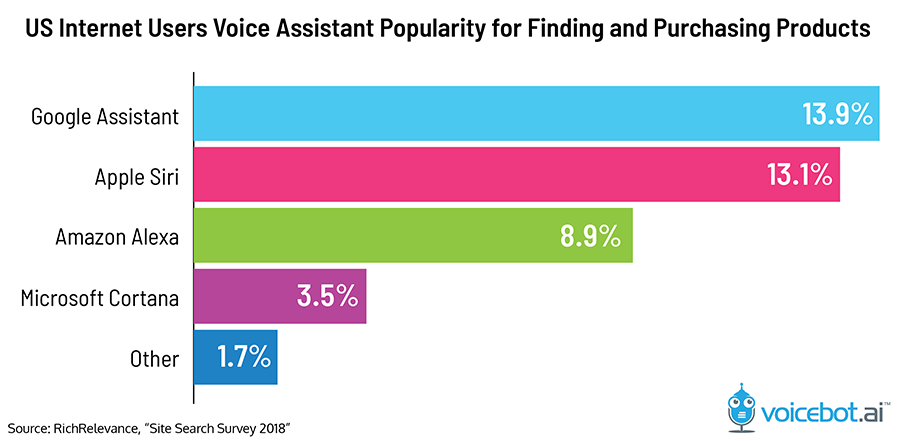

From IBM Watson winning Jeopardy less than a decade ago to Artificial Intelligence becoming a part of our daily lives through voice assistants like Siri, Google Home or Alexa, this technology has come a long way.

Recently in an interview, Google’s CEO, Sundar Pichai stated –

‘’AI is one of the most important things humanity is working on. It is more profound than, I dunno, electricity or fire.’’

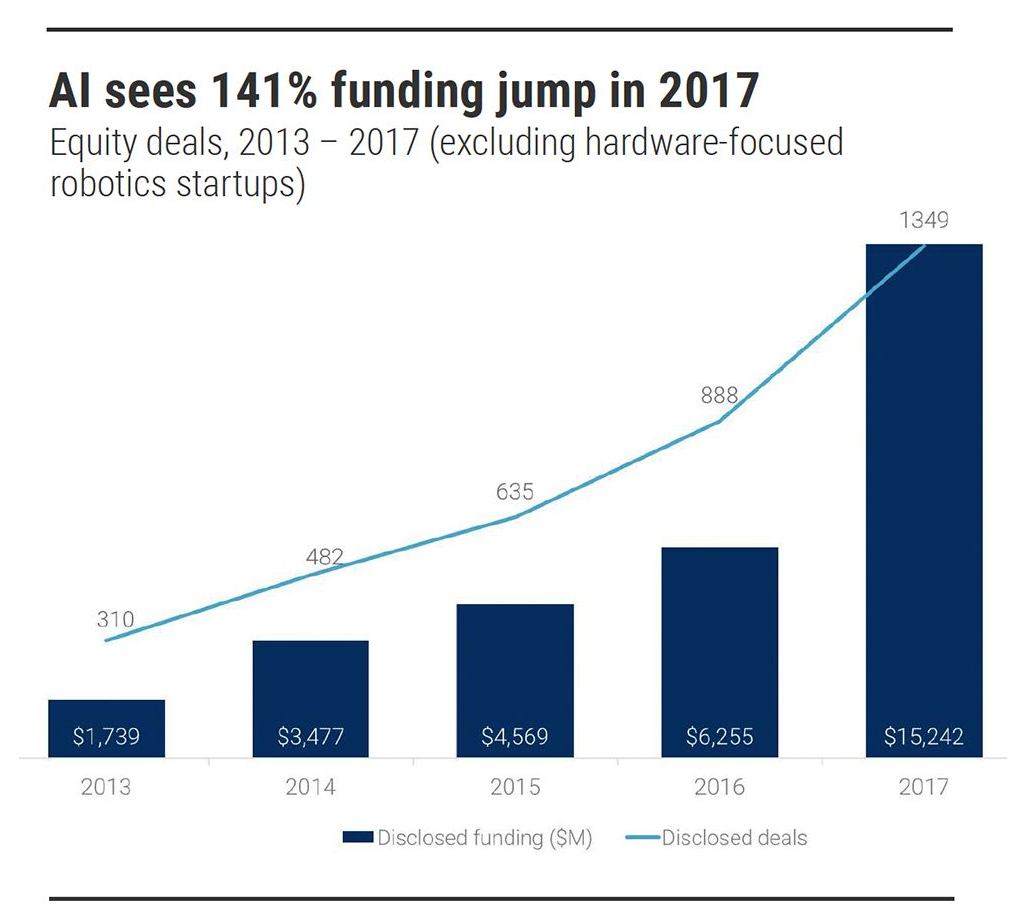

While it might take some time for AI to become as ubiquitous as electricity in our lives, we are heading towards that direction. And, enterprises are betting high on the technology. According to a report, the AI market will grow at a rate of 52% by 2025. As enterprises boost their investments in AI, the reign of AI is just beginning to reshape and push innovations across industries like healthcare, manufacturing, retail, etc.

Image Source

AI innovations across industries:

Here are some interesting innovations that we have seen in recent years revolutionizing various industries:

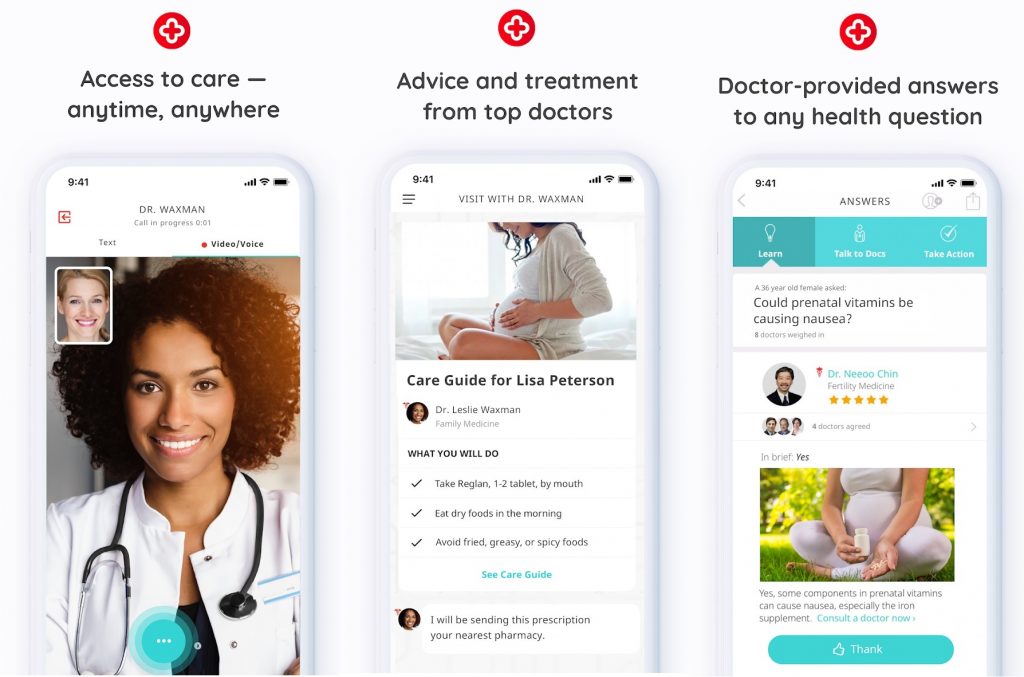

Healthcare

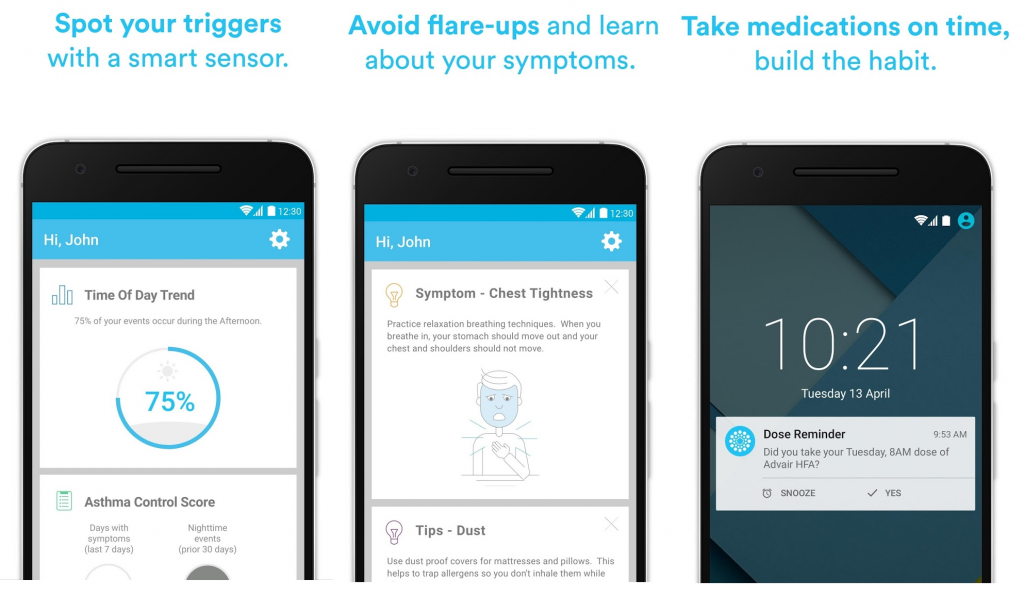

The AI healthcare market is expected to reach $6.6 Billion by 2020. The healthcare industry seems to be bullish about the technology and is using it in multiple ways.

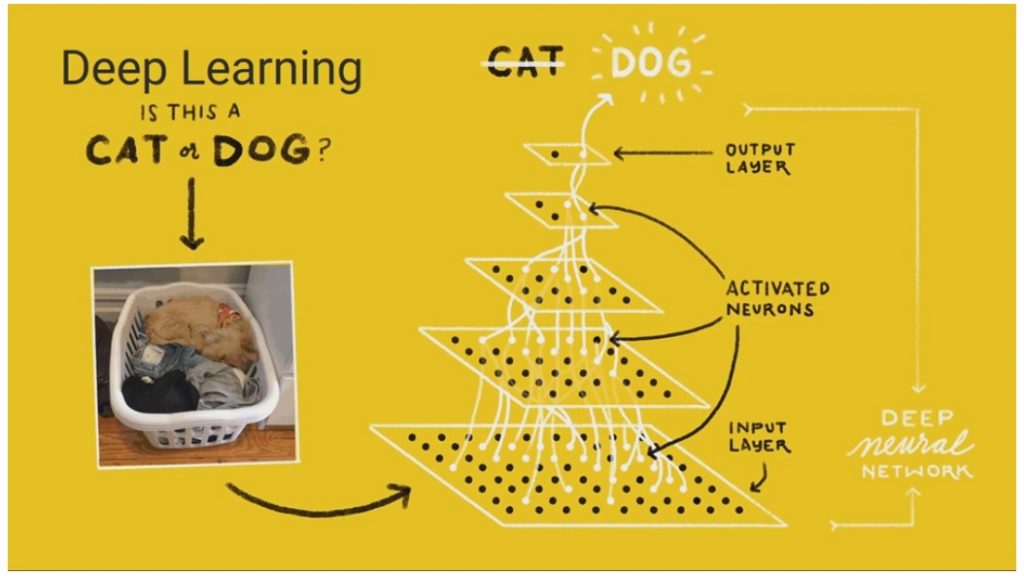

Precision medicine is one discipline of healthcare where AI has proven to be extremely useful. Here a patient’s DNA is scanned through deep genomics algorithms, to identify anomalies that could be linked to genetic disorders and mutations linked to diseases like cancer.

Another prominent example of how AI is accelerating healthcare’s efforts in saving lives is Atomwise’s AI, which was able to predict two drugs that could put a stop to the Ebola virus epidemic. In less than one day, their virtual search was able to find two safe, already existing medicines that could be repurposed to fight the deadly virus.

Retail

Japan’s SoftBank telecom operations created a humanoid robot ‘Pepper’ that could interact with customers and ‘’perceive human emotions’’. According to Softbank Robotics America, a pilot of the Pepper in stores in both Palo Alto yielded a 70% increase in foot traffic in Palo Alto. Nestle used ‘Pepper’ to serve coffee at its stores in China and Japan. A visitor chooses the type, size and strength of coffee using the tablet held by Pepper. Once the selection is made, the humanoid passes the order to a dual-arm robot, which makes coffee with a Nestle coffee machine and places the beverage on the serving tray. The entire process takes exactly three minutes.

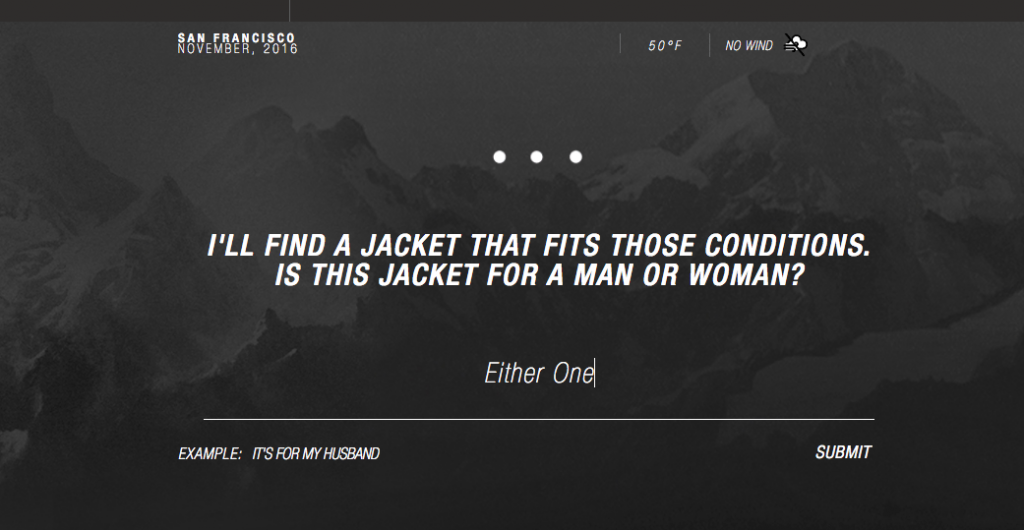

North Face an apparel brand has also adopted IBM Watson’s cognitive computing technology to help consumers with purchase decisions.

Image Source

Manufacturing

General Electric’s (GE) has created Predix Manufacturing Execution Software, which is designed to make the entire manufacturing process—from design to distribution and services—more efficient and hence save costs. This suite of solutions powered by data integration, the Industrial Internet of Things (IIoT), machine learning, and predictive analytics, provides manufacturers with plant-floor and plant-wide collaborative visibility of all work in process.

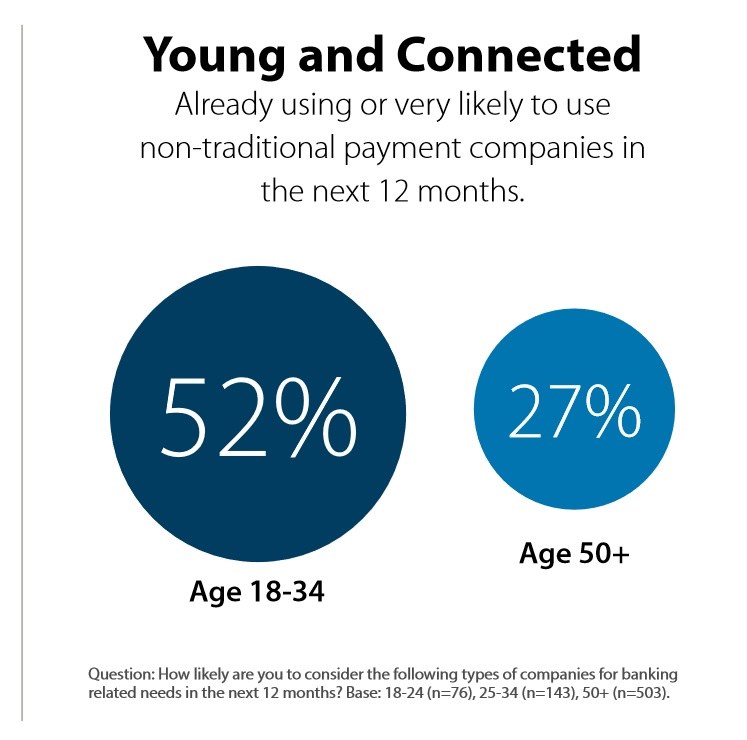

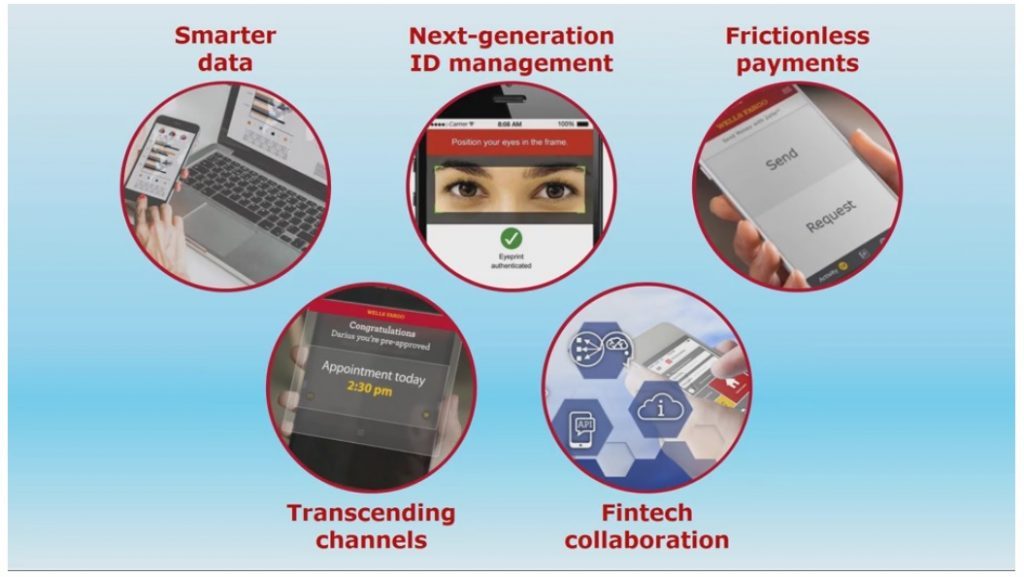

Banking and Financial sector

AI in the Banking and Financial sector can provide zero-lag customer service, improve efficiency and accuracy.

Commonwealth Bank of Australia (CBA) launched its in-house bot Ceba to more than a million customers. Swiss bank UBS last year launched its AI systems on the trading floor, which analyses the sea of market data to identify trading patterns and formulate new strategies for trading volatility for the bank’s clients.

AI is also helping in the compliance and security aspects of banking. HSBC partnered with big data startup Quantexa to utilise AI software to counter money laundering. According to Quantexa’s press release, “the technology will allow HSBC to spot potential money laundering activity by analysing internal, publicly available, and transactional data within a customer’s wider network”.

AI boosting efficiency in business operations

While AI has accelerated the pace of innovation across industries it has also permeated the foundations of business operations and is set to change the day to day work lives impacting the ROI of enterprises. A report from Accenture states that, by 2035, AI has the power to increase productivity by 40 percent or more, for enterprises.

Here is how enterprises are using AI and Machine learning in various functions for higher efficiency and boosting ROI

Marketing

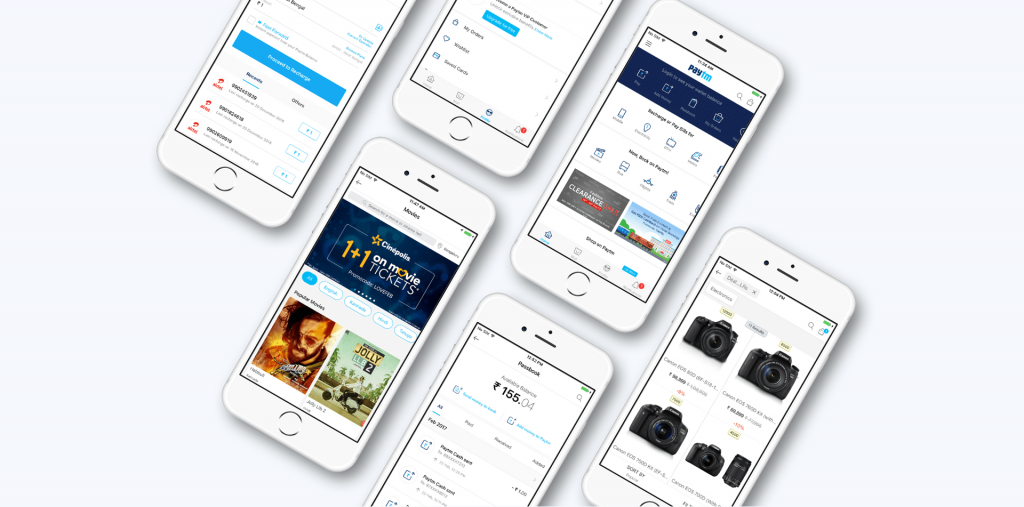

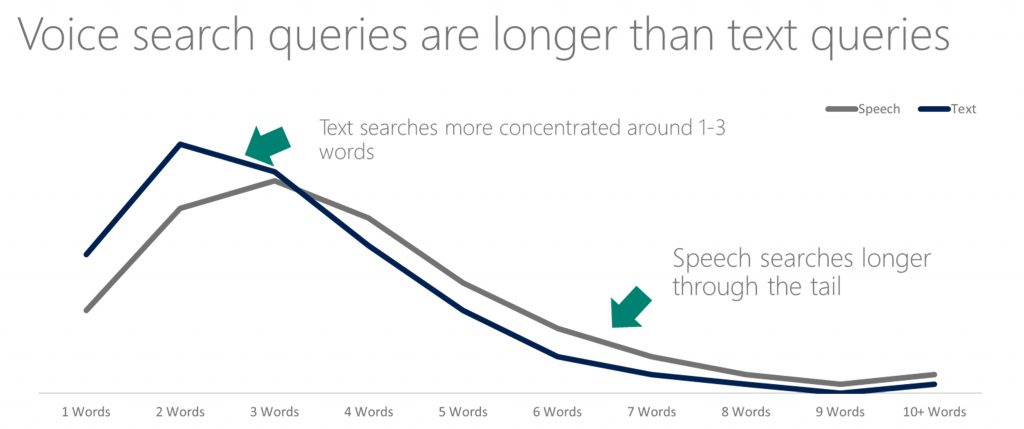

AI can find multiple applications in the marketing function from search to customer engagement.

Here are few examples of how marketing is leveraging AI

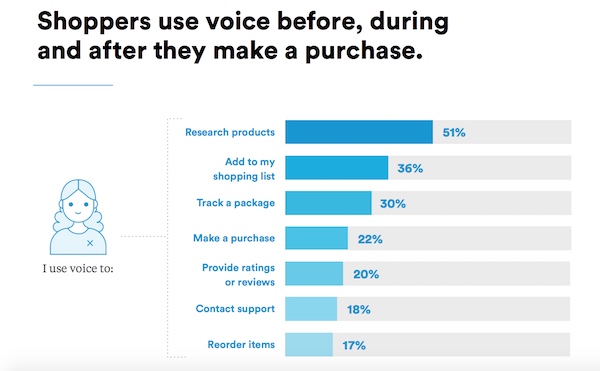

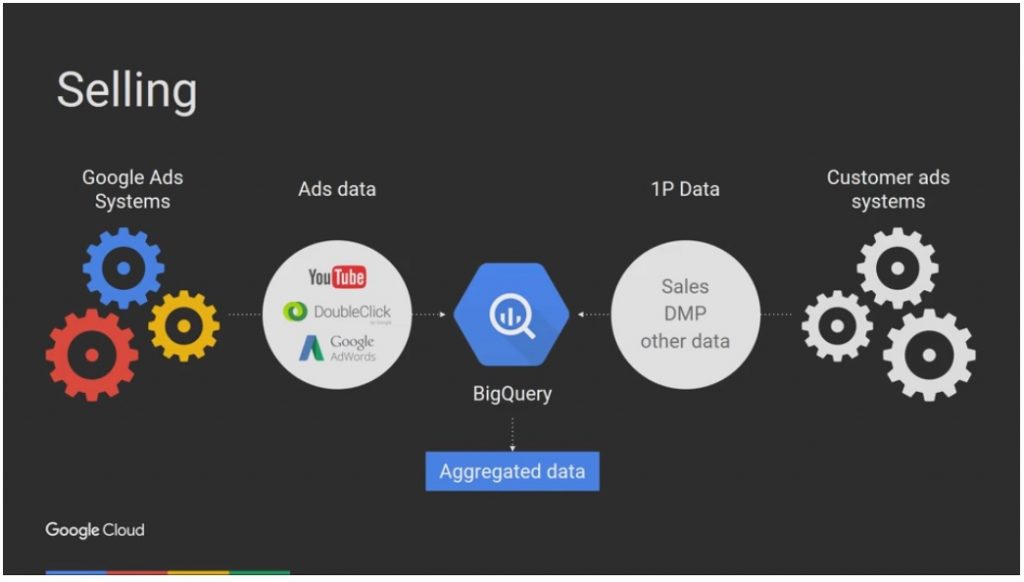

- Improved search functions – technologies like Elastisearch are becoming mainstream in e-commerce by populating the best possible results for a search query. The distributed nature of Elasticsearch enables it to process large volumes of data in parallel, quickly finding the best matches for consumers’ queries.

- Recommendation engines – Building a robust recommendation engine is the key aspect of creating a personalized user experience. Netflix is one of the best examples of how a recommendation engine works. More than 80 per cent of the TV shows people watch on Netflix are discovered through the platform’s recommendation system.

- Customer segmentation is another aspect where AI is improving efficiency for marketing by learning from customer behaviour for e.g. Companies such as AgilOne are helping marketers to improve and optimize email and website communications, by analyzing, continually learning from user behavior.

- Recently IBM launched its new IBM Watson AI Marketing Suite that improves the marketing efforts by personalized targeting, improved programmatic buying insightful campaign analytics. The suite contains three AI-based solutions – IBM Watson Ads Omni, IBM Media Optimizer, and Predictive Audiences.

At Robosoft, we were a part of a project aimed at helping a leading US retailer based in Illinois, draw maximum ROI out of their marketing spends. The company relied on senior managers’ making marketing investment decisions based on past experiences with traditional marketing channels such as billboard and newspaper advertising. Even though there were massive amounts of data available for analysis, no data was utilized in determining the best channels to spend marketing dollars for maximum return on investment.

As a solution, a large scale machine learning system was developed to maximize Marketing Return on Investment (MROI) across all digital marketing channels. The system helped in

- Enhancing the company’s customer touch points’ data collection capabilities across all web & digital assets.

- Determining customers’ purchase behavior across digital channels.

- Recommending optimal allocation of marketing budget across all digital channels.

The company saw improved EROI across all digital channels, prediction model empowered marketing managers to make data-driven decisions and also helped in defining the in-depth content strategy to rank highly for the most relevant keywords.

HR and Recruitment functions

AI can help in various aspects of HR like scheduling meeting, filtering candidates, reducing attrition, enabling a faster recruitment process, etc.

- HiringSolved is an AI-powered recruitment tool that enables diversity during selection.

- Mya, an AI recruitment tool expedite the process of recruitment by providing quick responses to applicants about their application and other information related to it

- IBM Watson is working towards building such a predictive model for companies, that can predict attrition patterns amongst employees.

A US-based recruitment startup wanted to revolutionize how recruiters hire using artificial intelligence. Through their proprietary machine learning algorithm, they wanted to reduce the time and effort required to fill a job position for companies. We were a part of a project for the client aimed at developing a robust machine learning algorithm to best match candidates to a job opening.

The matching algorithm that was created achieved high rate in matching candidates according to the job openings, making the recruitment process highly efficient.

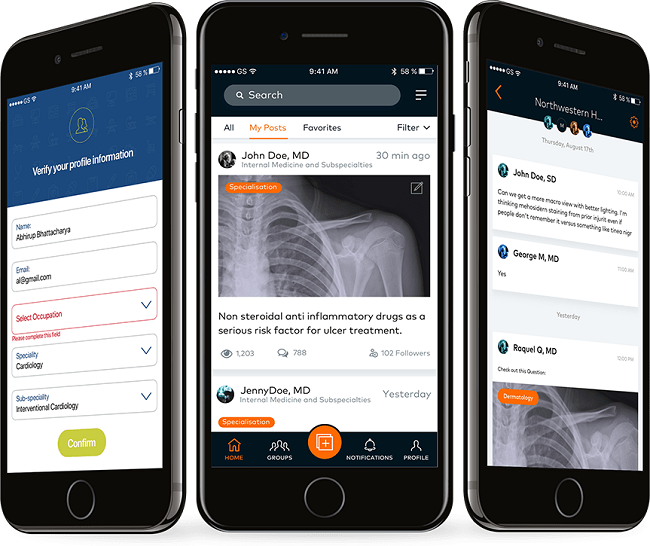

Customer service and customer engagement

Artificial Intelligence is currently being deployed in customer service. According to Gartner, by 2020, 55% of all large enterprises will have deployed at least one bot or Chatbot.

Since chatbots can lead to faster but at times inefficient and machine-like customer responses, enterprises are using bots which can work in tandem with their human counterparts. One company that provides AI-augmented messaging is LivePerson, where simple questions can be handled directly by a bot, but as soon as the conversation becomes too complicated the bot can hand the conversation off to a human.

AI can also help in creating models to boost engagement with customers by improving internal processes. One of the largest pharmaceutical companies in Asia that conducts clinical trials based on various types of drugs that belong to Therapeutic Areas like Gastroenterology, Neurology, etc. wanted to ensure patients have access to a simplified explanation of the documentation given to patients during clinical trials. We were a part of a project for the client which was aimed at optimizing the process & time required in translation from Scientific to Simplified documents.

An AI based model was used to translate the documents to the desired language of choice. Additionally, a mobile app was built for the patients as an engagement platform for clinical trials which consisted of an AI-Chat bot that provides answers to user’s text/voice-based questions on-the-go. Resulting in patients being more willing to participate in the trial as they felt more in control of the clinical trial experience.

Supply Chain Management

One of the most challenging aspects of managing a supply chain is predicting future demands for production. Machine learning algorithms can find new patterns in supply chain data daily, without needing manual intervention or the definition of taxonomy to guide the analysis. Lennox International Inc. is an intercontinental provider of climate control products for the heating, ventilation, air conditioning, and refrigeration markets use machine learning for their demand forecasting.

AI can also help in automating the inspection process for the manufacturing enterprises for e.g. The machine learning algorithms in IBM’s Watson platform can determine if a shipping container and/or product were damaged, classify it by damage time, and recommend the best corrective action to repair the assets.

Finance and Accounting

According to Bernard Marr, a futurist and a business strategist, –

‘’The key to the digital transformation of accounting and financing is pairing people and machines together allowing each one to contribute in areas they are best skilled at. Machines can efficiently and accurately analyze a tremendous amount of data, they can spot patterns in the data and learn how to treat various kinds of data.’’.

Some organizations are using AI to simplify their finance and accounting process simple like-

- At Deloitte, auditors access AI tools with natural language processing capabilities to interpret thousands of contracts or deeds.

- At Crowe Horwath, data scientists have harnessed technology to tackle complex billing problems in the healthcare industry. The team used machine-based learning to sift through enormous but disparate billing systems of its healthcare clients to flag accounts with discrepancies.

Challenges in deploying AI to business process

Like with many emerging technologies, there are challenges, with deploying AI to enterprise processes. According to a new MIT-Boston Consulting Group survey, 85% of executives believe AI will change business, but only 20% of companies are using it in some way, and just 5% make extensive use of it. Some of the challenges that may impede the process are –

- Access to data – companies need to invest in creating the infrastructure to collect and store the data they generate and to recruit talent capable of making use of it.

- Ever changing markets – businesses do not work on a static model, which means AI models will decrease significantly in efficacy, so smart companies will need to keep deploying resources and investments in keeping up with the market dynamics.

- Specialists – AI still being a niche domain, the lack of AI know-how in management is hindering its adoption in most cases.

Cost – AI technologies are an expensive deal to an organization. While big names have separate budget allocations for AI implementation, it is the small and mid-size enterprises that struggle to implement AI solutions to their business processes. - Computation Speed – Technologies like AI, machine learning and deep learning solution, require a huge number of calculations to be computed at hypersonic speed. This requires processors that have advanced processing power much higher than what is in general adoption today.

In Conclusion

As rightly stated by IBM’s Dr. Kelly –

“In the end, all technology revolutions are propelled not just by discovery, but also by business and societal need. We pursue these new possibilities not because we can, but because we must.”

The bigger technology players are paving the way for having automated and AI enabled processes. The industry as a whole has to evolve in terms of technology, trained resources etc., the costs of deployment will need to go down for smaller players to be a part of the AI revolution and finally infrastructure at an optimal cost will need to be created.

Image

Image