators, System Administrators, Infrastructure as a Service (IaaS) Providers, Platform as a Service (PaaS) Providers and many more play a role. Some of the services include Cloud Computing, Big Data & Analytics, Application Development & Maintenance, right deployment of Emerging Technologies (IoT, Blockchain & Artificial Intelligence) and more.

Suffice to say that even with Digital Experiences – a small component in the overall IT & ITeS industry the full potential of how it can benefit enterprises has not been full explored or understood by a large number of CXOs. According to Forrester Wave:

A digital experience platform architecture will help to align strategies, teams, processes, and technology to meet this integration imperative with six primary themes:

- Coordinate content, customer data, and core services to drive reuse and quality

- Unify marketing, commerce, and service processes to improve practitioner workflows.

- Deliver contextually and share targeting rules to unify the “glass.”

- Share front-end code across digital touchpoints to manage a common user experience.

- Link data and analytics to add insight and drive action.

- Manage code and extensions for maximum reuse while avoiding over-customization.

As you can see there is room for diverse skill sets and offerings. However, when it comes to technology partners, many view them with the narrow lens of coders and app development teams. The B2B service companies offering such services should also take a share of the blame as many have not made the endeavour to position themselves on a higher scale…up the value chain. To be able to get the attention of CXOs, digital experience partners should empathise with the business issues they grapple with and offer to be their design thinking and technology partners. They need to pitch their offerings at a higher level and not just as mere designers and coders. Also, the distinction between design and design thinking has perhaps not been highlighted enough over the years. Many enterprises still see design as ‘how things look’ and focus on the ‘beauty aspect’ (surely an important one) and not on the more process-driven design thinking aspects.

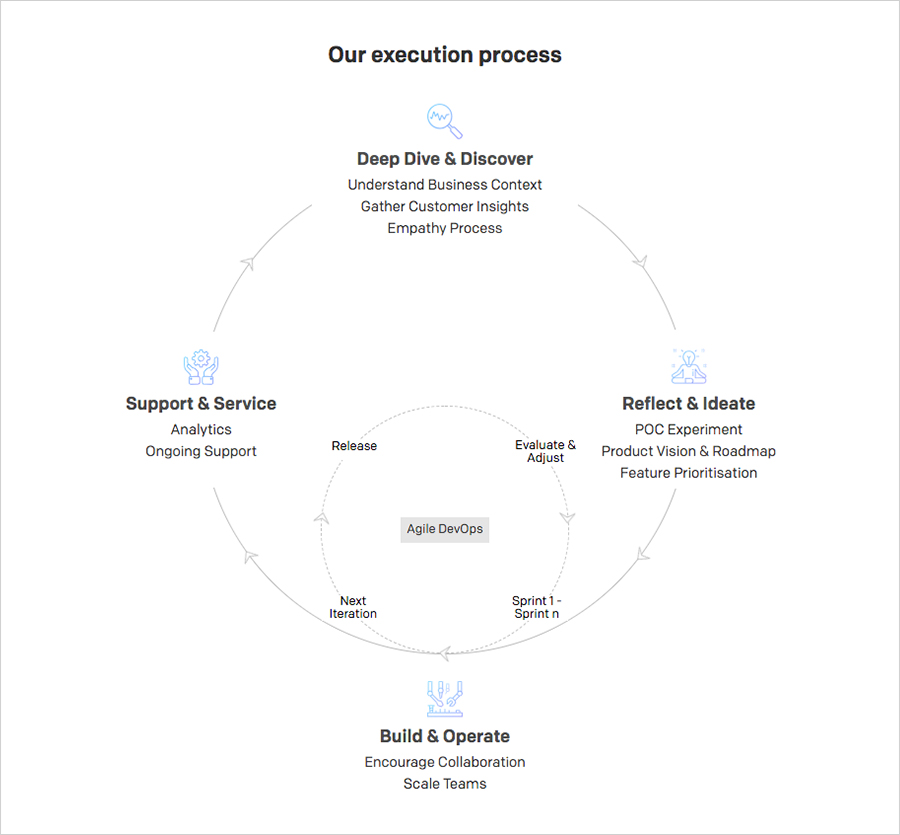

Today, digital experience partners such as Robosoft are uniquely placed to lead process of transforming the fortunes of enterprises by implementing processes that facilitate rapid product development. It begins with an understanding of the client’s business and is designed to be an ongoing process.

This helps cut long lead times to develop digital products and helps enterprises execute faster, learn quicker and iterate to get better. The process is cyclical and hence keeps pace with changing customer expectations.

We have worked with a few leading enterprises across key domains in going beyond the proverbial tip of the iceberg when it comes to integration of product roadmaps and emerging technologies.

Healthcare

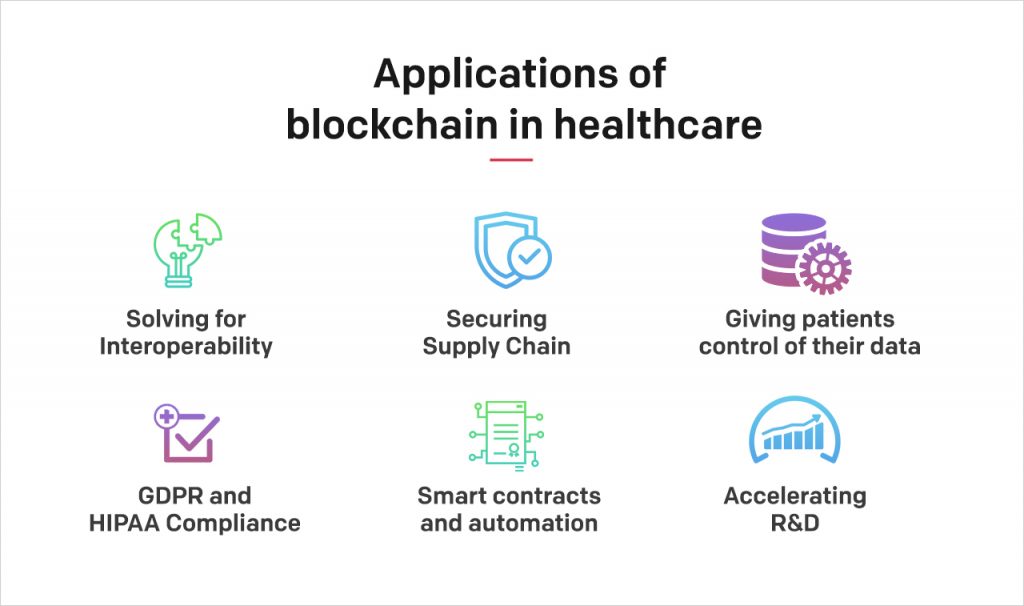

While the domain includes hospitals, pharmaceutical companies, health tech and more, our focus is in offering the benefits of blockchain in these areas:

Our team developed the mobile Clinical Trial Management System for a few leading pharmaceutical companies in the US. We have also created custom software solutions for Clinical Trials, Patients & Enterprise. A current clinical trial project integrates Blockchain, AI, ML, Mobile, Chatbots (Text & Verbal) and more. Apple is investing heavily behind healthcare where the focus is on using the ecosystem of the Apple Watch and iPhone working together to collect & share vital patient data.

Retail

Aside from blockchain, Artificial Intelligence & Machine Learning, Chatbots, Robo-advisors, & Voice Assistants, Big Data & Analytics, Internet of Things & Wearables are some of the technologies in different stages of development and adoption in retail. Here are some great examples:

Sephora introduced AR into their platform in early 2017 by way of their Virtual Artist platform, which shows customers a realistic “mockup” of how certain skin care and makeup products would look with their face shape, skin colour, and other distinguishing features.

The app for Bareburger harnesses AR technology to allow customers to “see” the menu item in front of them on their device before they order, giving them a better, more mouth-watering ordering experience.

Banking & Finance

Banks and financial institutions have a unique opportunity to use technology to create a tailored approach using empathy and automation for the delicate and sensitive nature of finance. Voice Assistant technology is one such. Aside from voice, blockchain, AI, Machine Learning and human-like interfaces are also opportunities in this segment.

The engineers at JP Morgan have created ‘JPM Coin’ – the first US bank-backed cryptocurrency

In 2018, Bank of America launched their artificial intelligence (AI)-driven virtual financial assistant, Erica, “to help clients tackle more complex tasks and provide personalized, proactive guidance to help them stay on top of their finances”

An Australian bank UBank is set to debut Mia (short for My Interactive Agent) a digital assistant with a human face powered by artificial intelligence technology.

Data Science is also a specialisation which banks tap into for use cases such as fraud detection, risk modelling, personalised marketing, predicting lifetime value, recommendation engine and more.

Enterprise Apps

Enterprise mobility applications are effecting a paradigm shift in the landscape of processes in organizations. Some of the areas in which they play a role include instant communication platform for employees, sales leads & CRM, Supply Chain & inventory management, workflows & approvals, onboarding & training to name a few. Digital experiences can play a role in boosting employee engagement too: interactive learning modules, HR operations, payroll come to mind.

To sum up, enterprises are skimming the surface when it comes to possibilities with digital experiences which can simplify lives of people. The future is exciting in this context as we discover more exciting possibilities of digital experience which delight.