Each passing year

How technology deconstructs

Teaches to start afresh

As we come to the end of 2018, this Haiku seems to be a fitting goodbye to the year. Endings are always about looking back appreciating what went well, gathering the learnings and moving ahead.

All year long, we have tried to do good work with our partners, explore and learn newer technologies and also sharing our experiences through our blog posts, e-books and case studies. So, as we arrive at the end of the year, we are taking a look at all that we learnt and shared through our blog, in 2018.

In this article, we have picked the 5 of the best reads for you. We hope you enjoy reading all of them…once again!

Read on.

Mobile Fintech vs Traditional Banking products: 15 awesome things winners do well

Ease of use of a digital product is paramount to client satisfaction and both FinTech companies and traditional banks realize this. And, as we all know – client satisfaction is the key to overall customer engagement, sales, long-term banking-client relationships and growth.

But do banking executives understand just how important exceptional user experience is for consumers? According to a recent survey, banks are misinterpreting and miscalculating the role user experience plays in the overall satisfaction customers have with a banking product. Something which FinTech enterprises and some prudent banks have gotten right. However, most banking executives are completely missing the mark at correctly understanding the rise in popularity for fintech products.

In this article, we will show a series of 15 different user experience features which have reached mass adoption among consumers. In doing so, we want to help banking executives visualize the difference between what their digital experiences offer and what consumers expect. And, hopefully, help them bridge the gap.

The road towards a cashless world – digital payments and the future

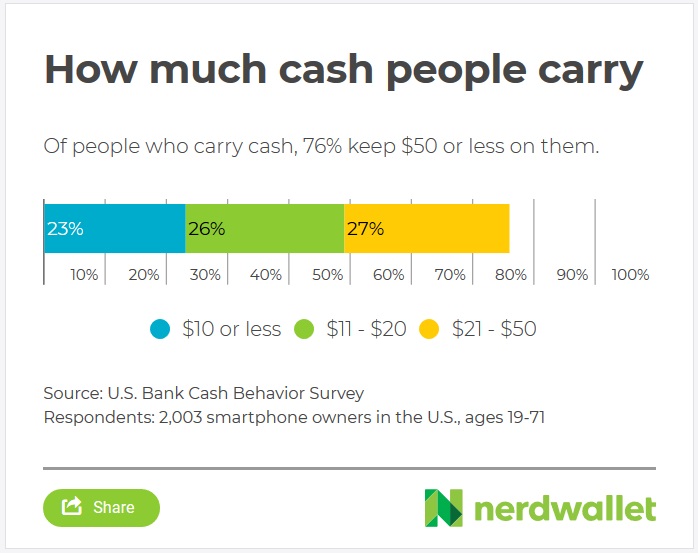

According to a recent study by U.S. Bank, 46 percent of people say that they do cash transactions less than eight days a month and 5 percent say they never use cash. Even if they do cash transactions, the amount spent is on the lower side. Most people keep less than $50 cash in their wallet. While for smaller transaction values cash remains the predominant mode of payment, spending through digital payment modes are on the rise.

It is predicted that by 2025, the overall spending through digital wallets will have increased by ten folds!

Image source

In this ebook, we outline how digital payments have evolved over the years, the current state of the industry and what lies in the future.

How Design Thinking can accelerate Digital Transformation

Digital Transformation is imperative for all businesses. However, Digital Transformation will look different for different companies. At Robosoft we understand both the necessities as well as the risks surrounding Digital Transformation. That’s why when we work with our clients to implement Digital Transformation in their organizations, we do it based on the principles of a holistic problem-solving framework: Design Thinking – a practical and creative method for problem-solving that has evolved from fields as varied as engineering, architecture and business.

In this article, we outline what is design thinking, the key principles around it and how it can accelerate an organization’s digital transformation journey.

Voice assistants in retail – what consumers want

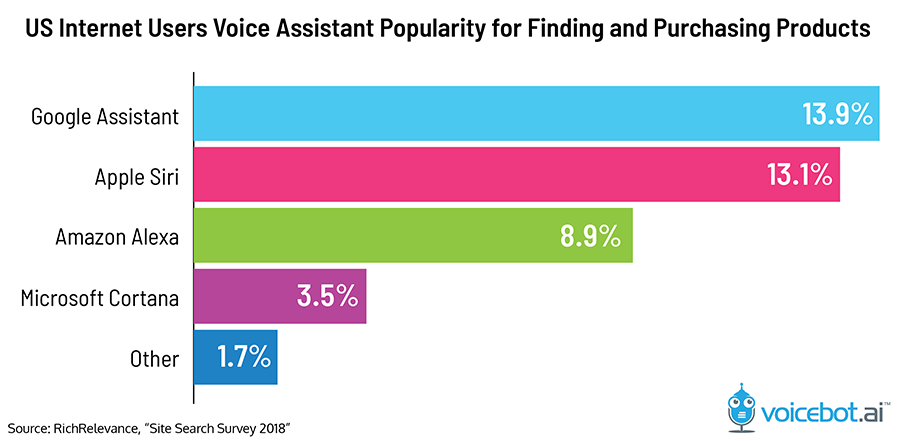

Voice searches and voice assistants have piqued users’ interest over the years. According to Gartner, about 30% of all searches will be done without a screen by 2020 and as per Comscore, 50% of all searches will be voice searches. Voice assistants have changed customers’ relationship with smartphones from being a communication device to being enablers of simplifying some of our daily tasks.

Image source

In this article, we outline how today’s consumers are using voice assistant and how the retail industry can use voice assistants to engage with consumers and offer a delightful user experience for them.

Changing Perceptions — creating a unified healthcare system

Health and technology are coming together like never before. From self-prognosis to smart diagnosis, from wearables for technophobes to object sensors for elderly care, from real-time health monitoring to remote patient management, from smart pharmacies to timely medicine dispensers, and from biostamps to injectables — processes, services and devices in the health spectrum are being vehemently explored. Today, we are witnessing varied types of innovations being explored in order to achieve a democratic approach towards healthcare. However, these healthcare interactions are happening in isolation. They are solving one problem at a time across the journey, waiting for the rest to be solved by another. So, there is a gap that the industry still needs to fill – integrating all the pieces on technologies together to create a connected ecosystem.

In this article, we outline, how process innovations, technology innovations and business innovations are changing the healthcare landscape and the need for a unified healthcare ecosystem and various possibilities towards achieving that.

And a bonus read…

5 must-read books on business thinking for CXOs

As we begin our preparations to welcome 2019, a lot of us will be keeping our reading lists for the coming year ready to grow in our professional and personal lives. As our CEO, Ravi Teja Bommireddipalli, puts it across –

‘’Aside from hands-on experience, I realized that the holistic thinking outlined in several books helped me immensely to grasp the problems at hand and offer solutions.’’

Among many such books, here are Ravi’s top five picks, which would help CXOs and budding CXO’s take a 360-degree approach in solving business problems.

We hope you enjoyed reading all these articles we are looking forward to learning more and sharing more in the coming year.