There are approximately 5 million apps in App Store and Google Play.

With over 1.2 billion mobile users worldwide, it is predicted that by 2020 the app economy will reach $189 billion, an increase of 270% from 2016.

While these numbers look promising, the truth is, though there are millions of apps out there in the app stores vying for users’ attention, the apps which get downloaded are abandoned in an eye’s blink. Almost 77% of users never use an app again 72 hours after installing. Time spent on apps is also low with 34% of mobile app engagements lasting less than one minute.

So, how can enterprises ensure that they course correct before it is too late?

While in a digital world, there is an avalanche of data available, this data deluge is precisely the problem. App creators often get overwhelmed by the availability of the information at their disposal and choosing to ignore what is not relevant can be a tasking job.

But this is a job that needs to be done.

Tracking the right metrics is the most critical aspect for determining the success of an app.

‘You can’t manage what you can’t measure.” – Peter Drucker

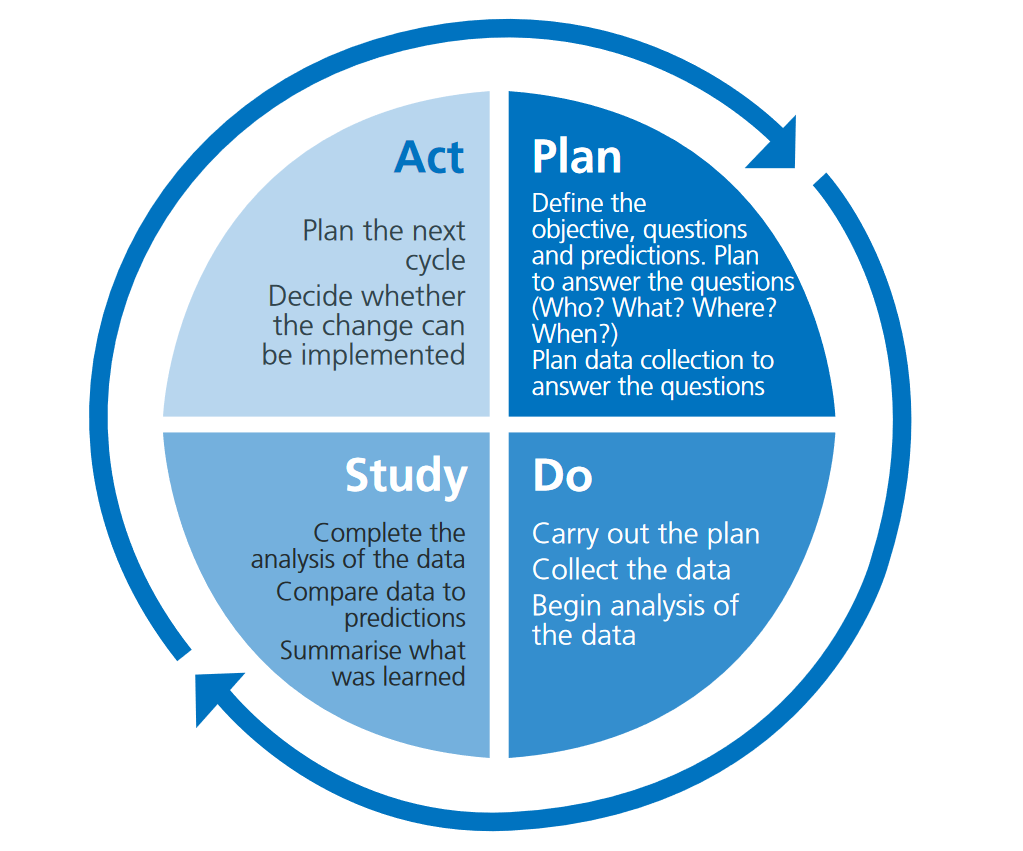

However, to ensure the success of an app, it is essential that for app creators, analytics is not an afterthought – not something to be thought of after the app release; they have to be clear of metrics which they want to measure when planning.

Not all metrics are created equally

Fundamentally, an app needs to help users accomplish whatever they set out to do, faster and better through delightful interactions. At the core of it, all are human emotions.

At Robosoft, we believe that mobile solutions need to strike a chord among users and engage them emotionally.

And, that is the most critical factor to ensure the success of your mobile app. However, even to get to a point where we are course correcting basis consumer engagement and interest, we need to track the right metrics. But more often product teams waste their precious time and money chasing useless metrics, which do not provide any real value.

Often app metrics are divided into four broad buckets

- Performance metrics: these metrics focus on how the user is experiencing the app.

- User and usage metrics: these data points provide visibility into the user and their demographics

- Engagement metrics: these metrics highlight how the user is engaging with the app

- Business metrics: Focus on business (revenue etc.) flowing through the app

Though there is no one-size-fits-all approach to measuring metrics for your app performance, it is different for individual businesses. However, for ensuring that you are tracking the right ones, it is important to look at these app metrics from a different perspective.

For instance, today, almost 22 percent apps users download on their smartphones end up not being used ever. So, if an app owner is concerned with mainly tracking downloads, they are chasing an empty metric.

Here are some tips on how app creators can approach tracking of the right metrics:

Identifying Vanity Metrics and Clarity Metrics

While there are a plethora of metrics available, app creators should move away from the broad categorization, which is mentioned earlier.

Not all apps are the same, so defining the right metrics for your business puts you a step ahead.

Our suggestion would be to divide these metrics into vanity metrics and clarity metrics

Vanity metrics

These are surface-level metrics that define macro-level trends. While we can use vanity metrics to support a high-level narrative, we can’t use these to make tactical product-level decisions.

Vanity metrics can measure baseline performance. However, vanity metrics cannot provide insights to allow for better product management decisions.

For instance, while tracking the Monthly Active Users (MAUs) may help us understand if overall engagement with the application is increasing or decreasing – it doesn’t help us understand the value of a specific feature to the business.

Example of vanity metrics include – number of downloads, monthly active users, and ad impressions.

Clarity metrics

These are product-level metrics that define micro-level usage trends. We use clarity metrics to inform decision-making around product modifications. Clarity metrics underpin competitive advantage.

While both vanity and clarity metrics will be used across operations, design, product, analytics, quality assurance, and marketing for team-oriented data, it is essential to have an organization-wide transition from purely using vanity metrics to adopting clarity metrics.

These are metrics used by engineering teams, product teams, and business teams to monitor the performance of the application. Clarity metrics provide insight on the performance of the business. Recommended clarity metrics include – feature adoption rate, feature abandonment, and goal-oriented conversions.

Progressing from clarity metrics to KPIs

To define clarity metrics, we need to start with high-level vanity metrics and apply more granular filters that are feature-specific and/or goal-oriented. However, to make use of these clarity metrics, it is crucial to progress them to KPIs.

KPIs are the clarity metrics which are connected to the business targets of an organization.

Converting clarity metrics to KPIs will ensure that app creators can make better product decisions faster and with a higher degree of confidence. Defining clarity metrics as KPIs will also ensure that the key stakeholders can take the right decisions and make product improvements in real time.

Typical issues faced and recommendations for setting up a result-oriented analytics framework

Here are the most common issues faced by the analytics team while setting up an analytics framework to measure app metrics

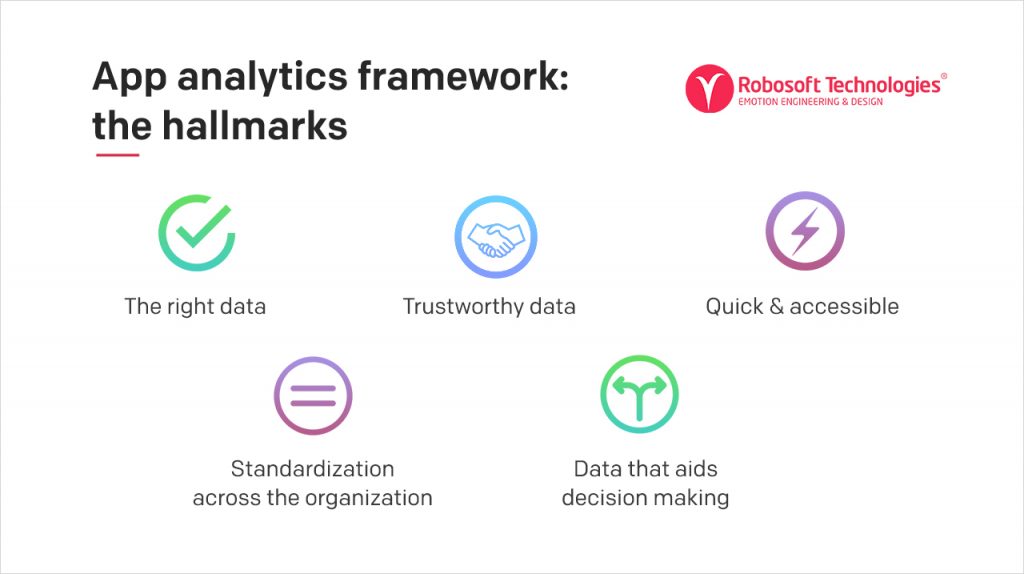

Collecting the right data

As mentioned earlier, often app creators are confounded by the flood of data available to them through various metrics, that they miss the important ones. At Robosoft, we take various measures to ensure that the data we collect is relevant and helps in achieving business goals.

Here is what we do:

- Proper event tracking implementation

Events are a useful way to collect data about a user’s interaction with interactive components of your app, like button presses or the use of a particular feature in a game. We help businesses in identifying the clarity metrics while tracking an event.

- Well defined event tracking specification (‘Event Taxonomy’ specification)

In this step, we define parameters against any action that a user takes and derive insights accordingly. For e.g., if a user is using the mobile wallet app on their phone to recharge their mobile, then parameters like – amount recharged, the name of the operator etc. might be useful for the business owners to make product based decisions.

- Comprehensive event tracking within the application

Our event tracking is aligned to insight-driven analysis. Funnels track the user’s behaviour starting from acquisition to conversion. We include conversion event tracking and campaign tracking as well.

- Allow for quick modifications to tracking

Most analytics tracking measures are archaic and hard coded. However, we use tools like Google Tag Manager; it helps is real-time tracking and modifications.

Collecting data you can trust

Identifying the data to be collected is just the first step. It is important to format this data in a manner so that it can be used right.

Here is what we do:

- Clean and reliable data through the setup of proper filters

We add appropriate filters while collecting data. We also use the method of cohort analysis, which helps us in deriving insights related to user behaviour. Cohort analysis allows businesses to derive actionable insights. For instance, for an e-commerce app, data points like – in how much time did a group of users checked out, how much money did they spend, etc. may be helpful in making product level decisions.

- Verify and augment analytics with back-end application data

Relying only on analytics data might not give businesses accurate understanding of the performance of the app. Especially, in case of any glitch in the analytics tool or if the tracking hasn’t been set up properly. So it is important to verify this data with the back-end data as well.

- Implement back-end performance monitoring

While insights that are derived from analytics data can help app owners can enable app owners in customizing the user experience, it will be a pity if the app performance isn’t up to the mark. When an app crashes on a user’s device, app developers need to know about it. Users who experience severe performance issues aren’t going to write in and inform—they’re going to leave bad app store reviews. Hence, we implement performance monitoring metrics to keep a track on how critical features in an app are performing. We track the time of logging of an API request and its response time.

Access data quickly and efficiently

Like mentioned in the earlier points, it is vital to specify event taxonomy. Doing it right is important.

Here are is what we do:

- Detailed and descriptive events taxonomy

While creating event taxonomy we make sure that we define the purpose of tracking a particular data point. For instance, if after the sign-up process the users are expected to update their profile, defining why tracking how many people update their profile is important. Or defining which information that is a part of the profile update process is important for the app owners.

Basis this analysis, app owners can take decisions like making some critical data points a part of the sign-up process instead of adding it to the next step.

Access to data across the organization

Sometimes different teams in an organization depend on the app metrics data to take decisions. For instance, product teams might be relying on this data to take feature level decisions at the same time marketing teams will depend on this data to take consumer-facing decisions. Hence it is important that everyone is looking at a unified format of the data.

Here are is what we do:

- Real-time analytics

While most app owners track periodic data (weekly/monthly), tracking real-time data for some critical app features is important. It helps app owners in taking right decisions at the right time.

- Standardization of data

Sometimes the data that is captured by the analytics team is in a raw format. Further, different analytics tools will have a different method of collecting this data. It is important to standardize the data visualization process across all divisions.

It will help every stakeholder derive and understand the data in a unified manner than leaving a room for ambiguity in the insights. It will help all decision makers take unified, informed and data-driven decisions.

Make data-driven decisions

Understanding your audience, their in-app behavior, and the natural screen flows are necessary for iterating and refining your app for better results. You can use these engagement insights to launch app marketing campaigns, redesigns, UX changes, and stronger funnels that boost ROI and make your app a profitable channel in your brand’s overall marketing strategy.

Here is how we aid app owners to achieve this:

- Rapidly deploy the best performing features to optimize KPIs

A lot of times the product team is blind without feature level insights. Hence it is important to define the critical features and track them on a real-time basis and optimize them according to changing user behaviour and performance metrics.

- Understand your user and use data to prioritize features

Only tracking performance data isn’t enough. It is important to capture user’s intent with analytics-driven features. Further prioritizing features basis, this data will help app owners in getting higher rates of user engagement.

In conclusion:

Most app developers pay heed to setting up an analytics framework after the app is developed and released in the market. Sadly, it is often too late to course-correct. It is critical to identify the clarity metrics that a business wants to chase and then define an analytics framework to capture that data. And, all this needs to be done before the app is released in the app stores.