We live and work in the information economy. Information is sacrosanct. Most struggling organizations I have seen, struggle because either vital information fell between the cracks in the communication chain, or good quality information was never channelled through to the right people in time.

This happens all the time in sales leads, CRM operations, customer discovery, inventory management, and the list goes on. This is why we have processes because we want to ensure that information is passed around as easily and as efficiently as possible. These processes work like a charm in smaller organizations. Information flows around quite fluidly. But as the organization keeps getting bigger, these processes start becoming a big overhead. A lot of times, they act as a crutch rather than an enabler. Communication becomes difficult, and often information is restricted to functional silos as opposed to being spread around the entire enterprise.

Consider a large digital services company. When the on-ground sales representative identifies a potential lead or untapped segment, he emails his boss about it. This, in turn, is relayed to his boss, and then to his boss and so on. However, the higher up the information passes, lower the weightage is attached to it. The next salesperson having a similar idea will face a similar outcome. Thus, the obvious pattern was missed, and the opportunity lost. This affects not only company revenue but also employee morale.

This kind of information asymmetry actually gets more acute in the presence of poorly designed and deployed enterprise solutions. The need of the hour is an easy-to-manage, easy-to-access, centralized application that takes care of all your communication and process needs.

We are talking about Enterprise Mobility Applications (EMA). Let’s take a minute to understand these terms.

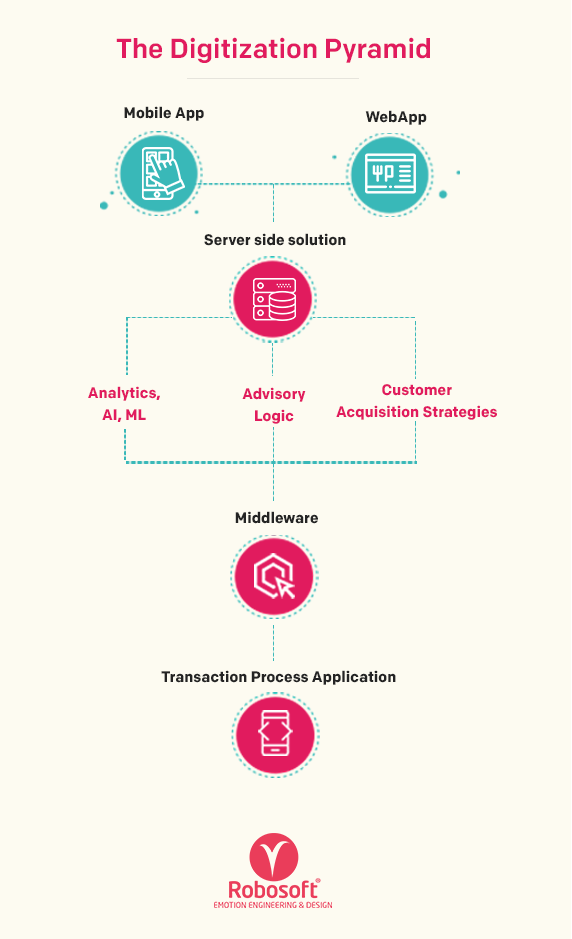

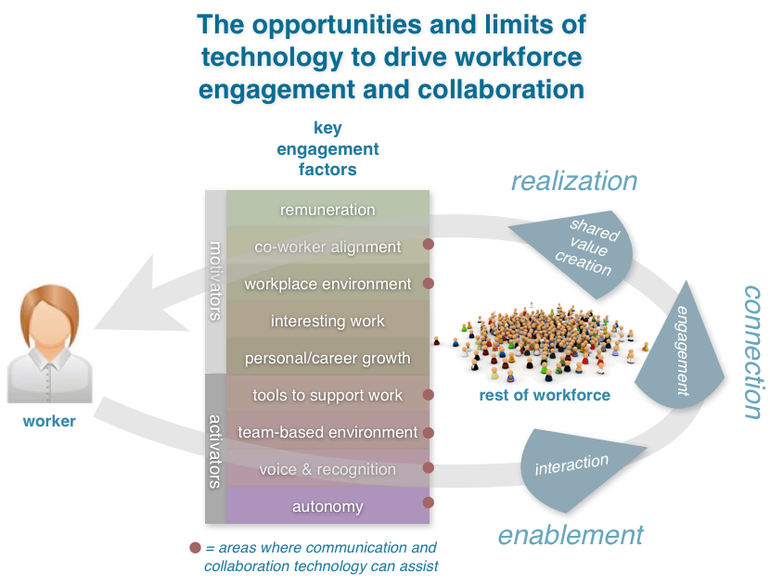

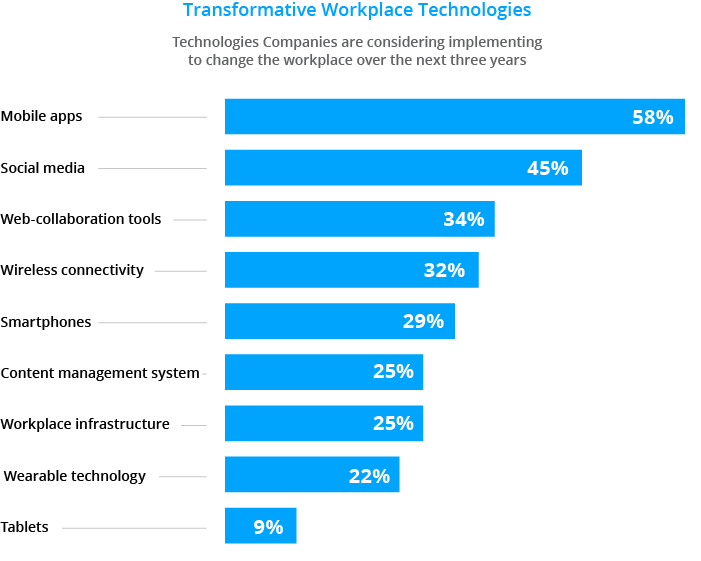

Traditional enterprise solutions can be defined as a suite of applications that perform certain functions like CRM, ERP, ticketing platform, internal communications and more. These disparate set of applications serve their own individual purposes. However, as more and more organizations feel the need to start communicating faster and passing information quicker, the suite of enterprise solutions stop becoming the conduit and start becoming the bottleneck. Enter Enterprise Mobility Applications (EMA). EMAs are nothing but enterprise utility applications on mobile phones. These applications are so ubiquitous that they can be installed and run on employee mobile phones also. These mobility solutions can provide employees with the ability to enter and read vital pieces of information without having to wait to get to a computer, or without the fear of it getting dropped off somewhere in the chain. This will definitely help boost business productivity. I am not alone in my thought. In a recent survey by Apperian, 43% of respondents stated that the primary goal of their enterprise mobility applications was improved productivity.

Why Do You Need a Change?

Before we deep dive into the world of EMAs, let’s take a step back and understand why a solution is even required in the first place:

- To improve employee productivity that is hampered today by either communication gaps or information asymmetry

- To quickly identify new revenue channels or predict the latest trends in the market

- To increase your bottom line by eliminating the unnecessary costs of travel and time delays in decision making

- To expedite processes that employees find unnecessary but management needs for better control and security

- To ensure higher productivity, transparency and thus higher levels of satisfaction of employees

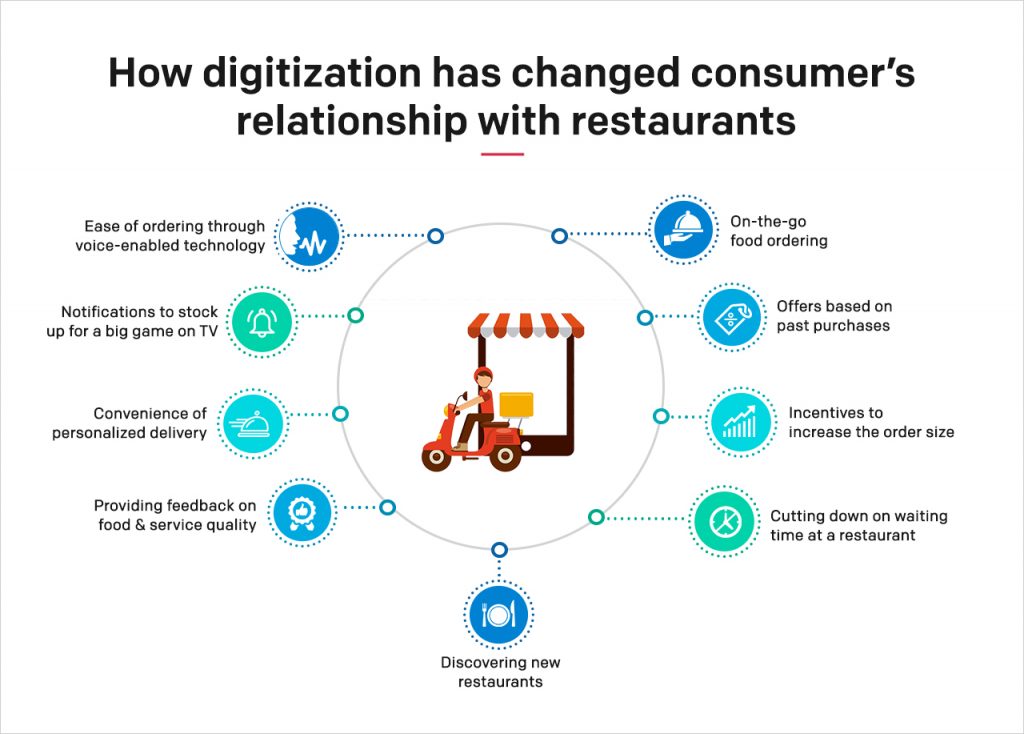

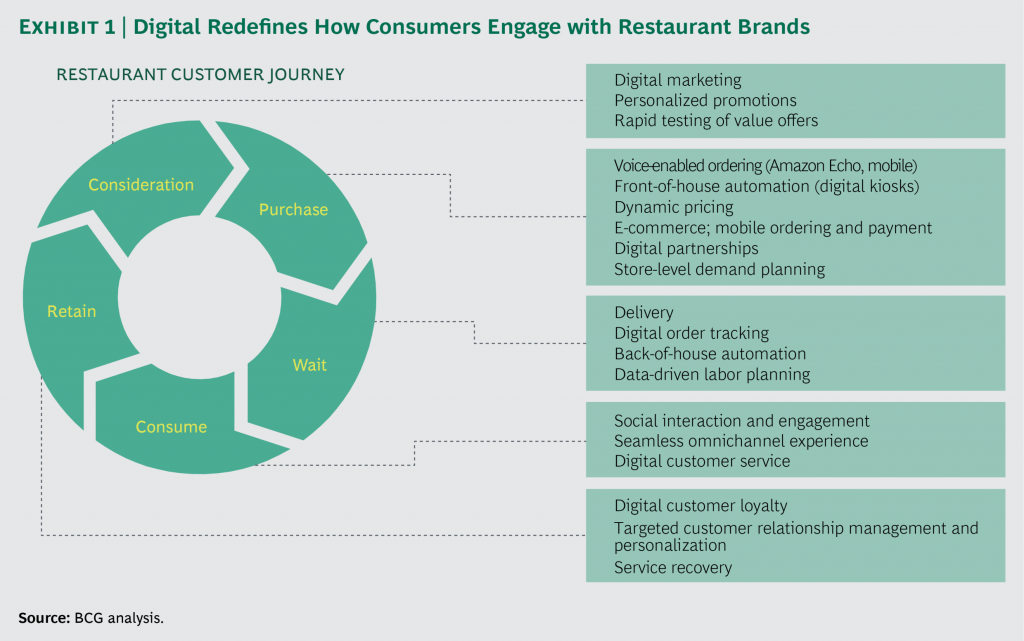

How Employee-Facing Business Processes Are Changing with Digitization and EMAs

Let’s try to understand some specific ways in which enterprise mobility applications are effecting a paradigm shift in the landscape of processes in organizations:

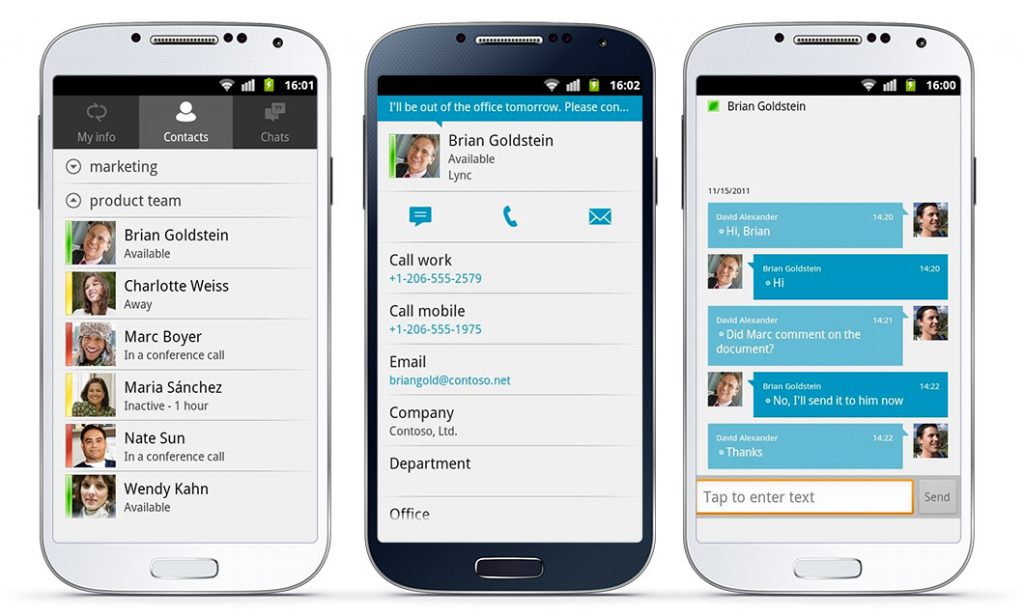

An Instant Communications Platform

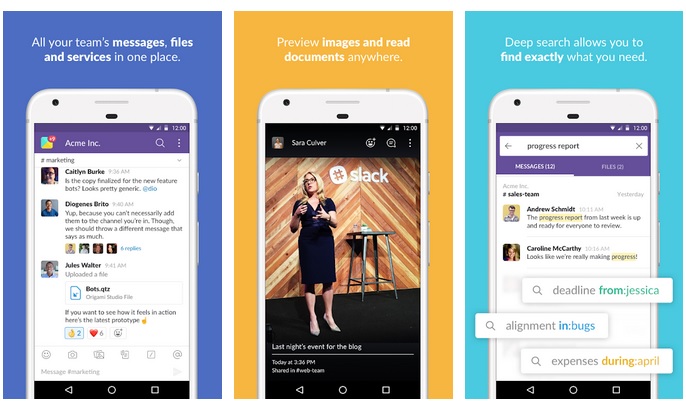

Any organization, big or small, realizes the importance of instant communications. But only a large enterprise can appreciate the need for an exclusive deployment of a communications platform for the company. This kind of platform can not only enable the linear model of communication but also transactional and interactional models of communication, and is a huge improvement over emails and personal/verbal notes.

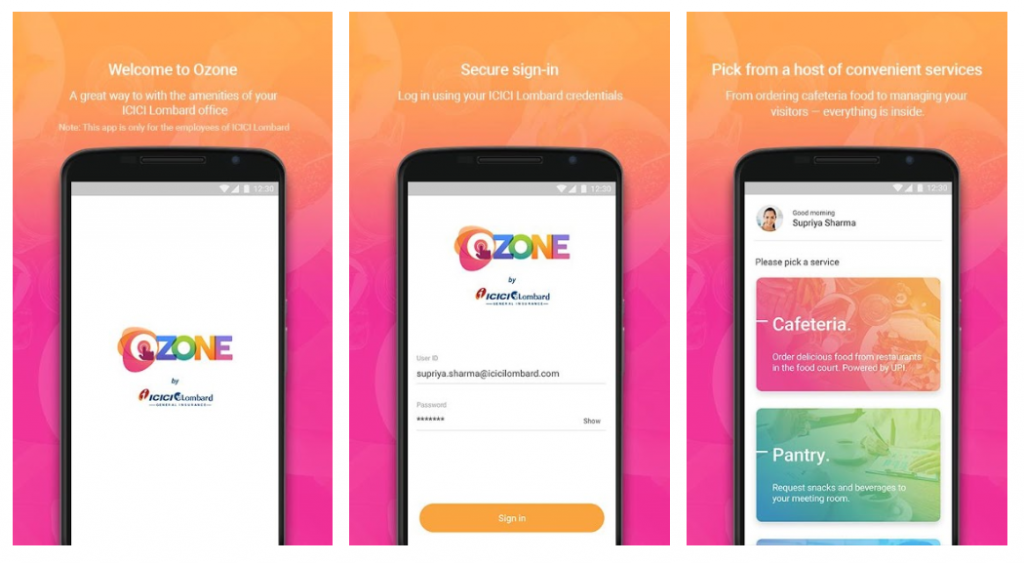

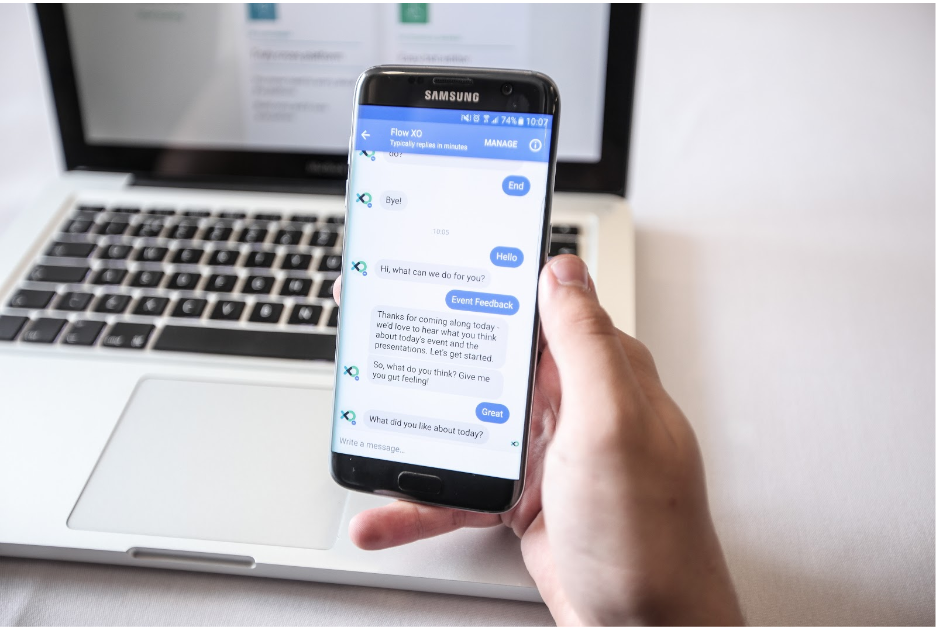

A good example of how a large enterprise has adopted a communications platform for its employees is the Ozone communications platform used by ICICI Lombard. ICICI Lombard wanted to develop an end-to-end solution to serve food using cashless mechanisms in their office premises, provide Bus shuttle booking, Visitor management, Cab and travel bookings etc. As a solution, we built Ozone app to host exclusive services so that employees can get everything need at the click of a button.

Image Source

This app has helped employees not only communicate amongst themselves better but also better manage their meetings and logistics.

Another real-world example of this is NewsCorp, which has managed to establish strong lines of communication between their 25000 employees using EMAs.

Sales Leads and CRM

Every sales organization understands how critical it is to make timely follow-ups on leads and act on information specific to that customer. No more written notes and disorganized emails. This will help ensure greater horizontal and inter-functional collaboration within the company. A robust and ubiquitous CRM solution helps the entire sales team to rally around information on customers and helps them close out deals faster and more efficiently. A cloud-based CRM solution is any day of greater use and significance than one maintained on desktop applications like excel.

Salesforce is one of the leading CRM solutions in the world. Urban Ladder has greatly improved its abilities to follow up on its customer leads, track SLAs and mine better consumer insights with the implementation.

Supply Chain Management and Inventory Management

No one cares about the timely delivery of services and goods more than the customer. If you delivered on time, you merely lived up to the customer’s expectation. However, if you delay your shipment, you will be branded as inefficient. Having access to real-time updates on the exact location of your inventory (for hard goods) or progress on your project (for soft goods) puts your front-line employees in a good position where they can make educated decisions for their customers. Just in Time delivery models and agile supply chains thrive on the timely availability of critical information.

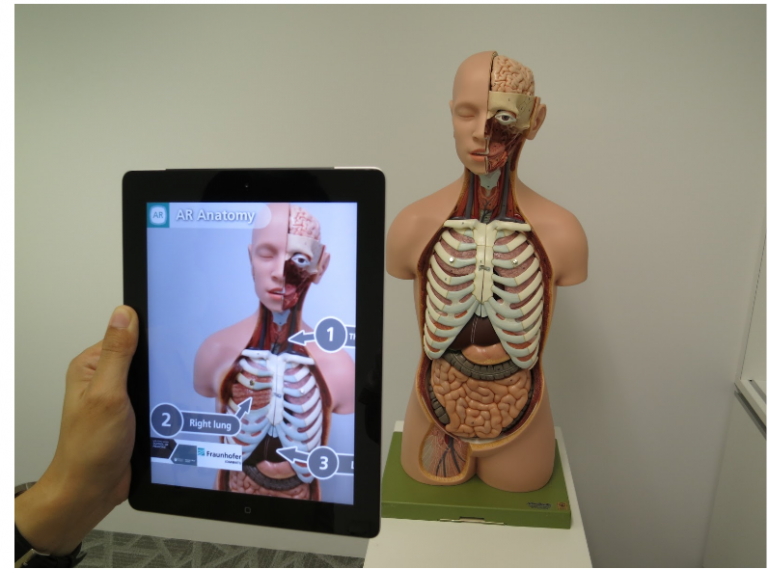

An extension of mobility applications is technology in wearables. DHL has successfully implemented a pilot program using Augmented Reality in their wearables to improve their warehouse operations by 25 per cent.

Another good example is that of Flex, the electronics manufacturer. Using a combination of IoT and cloud computing, Flex has increased connectivity between all stakeholders and consequently, productivity.

Workflows and Approvals

How many times have you had to stall some critical work because you didn’t receive approvals in time?

The prevalence of mobility solutions will ensure that all your approvers will get notified every time they have to approve some workflow, and give them the ability to do so from their mobile phones itself. Prevalence of cloud-based workflow models have fostered faster turnaround times.

A prime example of a solution that helps track workflows and maintain high standards is the BSI Entropy tool. Some of its biggest customers are GlaxoSmithKline and Vodafone, who have managed compliance and their customers better.

Onboarding and Training

If you run a sales organization, and you have new batches of people joining every month, you don’t want to be stuck conducting training throughout the year. A simple application that stores extensive training material on the cloud is the perfect solution to keep your organization agile. Another use case is to keep your executives and top leadership up to date with the latest happenings in the industry and thought leadership articles.

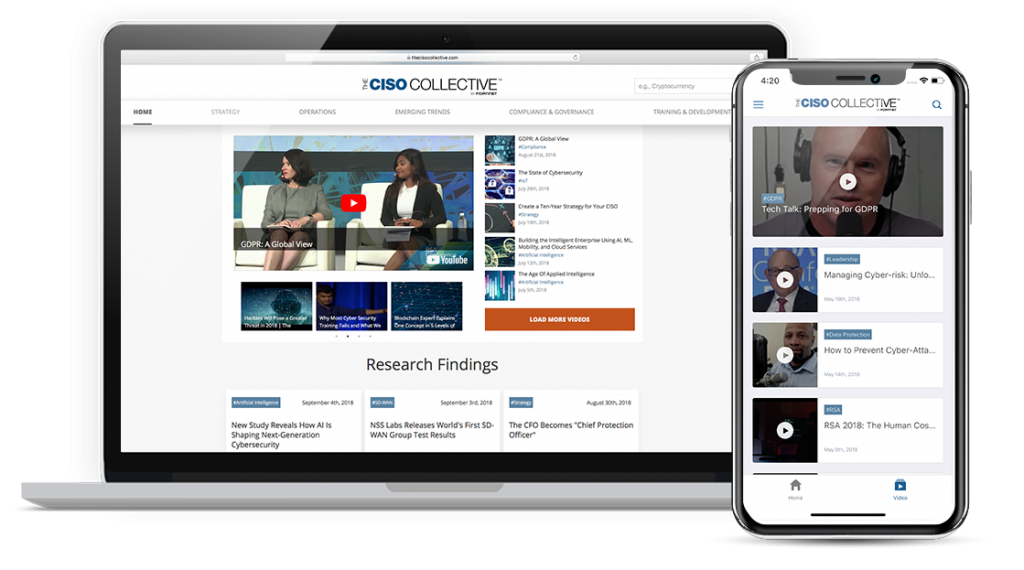

We have worked with the client to create a solution similar to this for Fortinet called the CISO Collective. This application has helped Fortinet executives and CIOs across the globe be on the top of their industry updates and consequently make better decisions.

CVS Health Corporation, the retail pharmacy chain has also ensured higher levels of collaboration between its executives using EMAs.

How to Select Applications That Work for You?

Whether you wish to develop your applications in-house or license them from a third party provider, enterprise app development requires you to follow some simple guidelines before making a decision.

Identify the Gap in Your Current Process

The first step in implementing a technology solution is to always identify the gaps that you want the technology to fill. Often times, companies fall prey to buzzwords in the industry without analyzing the need correctly, which results in a massive failure of the technology and a dip in employee confidence. Multiple ERP system implementations come to mind as examples. If your company can truly benefit from an enterprise mobility solution, you will know it from the information dissemination flows within your units. It is also possible that for various reasons unrelated to the technology, you are better off without the enterprise platform. This first step, though seemingly simple, is the most overlooked step of them all.

Work with the Functions Who Need It the Most

You can’t solve something unless you know what you’re solving for. Instead of imposing solutions on your frontline staff, it is always prudent to spend some time understanding the use cases of the business unit. A deep understanding of the daily operational activities and how these applications will augment the tasks is crucial in choosing the solution. This will give you a good idea of which features are the most important and which need to be shelved for the time being.

Evangelize the Product

A huge roadblock when it comes to adoption of new technology products is the adoption itself. Most teams get set in their ways of operations are often unwilling to move to a new style of working. The key is to target only a small subset of your workforce and test out the product with them. Work closely with the team to see how the product can be tweaked to suit them better. Once you gain the trust and confidence of this team, they become naturally influencers for the product across the company. Going big-bang with any new change is never a good idea. Working with teams while slowly building up confidence is the best and most effective approach.

Incorporate Feedback Regularly

No technology product can cater to 100 per cent requirement of everyone. Certain trade-offs are always required. However, never shy away from incorporating feedback from your teams. They are the ones who use the product daily, and consequently, they are the ones who will have a more informed opinion of it. Apart from making the operations smoother, you are also ensuring that your employees feel heard and appreciated.

Ensure Quick Technical Support

Though adoption is a slow process, rejection of a new solution can be brutally quick. To ensure that employees do not face technical difficulties in working with the product, ensure that they can readily access a technical support team to guide them through their roadblocks and hurdles.

Know the Pain Points Beforehand

In our collective experience of working in the enterprise, we know a few big reasons why such projects never see the light of day. It is in your best interest to know of them before you start the project so that you may be well prepared to circumvent any hurdles. Some reasons cited by other organizations are – the disparity in platform types and OS types; management of BYOD devices for contract employees; no budget from the higher management; prioritization of less important enterprise app features, thus not adding value to the chain. Prior knowledge of such impediments goes a long way in preparing the organization for rough waters.

The Ball Is Now in Your Court

Every organization might not benefit from employing an enterprise mobility solution. But the ones that might, seldom do it the right way. The advantages are evident; the process, not so much. A sensible decision-making body with common sense and an inclination for collaboration is all that is required to ensure that enterprise apps boost employee productivity in your organization.

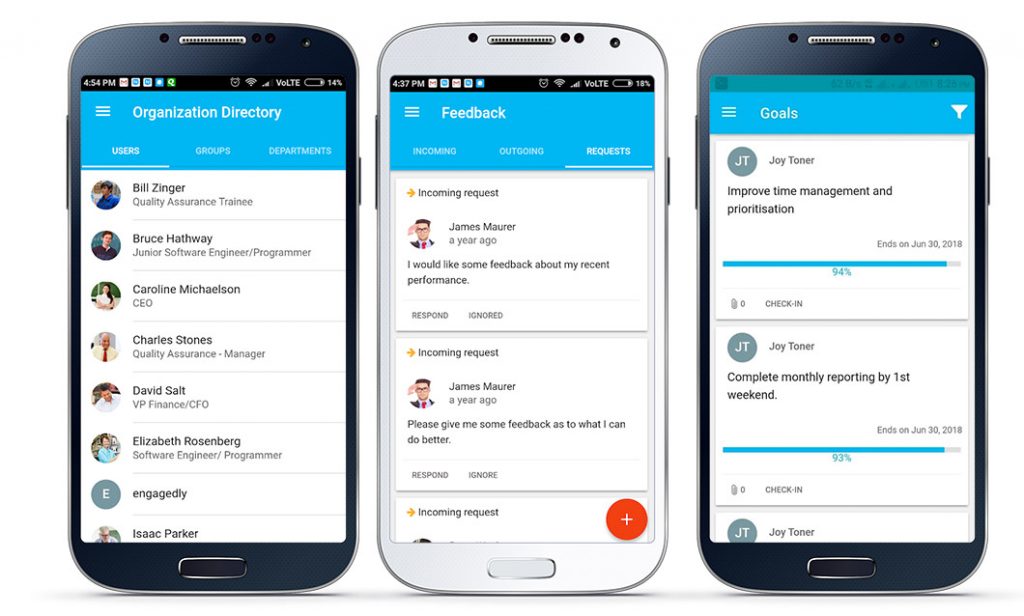

Image

Image