As businesses race to forge deeper, more meaningful connections with customers, AI-powered CRM systems transform how companies engage, operate, and grow. In our guide, Navigating CRM Implementation, we empowered businesses to deploy robust CRMs, streamlining operations and strengthening customer relationships. Now, artificial intelligence in CRM marks the next evolution, enabling personalized experiences and streamlined workflows while prioritizing data accuracy and trust. Explore how AI in CRM transforms customer connections and positions businesses to thrive in a competitive landscape.

The rise of AI in CRM

Integrating AI into CRM introduces a data-driven approach that elevates customer interactions, benefiting both businesses and consumers. By embedding AI and automation, AI-driven CRM software uncovers deeper insights into customer behaviors, preferences, and needs. Customer engagement, the core of CRM, has evolved with technological advancements. While CRM providers have long championed AI, its recent surge in adoption has transformed how companies connect with their audiences.

Originally, CRM systems functioned as simple databases, primarily used by accounting teams to store customer information and track interactions. As these systems evolved, they incorporated features tailored for marketing, sales, and customer support teams. However, as businesses expanded and customer expectations grew, the sheer volume of data generated by CRM platforms overwhelmed traditional systems. This challenge paved the way for generative AI tools, which have transformed modern CRM operations.

Today, organizations can choose from AI-driven CRM software, including Salesforce CRM – Einstein GPT, Hubspot CRM – ChatSpot, Freshworks – Freddy AI, Zoho CRM – Zia etc. Innovative AI tools, such as actionable meeting summaries, custom email templates, automated ticket routing, and intelligent notifications, provide real-time insights into sales pipelines. These advancements place the customer experience at the core of CRM, leveraging real-time data to deliver the personalized and timely interactions that customers now expect.

Generative AI in CRM

Generative AI in AI-driven CRM software unlocks new opportunities for delivering exceptional customer experiences through three key areas:

- Generative AI redefines customer experiences

By harnessing customer data from sales, marketing, and service functions, generative AI in CRM creates highly personalized experiences, maximizing the potential of CRM data.

What leaders can do: Set bold objectives for leveraging AI capabilities. Encourage designers to enhance content creation with generative AI and actively engage with the technology. Develop specific use-case guidelines, simplify processes with AI, and invest in proprietary data to complement open models. - Customer trust as a strategic asset

The success of generative AI in CRM depends on a foundation of trust. According to a study, 80% of business leaders identify explainability, ethics, bias, or trust as significant hurdles to adopting generative AI.

What leaders can do: Lead with empathy and prioritize ethical AI practices tailored to customer concerns. Build trust by delivering transparent, trustworthy experiences that enhance customer satisfaction. Integrate generative AI into user experiences from the outset, personalize marketing campaigns, and tailor direct outreach to reinforce trust. - Transforming the employee experience with AI

On average, 87% of executives expect generative AI to augment job roles rather than replace them. The challenge lies in fostering effective human-machine partnerships as AI tools are introduced. Leaders must strategically consider where AI fits within the value chain and account for its impact on employee well-being.

What leaders can do: Foster human-machine collaboration from the start to create greater value than either could achieve alone. Promote positive messaging about AI’s potential to enhance employee efficiency and productivity. Integrate AI tools, intelligent workflows, and hybrid cloud platforms in ways that empower employees, involving them in designing AI implementation strategies.

Generative AI’s advancements in CRM pave the way for enhanced personalization and efficiency, but businesses must address implementation challenges to fully realize these benefits.

Benefits of AI in CRM

AI-powered CRM systems deliver numerous advantages:

- Advanced reporting and predictive analytics

AI in CRM excels in predictive analytics, analyzing historical data and customer behavior to provide actionable insights. These capabilities enhance sales forecasting, streamline demographic targeting, and unify data analysis practices. Predictive tools also help reduce customer churn and identify necessary adjustments to sales strategies.

- Enhanced personalization

AI in CRM creates highly personalized experiences by analyzing customer data through sophisticated algorithms. It recommends products or services tailored to individual preferences, offering a compelling selling point for sales teams. This personalization extends across all channels, including in-app, online, social media, and in-person interactions, unlocking significant sales opportunities.

- Streamlined automation

While AI and automation are distinct, they complement each other effectively in CRM. AI-powered automation tools, such as chatbots and virtual assistants, manage routine customer inquiries and provide round-the-clock support. These tools reduce response times, enabling employees to focus on more complex tasks and improving overall efficiency.

- Focus on sentiment analysis

In the social media era, AI in CRM monitors text and social channels in real time to analyze customer feedback. This capability allows businesses to respond promptly to concerns, fostering long-term customer retention and satisfaction.

- Improved lead scoring

AI-driven lead scoring enables sales teams to prioritize high-potential leads based on demographics and behavior. This approach increases sales efficiency, supports targeted campaigns, and facilitates upselling opportunities by segmenting leads effectively.

- Effective management of unstructured data

CRM systems handle vast amounts of data, including unstructured and complex enterprise data from multiple communication channels. AI in CRM leverages tools like natural language processing (NLP) and machine learning (ML) to organize and interpret this data meaningfully, accelerating decision-making and unlocking untapped insights.

AI in CRM use cases

AI in CRM offers a wide range of applications, tailored to specific business goals:

- Business intelligence: AI tools provide actionable insights into customer data, enabling smarter decisions across sales, marketing, and customer service.

- Customer service: AI-powered chatbots deliver prompt, accurate responses to customer inquiries, offering 24/7 support and enhancing service quality.

- Data management: AI automates data entry, cleaning, and enrichment, ensuring a clean and accurate data foundation for all AI-driven processes.

- IT efficiency: AI, combined with automation, streamlines routine IT tasks, such as ticket routing and diagnostics, improving operational efficiency.

- Marketing personalization: AI in CRM tailors marketing content and segments customers based on purchase history and engagement patterns.

- Lead management: AI automates lead qualification and scoring, while machine learning provides deeper insights into lead characteristics, refining outreach strategies.

- Predictive customer analytics: AI leverages historical data to anticipate customer behavior and needs, enabling proactive engagement.

- Process optimization: AI identifies inefficiencies in workflows, directing operations and addressing bottlenecks to enhance performance.

- Sales optimization: AI enhances CRM sales modules with predictive analytics, prioritizing high-value prospects and streamlining sales processes through automated workflows.

AI integration considerations

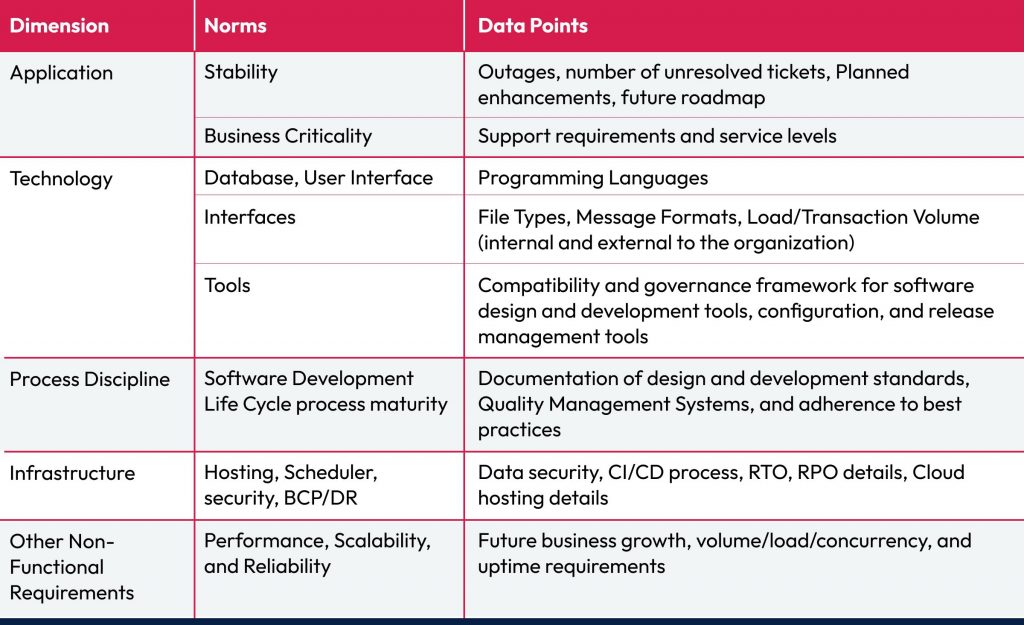

Integrating AI into CRM requires more than just tool adoption—it demands data readiness, system scalability, and employee alignment. Businesses must ensure customer data is clean, structured, and reliable to train effective AI models. Industry-specific customization is critical to make insights relevant. Equally important is preparing employees through training and clear communication, ensuring they understand how AI complements their roles. IT teams must support seamless integration and real-time processing. A holistic approach enables AI to transform CRM from a passive database into an intelligent, predictive system.

Regulatory and ethical considerations

As AI in CRM handles sensitive personal data, compliance with regulations like GDPR and CCPA is critical. Businesses must ensure data transparency, obtain customer consent, and audit AI behavior regularly to address bias and maintain fairness. Ethical AI practices not only prevent legal issues but also strengthen customer trust—an essential factor in long-term engagement and loyalty.

Challenges of AI in CRM

Implementing AI in CRM presents several hurdles:

- Time and investment: Setting up AI in CRM can be time-consuming and costly, depending on the organization’s size and specific requirements. Effective team collaboration is essential for successful implementation, and more complex AI systems may require significant financial investment.

- Cybersecurity: Safeguarding sensitive customer data is paramount. Organizations must securely manage both external and internal data, ensuring compliance with legal standards. Customers should be informed about how their data is collected and used, reinforcing trust.

- Balancing AI and human interaction: Over-reliance on AI in CRM risks reducing human connection, potentially alienating customers who value personal interaction. Businesses must clarify that AI serves as an informational tool, not a substitute for human support, to maintain meaningful customer relationships.

Addressing these challenges is essential to unlocking AI’s full potential in CRM and fostering stronger customer relationships.

KPIs to measure the impact of AI in CRM

To evaluate AI’s effectiveness, organizations should track key performance indicators (KPIs) that reflect its impact on customer engagement and business outcomes. Metrics such as lead conversion rates, reduced response times, and improved customer satisfaction scores (e.g., Net Promoter Score) highlight AI’s role in driving efficiency and loyalty. Additional indicators, like churn reduction, upsell success, and faster deal closures, demonstrate the value of predictive insights and automation. These KPIs provide actionable insights to refine AI strategies and validate return on investment (ROI), ensuring businesses maximize the benefits of AI-driven CRM.

The Future of AI in CRM

As customer expectations for hyper personalization continue to rise, AI in CRM will play an increasingly vital role. Every business now competes to deliver the most personalized digital experience, vying for consumer attention. Generative AI is poised to meet these demands, offering tailored sales offers, recommendations, and exceptional customer service. As AI technology advances, businesses can anticipate more sophisticated AI-powered tools, such as voice recognition and augmented reality, further enhancing CRM capabilities.

The future of AI in CRM is promising, with ongoing development of innovative tools that will continue to redefine customer engagement. Organizations that proactively integrate AI into their CRM processes will maintain a competitive edge, fostering stronger customer relationships and thriving in the dynamic landscape of customer relationship management.